Greetings from Nebraska and Missouri, where we celebrated the Fourth with friends and fireworks! Hope that your holiday was restful and safe. Our opening picture today is of the Fastwyre Ribbon Cutting invitation for Sedalia this coming Tuesday. We look forward to launching fiber services throughout Sedalia and Pettis County.

While many of you enjoyed an extended holiday, the news cycle was remarkably full. We will use this Brief to catch you up on the events of the last fortnight and highlight a few articles that we think are worth a deeper dive.

As a reminder, earnings are coming up later this month. Here is the earnings calendar as of July 7:

| Verizon | Tuesday July 25 | before market close |

| Microsoft | Tuesday July 25 | after market close |

| AT&T | Wednesday July 26 | before market close |

| Meta | Wednesday July 26 | after market close |

| Comcast | Thursday July 27 | before market close |

| Charter | Friday July 28 | before market close |

| Apple | Thursday August 3 | after market close |

The fortnight that was

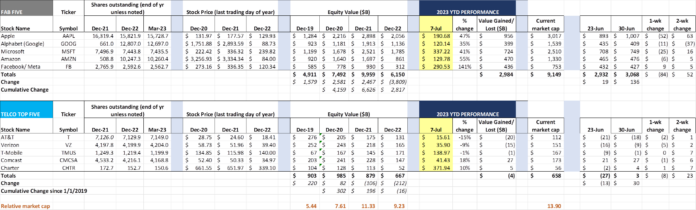

Coming off a fantastic first half performance, the Fab Five took a breather in the holiday-shortened trading week with total market capitalization down $84 billion. Four of the five companies lost market value this week, with Meta/ Facebook up slightly on what appears to be a successful launch of the Threads platform (latest signup statistics here). Since the last Brief, however, the Fab Five have increased value by $52 billion.

With the Fab Five total gains for 2023 hovering around the $3 trillion level (roughly a 50% gain), some sort of pullback should be expected. Apple and Microsoft are achieving fresh highs, while the rest are going to need additional catalysts to approach 2021 levels. Whether Artificial Intelligence (AI) is that catalyst remains to be seen.

Meanwhile, Verizon and AT&T continue their slow melts, with Ma Bell approaching decade-low equity valuations. Since the end of 2019, Verizon has shed $100 billion in equity market value and AT&T has lost around $160 billion. While they have paid dividends throughout that period, confidence in share price floor levels is eroding.

Comcast and Charter have begun to recover, with the former getting closer to end of 2019 market cap levels. Only T-Mobile appears to be holding their value. One of the interesting metrics we will be looking at in the 2Q release is their share buyback level. While some expect significant repurchase levels, we aren’t quite sure that their activity was materially different than the first quarter.

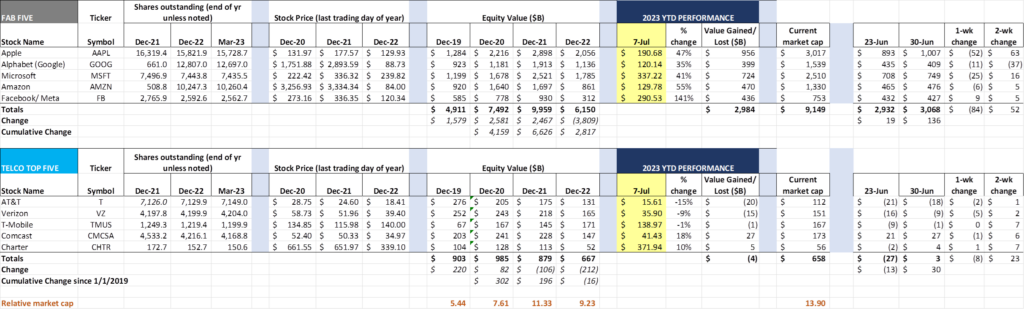

Mobile net additions will be another important metric. As we discuss occasionally in the market commentary, Verizon has flexed their muscle again in the latest RootMetrics RootScore Reports. Here is the schedule that tracks Verizon wins versus all other categories for 125 metropolitan areas:

Verizon captured an outright win for 68% of the markets measured and tied in another 18%. This represents the largest number of outright wins for Verizon in three years. AT&T’s outright wins came in Albany (NY), Austin, Baton Rouge and Hartford. For the first time since 2021, T-Mobile had no outright wins. On the statewide level, AT&T has won more awards, but in the metro areas, the FirstNet-driven leads of 2021 have disappeared.

Comcast and Charter use Verizon as their MVNO network provider. This strategy has played out very well, and all of the recent comments from Dave Watson (Comcast Cable CEO) and Chris Winfrey (Charter CEO) seem to indicate that they have excellent long-term contract terms that minimize their need to build out additional wireless networks. As cable expands (BEAD-driven, housing recovery, etc.), however, Verizon needs to keep up their pace. C-Band requires more towers, and, like wired home development, less dense populations make justification of new towers more difficult.

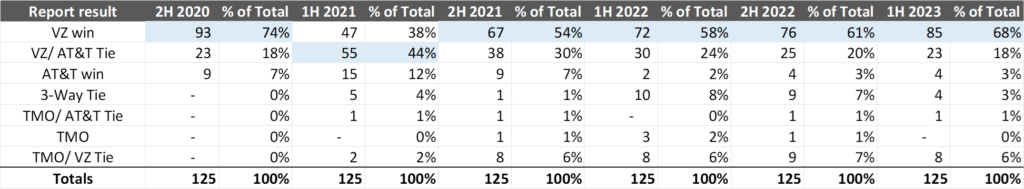

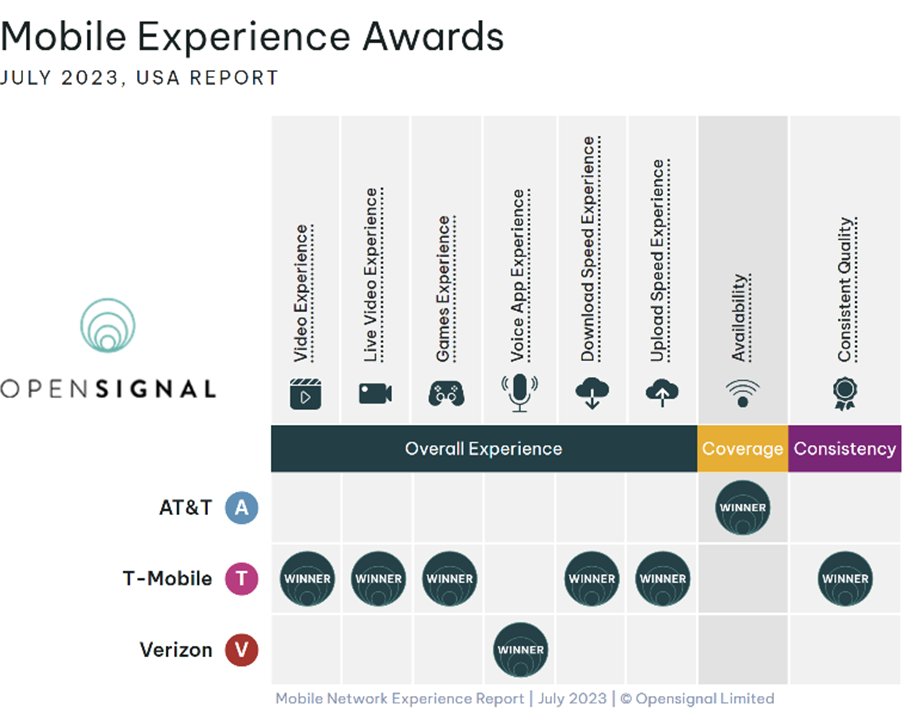

A second wireless quality study came out last week from Opensignal (link to report here). Here are the results for overall (4G and 5G) experience:

The Opensignal study paints a strikingly different picture from RootMetrics. T-Mobile continues to dominate the overall metrics with outright wins in every category except availability (where the three carriers were separated by 1.3%) and Voice App experience (where all three carriers achieved “Acceptable” status).

The differences are even more noticeable at the state level, where T-Mobile leads for consistency and speed. RootMetrics and Opensignal have different methodologies (one tests using the same device both indoors and outdoors using a combination of in-car/ on-street/ in-building testing, while the other uses automated test measurements from current subscribers) which drive separate results. The most important difference in any test experience is the use of Wi-Fi as driven by the device’s connection manager (this is the software in each smartphone that routes data to Wi-Fi or to the carrier’s macro network). RootMetrics is a “if Wi-Fi did not exist” result, while Opensignal closely mirrors the average user experience. This is why it’s important to look at a variety of third-party results as opposed to focusing on one over another.

Cable, telco and fiber companies received good news before the holiday when the National Telecommunications and Information Association (NTIA) released their state allocations of the $42.5 billion Broadband, Equity, Access, and Deployment (BEAD) funding initiative. Not surprisingly, Texas ($3.3 billion) and California ($1.9 billion) finished #1 and #2, respectively. Behind them, however, was Missouri with $1.7 billion and Michigan with $1.6 billion. Virginia, North Carolina, Louisiana, Alabama, Georgia and Mississippi each received $1.2 billion or more in BEAD funding. Assuming some degree of match from infrastructure providers seeking to win these grants, that’s likely $2.5-3.0 billion in new broadband deployments (fiber and wireless) in the Show Me state alone.

This is very good news for consumers, streaming companies (YouTube TV, Hulu + Live, Fubo, etc.), and next generation applications for learning, telemedicine, and remote work. This is potentially bad news for traditional satellite video (already experiencing the effects of cord cutting) and some fixed wireless providers (although we think both fiber and fixed wireless co-exist in the post-BEAD world).

Railroad expansion spurred the development and increase of small towns in the nineteenth century (great article from the BBC here). President Eisenhower led the advance of the interstate highway system after World War II, leading to suburban sprawl (great article from the Richmond Federal Reserve here). Fiber deployment, to the home, business, and cell tower, has the potential to spur the same degree of productivity and expansion for many small towns across America, especially those who touch a multi-lane highway.

With home values rising (which drive property taxes), mortgage rates rising, and the population aging (making long commutes less of an issue), the presence of broadly deployed, consistent broadband (fiber-fed, coax-fed, or even wireless) makes the move decision much easier. We will spend more time with this topic in the next Brief.

One additional trend that was reinforced last week was “The Great American Move.” For those of you who have subscribed to The Sunday Brief more than a year, you will remember we wrote on this trend using U-Haul “to vs. from” rates for many key cities (see above link for the online edition of that Brief). We specifically cited the acceleration of move activity driven by state COVID policies (e.g., who was considered an essential worker, in-classroom school policies, etc.).

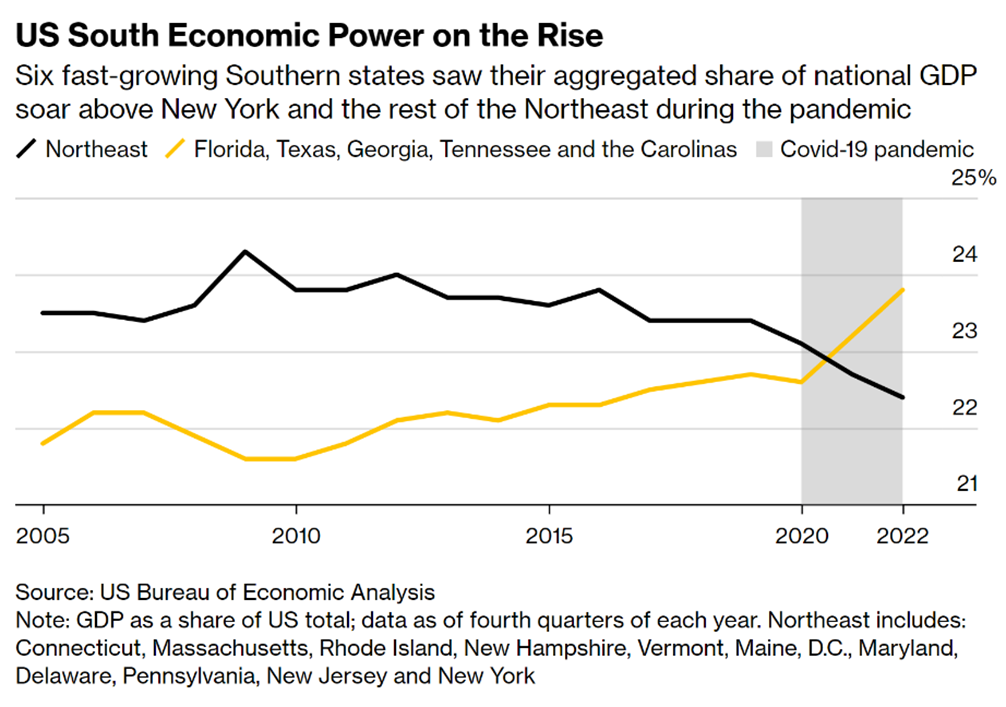

Bloomberg published a lengthy piece on the value of that migration (> $100 billion) right before the holiday. It’s definitely worth reading. Of particular interest is the nearby chart which shows the share of Gross Domestic Product (GDP) contributed by the Southeast vs. the Northeast. It’s a striking chart. Pair this article with the Bureau of Labor Statistics (BLS) employment report (with unemployment rates low, we are now focused on the total level of employment growth as that drives hiring and ultimately state income tax levels), and the results show that economic change is occurring in a manner not seen since the introduction of the interstate highway system.

One example: The population of the “Carolinas” (North and South Carolina) is ~ 16 million. New York State is roughly 20 million (slightly more than 20% larger). The net employment growth for these two areas (even with New York coming out of COVID) is roughly equal – 218.7 thousand for the Empire state vs. 209.1 thousand for the Carolinas.

Where America grows in the next decade will be driven more by state/local government policies than by roads. Availability of low-cost power (and water) and the availability of affordable housing will grow in importance as programs like BEAD diminish the rural vs. suburban vs. urban broadband gap. Amazon has increased product availability (no more than two-day wait for Prime members), and remote learning and technology developments like Augmented Reality (AR) can bring the benefits of the symphony, museum, or lecture hall to every home. Bottom line: Infrastructure allocations like those seen with BEAD are going to change where the fastest job and housing growth occur. This favors development of areas like central Georgia and the Carolinas versus central Pennsylvania.

Lina Khan’s “Big One”

The Federal Trade Commission (FTC), led by Chairperson Lina Khan, is planning on suing Amazon for its online merchant practices, per this Bloomberg article released shortly before the holiday weekend. Dubbed “The Big One” by the reporters, the suit will focus on Amazon’s selection of which merchants receive the “Buy Box,” a feature which enables one-click purchases.

While this sounds nuanced (and the article mentions that this was the subject of a European investigation which resulted in changes to Amazon’s selection procedures), Khan “strongly disfavors” these types of remedies and is likely to recommend a bold restructure of the Seattle company.

Khan’s interest in Amazon’s business practices dates back to 2017 when she penned a Yale Law Review article titled “Amazon’s Antitrust Paradox.” While lengthy, we think that this excerpt from the Abstract foreshadows where Khan will take the upcoming case:

“We cannot cognize the potential harms to competition posed by Amazon’s dominance if we measure competition primarily through price and output. Specifically, current doctrine underappreciates the risk of predatory pricing and how integration across distinct business lines may prove anticompetitive. These concerns are heightened in the context of online platforms for two reasons. First, the economics of platform markets create incentives for a company to pursue growth over profits, a strategy that investors have rewarded. Under these conditions, predatory pricing becomes highly rational—even as existing doctrine treats it as irrational and therefore implausible.

Second, because online platforms serve as critical intermediaries, integrating across business lines positions these platforms to control the essential infrastructure on which their rivals depend. This dual role also enables a platform to exploit information collected on companies using its services to undermine them as competitors.”

Amazon’s defense of their business practices will be of particular interest. As the Bloomberg article states, the FTC has already interviewed twenty Amazon executives and is planning a few more. Of highest interest will be the debate between platform scaling (a logical business practice) and anti-competitive actions (as a result of using third-party platform information to benefit current or future lines of company business). The impact on Google, Apple, and Meta cannot be minimized.

Bottom line: The FTC anti-trust stance has hindered the approval of several mergers and chilled the M&A environment (see article here on Wall Street bonuses). How this impacts the long-term competitiveness of the Fab Five remains unclear, but Chairperson Khan’s stern remedies deserve notice.

That’s it for this holiday Brief. In two weeks, we will have our final questions and comments about the second quarter earnings picture and expand on the earlier theme of rural cost of living. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals and Sporting Kansas City!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.