Greetings from Louisiana and the Midwest. Pictured blow is the Fastwyre ribbon cutting held last week in DeRidder, Louisiana. We had a terrific time meeting hundreds of future customers frustrated with their current broadband options. There are many more Fastwyre ribbon cuttings coming to towns in Louisiana, Missouri and Nebraska — stay tuned!

Over the last two weeks, each of the Telco Top Five have announced earnings. As we do every quarter, we will attempt over the next two Briefs to summarize where each of the large carriers is competitively positioned.

The fortnight that was

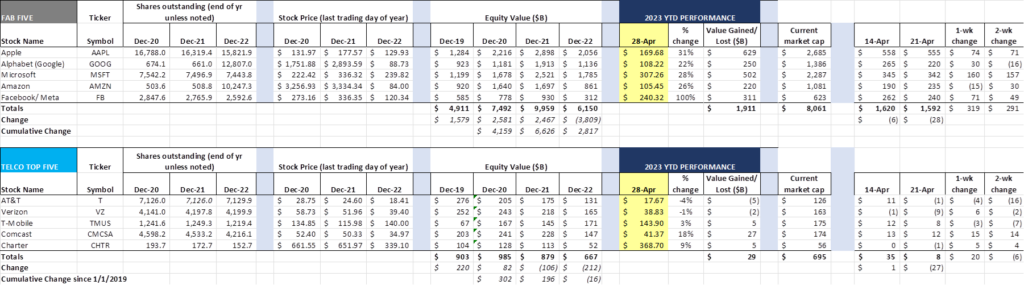

The Fab Five had a $319 billion bounce back this week as investors decided that they are strong enough to weather any recession. As we mentioned earlier and will chronicle in the next Brief after each Fab Five company has reported, cash/ equivalent balances have been steady, even for Meta/ Facebook. Buybacks using excess cash are in vogue, and, dare we say it, each of the Fab Five is thinking about more debt.

So far in 2023, the Fab Five have managed to recoup half of 2022’s losses with Apple (-$842 billion in 2022) recovering the largest percentage (75%). In two weeks, the dust will have settled on first quarter earnings (Apple left to report next week) and we can evaluate winners and losers more closely. It is highly likely that Apple will meet or beat Q1 expectations even with recent announcements about lower Mac sales.

On the Telco Top Five front, Comcast had much stronger earnings than analysts expected and gained $15 billion in equity market value this week as a result. Verizon and Charter also gained this week, while T-Mobile and AT&T lost modest amounts. Both AT&T and Verizon have lost equity market capitalization in 2023. As of Friday’s close, Comcast was within $1 billion of AT&T’s market capitalization (note – the share counts above reflect Q4 2022 10-K disclosures and will be updated in next week’s interim Brief).

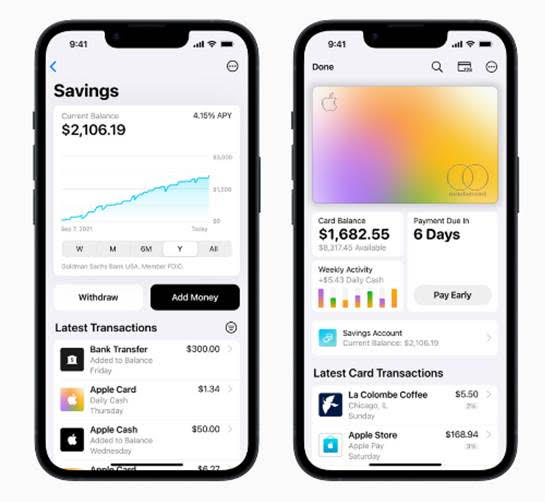

While Apple did not announce earnings yet, they have announced that they are going to be offering Goldman Sachs high-interest savings accounts to their Apple Card customers (company announcement here). While Apple rarely provides updates on the success of any program, we think the initial response likely fell short of expectations. According to the latest data from Lending Club (here), 60% of all Americans (and 66% of GenZ) are living paycheck-to-paycheck. New account numbers are likely tracking to expectations, but the average balance is likely materially smaller as inflation continues to crimp the savings rate.

One announcement that positively impacted Apple this week came from the Ninth Circuit Court of Appeals, which held that the Cupertino giant did not have a monopoly over mobile games (article from The New York Times here). The only silver lining in the judgment for Epic Games appears to be that Apple did violate California’s Unfair Competition Law by prohibiting customers from directing payments outside the App Store. While Apple indicated that they may appeal this decision, we expect that that will not be a priority for the company.

The big ruling of the last two weeks came from the United Kingdom Competition and Markets Authority (known as the CMA), which stated that they would be blocking Microsoft’s $68.7 billion acquisition of Activision Blizzard. This announcement was particularly surprising as they had recently dropped a key objection surrounding impact on gaming consoles. Per the CMA (link here):

“We found that the Merger would make Microsoft even stronger and substantially reduce competition in this market. We found that Activision’s titles—including [Call of Duty] CoD, World of Warcraft, and Overwatch—will be important for the competitive offering of cloud gaming services as the market continues to grow and develop. We found that, after the Merger, Microsoft would find it commercially beneficial to make Activision’s titles exclusive to its own cloud gaming service. Given its already strong position, even a moderate increment to Microsoft’s strength may be expected to substantially reduce competition in this developing market, to the detriment of current and future cloud gaming users.”

To have a successful appeal against this ruling, Microsoft will need to prove “that the CMA acted irrationally, illegally or with procedural impropriety.” Since most of the statement concerns how the combined Microsoft-Activision Blizzard will act, making this has will be difficult. Microsoft has plenty at stake here, but there is a point where additional concessions do not make sense (versus a tight-knit commercial relationship).

First Quarter Earnings in Five Words or Less (Part 1)

Rather than the simple regurgitation of conference call, presentation and 10-Q snippets, we thought we would try some extreme summarization for each of the Telco Top Five entrants. This week, we cover AT&T, T-Mobile, and Charter. In the next Brief, we will summarize Verizon and Comcast (nominations strongly encouraged). Here are our super-short summaries for the first three:

AT&T: Durable customers

T-Mobile: Durable cash flow

Charter: Mobile and rural subsidies

AT&T: Durable customers

AT&T was the first of the telecom carriers to report earnings (package here), and analysts punished the report with a 10% equity haircut on announcement day (the stock clawed back about three quarters of this loss last week). No business unit surprised to the upside, and questions remain about the viability of DirecTV (without a Dish merger), and the sustainability of recent trends that drive disproportionate profitability (e.g., AT&T Mexico).

AT&T continually mentioned the word “durable” during their conference call. Their top priority is to “Grow durable 5G and Fiber relationships.” John Stankey, AT&T’s CEO and Pascal Desroches, AT&T’s CFO, used the word durable nine times in the 61-minute earnings call (they used another common buzzword, AI or Artificial Intelligence, just twice).

One of the commonly used metrics in telecom decision making is Customer Lifetime Value or CLV. This is usually viewed as the product of two financial ratios: a) profitability, and b) average customer life (in months). A customer that generates an operating profit of $30/mo. and has a 100-month life would generate a $3,000 CLV.

Profitability largely depends on scale (which AT&T clearly has), and competitiveness. Customer life is directly correlated to churn, which also is directly tied to competitiveness. AT&T’s strategy focuses on investments that generate very low churn and therefore high CLVs. Examples include:

- Being first in the market with fiber to the home (FTTH) products. The value proposition is not as durable if a like product from a more nimble competitor exists

- Choosing segments and customers like FirstNet (First Responder Network Authority) over business wireline and even some enterprise customers

- Foregoing quick cash flows (see T-Mobile below) from better wireless spectrum and transport/ backhaul capacity utilization in lieu of focused in-region FTTH deployments

- Expanding all promotions to include existing customers

- Lowering monthly costs to consumers through the migration from 24- to 36-month equipment installment plans

In this sense, durable has a two-fold definition: 1) protect the current base from competitors’ promotional threats, and 2) make investments that result in high barriers to entry.

AT&T has concluded that a Max bundle, for example, is not as durable as other promotional alternatives (in our opinion, a missed opportunity to acquire additional fiber and wireless customers). DirecTV is not durable given its high churn and competitive threat from rural infrastructure winners (which could include AT&T in 2024). Fixed wireless, as they conveyed on the call, just did not have the CLV staying power. We wonder how Mexico (a key driver of improved EBITDA in the quarter) and US Prepaid businesses fit into the durability equation.

The problem with AT&T’s durable strategy is that it depends on a very predictable (likely 2-3 competitors depending on the opportunity density) competitive environment for the next 10-20-50 years. Specifically, it is predicated on the fact that we are currently living in a “once in a generation” infrastructure investment opportunity, ignoring the previous waves of interexchange and global fiber, [small] cell towers, and [hyper] data centers among others. In many respects, AT&T’s strategy relies on a pre-1996-Act world where occasional competition is quickly extinguished by the largest providers.

AT&T’s durable customer strategy requires a very long and stable future. Has stability has been the theme in telecommunications over the last three decades?

T-Mobile: Durable cash flow

Not to be outdone by AT&T, T-Mobile announced solid earnings (package here) and CEO Mike Sievert co-opted AT&T’s prized word, using “durable” four times in his comments. His focus: a durable network lead (mentioned twice), a durable acquisition strategy focused on under-penetrated segments, and this comment (emphasis added):

“We expect our industry-leading cash flow margin to be a durable and differentiated unlock of shareholder value going forward.”

Durable cash flow is driven by the scale-driven cost basis caused by a well-executed integration of Sprint’s base into T-Mobile. As was said many times by now retired President of Technology, Neville Ray, if T-Mobile could integrate the Sprint base with precision, it would prove to be substantially less expensive and faster than acquiring C-Band spectrum. He was right and, at least so far, it appears that T-Mobile is ahead.

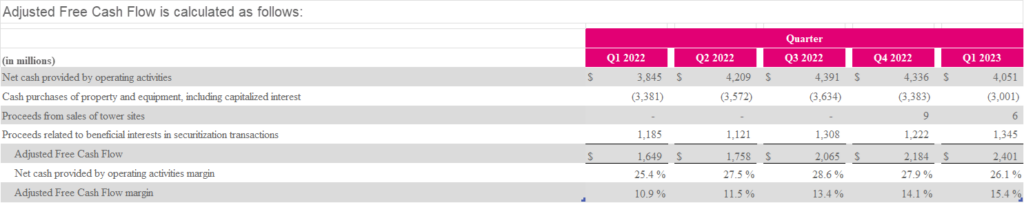

In Q1, we started to get a glimpse of the post-Sprint T-Mobile cash flow picture. It’s quite good:

Adjusted free cash flow is rising to nearly a $10 billion annual rate, driven by higher income and lower capital spending. Importantly, it’s accompanied by stable debt levels and $7 billion in stock buybacks.

This cash flow picture will get better as Sprint merger costs continue to decline. AT&T, in contrast, faces higher short-term debt loads as they deploy C-Band and fiber. As of the end of 2022 (post-WarnerMedia spin), they had approximately $132 billion in net debt and $5 billion in unfunded pension benefit obligations with just under $36 billion in cash flow from operations and $10 billion in dividends.

We recently devoted an entire Brief to T-Mobile’s free cash flow options (here) and will not belabor the point. T-Mobile has leverage (pun intended) because they spent less for Sprint’s mid-band spectrum than they would have had they made a similar investment in the C-Band auction. That’s a different type of durability.

T-Mobile’s strong quarter aside, we were particularly interested in Mike Sievert’s potshot at Charter in the conference call:

“Charter had a blockbuster quarter, we think, in phone net additions and we saw that unfolding through the quarter. But one of the things we try to do when we sort of make out — at least for us, when we make our operating decisions is we try to figure out, well, what’s behind it and double click into it. And what we see going on is that, for example, in this big number, they’re about to report, about 75%, we think, of the uptick from prior normal levels, let’s say, a year ago, are in non-parts sort of printed net adds, like drop you a free line in the bag or kind of low-calorie net adds. And so we try to kind of adjust for that when we make our operating decisions as to how fast to run and where and how to compete because they’re really — it’s kind of a quantitative easing happening in the marketplace. There’s just new adds being printed that don’t appear to be coming from any of the incumbent players. So it’s kind of important to adjust for all that, at least for us, as we make our operating decisions. It looks to us about 75% of the uptick has been those kinds of nets.”

Applying Mike’s logic to what Charter reported the next day (666K net additions in consumer, up 309K or 87% from Q1 2022) would imply that 232K net additions were “free lines in the bag (new telephone numbers vs. ported numbers from another carrier).” More on Charter’s response below.

Charter: Mobile and rural subsidies

Charter reported better than expected earnings and cash flow last Friday as they launch mobile and rural fiber-to-the-home (FTTH) builds as a result of their participation in the Rural Development Opportunity Fund (RDOF). The full earnings package is here.

Leading the way was Internet and mobile growth. Of the $453 million in Q1 2022 to Q1 2023 growth, $294 million (65%) came from mobile service revenue growth and $266 million (59%) came from residential Internet. Mobile growth is needed to offset the video and voice losses (total combined RGU losses of 461K between the two products in Q1 is high and portends a number closer to 550K net losses in Q2).

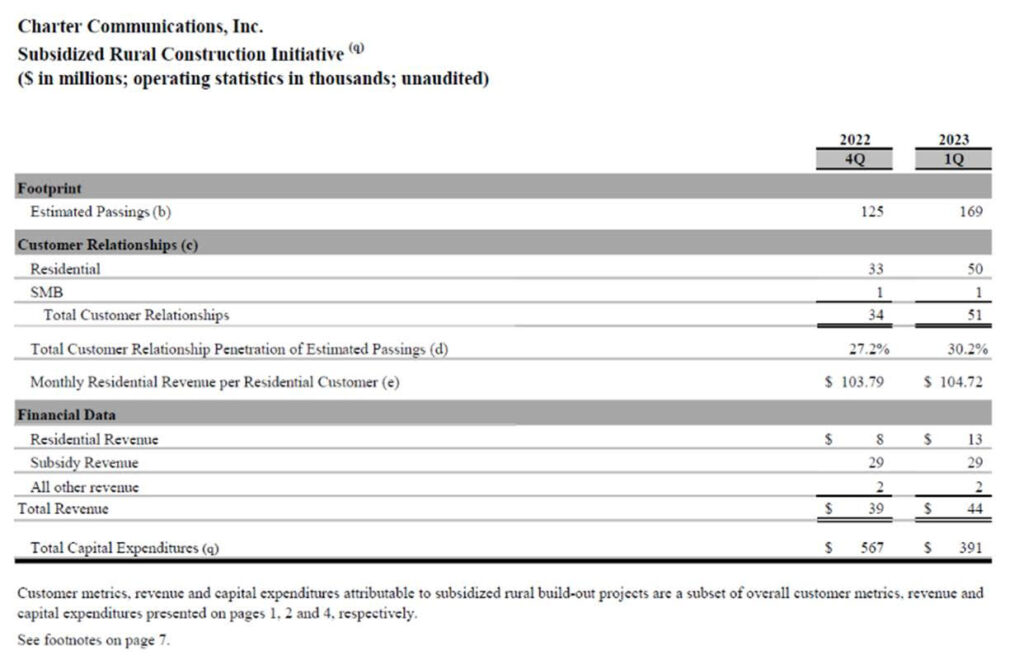

Charter’s passings also rose by 312K in Q1, with 169K (54%) of that coming from the rural initiative. Given Charter’s strong presence in markets like Tampa, Austin, Dallas, San Antonio, and Los Angeles, we find the remaining 143K to be very low and wonder if the company is taking full advantage of edge out opportunities near these high-growth centers.

Charter included a separate disclosure on their rural initiative (see nearby chart). They have passed just under 170K homes which puts them on track (assuming permits come in on schedule) to complete their build by the end of 2025. As CEO Chris Winfrey indicated, the company has meaningful RDOF obligations in Ohio, Michigan and Wisconsin where ground was still frozen. We anticipate that they will end 2023 with more than 450K homes passed (nearly halfway there). Note that the most rural areas will take the longest and yield the fewest homes.

What is surprising to us is that they have spent ~$1.9 billion to date in the rural since the beginning of 2022 (see page 4 in their trending schedules through the link above); we assume that the $958 million shown in the picture nearby represents the capital associated with the 169K homes completed, and that the $1.9 billion represents additional construction work in process. As such, Charter appears to be building out rural for $5,600-5,700/ home passed, which, as they designate in a footnote, excludes customer premise equipment and installation. The government is picking up ~ $1,160/ home passed of that number, leaving the “net of subsidy” for the 169K homes at ~$4,500/ home passed.

Charter is also seeing a stronger attach rate of video and phone with the $104.72 monthly revenue per residential customer figure (we are assuming that mobile phone is not a “lead” product in the rural areas and that products such as Spectrum One are not offered at the same $49.99 price point). Based on our internal estimates, it would not surprise us to see a 7-8 year payback depending on the penetration.

Bottom line: While the word “subsidy” was used extensively on the call, the RDOF program contributes far less than more recent grants and what most experts assume will be the case with the next round of infrastructure funding (called BEAD). Assuming our numbers are correct (we’ve seen higher than $5,600 in many grant applications), it’s more of a 20/80 funding scheme for the million homes covered in the schedule.

Back to the comment made by Mike Sievert mentioned above. The first question on the analyst call was from Doug Mitchelson at Credit Suisse and basically asked Chris to address the “low calorie” comment and specifically release what percentage of the quarter’s gross additions were ported vs new telephone numbers. Without giving Chris’ full quote, here’s how he responded:

- Each customer we have acquired is a “great customer”

- In the aggregate, the customers acquired through the program have “good usage”

- They are getting the fastest Internet product in mobile

- When the 12 months end, they get a terrific price at $29.99/ month (taxes and fees included)

He ends this part of the question with “So our expectation is that it all sticks.” We interpret that comment to include both the service “Buy One/ Get One” (BOGO) offer as well as the Spectrum One customers. No doubt retention will be high for the first, but, as we have discussed when it came out, when the Spectrum One promotion ends, the total price rises from $49.99/ mo. to $114.99/ month. With AT&T in the Texas and Florida markets @ $55/ month for 300 Mbps symmetric fiber to the home pricing that includes Wi-Fi, that would imply that customers could not find a wireless offering for less than $60/ month.

Bottom line: We think that more than half of the additions came from Spectrum One or a free line. Those lines are at high risk. Spectrum should be more transparent on the new vs. ported telephone number figure and publish in their next earnings report.

That’s it for this week. In our next Brief, we will continue the earnings discussion with more info on video and the key to Comcast’s long-term success. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific end to the quarter and Go Royals, Sporting Kansas City, and Davidson Wildcat Baseball!

*Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.