Greetings from Louisiana, Texas, Nebraska and Missouri. Pictured is Fastwyre’s oversized check presentation for the First Annual Sedalia Hot Air Balloon and Kite Festival. We are excited to be a part of what will hopefully be a terrific tradition for the Sedalia area. More details on the event are here. Our Warrensburg ribbon cutting pic is at the end of this week’s Brief.

This week’s Memorial Day Brief varies slightly from our traditional format. After a brief market commentary, we will explore the overall economic landscape through the eyes of Warren Buffett (Berkshire Hathaway), Jamie Dimon (J.P. Morgan, and Andy Jassey (Amazon). While lengthy, we think this provides a starting point for strategic planning departments and executive teams to evaluate conditions for the next 12-18 months.

A quick note of congratulations to Kansas City-based Unite Private Networks (UPN) on the sale of the remaining portion of the company to Cox/ Segra (announcement here). While no one was surprised at the announcement, it reflects Cox’s significant expansion out of their traditional territory. Today Segra is focused on commercial services, but one can only think that this eventually leads to more residential overbuilding of their cable brethren.

The fortnight that was

As debt ceiling talks continued into the Memorial Day weekend (and the “till is dry” date was elongated to June 5, or maybe even July), short-term interest rates continued their volatility, with the one-month Treasury bill briefly eclipsing 6%. With a terrific start to 2023 and a guaranteed 5+% return through the remainder of the year thanks to Uncle Sam, the equity markets are not as attractive today as they have been over the past decade.

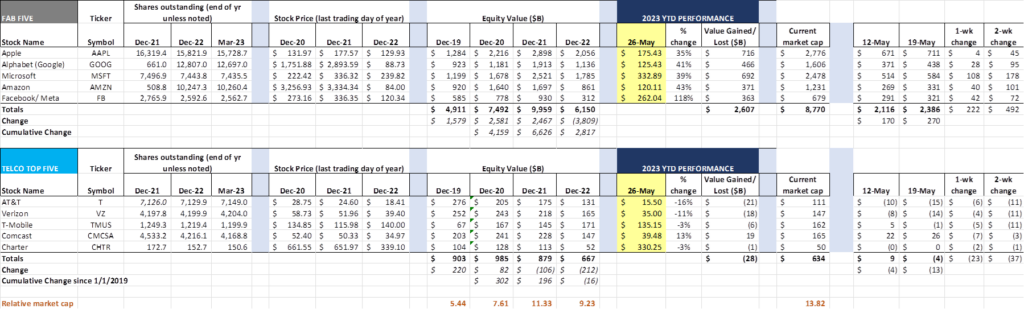

Verizon and AT&T have long been considered “safe stocks” in uncertain times. That is no longer the case, with each down $11 billion in value over the last two weeks and down a combined $39 billion in 2023. Verizon is now yielding 7.5% and AT&T just below 7%. AT&T could very well end the year with less than $100 billion in market capitalization after being nearly 3x higher entering 2020.

While many analysts are attempting to cite specific actions (e.g., Verizon’s myPlan introduction last week; Verizon’s offshoring of 6,000 customer service positions; the fact that AT&T has shed more workers over the last nine quarters than were lost due to the Sprint/ T-Mobile merger – see trending schedule here), it’s really more of a mathematical function for portfolio managers: Hit the 2023 target without doing any work. The overall S&P is up 9.5% prior to dividends through last Friday, and, for no work, seven months of 5.25% yielding bonds (+ S&P dividends) will result in 12.5–13.5% returns for 2023.

What’s interesting is that the Fab Five (and any other company that can make a convincing case that Artificial Intelligence and Machine Learning will transform their growth trajectory) are exempt from the “stay away in May” case. As a group, the Fab Five are up nearly $500 billion in the last two weeks, and their accumulated value now exceeds $8.7 trillion dollars. We don’t talk much about this, but the difference between the accumulated value of the Fab Five and the Telco Top Five is now $8.1 trillion. For every dollar of market capitalization created by the Telco Top Five, the Fab Five have now created $13.82. A little less than five years ago, that ratio was 4.88x.

On the bright side, it does make the case for accelerated stock buybacks for T-Mobile (which we think they will do – see link below). Also, the market has correctly determined that Comcast can command a higher price/ earnings multiple than Charter (29.5 vs. 11.4 as of Friday’s close). We aren’t quite sure it should be this large, but we do think that Comcast’s broadcasting and Sky assets might generate more cash flow growth than the US cable business. This elevated view leaves Comcast as a most valuable US telecom stock and second globally to China Mobile.

Words of wisdom (Memorial Day weekend edition)

Long holiday weekends are great for reflection, whether to commemorate the sacrifices made by those who bravely served the United States in military conflicts or the depth of the upcoming recession.

We will be doing both, and though that it would be beneficial to provide three perspectives for Sunday Brief readers to consider. The first will come from the Oracle of Omaha, Warren Buffett. He will be followed by J.P. Morgan’s Jamie Dimon, and we will conclude with Andy Jassey from Amazon.

We will attempt to tie the themes expressed in these letters back to telecom – sometimes, that has to be at a very high level.

Letter #1: Warren Buffet’s Letter to Berkshire Hathaway Shareholders

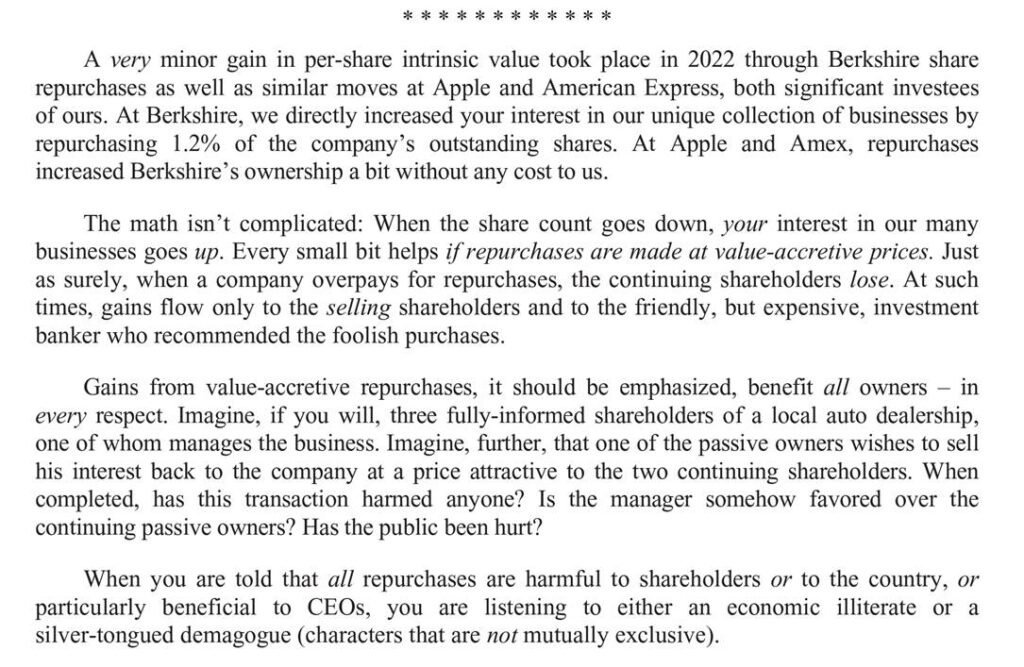

We could write multiple Briefs on each Berkshire Hathaway Letter to Shareholders (link here). As Warren Buffett and Charlie Munger have grown older (now 92 and 99, respectively), their letters have turned even more folksy and retrospective. This year, in addition to quoting many Charlie Munger maxims (which, in many cases, are from others like Ben Graham), Buffett takes on the concept of shareholder repurchases:

The simplicity of this section should not be lost on any executive. Provided the purchases have been value accretive, everyone wins.

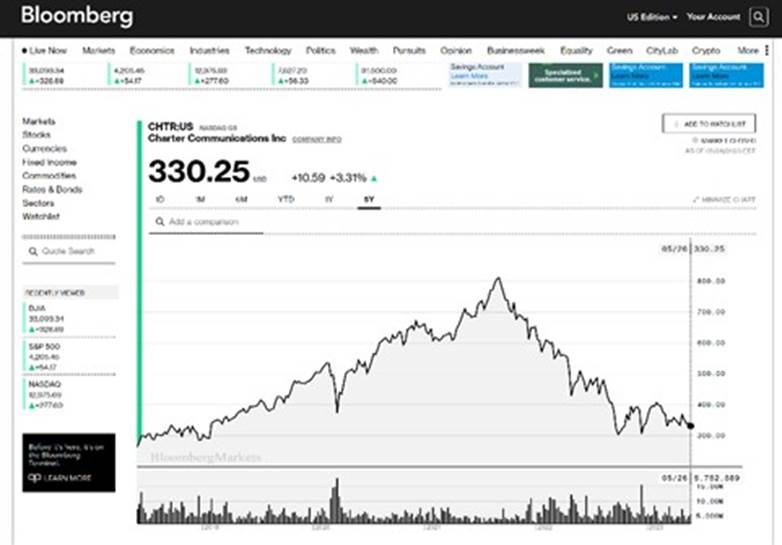

Did the folks at Charter Communications make the right decision for shareholders when they repurchased shares from July 2020 through June 2022 (see nearby chart)? Time will tell, but it’s certainly a harder case to make given their current stock price. According to the folks at Y Charts (link here), the company purchased over $30 billion in shares over those eight quarters and now has a leverage ratio of 4.5x trailing adjusted EBITDA.

Then there’s the case of T-Mobile who is likely going to be generating a lot of cash over the next 2-3 years (see our February 2023 Brief here on the topic). They are already at an investment grade bond rating, nearing the end of a substantial network and business integration with Sprint, and with a competitively advantaged balance sheet (versus the debt they would have undertaken through full participation in the C-Band auction). Should they pursue US Cellular (likely a 2-3 year approval process)? Should they be more aggressive in their fiber-to-the home pursuits with increased BEAD (a.k.a. “house”) money available? Using Buffett’s logic from his note, there’s a price where share repurchases are in the best interests of shareholders, and that time may be now.

Letter 2: Jamie Dimon’s Letter to J.P. Morgan Shareholders

Unlike Buffett’s letter, J.P. Morgan CEO Jamie Dimon’s focus is more on contemporaneous issues, and, given that it was written shortly after the collapse of Silicon Valley Bank, there were many current events of interest. On SVB, Jamie did not mince words (emphasis added in the quote is from the company – full letter here):

“The recent failures of Silicon Valley Bank (SVB) in the United States and Credit Suisse in Europe, and the related stress in the banking system, underscore that simply satisfying regulatory requirements is not sufficient. Risks are abundant, and managing those risks requires constant and vigilant scrutiny as the world evolves. Regarding the current disruption in the U.S. banking system, most of the risks were hiding in plain sight. Interest rate exposure, the fair value of held-to-maturity (HTM) portfolios and the amount of SVB’s uninsured deposits were always known — both to regulators and the marketplace. The unknown risk was that SVB’s over 35,000 corporate clients — and activity within them — were controlled by a small number of venture capital companies and moved their deposits in lockstep. It is unlikely that any recent change in regulatory requirements would have made a difference in what followed. Instead, the recent rapid rise of interest rates placed heightened focus on the potential for rapid deterioration of the fair value of HTM portfolios and, in this case, the lack of stickiness of certain uninsured deposits. Ironically, banks were incented to own very safe government securities because they were considered highly liquid by regulators and carried very low capital requirements. Even worse, the stress testing based on the scenario devised by the Federal Reserve Board (the Fed) never incorporated interest rates at higher levels. This is not to absolve bank management — it’s just to make clear that this wasn’t the finest hour for many players. All of these colliding factors became critically important when the marketplace, rating agencies and depositors focused on them.”

There’s a lot to this section of Jamie Dimon’s letter, especially the comment that SVB’s risks were “hiding in plain sight.” Sure, a few large venture capital firms hastened SVB’s demise (this concentration is apparent with a bit of portfolio sleuthing from each VC’s websites) but the attempt to stretch out the investment horizon of government debt (which resulted in an investment portfolio that did not mirror the increased liquidity of their depositors) created a valuation risk.

The closest representation we could think of would be if Verizon or another large wireless carrier decided to finance spectrum purchases using commercial (short-term) paper. It’s not impossible to do it, but, if credit alternatives exist that would align the investment horizon with the debt term, why not align the two (or at least get closer than annual resets) and properly de-risk the investment? To us, the SVB crisis had its roots in bad investment decisions, poor stress testing (first by the bank, and then by the regulators) and then through panicked depositors.

In the “Management Lessons” section of Jamie Dimon’s letter, he discusses the importance of long-term value creation on decisions about bank branch location selection and resourcing;

“Another example relates to any branch-based business. Let’s say I build a system with well-designed and well-located branches, staffed by well-trained personnel who can offer customers great products and services and who strive to do every task a little bit better. Then you build a branch system with outdated sites in poor locations (often to save money) that have undertrained and underpaid staff and lower-quality products and services. Between the two, my branch system will win every time. One system will have high franchise value and be self-perpetuating with high returns. The other enterprise is probably on the road to eventual failure. If you study the history of business, you can see this phenomenon play out in grocery stores, car companies, restaurants, retailers and various other enterprises.}

Needless to say, we immediately thought of the decisions wireless providers (and to a lesser extent, cable companies) are facing with respect to retail store selection and staffing. The wireless industry had an easy response when growth was prevalent (more doors = higher share of decisions), but in a post-COVID world with 30-day returns and crowd-sourced service, the fight to maintain many (or any) company-owned stores is harder. No communications company has perfected the retail equation (although MVNOs Mint Mobile and Consumer Cellular are coming close in the direct-to-consumer world), and the parallels to the banking industry are many.

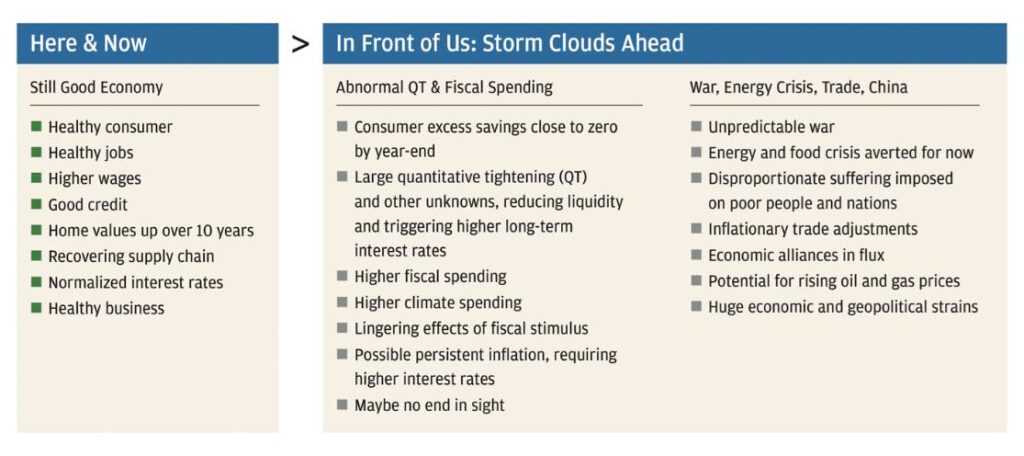

Finally, the letter lays out a 2023 economic summary which looks a lot like our view from previous Briefs:

In many telecom earnings calls (especially with cable companies), a “lack of movers” is cited as a reason for lower gross and net additions. This “stay in place” mentality is reinforced as mortgage rates rise (note: 30-year fixed interest rate mortgages for mid-tier credit (700-720 FICO score) are now topping 8% – just Google “mortgage rates” for more details).

But what if a job change or another life circumstance forces a move? Who is impacted when a higher mortgage payment (if approved) removes hundreds of dollars of discretionary income? Unlike last summer’s gas price spike, mortgage costs (as well as other items such as property taxes) tend to me more permanent. Does a longer-term higher interest rate environment lead to a “stay in place” mentality, or a lower-value home? Could it lead to the resumption of owner-financing? Many questions come to mind when the long-term impacts of higher mortgage rates are considered, with nearly all scenarios leading to less discretionary spending for the foreseeable future. That news is not good for streaming (ad-supported or otherwise), bandwidth upgrades, and traditional cable TV pricing.

Letter #3: Andy Jassey’s Letter to Amazon Shareholders

Finally, we highlight Amazon CEO’s letter to shareholders (here). This letter followed a particularly difficult year for the company after two years of COVID-driven blockbuster returns (see the table above: $830 billion in shareholder value lost in single year doesn’t happen every day, regardless of the reason). The company ended 2022 with less equity value than they had prior to COVID’s onset.

Jassey’s letter is probably the closest proxy for what many large corporations faced as they emerged from the pandemic. How many other companies asked questions like those addressed in his letter:

- What is the new normal? How big are the changes going to affect our current operations?

- What should we focus on? What should we stop? What should we accelerate?

- How does Amazon continue its culture of invention and innovation without routine in-office presence?

Jassey also goes into their transition from a national to a regional logistics structure (very smart), a clear outcome of the newfound pandemic scale.

At the same time as he defends cutting some businesses, Andy defends continued AWS investment, and specifically cites the performance their GPU processor (called Graviton) is delivering to make better decisions.

Given time and space constraints, we will limit ourselves to an excerpt from the closing section:

“I’m optimistic that we’ll emerge from this challenging macroeconomic time in a stronger position than when we entered it. There are several reasons for it and I’ve mentioned many of them above. But, there are two relatively simple statistics that underline our immense future opportunity. While we have a consumer business that’s $434B in 2022, the vast majority of total market segment share in global retail still resides in physical stores (roughly 80%). And, it’s a similar story for Global IT spending, where we have AWS revenue of $80B in 2022, with about 90% of Global IT spending still on-premises and yet to migrate to the cloud. As these equations steadily flip—as we’re already seeing happen—we believe our leading customer experiences, relentless invention, customer focus, and hard work will result in significant growth in the coming years.”

At the end of the day, even with Amazon’s substantial growth, they believe that they are just scratching the surface. That view of ever-expanding addressable markets is largely absent in the telecommunications industry. And it’s why Amazon has recovered nearly half of 2022’s historic loss already in 2023.

That’s it for this week. In two weeks, we will analyze comments from several past and upcoming investor conferences and tease out implications to second quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific remainder of the long weekend!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.