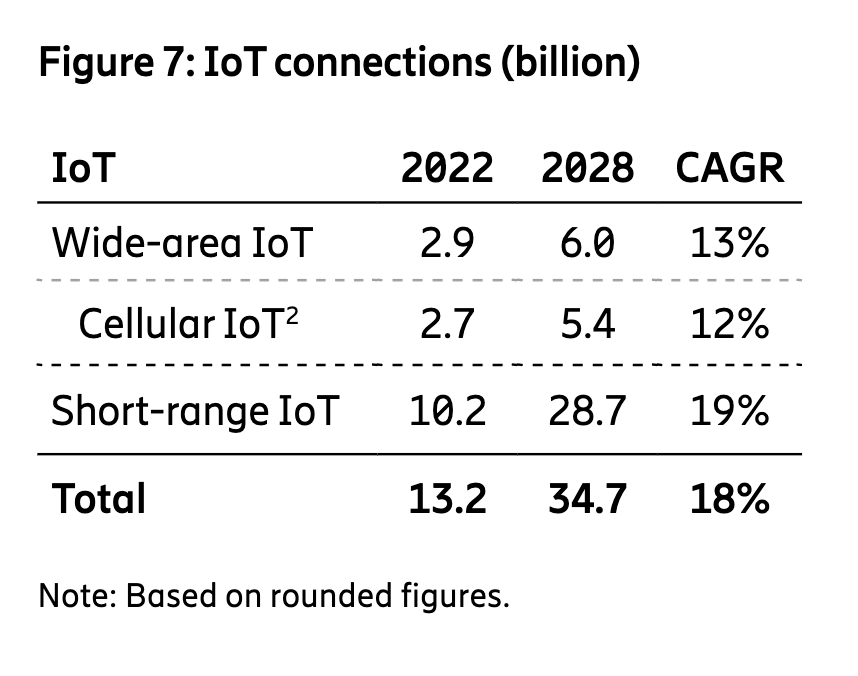

The total number of IoT connections will increase by 162 percent – more than double, less than triple – in the period to 2028, says the latest edition of Ericsson’s bi-annual mobility report. It has the total at 13.2 billion connections, as of the end of 2022, and forecasts the figure will spiral upwards at an compound annual rate (CAGR) of 19 percent in the five years to 2028, finishing at 28.7 billion. Most of the growth will not come from cellular-based IoT, it might be noted.

Indeed, while doubling connection numbers in the period (100 percent growth), the cellular industry will see its share of the total IoT base slip by about seven percentage points. Cellular IoT will go from a 26 percent share of the total IoT base in 2022 (2.7 billion out of 13.2 billion connections) to closer to 19 percent in 2028 (5.4 billion out of 28.7 billion connections). Most of the accelerating growth in IoT will come from short-range solutions.

These include Bluetooth, RFID, and Wi-Fi, notably, plus a number of proprietary 805.14 technologies. In total, short-range IoT technologies will account for 28.7 billion connections in 2028, up from 10.2 billion in 2022, representing growth of 181 percent over the period (over-indexing against the 162 percent growth rate for the whole IoT market), and 19 percent per annum as a CAGR measure.

Perhaps worryingly for the cellular market, the Ericsson forecast says cellular IoT will lose share, marginally, in the wide-area IoT space, as well, defined in opposition to the short-range IoT market. Total wide-area IoT connections will go from 2.9 billion in 2022 to six billion in 2028, with a CAGR figure of 13 percent. Cellular IoT’s share of this market, into which it falls, consequently goes from about 93 percent to 90 percent, according to the figures.

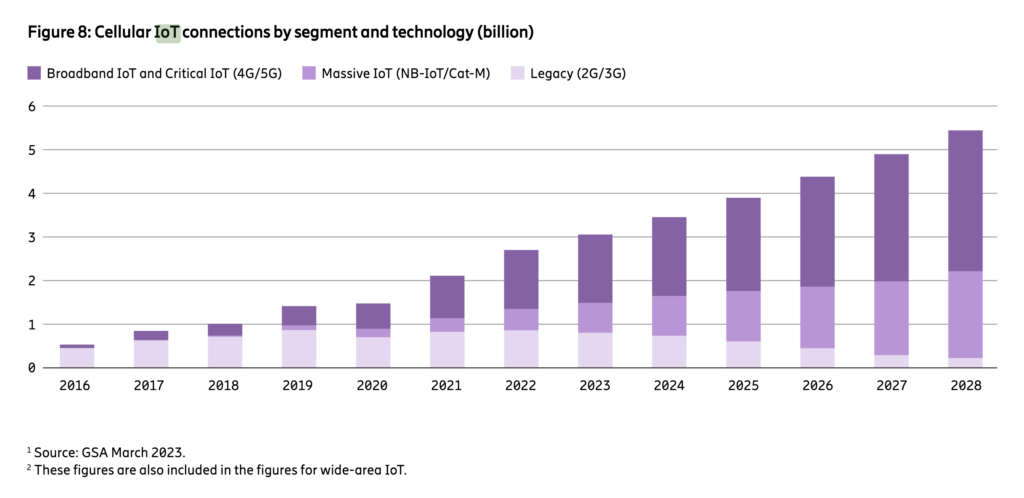

Nevertheless, it remains a lion’s share. Ericsson, perhaps, explained-away the decline by stating that the 2G/3G switch-off will have a “negative annual growth rate of around 20 percent up to 2028”, as both technologies are switched off at an increasing rate in “the coming years”. But the so-called ‘massive-IoT’ pairing of NB-IoT and Cat-M (LTE-M) will shore up some of these losses, the message goes.

In total, 125 mobile operators have “deployed or commercially” launched NB-IoT networks and 56 have launched Cat-M networks, it said, quoting GSA stats from March; 40 of these have deployed both technologies. The number of devices connected by these technologies reached almost 500 million at the end of 2022, it said. A rough view of a bar graph contained in the report (see below) suggests the total number of massive IoT (NB-IoT and Cat-M) connections will go from about 400 million in 2022 to two billion in 2028, representing about four-times (400 percent growth).

At the same time, legacy 2G/3G based IoT connections will go from somewhere north of 900 million in 2022 to virtually nothing (maybe 100 million?) in 2028. Meanwhile, higher-end IoT applications – grouped as broadband IoT and supported by LTE (4G) and 5G networks – will increasingly dominate. Ericsson says the total number of broadband IoT connections was 1.3 billion in 2022; the same bar graph suggests they will top three billion in 2028.

The report explains: “LTE Cat-1 devices… are increasingly being used for a variety of use cases. Broadband IoT will be further strengthened by the introduction of RedCap. By the end of 2028, almost 60 percent of cellular IoT connections are forecast to be broadband IoT, with 4G connecting the majority. As 5G NR is being introduced in old and new spectrum, throughput data rates will increase substantially for this segment.”

Reduced capability (RedCap) 5G is drawing some excitement, especially among enterprises; Ericsson announced a RedCap geared system this week. The report states: “The first RedCap devices have been announced, further strengthening SA technology. These are based on 3GPP Release 17 and are expected to target the current market for LTE Cat-4 devices, such as smart watches, pocket routers and IoT devices. A second wave of RedCap devices is in development and will eventually compete with low-cost IoT devices using LTE Cat-1.”

The full report is available here.