Greetings from Nebraska and Missouri, where we finally cut the ribbon at the historic Fox Theater in Sedalia. We are pleased to be bringing fiber to more than 11,000 homes and businesses in and around Sedalia with additional expansions to be announced. Our reception left us grateful – there are many partners to thank. We have turned up many customers in Sedalia, La Monte, Knob Noster, and Warrensburg. If you or your friends live in those areas, check our service here.

Earnings season begins next week. Here’s how it’s shaping up:

| Verizon | Tuesday July 25 | before market open |

| Microsoft | Tuesday July 25 | after market close |

| Alphabet | Tuesday July 25 | after market close |

| AT&T | Wednesday July 26 | before market open |

| Meta | Wednesday July 26 | after market close |

| Comcast | Thursday July 27 | before market open |

| T-Mobile US | Thursday July 27 | after market close |

| Charter | Friday July 28 | before market open |

| Apple | Thursday August 3 | after market close |

| Amazon | Thursday August 3 | after market close |

We will have a summary of our earnings questions below.

The fortnight that was

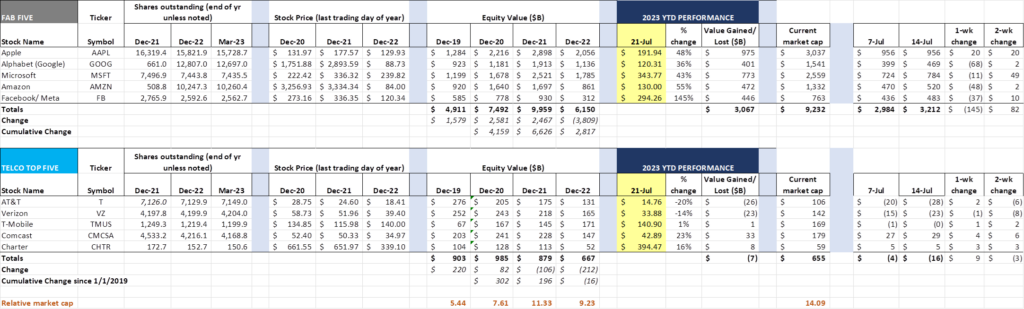

The second quarter earnings season has started for the broader market (mostly financial institutions), and there have only been a few negative surprises. After many weeks of gains (more than $1.5 trillion since April 24), the Fab Five took a breather this week (down $145 billion). Four of the five stocks lost market capitalization and Apple’s gain was minimal. The group overall has not had two consecutive down weeks since mid-April, and Apple and Microsoft have recovered all of 2022’s equity losses.

Further gains past this point will be directly dependent on earnings outlooks. With gains for the group already at $3 trillion, it would not be surprising to see more muted Fab Five gains in the second half of the year.

Two of the stocks in the Telco Top Five (Verizon and AT&T) were rocked by a series of Wall Street Journal stories that highlighted the existence of lead-clad cables in their networks. The two most important articles are here and here (subscription required). While it’s not surprising to learn that the old AT&T network (the “Baby Bells” + AT&T Long Lines) still exists in many parts of the country (voice is still an important part of the communications landscape), it is interesting to note how much of it still exists on utility poles, even in major cities (the risk of “in conduit” and direct buried cable should be viewed through a different lens than aerial or “close to water supply” locations). Nearby is AT&T’s one-month stock price chart from Yahoo! Finance. Note that much of the monthly losses had been recovered by Friday. Lead is no laughing matter, and the government and telephone companies should work together (maybe using remaining RDOF I and unspent RDOF II funds made available by Congress to the FCC) to start the remediation process.

Microsoft and Activision Blizzard extended their merger timetable after a series of victories over the Federal Trade Commission (FTC). Here is what Activision Blizzard included in their earnings report (here):

“On July 18, 2023, Activision Blizzard and Microsoft entered into an agreement waiving certain rights to terminate the merger agreement if the merger has not been consummated prior to October 18, 2023. The terms of the agreement include an increase in the termination fee payable to Activision Blizzard from $3.0 billion to $3.5 billion if the transaction is terminated after August 29, 2023, and to $4.5 billion if the transaction is terminated after September 15, 2023. The agreement also includes amendments to Activision Blizzard’s commercial Xbox arrangements with Microsoft, valued at up to $250 million for each of fiscal years 2023 and 2024. The agreement further enables Activision Blizzard to declare and pay one regular cash dividend for fiscal year 2023 of up to $0.99 per share, prior to and not contingent on the closing of the transaction.”

Since the last Brief, several events have occurred that point in the direction of conditional approval by the United Kingdom’s Competition and Markets Authority (CMA). They include: a) A ten-year agreement between Microsoft and Sony to provide the Call of Duty titles on the Sony PlayStation platform (more in this article from The Verge); b) the FTC’s July 14 loss of their appeal to block the merger and subsequent decision last week to pause an in-house trial (Bloomberg articles here and here); and c) the indication by the CMA that they were “ready to consider any proposals from Microsoft to restructure the transaction” (more in this CNBC article). With the CMA attempting to reach a decision by August 25, it’s likely that we could see the August 29 deadline achieved.

The FTC has had more on its mind than one particular transaction, however. Last week it released, in conjunction with the Department of Justice, draft Merger Guidelines covering both horizontal and vertical mergers (announcement here, which has a link to the draft guidelines). These guidelines are routinely revised periodically, with the last change in 2010 under the Obama Administration.

We read this document from several perspectives, including that of a cable executive. Unlike the wireless industry, cable companies continue to be fragmented, with two (Comcast and Spectrum) controlling most of the major metropolitan geographic areas. However, Cox Communications still has a major presence in Phoenix, Las Vegas, Omaha, Norfolk/ Newport News, certain parts of San Diego and Washington DC, and most of the state of Rhode Island. Mediacom, also privately held, controls most of the cable systems in the state of Iowa and Altice has a meaningful presence in Long Island, New Jersey, and most of West Virginia. Mediacom, along with Altice and Cable One, own or control many systems throughout rural America.

Two principles in the document seemed to be aimed directly at the cable industry:

- Mergers should not entrench or extend a dominant position. The guidelines go on further to state the Agencies evaluate whether a merger involving an “already dominant firm may substantially reduce the competitive structure of the industry.” The Agencies also evaluate whether the merger may extend that dominant position into new markets, thereby substantially lessening competition in those markets.

- When a merger is part of a series of multiple acquisitions, the Agencies may examine the whole series. The accompanying clarifying language goes on to describe that the Commission may consider a series of smaller acquisitions (time period not specified) or evaluating consolidation as part of an “industry trend.”

Guidelines are generally designed to be broad and vague, allowing for interpretation and discussion. This latest draft provides a degree of clarity that will not sit well with the cable industry. It will challenge the ability of Comcast or Charter (or Cox as an acquiror) to purchase another cable provider given their vastly superior content purchasing power or improved contractor labor rates (two reasons many smaller companies sell to larger providers).

The vagueness of the timeline in an acquisition series is also troubling. Will the FTC go back to the Adelphia carve-up and subsequent market re-clustering in an evaluation of a Charter or Comcast acquisition (that transaction closed in 2006)? What about the Brighthouse/ Time Warner Cable/ Charter combination (closed in 2016)? The ability to consider industry trends and the overall competitive impact indicates that cable companies will either need to announce multiple consolidating transactions at once or argue that the driving factors in 2006 and 2016 are different from those seen in 2024.

We have long argued that the government’s ability to predict future competitive conditions using historical trends (or some amorphous supposition) is poor and have the T-Mobile/ Sprint merger as proof. Originally, the agencies and anti-merger advocates held fast to a “four to three” argument as the reason to prevent the transaction from proceeding (see Peter Kafka’s infamous Vox article here). MVNOs were too unpredictable, and cable companies “weren’t serious” about entering the wireless market (Spectrum One $49.99/ mo. offer here). Dish would never get a wireless product to market, or, when they did, it would be too expensive (it’s $25/ mo. from the first line – Boost Infinite offer here). Prices will skyrocket because competition is scarce (many advocates erroneously still cling to this argument).

None of these arguments worked, and Sprint and T-Mobile are now combined. And no one is pining for the “good ‘ol Sprint days” except the Sprint postpaid carcass-pickers (Verizon and AT&T) who now find themselves in a bind. More on that below.

Lead balloon

Earnings season is about to begin, and we look forward to finding out the answers to several questions. Some of these were detailed in two previous Briefs (here and here), but several are new. And none of them deal with the Wall Street Journal articles or the subsequent AT&T court filings.

Here are the questions we posed in the previous Briefs:

- How will Verizon’s myPlan impact Big Red’s revenue growth (specifically ARPA) and gross add trajectory? Is disaggregation enough to lure postpaid customers away from AT&T and T-Mobile?

- Will this be the quarter where AT&T will begin to grow their total cash flow as they take away share from wireless and wireline competitors? What will be different this time?

- How can cable acquire and retain more mobile customers faster, reducing the exposure from Internet-only customers?

- How much share can cable lose without significantly impacting scale costs?

We will not rehash the details here but encourage readers to consider each argument made in those previous Briefs. In addition to those questions, we have several more:

- What is the impact of the recent strikes on the ability of Comcast to grow 2024 cash flow from their NBC Universal unit? Comcast has a lot of live sports, which should offset some of the Universal (film) losses, but a cash flow impact figure has not been released by the company. While this does not change the long-term prospects of the company, it does impact 2024 planning.

- What is T-Mobile’s target for federal infrastructure (BEAD) funding, and how will they achieve it? We applaud the company’s rural initiative, but also understand that more towers are going to be needed to bring 2.5 GHz and C-Band infrastructure to the countryside. Will the company commit to the 100 Mbps down/ 20 Mbps up bandwidth guideline as a part of a broader effort to serve millions of underserved customers? Is this the trigger to move from an “excess capacity” model to a more dedicated one? If not, will the company take other moves to support or otherwise enable rural fiber initiatives?

- What is the future of Verizon Business if MEC does not take off (more on the company’s MEC offerings here)? How is the company progressing in its ability to grow their One Fiber initiative?

- What is the core profitability of Verizon’s retail consumer wireless unit without the cable MVNO contribution? How does this compare to 2Q 2019 (pre-pandemic)? We clearly recognize that this is not a question we will receive an answer to, but it’s worth thinking about after we see the company’s results on Tuesday.

- What percentage of Charter’s Rural Development Opportunity Fund fiber route miles (vs homes passed) remain to be built? We applaud Charter’s efforts to bring broadband to rural markets, even though they are receiving $1,155 per home passed from the federal government (see Light Reading article here with the final tallies). We also expect them to disclose that they are getting much closer to hitting the 40% homes passed threshold that is required by the end of 2024. Assuming that Charter is bringing fiber to denser neighborhoods and towns first, it’s likely that these builds consume fewer total fiber miles than what’s to come. And those capital costs will be significant, if they are built (Charter may choose to pay the penalties allowed for in the RDOF agreement).

Bottom line: There will be many bright spots in second quarter earnings (Comcast’s Masergy integration progress, T-Mobile fixed wireless net additions, AT&T Fiber ARPU and net subscriber growth, cable MVNO growth for starters) but earnings growth prospects are going to go over like – you guessed it – a lead balloon. Competition is growing, and competitive responses are also increasing. That’s great for consumers, but, as the telecom industry has proven for the last thirty years, shareholder returns have been uneven. We are entering a new season of uncertainty.

In two weeks, we’ll see how heavy that lead balloon really was. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and our U.S. Women’s Soccer Team!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.