UK telecoms regulator Ofcom has opened a six-week consultation with a view to open more cellular spectrum for shared and private usage. It said the success of its Shared Access Licence (SAL) framework, which opened four bands for a range of enterprise users in 2019, including a seismic 400 MHz chunk of prime mid-band spectrum at 3.8-4.2 GHz, has seen more than 1,600 licences issued, and prompted its latest review.

Ofcom wants to make “improvements… to support [its] original policy intention” to make spectrum available for UK enterprises, and also for operators looking to support them. It stated: “As innovation stimulates greater demand for limited spectrum resource(s), spectrum sharing becomes ever more important.” The consultation period closes May 16, and is presented as the start of a “renewed dialogue… to inform… thinking” around a revised framework.

The consultation, opened at the end of March, seeks to build on its 2019 release of “simple, low-cost” spectrum, available to enterprises in a “rapid … manner”, at 3.8-4.2 GHz, where most private LTE and 5G activity has focused, as well as at 1781.7-1785 MHz (paired with 1876.7-1880 MHz), 2390-2400 MHz, and in the the lower 26 GHz band for indoor usage. It said 850 licences have been issued since 2020, when the SAL framework was properly in place.

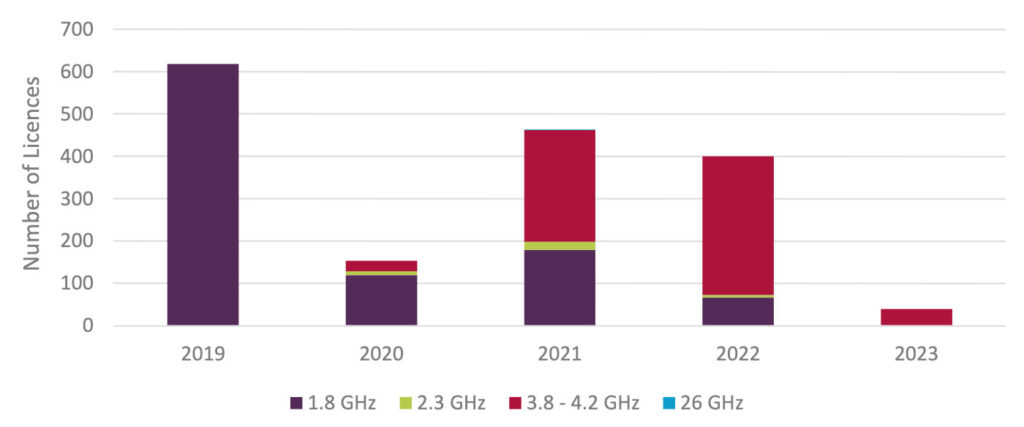

A graphic (see below) suggests Ofcom granted around 260 private 5G licences in the 3.8-4.3 GHz band in 2021, rising to around 320 in 2022, and sitting (curiously, only) at around 40 in the first quarter of 2023.

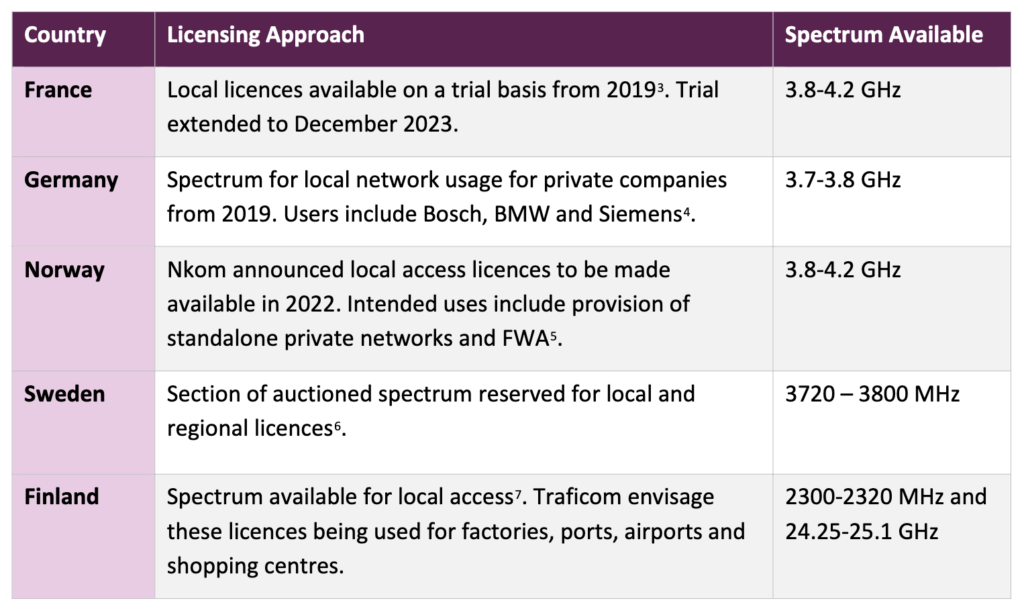

It noted moves (see below) by France and Norway, and Sweden in limited fashion, to align on the 3.8-4.3 GHz band, which is the subject also of a CEPT mandate on EU harmonisation. “The 3.8-4.2 GHz band represents the area of greatest demand and growth,” it said, suggesting as well that local 400 MHz allowances may not be enough in the end for future Industry 4.0 scenarios.

“Fixed-wireless access and private network providers predominate in this band, followed by a ‘long tail’ of varied uses… A large proportion are requesting significant bandwidths, with more than three quarters requesting 100 MHz, to support higher capacity services,” it said. Ofcom suggested limited availability, currently, of 4 GHz compatible devices has also restricted spectrum availability, effectively – and said the ecosystem has work to do alongside.

Ofcom is looking for guidance on future use cases for private and shared cellular, exceptions to its current rule on mid/high-power deployments in urban areas, as well as general feedback on the licensing process. It also took the opportunity to restate that licence applications will be automated and accelerated, in line with the equivalent CBRS system in the US (at 3.55-3.7 GHz).

Ofcom said: “We acknowledge that some stakeholders have been frustrated with the time taken to process their licence applications, and that administrative aspects of our systems and approach could be refined. We are already working on the automation of our licensing processes, to provide a better user experience and significantly reduce the time taken to access spectrum. This work is being delivered in phases.”

The full consultation document is available here. It commented: “Many industries are moving to digitise their systems, often using wireless technology as a key enabler of this, leading to an increased demand for spectrum. Advancements in technology are also making it possible for businesses to deploy their own networks to automate their processes and increase efficiency.”