5G+ and 5G Ultra are two of the names that Communication Service Providers (CSPs) have given their new 5G SA (Standalone) services. Having a cool, new name that differentiates 5G SA from existing 5G NSA (non Standalone) services makes perfect sense as for the majority of customers, 5G NSA is really just faster 4G.

Having a clear distinction between 5G NSA and 5G SA is important for customers as it gives them more choice but it’s also important for CSPs as the potential business impact and change is significant.

5G SA can play a major role in changing a CSPs business and enable them to take a more central role in the digital economy and to serve consumers and business customers with a wider range of services.

The move to sell more services ‘beyond connectivity’ can be accelerated with 5G SA, as CSPs can now control and manage the level of network service quality and the customer experience. Network slicing is a central component of 5G SA which enables CSPs to allocate specific quality of service (QoS), bitrate throughput and latency for specific services, devices, customers and partners.

This means that CSPs can go from selling data to selling experiences and assurance. With 4G and 5G NSA data speeds, and therefore the customer network experience, could not be guaranteed. Despite massive investment in 5G RAN (radio access networks) and spectrum, many CSPs struggled to charge a premium for 5G NSA connectivity. 5G SA could be set to change this and offers the opportunity for CSPs to move from commoditised pricing to value-based pricing.

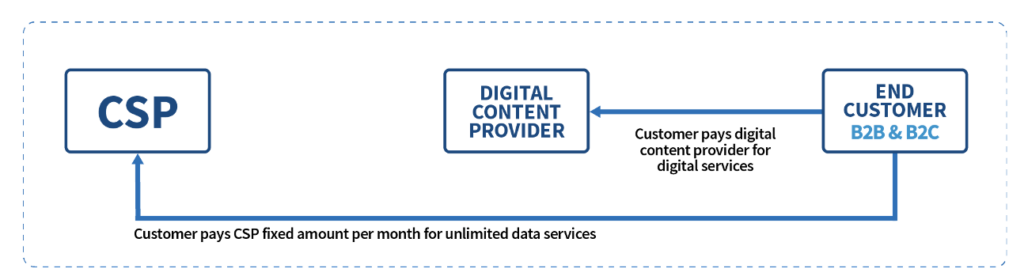

As can be seen in figure 1 below in the current 4G / 5G NSA value chain the CSP is often reduced to providing a commoditised delivery channel for digital content providers. End user customers pay a fixed amount per month to the CSP for all you can eat data. In many countries mobile APRUs are falling making it difficult for CSPs to grow profitably using the existing model.

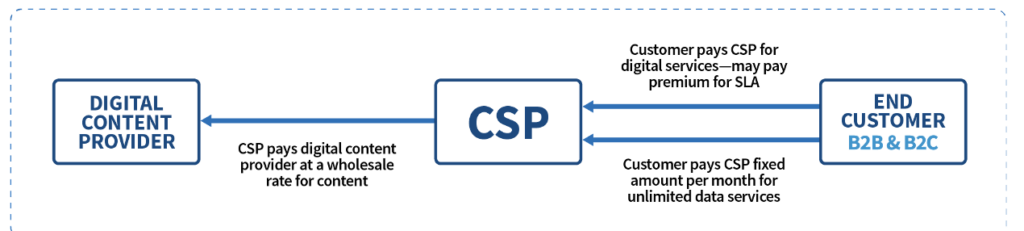

With 5G SA, the CSP can play a more active role in the value chain. As well as getting connectivity revenues they can sell and assure the delivery of 3rd party digital content to end customers (see figure 2), where the CSP is the 2nd B in the B2B2X model.

This model is set to be a significant driver for 5G revenues, a recent Nokia survey found that 60% of 5G revenues will come though the B2B2X business model.

We can illustrate this by giving an example using mobile gaming which can represent a lucrative opportunity for CSPs, as gamers are a target group who are willing to pay for premium mobile connectivity for an enhanced gaming experience. According to the data.ai report State of Mobile 2023, consumer spend on mobile games jumped from $86 billion in 2019 to $100 billion in 2022, and downloads of mobile games jumped from 68 billion to 90 billion in the same time period.

The data.ai report highlighted the success of the adoption of mobile games and rise of in-app purchases from leading games because “mobile games are now capable of offering console-like graphics and gameplay experiences”. This focus on quality and delivering the best gaming experience for customers bodes well for gaming companies and CSPs looking to grow revenues in this segment.

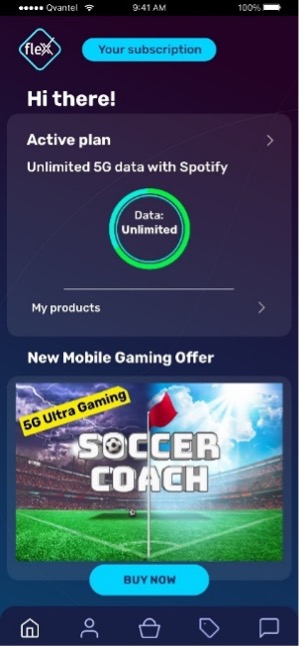

Let’s take an example where a CSP partners with a gaming company to offer a mobile game called Soccer Coach. Here the CSP can offer the game on a dedicated network slice and position it as ‘Ultra 5G’, thus delivering the best graphics and gaming experience.

This can focus on delivering the best gaming experience which will drive adoption of more mobile games and increase in revenues, not just from gaming subscriptions and purchases but also from in-app purchases which can provide revenue growth for the CSP and the gaming company. This can be illustrated by the offer on the CSPs app where the Soccer Coach game can be bought as a new offer.

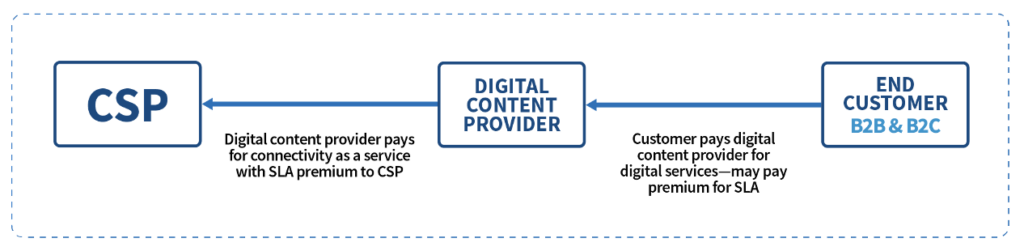

The other variation of the value chain is where the CSP sells connectivity as a service, with a wholesale SLA to the digital content provider who then sells the content directly to the end customer. In this case the CSP is the first B in the B2B2X value chain.

Sticking with the gaming example, in this case a gaming company (say Nintendo this time) could sell a gaming handset with an eSIM. Each time this handset is switched on it activates 5G SA connectivity for a particular gaming slice. Here Nintendo has the direct relationship with the consumer and is using 5G SA slicing to deliver the best gaming experience to their customers.

The introduction of 5G SA and network slicing will impact more than just 5G core functions where policy control will drive the rules of allocating the characteristics of network slices. How CSPs will monetize the offers provided on these slices and how they manage the vast number of offers that they could have, will have a significant impact on charging and Business Support System (BSS) stacks used by CSPs. 5G SA creates new revenue opportunities, but in order to capitalise on them will require changes in the systems used by CSPs to run their business.