Cellular IoT module shipments rose by 14 percent in the 12 months to the end of 2022, with China leading the way for regional shipment volumes India leading the way for regional shipment growth, NB-IoT leading the way for low-power IoT volumes, LTE CAT1.bis leading the way for new growth, and Quectel and Qualcomm leading the way for modules and chipsets, respectively. Counterpoint Research has a new report on the subject; it predicts growth will jump higher, reaching 19 percent, in 2023.

It said cellular IoT volumes have reached a “record high” in 2022, despite the macro signs of a developing economic slump, the impact of war in Europe, and the long-tail effect of the Covid pandemic. It said IoT sales grew as the global smart meter market reasserted its buoyancy after lockdowns and distancing, and POS upgrades in retail, asset tracking in logistics, and telematics and connectivity in the automotive space drove higher demand.

China invariably leads the cellular IoT market by region, noted Counterpoint Research. North America and Western Europe follow, in order; India is the fastest growing market, followed by Latin America, and North America (already second for volumes). India, it noted, has “immense potential”, despite starting some way behind. Demand in Eastern Europe declined due to war in Ukraine.

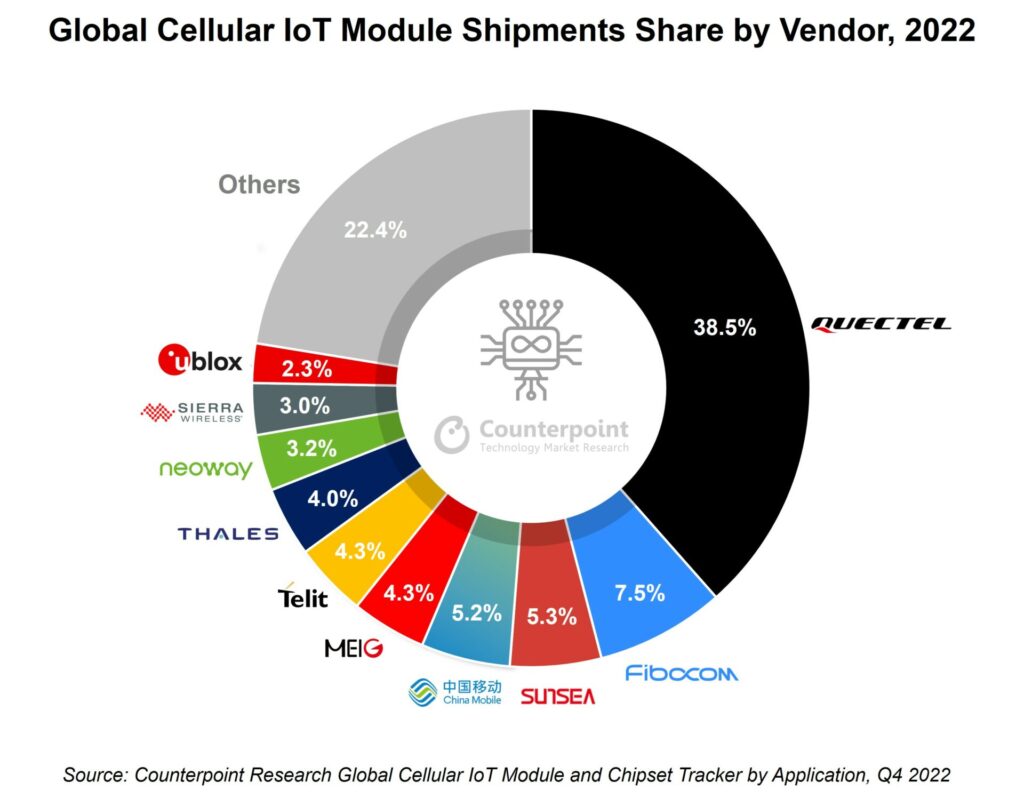

Chinese outfit Quectel was top of the pile, with a dominant 38.5 percent share of the IoT module market because of its popularity at home. Mobile operator China Mobile (7.3 percent), internet provider Sunsea (5.3 percent), and module maker Fibocom (5.2 percent) – all Chinese – ranked behind. Telit and Thales, in fifth and sixth globally, were second and third behind Quectel outside of China; they will combine as Telit Cinterion by the end of Q1.

Counterpoint Research said Quectel did well on the back of supply of network access device (NAD) modules – IoT modules geared for cars; it won “multiple design wins with major automakers”. It wrote: “The competition in the NAD module market is intensifying as the industry transitions to 5G. With every transition of cellular, the market has consolidated… to serve the automotive segment, which requires heavy customization but garners a lower margin.”

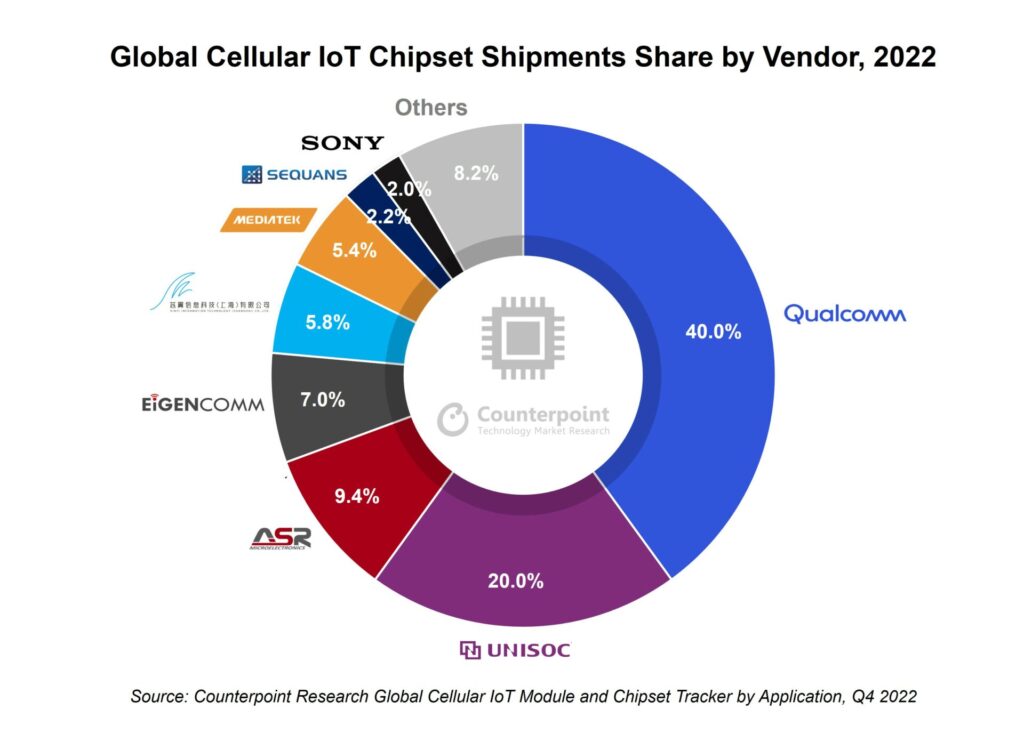

Meanwhile, Qualcomm claimed a 40 percent share of the cellular IoT chipset market in 2022; it was followed by UNISOC (20 percent) and ASR (9.4 percent), buoyed by the LTE CAT1.bis market. Qualcomm was strong in the higher-end IoT categories – LTE CAT 4, up to 5G. Its new CAT1.bis chipset, QCX216, goes up against “LTE CAT1.bis leaders UNISOC and Eigencomm”, said Counterpoint Research.

Eigencomm and Xinyi Semiconductor, both “new players from China” with successful low-cost/high-volume NB-IoT games, broke into the top five, it said – “filling the gap left by HiSilicon”. NB-IoT was the most popular cellular-based low-power wide-area (LPWA) IoT technology in the period, followed by 4G CAT 1 and 4G CAT 4 modules. Together, these contributed to 60 percent of the total IoT module market, calculated Counterpoint Research.

A statement explained: “NB-IoT saw strong adoption in China but has been less popular outside the country. In contrast, 4G CAT.1bis has been gaining traction globally and has the potential to be an alternative to several NB-IoT and existing 2G/3G applications.” 5G-based IoT modules are still too expensive, the report concludes – and will remain so until the average selling price (ASP) goes under $100, and probably until 5G-based RedCap appears.

Mohit Agrawal, associate director at Counterpoint Research, commented: “Global cellular IoT module shipments [will see] register robust growth of 19 percent in 2023. Growth… in the high-value industrial segment will be key for IoT projects that have struggled to move beyond the pilot stage and for companies that are focusing more on ROI in a tough macroeconomic environment. Nevertheless, shipments of IoT modules for the smart meter, point of sale (POS) and automotive markets are expected to continue seeing strong growth.”