Sixty to 80% of mobile data usage is generated indoors, yet carriers consistently under-invest in indoor coverage. Nowhere is this more true than in the “middleprise” — buildings that fall between 50,000 and 500,000 sq ft.

Middleprise property owners, IT teams and facilities managers are willing to invest in distributed antenna systems (DAS) to help solve cell coverage issues. But the infrastructure for distribution alone is not enough: DAS deployments today are often left orphaned without signal sources from carriers.

By failing to make easy-to-use, low-cost enterprise-grade small cells available for DAS usage, carriers are ultimately harming their own networks. Thousands of venues each year choose to deploy “Part 20” signal boosters that add load to already-congested macro towers and increase uplink noise levels, degrading performance across the network.

Unlocking middleprise coverage: The crucial role of signal source availability

Today, most stadiums, airports and other high-capacity venues have DAS as part of their core infrastructure. Those DAS systems are funded and installed by the carriers themselves or third-party operators (3POs).

However, for every single high-capacity venue, there are more than 40 middleprise venues. Carriers simply can’t afford the capital expenditure required to install a DAS in each. Instead, the cost of installing the “fifth utility” in buildings falls to building owners, operators, tenants and facilities managers.

Many offices, hospitals, colleges, schools, REITs and warehouses are willing to make the investment required to deploy a coverage solution. As a middleprise DAS systems integrator, we talk to these customers on a daily basis. The need for a DAS is often driven by complaints from tenants, employees and guests, and their primary concerns are cost-effective solutions that provide multi-carrier coverage. Cellular connectivity issues often directly impact their bottom lines through lost sales and low productivity.

While carriers sometimes make small cells available to their enterprise customers, these devices offer limited coverage areas, are tied to enterprise accounts and can’t easily be monitored for reliability. Those small cells need to be connected to a DAS to be cost-effective in multi-carrier deployments for buildings larger than 50,000 sq ft.

Setting the standard: Key criteria for middleprise signal sources

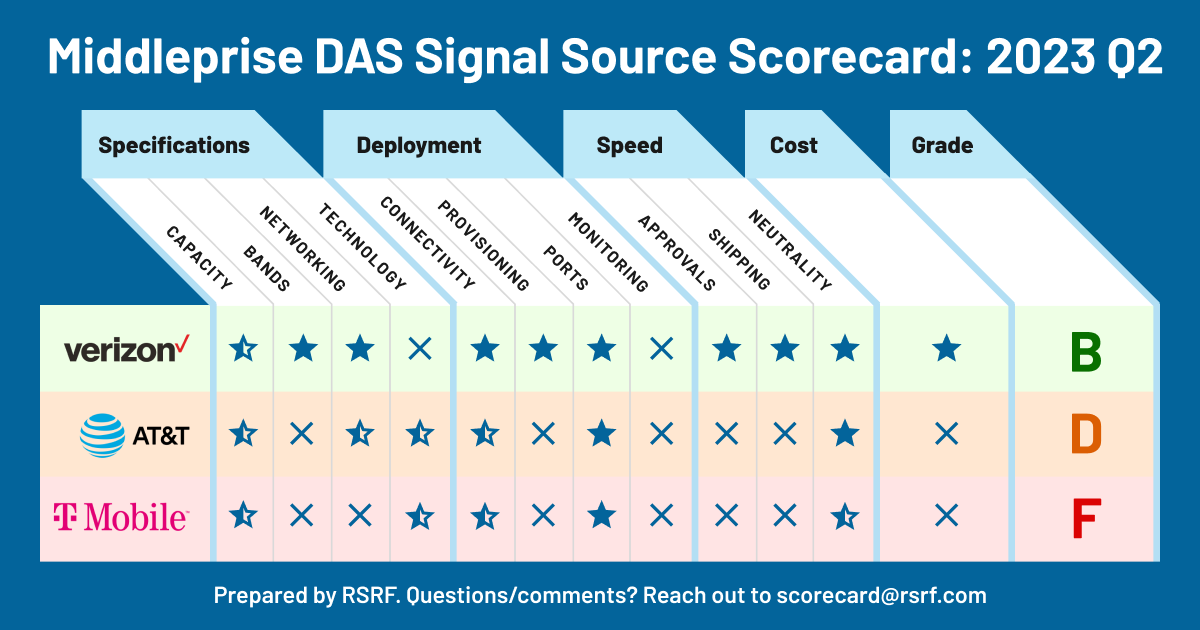

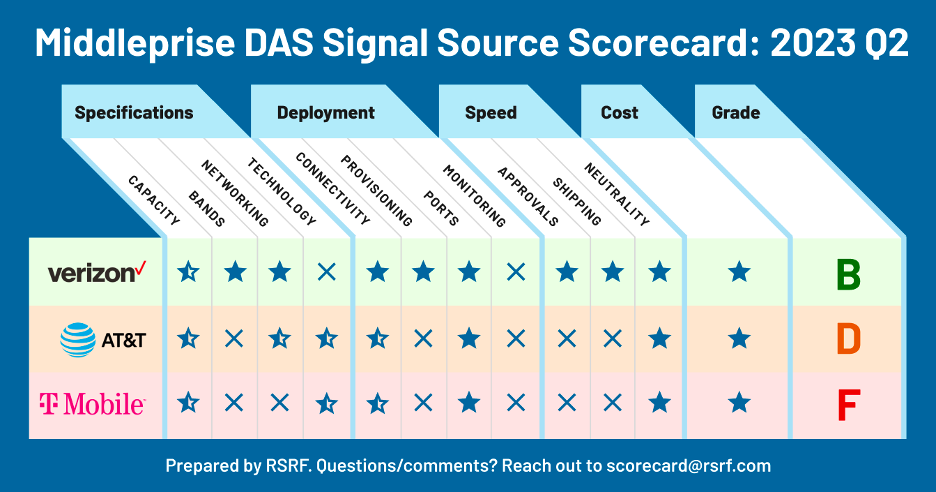

In grading the carriers below, we created the following criteria for the ideal middleprise DAS signal source line-up:

Device specifications:

- Capacity: Multiple devices that support between 64 to 256 simultaneous active users to support for various building sizes and user densities.

- Bands: Support for both low-band (600/700 MHz) and mid-band (1700 to 3.5 GHz).

- Networking: Minimal firewall/port opening requirements.

- Technology: 4G LTE and 5G NR support.

Deployment

- Connectivity: Works over untrusted backhaul.

- Provisioning: Simple self-provisioning without local network involvement.

- Ports: External antenna ports for easy DAS connection.

- Monitoring: Easy configuration and monitoring for DAS integrators.

Speed:

- Approvals: Fast-track approval for DAS connection with minimal or no network team involvement.

- Shipping: Availability for online ordering and ships within 14 days directly from the carrier.

- Neutrality: Not tied, associated with, or limited to a specific DAS vendor.

Cost

- Cost: Under $50 per simultaneous, active user. E.g. a device that supports 64 active, connected users should cost less than ~$3000.

Carrier performance: The middleprise scorecard

Verizon: B

Verizon gets it: they give broad permission for their “Enterprise Network Extender” to be connected to DAS, understanding that it offloads their macro towers. Verizon remain in control of each device if there’s ever a problematic deployment.

The “eFemto,” originally made by Samsung and now by Casa Networks, is the single best middleprise DAS signal source offering from a carrier.

Priced at $3,000, the devices ships quickly, self-provisions over untrusted backhaul and has minimal firewall requirements. It can easily be toggled from 700 MHz up to the AWS 2100 MHz frequencies, and supports 64 active, connected users (~320 total users at a 4:1 idle to active ratio).

That being said, the eFemto is not perfect. The current generation device does not support 5G, and only one 64-unit capacity variant is available, making it challenging for densely populated buildings. It also doesn’t support SNMP trapping or provide an API or detailed metrics for integrators looking to monitor and maintain devices.

Given the poor showing by the other carriers, Verizon takes the crown for best middleprise signal source. Despite lacking 5G support, the Enterprise Network Extender is far ahead of the competition.

AT&T: D

AT&T knows every answer on the test, but insists on flunking anyway. Their “Cell Booster Pro” enterprise small cell would be an excellent middleprise signal source. However, the unit is hobbled by the lack of external antenna ports. Further, connecting a Cell Booster Pro to a DAS is strictly forbidden by AT&T’s network team.

How could an enterprise femtocell that they ultimately control be worse than adding more off-air, Part 20 signal boosters to their network?

AT&T does have a nationwide HQ-driven signal source program for venue-funded DAS, but it’s slow to deploy due to a requirement for dedicated fiber backhaul, extremely expensive and the RF design requirements to qualify make DAS deployments dramatically more expensive. The final signal sources provided to customers (e.g. Nokia MBOs) cost tens of thousands of dollars and take months to deploy, making them untenable for all but the largest buildings.

T-Mobile: F

T-Mobile has rolled out multiple signal source programs (BYOC, then BYOC Express/2.0) to easy deployment of signal sources. Those programs are – as far as we can tell – overcomplicated and underfunded.

Obtaining a signal source is nearly impossible unless explicitly approved by the local network team. There are no self-provisioning enterprise small cells that support untrusted backhaul available and enough capacity to be connected to a DAS (T-Mobile has floated Commscope’s OneCell for this, which fails in multiple ways but most importantly on pricing and neutrality).

Deploying a signal source from T-Mobile takes months, is mired by bureaucracy, and is only priced reasonably if the sales team sees an opportunity to sell SIMs to the venue.

Conclusion: It’s time to prioritize the middleprise

Middleprise customers are both willing and able to pay for DAS deployments and signal sources. But deployments need to happen in weeks, not months or years. And signal sources can’t cost exorbitant amounts.

By making low-cost signal sources available for DAS deployments, Verizon has a huge head start. AT&T and T-Mobile would benefit from investing in similar solutions to enable easy connection to venue-funded middleprise DAS deployments.

Easy-to-use signal sources would improve AT&T and T-Mobile’s indoor coverage and protect their macro networks from the additional congestion and noise caused by Part 20 signal boosters.