US Cellular says its Fixed Wireless Access gross adds for the quarter were up 130% YoY

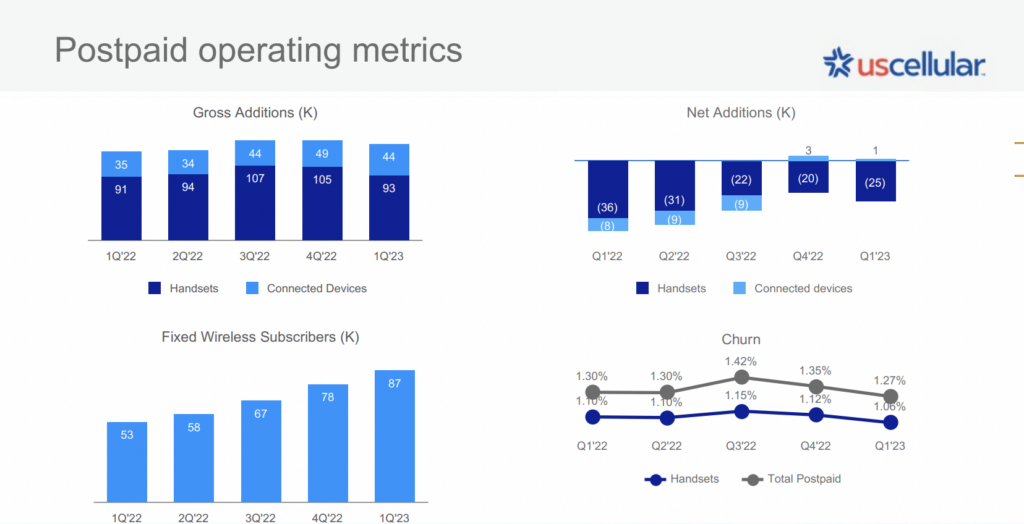

In a Q1 2023 earnings call, US Cellular executives reiterated the company’s top priority of boosting customer results, claiming improvements in postpaid gross adds on a year-over-year basis and postpaid churn on both a year-over-year and sequential basis. US Cellular President and CEO Laurent Therivel provided context for these improvements, explaining that pricing and promotional efforts launched in mid-2022 contributed significantly.

“Specifically, we were looking to address churn reduction,” he said on the call, adding that the company expects to see notable improvements within six to nine months. “We’re now starting to see that in the consumer channel. Our voluntary churn improved about 10% year-over-year,” Therivel said. “At the same time, we also launched our flat-rate plans in order to improve the gross ad trajectory. And we continue to see steady adoption of those plans. And on average, nearly 27% of our flat rate customers have selected the higher tier unlimited plans.”

Therivel added that he is “pleased with the balance” that US cellular has struck between “subscriber and financial aggressiveness.” He also noted that while there is “still a lot of room to go,” the company’s in-contract rate is about 64%, which he said is “as high as it’s been in a long time … We’re going to have to maintain that type of in-contract rate if we want to continue to see positive churn momentum.”

Fixed Wireless Access and network results

US Cellular’s EVP, CFO and Treasurer Doug Chambers highlighted the carrier’s Fixed Wireless Access (FWA) customer growth, which he said drove 9,000 year-over-year connected device gross and net additions. “We continue to see strong momentum in fixed wireless, with a base of customers up 63% from the prior year and up 11% from the end of 2022,” he said.

Further, FWA gross adds for the quarter were up 130% year-over-year, and the carrier claimed 87,000 subscribers, with a total of 100,000 subscribers expected later this year. “We expect another solid quarter of year-over-year growth in the second quarter, as we did not expand fixed wireless to our entire footprint until June of last year,” stated Therivel, adding that as the company starts to deploy its mid-band spectrum, additional growth momentum for fixed wireless is anticipated.

Approximately 80% of US Cellular’s traffic is carried by sites supporting 5G, and Therivel shared that the carrier is starting to roll out 3.45 GHz spectrum and C-band, so as more spectrum clears, they are ready. “We expect that to be in late 2023,” he said.

Other key takeaways

US Cellular reported tower business revenue growth at 11% year-over-year, with total operating revenue of $986 million for Q1 2023, compared to $1,010 million in Q1 2022 and total service revenues of $767 million, versus $787 million for the same period one year ago. Therivel also took a moment to comment on the recent staffing reduction at US Cellular, calling the decision a “difficult” one, but one that allowed the carrier to “sharpen [its] focus and … alignment as well as improve [its] operational efficiency and effectiveness.”