Greetings from Nebraska and Missouri. Pictured are the balloons from the Friday night glow at the Sedalia Hot Air Balloon and Kite Festival this past weekend. It was spectacular, and Fastwyre was proud to be a sponsor. Fortunately, the rains held off for most of the event, and thousands of families came out to enjoy a free and fun time. Can’t wait until next year!

This week is going to be a shorter Brief than normal given our duties in Sedalia, but we are still going to explore a couple of intriguing comments made by senior telecom executives during recent conferences. We believe that they shed some light on second quarter and second half earnings.

Many thanks for your comments on the Memorial Day Brief (here). We tried something new yet not totally different for a Holiday weekend and readership did not suffer one bit. Absent breaking news, we plan on taking a similar tack in the July 9 Brief.

The fortnight that was

Since the last Brief, we have reached a debt deal, had a stronger than expected May employment report, seen the future through Apple’s Vision Pro, seen the future of Lumen through new leadership, and cycled through a rumor of Amazon’s MVNO plans. Definitely a full news month for June.

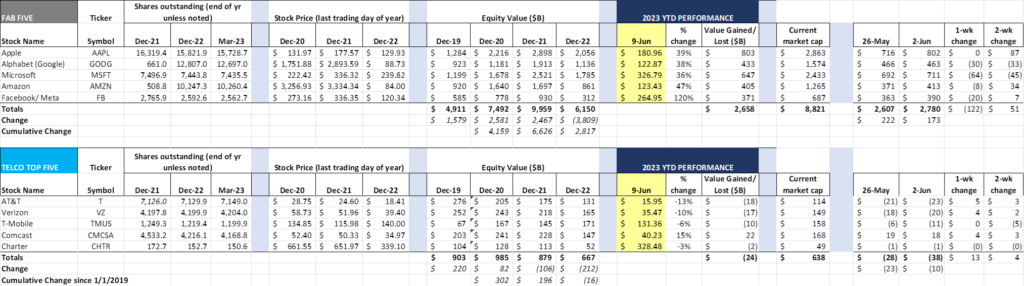

Over the last two weeks, the Fab Five have gained $51 billion with gains at Apple (+$87 billion) and Amazon (+$34 billion) offsetting losses at Microsoft (-$45 billion) and Google (-$33 billion). Through the first 5+ months of 2023, the Fab Five have gained $2.66 billion in market value which represents 70% of 2022’s loss. Apple has fully recovered from 2022 and reached fresh all-time highs last week from their WWDC announcements and Microsoft has nearly recovered as well. Google (~$340 billion gap from end of 2021 market capitalization) and Meta/ Facebook (~$240 billion) have the most value remaining to recoup.

Meanwhile, the Telco Top Five continue their slow-motion declines, with Comcast (+$22 billion) the only stock up for the year. From their respective end of year peaks (Verizon and AT&T = end of 2019, Comcast and Charter = end of 2020), four of the Telco Top Five have shed considerable value (AT&T down $127 billion including the WarnerMedia spin; Verizon down $103 billion, Charter down $79 billion, and Comcast down $73 billion). T-Mobile, propelled by synergies achieved through the Sprint merger, has been the winner of this group, although even the mighty Magenta has appeared to hit a market cap ceiling of ~$170 billion.

Shortly after the last Brief was published, many telecom stocks moved lower on the Bloomberg report (here) that Amazon had been in active discussions about adding a wireless service benefit to their Prime product. This news sent Dish shares up temporarily as traders surmised that a deal would benefit the company (those gains were largely erased as analysts’ research began to reveal various disclosures about MVNO resale). For the last month of trading, however, Dish is up 1.4%, an encouraging and likely temporary sign considering their 50% overall market cap decline since the beginning of 2023. Our interim Brief view of Amazon’s potential move is here.

While a lot of analysis has word-parsed the article, we thought the disclosure that discussions had been occurring for “six to eight weeks” was particularly interesting. On March 3, Verizon announced that Sowmyanarayan Sampath would be taking the helm of the Verizon Consumer Group (Verizon Business has a very strong working relationship with Amazon’s AWS unit). On May 18, Verizon announced their new pricing plans (myPlan). In between that time, the company created their “a la carte” myPlan strategy, which now includes a 30% discount on a monthly Walmart+ membership (while this may not have been the only new brand addition to myPlan, it caught our eye given the alignment of Walmart to Tracfone subsidiary Straight Talk Wireless on Verizon’s network).

Our guess is that Amazon entered into negotiations with Verizon to be featured in their myPlan launch in March, but Walmart+ (the challenger to Prime) won the business. This will allow Walmart+ to close their gap with Prime more quickly (see this Bloomberg article for the stats – there’s a lot of gap to close). Given T-Mobile’s recent drop of the Amazon Prime on Us benefit for legacy Sprint customers (article here from TmoNews), Amazon’s clout with telecom carriers was weakened, and that diminished state likely prompted the Bloomberg article.

Over the last month (May 9 – June 9), T-Mobile has lost 7.5% of its value, AT&T 6.3%, and Verizon 5.6%. As stated above, Dish is slightly higher, and Walmart is flat, while Amazon is up 16% (driven by many other factors than MVNO rumors). Bottom line: Telecom was caught in the crossfire between Walmart and Amazon. As we stated in the interim Brief, a full MVNO is unlikely, but additional relationships (e.g., an AT&T-Amazon Prime relationship) will happen. While this is not the last chapter, it’s unlikely that the next one will include Amazon Prime Wireless.

The other major event this week was Apple’s 2023 Worldwide Developers Conference which kicked off last Monday. We have watched WWDC for the last 15 years (the iPhone 3G was introduced at the 2008 conference) and think that this year’s event was one of the most impactful.

On top of the introduction of the Vision Pro (which, as Apple indicated in their keynote, directly depends on the developer community), there were many other features introduced that will further enhance communication. These included:

- iOS 17: Personalized Contact Posters. This is a logical extension of the personalized lock screen introduced a couple of years ago. While this seems small, the ability to influence presentation (e.g., how you look, why someone should connect) has been something we thought Apple should have capitalized on years ago. Personalization should beget loyalty, and this is one small step to enhance that feature. It’s also important to note that Contact Posters will be integrated into CallKit, meaning that one identity could be used for multiple communications applications (although we think some larger apps might develop their own versions of Posters). Note – With the enhancements Apple has made with Airdrop, contact information is easily transferred.

- iOS 17: FaceTime Video Messages. Another feature that we thought should have been included long ago, and, as we found out in a later session, also includes the ability to prohibit certain contacts from leaving video messages (a “mailbox is full and not accepting messages” feature). Nice to have.

- FaceTime is Coming to Apple TV. Seems small to many, but companies like Fastwyre, who want to create value from increased upstream bandwidth usage, now have their killer app. Leveraging the iPhone rear (not front) camera and features such as Center Stage, Apple has begun the “personal communications on a larger screen” journey with this feature. With the ability to share experiences (e.g., watch a particular episode of a favorite show together), this could drive considerable upstream bandwidth, especially with larger screens that are capable of 4K or higher resolutions.

There’s more to say about Apple’s approach to augmented reality, and how the operating systems will need to interoperate as a result. Given Apple’s ability to integrate operating systems and applications layers (and soon, one or multiple Artificial Intelligence layers), they appear to have a competitive advantage. More on this topic in a future Brief.

What They Said – Second Quarter Clues from Analyst Conferences (Part 1)

There are many questions we would pose to the telecom companies with respect to earnings. Apparently we are not alone as they have shown up in recent analyst calls. Some of these questions include:

- How will Verizon’s myPlan impact Big Red’s revenue growth (specifically ARPA) and gross add trajectory? Is disaggregation enough to lure postpaid customers away from AT&T and T-Mobile?

The best answer to this question comes from Mike Sievert, T-Mobile’s CEO, at the J.P. Morgan Global Technology, Media, and Communications Conference held immediately prior to Memorial Day (slight paraphrasing from audio transcription here): “If Verizon had slashed their prices when they took out all of those goodies, and then allowed you to buy the goodies back, that would have made rational sense to consumers. But instead they kind of just sort of took them out, didn’t reduce prices, and said look, we’re giving you choice now. Consumers probably see through that. They are hoping consumers won’t see through that, but we’ll see.”

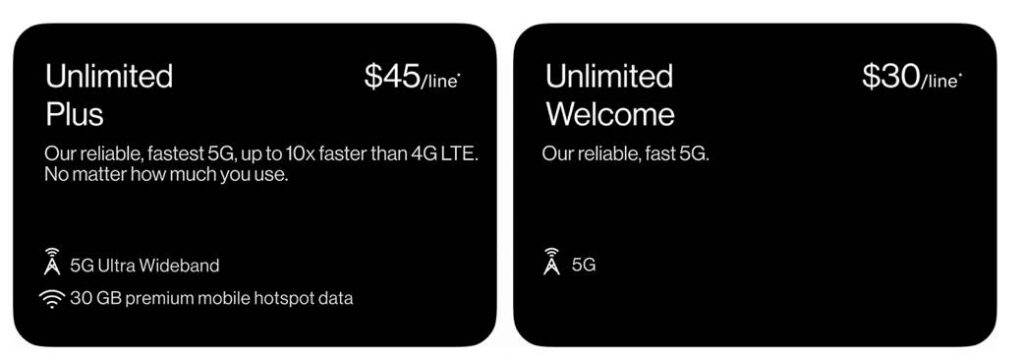

While we agree with Mike, we aren’t sure that myPlan in and of itself is going to really help Verizon (we also don’t think it will really hurt them, either). What really concerns us is the first selection choice from the press release (and buy flow on the website):

We cannot imagine explaining the benefits of 5G Ultra Wideband vs 5G to an existing customer looking to optimize their wireless spending. Is the network faster? Yes, but your device screen really cannot process much more than 10-15 Mbps given its size and technology. It seems like another attempt to charge for 5G on a device that, unless using tethering, cannot really detect the difference between 5G and 5G Ultra Wideband.

Bottom line: If you are looking for myPlan to be an instant hit, you will be disappointed. It begins with the network selection. If Verizon were to drop that selection (one network selection for $30 or $35), then acquisition ARPU/ARPA would suffer. The company, in our opinion, is making the process more difficult and it’s harder to get to the Disney+ and Walmart+ benefits as a result.

- Will this be the quarter where AT&T will begin to grow their total cash flow as they take away share from wireless and wireline competitors? What will be different this time?

Judging from AT&T CEO John Stankey’s comments at the same J.P. Morgan conference (transcript here – a very good read and the Webcast is equally entertaining), this time will be different: “So what do I think is different this time? I’ll point to three things. One… profitability, customer metrics, customer growth, ARPU growth, EBITDA growth, the profitability of our largest business [wireless]. The guide we’ve given on EBITDA growth of three percent or greater, those are all going to drive real improvements in cash flow as we move through the year. Customers are paying us. We have every reason to believe they are going to continue paying us. That’s going to result in money in the coffers and improve the performance of the business in 2023 vs 2022.”

Stankey then goes on to describe the other two cash flow factors – cash flow impacts from [Apple] handset purchases, and the timing of capital expenditures.

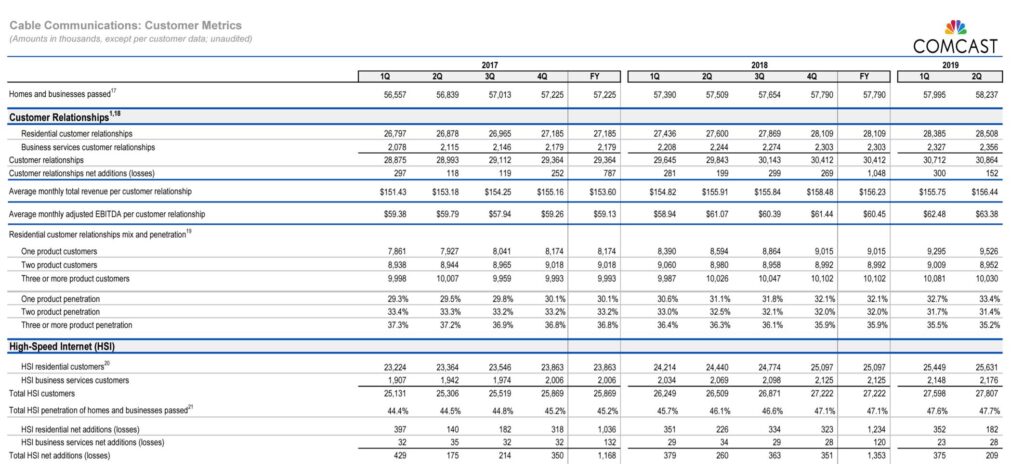

We don’t think that the picture will be unexpectedly bright for Charter and Comcast in the second quarter (specifically, we don’t see 2018 or even 2019 High Speed Internet net addition levels), but also don’t think that they need to panic simply because AT&T is entering the market with fiber. What we do foresee is a dip from Q1 levels (2Q is seasonally lower) but something like 2Q 2017 where Comcast added 140K net Internet subscribers (see historical trends in chart below).

Bottom line: Move activity is down thanks to higher mortgage interest rates. Anxiety is up which is constraining some (not all) business capital expenditures. But job growth continues unabated and unemployment is historically low. Verizon is trying something new, but it’s unlikely to be attractive to new customers. AT&T is mid-transformation, but cost cuts need to be accompanied by aggressive and profitable growth. So far, the second quarter looks like it will generate more questions and less confidence.

That’s it for this Brief. In two weeks, we will focus on Verizon’s Tracfone acquisition and also explore how accelerating video and phone losses will impact cable’s profitability growth picture. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals and Sporting Kansas City!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband