AT&T hit its $6 billion cost-cutting goal ahead of schedule, and is now looking to shave off another $2 billion or more

Despite an only 0.9% year-over-year increase in revenue and a decrease in mobile net adds, AT&T grew its net profit in Q2, leaving the carrier confident that it can deliver on its full-year financial guidance.

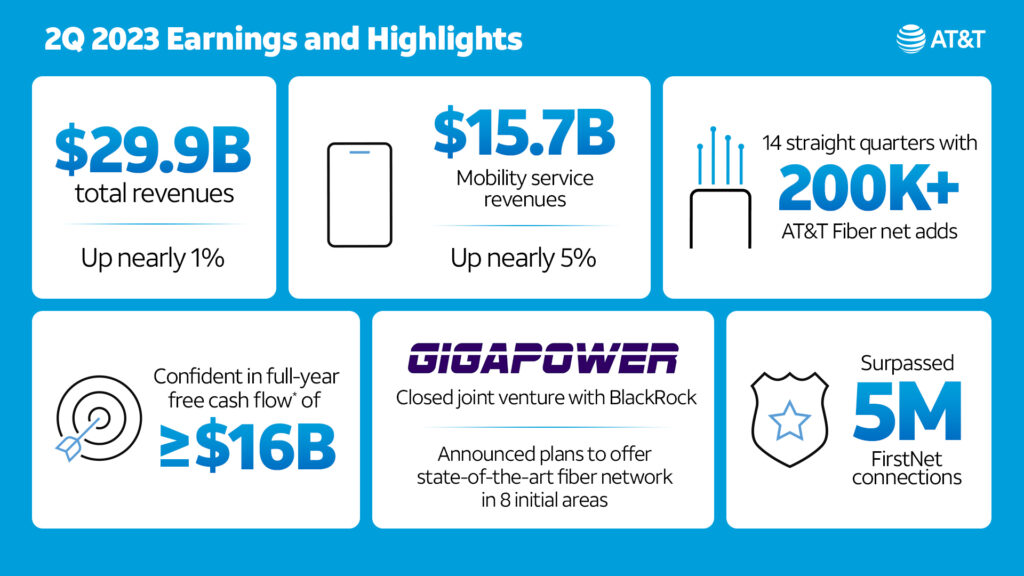

AT&T also hit its $6 billion cost-cutting goal ahead of schedule, contributing to the $4.2 billion free cash flow it reported for the quarter, which surpassed analysts estimates of $3.60 billion. The carrier said it is now looking to shave off another $2 billion or so over the next three years, and is on track to achieve a full-year free cash flow of at least $16 billion.

Further, AT&T’s operating income for the quarter was $6.4 billion, up 29.3% year-over-year, and the company expects a full-year Adjusted EBITDA growth of more than 3%.

Post-paid phone net additions fell from 813 million in Q2 2022 to 326 million, and the 326,000 postpaid phone subscribers added in Q2 2023 is nearly 60% lower than the number added a year earlier. Total wireless net adds for the latest quarter were 6.2 million. Postpaid churn was 0.95% versus 0.93% in the year-ago quarter.

Notably, there was no mention on the investor call of last month’s report that thousands of toxic lead-covered cables, some of which belong to AT&T, have been left behind, posing a series health risk for people and the environment in the surrounding areas. At the time, AT&T commented, “The health, safety and well-being of our people, our customers, and our communities is of paramount importance.” It added, however, that the report “conflicts not only with what independent experts and longstanding science have stated about the safety of lead-clad telecom cables but also our own testing.”

According to CEO John Stankey, AT&T will continue to focus on adding 5G and fiber customers, a direction in line with what was set three years ago. Stankey said this direction remains “sound” and that the carrier is “on the right trajectory.”