Tax weekend greetings from Missouri, Nebraska, Louisiana, Texas and Jamacia. No, Fastwyre is not going global, but the staff of the Brief took part in a long-needed vacation to one of the largest and friendliest islands in the Caribbean. Pictured is the sunset from Rick’s Café in Negril, a familiar spot for cliff diving.

This week, after a full market commentary, we continue our earnings questions for telecom providers. There is a lot to cover this week, and apologies in advance for a longer than usual Brief.

We look forward to catching up with many of you at the Mid-America Cable and Telecommunications Association meeting in Omaha next week. More on the panel in this LinkedIn post – yes, we’ll be wearing the MVNO hat and describing the opportunities and challenges that cable providers will face as they enter the wireless business.

Since many of you have commented about the earnings calendar publication, here is the latest call schedule (all times ET – T-Mobile had not announced their call time as of Friday):

| AT&T | Thursday, April 20 | 8:30 a.m. |

| Verizon | Tuesday, April 25 | 8:30 a.m. |

| Alphabet | Tuesday, April 25 | 5:00 p.m. |

| Microsoft | Tuesday, April 25 | 5:30 p.m. |

| Meta | Wednesday, April 26 | 5:00 p.m. |

| Comcast | Thursday, April 27 | 8:30 a.m. |

| Amazon | Thursday, April 25 | 5:30 a.m. |

| Charter | Friday, April 28 | 8:30 a.m. |

| Apple | Thursday, May 4 | 5:00 p.m. |

The fortnight that was

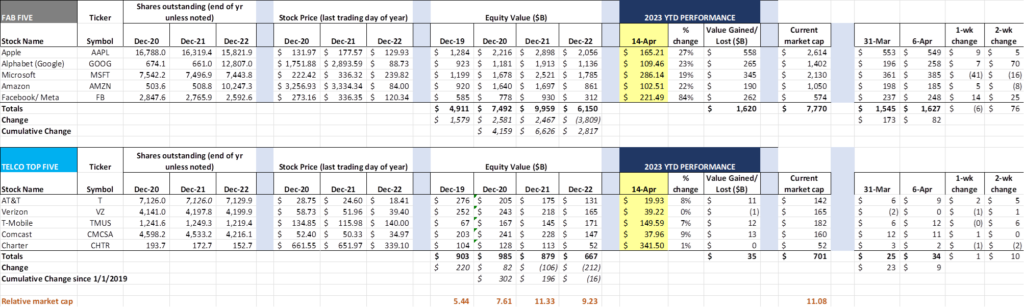

After a lot of bank-driven turbulence to start March, the markets clearly entered April like a lamb. The net change over the last two weeks has been +$70 billion or slightly less than 1%. Microsoft has been the only major moving stock over the period (-$16 billion), with Meta/ Facebook continuing its recovery from a tough 2022 (+$25 billion). AT&T and T-Mobile were up the most over the two-week period for the Telco Top Five. There was generally stable performance for each stock ahead of earnings season.

Stability does not adequately describe the rest of the telecom industry, however. Shown below is the Yahoo comparison chart of the worst performing Telco Top Five stock over the last five years (AT&T, down just over 25% excluding the negative impact of the WarnerMedia spin) versus some of their smaller peers:

Altice, Dish, Lumen, and Uniti (the best publicly traded proxy for Windstream) are all down 75%+ over the last five years, excluding dividends (only Uniti continues to pay a dividend). To put this into context, Altice paid $9.1 billion for Suddenlink in 2015 – today, that amount would purchase the equities of Dish, Lumen, Uniti and Altice. Larger capitalizations are stable, but beneath that calmness there is a lot of angst.

Charts like the one above raise questions about the current market value of Digital Colony + EQT’s purchase of Zayo for $8.2 billion in 2019. Fortunately, both acquirers have strong balance sheets and long investment horizons. Less certain is the current market value of Brightspeed, the local exchange properties in 20 states that Lumen sold to Apollo Group for $7.5 billion (which included $1.4 billion of debt). Lumen’s current stock price implies a value of the local exchange asset of ~2.5-3x 2023 estimated earnings – Apollo’s purchase price was double that level, and supposedly represented the “fixer upper” assets.

One stock that appears to have been thrown a lifeline this week was Consolidated Communications. After a tough 2022 (down ~45%), and an equally tough 2023 (down 28% year-to-date prior to the acquisition announcement), their largest equity owners (Searchlight and BCI) offered last week to purchase the remaining shares that they do not already own for $4/ share. This equates to the closing price of the CNSL shares at the end of February.

Prior to the announcement, Searchlight+BCI owned slightly more than 34% of the company; since nearly the entirety of these equity conversions occurred by the end of 2021 (see second tranche announcement here), it’s likely that their investment value has been halved. Searchlight already owns Ziply fiber and has an investment in Uniti (according to Whalewisdom.com, likely at a $26/ share basis – UNIT closed Friday at $3.33) – we think there might be some additional synergies possible from greater cooperation and collaboration with these companies.

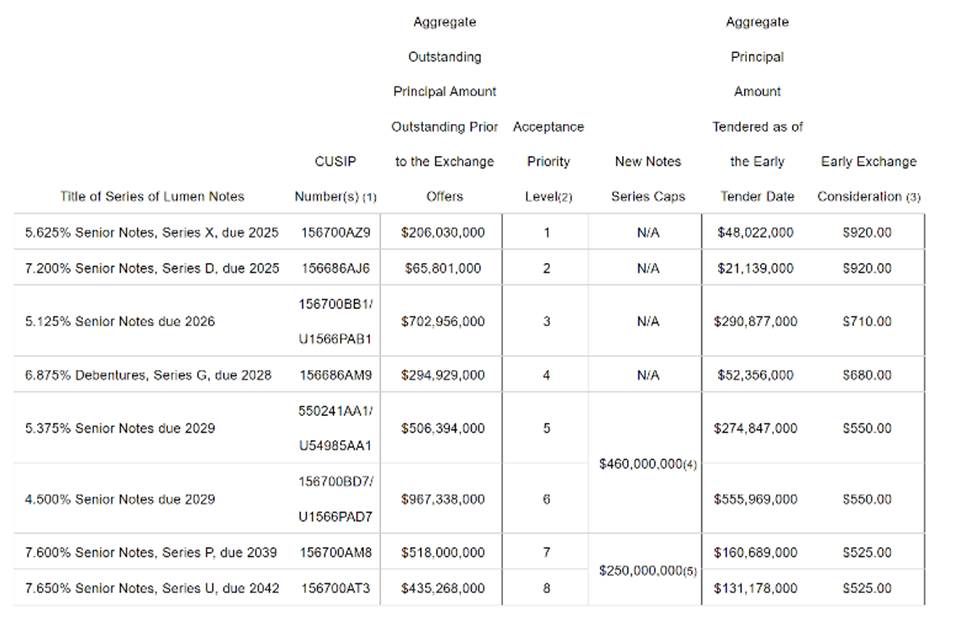

In slightly more encouraging news, Lumen announced the equity results of the equity swap that we chronicled in the last Brief (see nearby chart, as well as this link which contains all of the relevant footnotes). Note holders had until last Thursday to select to swap their current notes for debt maturing in 2023 and sporting a 10.5% coupon.

As the nearby chart shows (and as expected), holders of notes maturing in 2025 were less enthusiastic about the proposal than longer-term holders. Only about 25% of the senior notes maturing in 2025 and 40% of the 2026 notes were tendered as of the early date. It’s unlikely that there will be additional tenders for shorter durations in the final announcement (we would be surprised if the final tally shows a 5% improvement). What’s interesting to note is that the cap was significantly oversubscribed for the 2029, 2039, and 2042 durations and that overall, it appears that the $1.1 billion swap target will be achieved. Not quite sure this met all of the expectations, but it does buy the company a little bit of breathing room (note – Moody’s continues its negative outlook on Lumen debt – see here for their March 2023 release).

Finally, we would be remiss if we did not mention the new name of the Discovery/ WarnerMedia service: max. Not Cinemax (also owned by WarnerMedia), not a separate name that combines the legacies of two giant content creators (we liked Discovery Brothers), not an entirely new name – simply max.

This will be a “mega” service that puts it in line with Disney+, Netflix and Peacock (different content, but a large library). Their new website, max.com, says it all – something for everyone.

The company faces a balancing act: A mammoth content library, refreshed constantly to increase engagement, yet easily accessible and enjoyable from a variety of devices, and attractively priced to accommodate different screens and budgets. We have long held that a product like Max, coupled with one other streaming service and local television for live sports (perhaps through a digital antenna), could satisfy the viewing needs of many Americans. When this new service is launched on May 23, we will find out how valuable the cable video platform is versus the combined $30-35/ month bundle of Max and Disney/Hulu/ESPN+ and a $30 one-time cost of a digital antenna.

First quarter earnings questions (Part 2)

Three weeks ago (Brief here), we started the earnings preview with two questions:

- With T-Mobile’s integration largely realized (billing integration remaining but plan synchronization nearly complete), the opportunity for a merger-related postpaid wireless switching event is remote. How will Verizon and AT&T increase the pool of switchers without igniting destabilizing counteroffers? What is the ramification of a low-switcher pool to their long-term wireless profitability prospects?

- There have been many management changes over the last year at Verizon, Comcast, Charter, and, to a lesser extent, AT&T. How are these changes impacting the velocity of strategy execution?

These questions spawned a host of responses, from “postpaid is dead” (we strongly disagree) to “retail stores are dead” (we tend to agree) to “postpaid wireless is not their (Verizon/T-Mobile/AT&T) focus” (we believe that depends on the company). One of you quipped “Hans [Vestberg, CEO of Verizon] has a One Trac [phone] mind” which we will explore below. But there was unanimous agreement that personnel changes, as tough as they are, are often necessary when competitive forces and strategies shift.

This week, we add two additional questions we think should be asked:

- What is the ultimate goal of Verizon and T-Mobile’s fixed wireless efforts? Are those businesses sustainable? How should the cable industry respond?

- With an economic downturn looming, prepaid services will play a larger role in gross additions. Which company is best positioned to acquire and upsell a prepaid base and maximize profits?

Fixed wireless – similar prices, different profits and risks

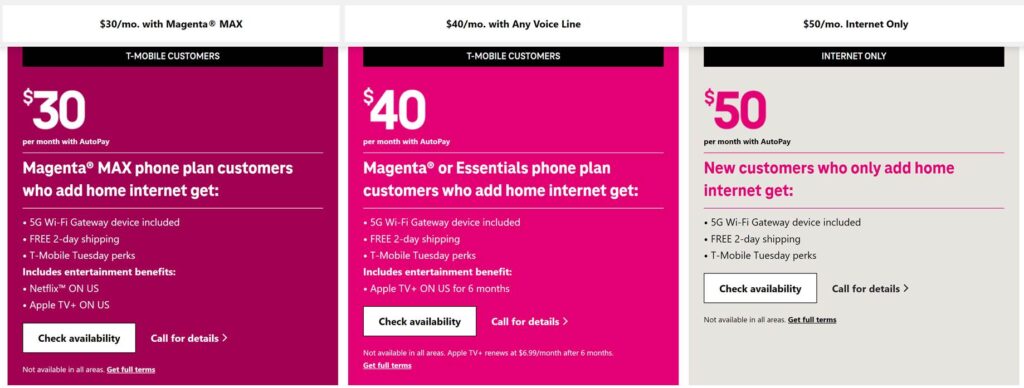

Below is a description of each of T-Mobile’s residential Home Internet plans (link to full details here):

We were not surprised to learn from the company that most T-Mobile Home Internet customers are paying $30 or $40/ month for service. This means that a family of four on T-Mobile’s Magenta plan (with AutoPay and paperless billing) currently pays $180/ month (+ any taxes and fees on the Home Internet package). This compares to Spectrum Mobile’s current offer of $170/ month for the first 12 months ($30/ line for unlimited service + $50 for 300 Mbps/ 15 Mbps Home Internet) and $200/ month after the first year.

Verizon’s comparable plan (5G Play More – see full details here) is available for $45/ line ($180 for a family of four) and they offer Home Internet with this plan for $25/ mo. This plan includes a streaming package (Disney+/ Hulu/ ESPN+) just like T-Mobile’s Netflix, although there are some limitations on video resolution and number of simultaneous streams. The total for Verizon comes out to ~$220/ month assuming $15 in taxes and fees for all services (wide variance by area).

The bottom line is that each wireless carrier (except AT&T) comes out with a whole home family bundle that equals $170-220/ month with T-Mobile and Spectrum lower priced and Verizon charging a premium (note: Comcast is between Spectrum and Verizon as they do not include taxes and fees in their monthly rate). Customers who are over 55, serve or have served in the military, or have other discount qualifications (e.g., a corporate discount) may pay less.

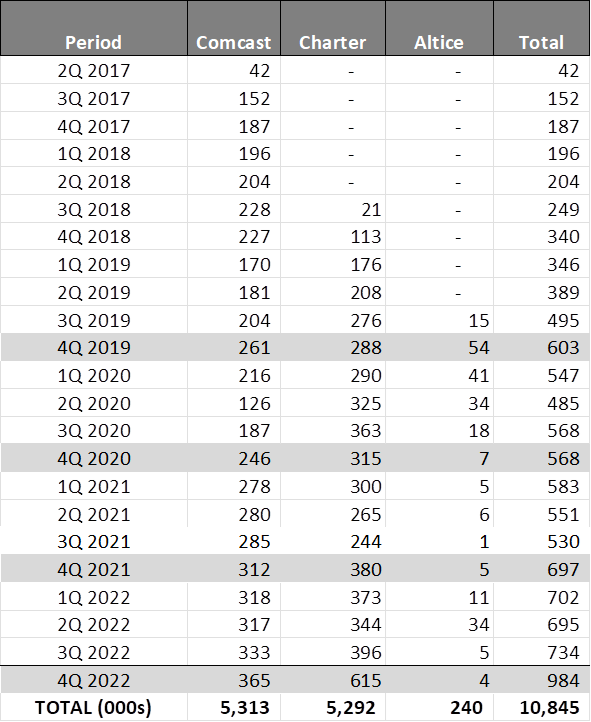

Based on this data, cable should be attracting more subscribers than their current pace of 350-400 thousand per quarter (see nearby chart). In 2022, Comcast added 1.33 million net new wireless lines while Spectrum, boosted by their November launch of Spectrum One, an Internet, mobile, and Wi-Fi bundle, added 1.73 million.

Meanwhile, T-Mobile added 2 million and Verizon added over 1.2 million fixed wireless locations. A little over 3.2 million fixed wireless customers offset around 3.1 million wireless subscriber losses (note – not all of these were through Verizon or T-Mobile’s retail channel – some could have come from Boost, Tracfone or an MVNO served by one of these brands).

Neither group has admitted to any pain from this change (and 2023 was the first full year where wireless providers offered substantial fixed wireless bundle discounts to their base). We think that story line is going to change in 2023 as competition intensifies.

Here’s our take on the profitability equation:

- Every Spectrum High Speed Internet customer loss (at month 13 price – $80/ mo.) likely costs the cable company $65-70/ mo. as Internet is a highly profitable product. It also results in a stranded asset if it is not already fully depreciated;

- Every Spectrum Mobile family bundle (4 lines – $120/ mo.) yields ~ $35-40/ mo. in direct contribution margin. This implies a network cost per line of $16-18/mo. (a 40s gross margin %) with the remainder being marketing, promotion and retail operations costs (there are no truck roll costs associated with mobile services);

- Every T-Mobile Home Internet customer who signs up earns the company a 90-95% margin (the remainder covering equipment and miscellaneous costs). The value of retaining a Magenta [MAX] family is separate and more valuable than the $36-38/ mo. in profits generated for Home Internet;

- Verizon places more emphasis on preserving the family plans and, as a result, generates less profit from each Ultra Broadband home acquired (likely $20/mo. of incremental profitability per home).

Bottom line: Without an increasingly diminishing video offering value (see Max discussion above) and minimal incremental home phone acquisition opportunities, cable has more to lose from fixed wireless than T-Mobile and Verizon have to gain. That said, if cable begins to accumulate family plan gains, then look for wireless to include wireless for free (at least for 6 months or a year) for new/ win back customers. Regardless, we aren’t sure where this leaves AT&T; outside of their 30-million home fiber footprint they seem to have few options other than steeper corporate and FirstNet discounts if the home bundle breaks below $180 including taxes and fees. A Max content bundle (described above) may help, but it will impact profitability.

Prepaid to the rescue?

A lot of news and discussion about the role of prepaid occurred this quarter. Verizon admitted that the Tracfone integration has a ways to go (see Matt Ellis’ comments here) but that new plans, compensation and postpaid upgrades were coming (and, with 22+ million Tracfone subscribers at the end of 2022, a well-crafted upgrade strategy could help Verizon’s postpaid numbers for many years).

Meanwhile, T-Mobile announced their acquisition of Mint Mobile (link is to video announcement; also this CNBC interview is very telling and humorous). After that acquisition is complete, they will have over 24 million pre-paid subscribers to manage. AT&T already has over 19 million prepaid subscribers with the vast majority under the Cricket brand.

Combined, that’s 65 million prepaid subscribers, with probably 10-15% eligible today to be upgraded to a postpaid product. Then there’s Boost and other prepaid MVNOs (totaling ~13 million).

Prepaid is a largely misunderstood product. The importance of local distribution is critical for many brands. Some prepaid customers pay their monthly fee in a store, often by cash. Their “face of the brand” is the person behind the counter. That person may also help fix an older iPhone or recommend a new or reconditioned device. Whether it’s a bodega owner or Walmart employee who markets multiple brands or a Metro by T-Mobile store, the relationship matters – a lot.

Others like Mint are completely online (at least until the T-Mobile acquisition closes) and focus on affordability (in Mint’s case, a discount for 3-6-12 month in advance purchase). Or, as in the case of a company like PureTalk (another online-only direct to consumer company), they cater to specific customer segments (Fox News commentator Sean Hannity is their spokesperson).

We see a lot of opportunity for customers to shift prepaid providers as local distributors align themselves with specific brands. We also think that, in some circumstances, the traditional prepaid base will move to cable MVNOs – simply because a cable customer service representative asked. Credit risks are higher, but there’s a case to be made with a single bill that wireless payment risk is less than paying two invoices.

Bottom line: The wireless service industry is looking for anything to move the gross and net add needle. Prepaid will gain greater attention as individuals and families aim to save money and as the cable wireless message expands. With Verizon’s acquisition of Tracfone, every major wireless player now has a retail prepaid strategy. We anticipate materially different results from each carrier (including cable).

That’s it for this week. In our next Brief, we will comb through first quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific end to the quarter and Go Royals, Sporting Kansas City, and Davidson Wildcat Baseball!

*Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.