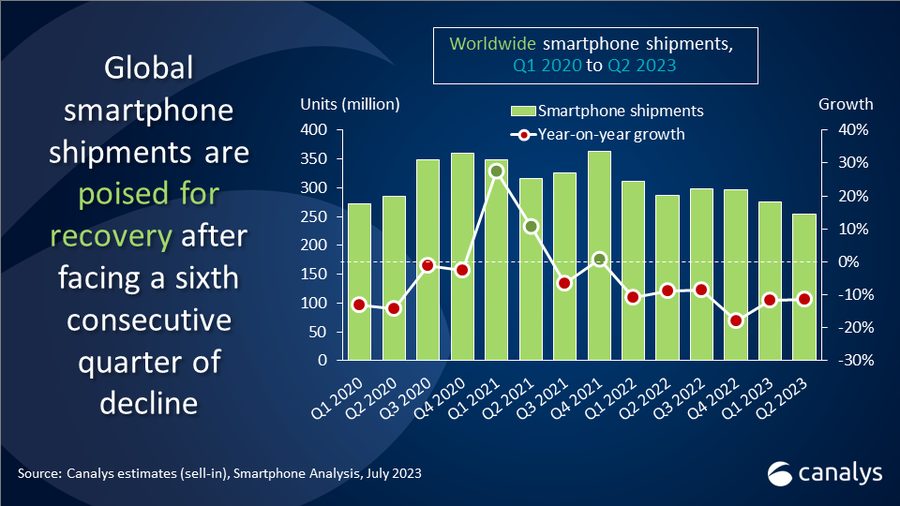

The global smartphone market declined for the sixth consecutive quarter since 2022, according to the latest data from Canalys

According to the latest data from Canalys, the global smartphone market declined by 11% year-on-year in the second quarter of 2023, due to such low demand that even giants like Samsung and Apple saw a reduction in their sales numbers. However, Canalys Analyst Le Xuan Chiew said the market is actually showing “early signals of recovery,” following six consecutive quarters of decline since 2022.

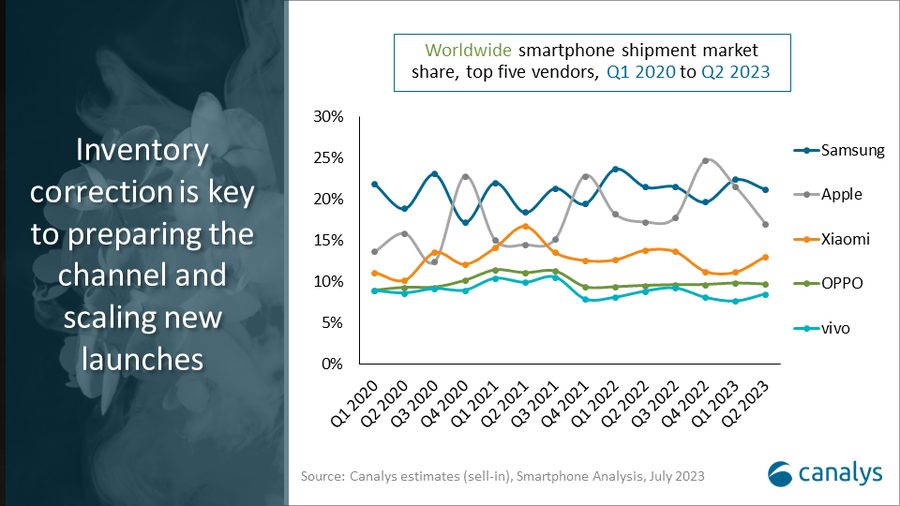

“Smartphone inventory has begun to clear up as smartphone vendors prioritized cutting inventory of old models to make room for new launches,” he said, adding that the analyst firm has found evidence of “growing investments in the channel in the form of channel incentives and targeted marketing campaigns to stimulate consumer demand for new launches, driving channel activity.” He pointed to OPPO, vivo, Transsion and Xiaomi, as examples of vendors displaying signs of stronger sales incentives and retail aggression to grow their market share in the sub-$US200 price band.

Despite the impacts of low smartphone demand, Samsung maintained its leading position with a 21% market share, and Apple held onto second place with a 17% market share. Most other vendors, while still behind the top two leaders, showed signs of recovery as their inventories returned to “healthier levels.” Specifically, Xiaomi secured third place in Q2 2023 with a 13% market share, OPPO (including OnePlus) secured fourth place with a market share of 10 and vivo came in fifth with an 8% market share.

“There are indications that vendors are preparing for market recovery in the further future,” commented Chiew. “They are looking to hedge key component prices to combat potential prices hike, given the present inflationary conditions, leading to the recent increase in component orders.” He also added that other present driving forces for sustainable growth included continued investment in manufacturing and establishing a presence in emerging markets like Southeast Asia and India.

According to another Analyst at Canalys Toby Zhu, smartphone vendors must “stay agile” moving forward in order to best react to new market signals and to effectively allocate resources. “Despite being plagued by uncertainties in consumer demand, vendors are still looking for some short-term opportunities while trying to maintain their top-level strategy,” he said.