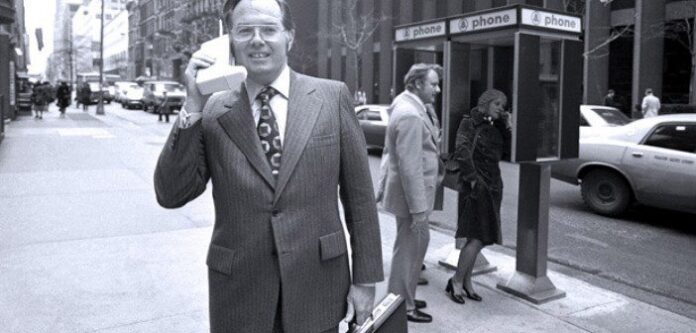

Editor’s Note: RCR Wireless News goes all in for “Throwback Thursdays,” tapping into our archives to resuscitate the top headlines from the past. Fire up the time machine, put on those sepia-tinted shades, set the date for #TBT and enjoy the memories!

Canada auctions midband 5G spectrum

The government of Canada raised a total of CAD8.9 billion ($7.2 billion) in its auction of 3.5 GHz spectrum, which will be used by local carrier to further expand 5G services in the country. The spectrum auction, initially set to take place in June 2020 and delayed due to the COVID-19 pandemic, closed after eight days and 103 rounds of bidding, the government said 5G licenses in this key band were made available based on 172 localized service areas covering the entire country, allowing bidders to target geographic markets, including rural areas. The government noted that a total of 23 companies participated in the auction. In total, 1,495 out of 1,504 available licenses were awarded to 15 operators, including 757 licenses to small and regional providers across the country. The government had reserved up to 50 megahertz of spectrum in the 3.5 GHz band for small and regional providers to enhance competition in the Canadian wireless market. The spectrum acquired by these companies will support the deployment of high-quality wireless services so consumers and businesses across Canada, including those in rural and remote regions, the government said. … Read more

Oppo tests 5G Standalone in India

Oppo India conducted a 5G Standalone (SA) network trial with its Reno6 series of devices with Reliance Jio at the mobile carrier’s 5G Lab, yielding, according to the company’s “highly positive results.” The Reno6 Pro smartphone supports 11 5G bands, and the Reno6 supports 13 5G bands. Tasleem Arif, VP and R&D head of OPPO India, commented: “Our 5G Standalone network trial for [the] Reno6 Series with Jio is part of our in-depth research in the 5G era towards ensuring a better experience for the users. The successful validation of Reno6 Series devices on the 5G SA network of Jio is testimony to our commitment as a company to bring cutting-edge technology to our customers.” Oppo’s statement about the trial indicated that most 5G tests in the country were focused on a Non-Standalone (NSA) architecture, in which 5G New Radio infrastructure is connected to an Evolved Packet Core that also supports LTE data transmissions, adding that by prioritizing initiatives around 5G SA instead, Oppo “aims to ensure that once commercialized, every adopter can have a true 5G device experience.” … Read more

Comcast notches another best-ever quarter of wireless adds

Comcast continues to draw mobile subscribers at a rapid clip, reporting that its Xfinity Mobile service added 280,000 net lines during the past quarter — its best-ever reported adds since the service launched in 2017. Comcast saw an overall rebound from the same period last year, during which its business was significantly impacted by the Covid-19 pandemic. Revenue for the second quarter of 2021 was up 20.4% to $28.5 billion, with profits up more than 25% from the last year’s second quarter, to $3.7 billion. Its Cable Communications revenues were up 10.9% to $16 billion, on broad increases across broadband, wireless, advertising, business services, video and other revenue sources; voice revenues, however, were down. Brian Roberts, chairman and CEO of Comcast, called the cable segment’s performance “exceptional.” … Read more

MNOs vs. NEPs vs. SIs in the battle for private 5G

What do we think we know about the burgeoning private 5G, and how it will play out? We know, at least we hear, that it is going to be important and massive – for both the supply-side telecoms sector and demand-side enterprise market. The first will gain new life in terms of its sales income and corporate worth; the second will have a base-level networking platform to drive transformational change. So the story goes. But how massive? It depends who you ask. ABI Research reckons the total market value for private LTE and 5G will be around $65 billion in 2030 (with $37 billion going on 5G), from a couple of billion dollars today. That figure covers the whole ecosystem, from supply of cloud-to-edge infrastructure, cellular networking, plus all of the hardware and software pyrotechnics on top, supposed to light up whatever-4.0 market it has in mind. Dell’Oro Group narrows the focus, and says sales revenue from radio equipment, as a slice of the telco stack, will top just $2 billion by 2025 – a fraction of ABI’s 2030 forecast figure for the ‘total’ market value. It says the balance tilts towards 5G by the end of the period. Stefan Pongratz, vice president at the firm, says the number of installations will rise from “low single-digit thousands” today to “tens of thousands” in 2025. Still, he describes the market opportunity as, “rather large – in the tens of billions”. … Read more

Wireless investment hit a 2020 high, driven by C-Band auction

CTIA’s annual industry survey has found that wireless network investment reached $30 billion last year — the third year in a row of increasing investment, and a five-year high that comes as carriers transition their networks to 5G. The number of operational cellular sites in the U.S. has rapidly increased over the past two years, the survey found, and data-only devices such as hot spots, smart watches and other IoT devices now represent more than 40% of the wireless device base. CTIA has been conducting its annual industry survey for more than three decades. The 2021 survey, the industry organization said, reflects a “remarkable run of private investment that ensured wireless networks were more than up to the challenges posed by COVID-19. [Last year] saw 5G networks lit up across the country, bringing these next-gen networks into the hands and homes of millions—and keeping us connected when we needed it most.” The U.S. wireless industry accounts for 18% of the world’s total mobile capital expenditures, although CTIA notes that the country has less than 5% of the world’s population and 5.9% of its mobile connections. The domestic wireless industry has invested nearly $140 billion in their network the past five years, the report says — and that doesn’t include the cost of spectrum. The two Federal Communications Commission auctions held during 2020 accounted for another $85 billion in spending, with most of that coming from the C Band auction. CTIA said that auction revenues in the U.S. since 2016 total more than $116 billion. … Read more

EXFO’s Germaine Lamonde on pursuit by Viavi

Germain Lamonde says he has fielded many offers to buy EXFO, the network test and measurement company that he founded, over the decades that it has been in business as a private and then public company. Lamonde, the majority shareholder of EXFO, its former CEO and now executive chairman, has turned them all down. In that sense, the recent series of escalating acquisition offers from competitor Viavi Solutions is business as usual. “I am a builder, not a seller,” Lamonde told RCR Wireless News, calling himself an “entrepreneur at heart.” He was, in fact, named Canada’s EY Entrepreneur of the Year in 2019 and has helped to nurture other entrepreneurs over the years as well, currently serving on the board of CEO development forum QG100, which aims to foster business leadership in Quebec companies. Lamonde has maintained his position as EXFO’s majority shareholder through the years and after serving as CEO for three decades, has continued to be “actively involved in defining the company’s growth and investment strategies, strategic direction and corporate governance policies,” as EXFO describes his current role as executive chairman. He speaks about EXFO as a home, and he has no desire to turn over its ownership to someone else. “I am the majority shareholder, and it comes to me to decide whether or not I will sell the business,” he explains. “If I walk in front of your house, and I find it to be wonderful and I want to buy it, it’s up to you if you want to sell or not. It’s the same here.” … Read more

China Unicom deploys Huawei’s ‘Super Uplink”

China Unicom and Huawei announced last week that they have deployed Huawei’s 5G Super Uplink at more than 1,000 5G commercial sites in Beijing. The deployment, which was carried out over five days, is part of the pair’s joint 5G Capital project established in April 2020. By using TDD 3.5 GHz and FDD 2.1 GHz coordination, high- and low-band complementation, time- and frequency-domain aggregation and millisecond-level resource scheduling, 5G Super Uplink significantly improves uplink capabilities and can meet the high network requirements of services such as short video upload and HD live broadcast, Huawei said. The network equipment vendor has said that the Super Uplink capability enables the “full potential of high and low frequency bands through TDD and FDD collaboration, and by enabling innovative time- and frequency-domain aggregation … eliminates the uplink speed bottleneck to deliver higher upload rates and improved image quality for popular services such as streaming and gaming.” Further, according to Fan Liqun, head of China Unicom Beijing’s 5G co-construction and sharing work team, 5G Super Uplink is “up to [the] task” when it comes to providing the “ultimate” user experience during the 2022 Beijing Winter Olympics and Paralympics. “Its large-scale commercial deployment at 1,000 of our sites is another major innovation milestone of the 5G Capital project,” he continued. … Read more

Breaking down the Dish/AT&T services deal

Dish Network and AT&T recently struck a $5 billion deal to move Dish’s wireless customer traffic — including customers of its Boost Mobile, Ting Mobile and Republic Wireless brands — to AT&T’s network, instead of Dish continuing the wholesale agreement that had been worked out to use T-Mobile US’ network as part of the settlements that allowed the T-Mo’s acquisition of Sprint to move forward. Dish has been feuding with T-Mobile US over the shutdown of T-Mo’s 3G network, which it said was premature and impacted its ability to successfully transition customers. Dish is in the process of building out its own network, but it is going to need wholesale network access — a mobile virtual network operator (MVNO) arrangement — to support customers until it actually has a wireless network that can support them. AT&T executives fielded a number of questions about the deal during the company’s quarterly results call. Here’s a breakdown of what the two companies have publicly said about the network services deal, and its implications for AT&T and Dish’s businesses.Dish provided some details in a filing with the Securities and Exchange Commission and a press release. It’s a 10-year network services agreement worth a minimum of $5 billion — that’s at least $500 million a year. The agreement isn’t exclusive and doesn’t restrict Dish’s ability to deploy equipment in markets where its users will be accessing AT&T’s network. Dish agreed to activate “at least a minimum percentage” of MVNO subscribers on AT&T’s network; the percentage was not specified. It covers both Dish’s prepaid and postpaid customers. … Read more

Check out the RCR Wireless News Archives for more stories from the past.