As a long-time independent technology analyst, I cover a lot ground and follow a lot of companies. Communications technology is my main focus, and the wireless world has increasingly become part of that, especially 5G. Along those lines, my travels recently took me to MWC Shanghai, and it provided a first-hand perspective on just how dynamic the 5G market is in this part of the world. News from the event has been extensively reported by RCR Wireless and other publishers, but there were not many analysts from the West, so I’m going to share my perspective here.

There was a lot to see and do, and as with all major events, there was a firehose of news releases and announcements. As an analyst, however, I’m more interested in the bigger picture, and on that basis, three themes resonated for me. Before getting to those, it’s worth noting this was 10th anniversary of MWC Shanghai, and the first in-person edition since 2019, and based on the size of the crowds, there was a lot of pent-up demand. I plan to attend MWC Barcelona this February, and given how fast this market is moving, I’ll be keen to compare notes between my East and West experiences.

Theme 1 – 5G is about connectivity

There’s Western scale, and then what I call China scale. GSMA CTO Alex Sinclair noted there are now over 660 million 5G connections in China, accounting for almost 60% of the global total. In comparison, 5G Americas cites that North America is on track for 215 million 5G connections by the end of this year. China is setting the pace for 5G, and looks to be on track for having 1 billion 5G connections by 2025.

This growth trajectory requires significant upfront investment to build out the infrastructure, and they’re not doing this just to lower your phone bill and allow you to livestream sporting events. That’s a big part of it, since there must be demand to consume the supply. However, connectivity really only matters when you can deliver faster speeds than before and provide new services. Otherwise, 4G is perfectly serviceable – with no need to build out 5G – and anyone using a smartphone pretty much has that already.

Based on what I saw on this trip, China certainly understands that, and their rollout seems to be hitting both marks, reaching critical mass for connectivity, and delivering 5G speed to drive a new generation of services and applications. The latter is mainly about spectrum, and highlights another point of difference for the 5G experience in the US, where mobile carriers have been using low-band frequencies. This approach makes the network buildout less costly, as the signal travels longer distances, but with less throughput. As such, 5G services in the US aren’t really much faster or different than 4G, and is a key reason why adoption hasn’t followed the hype.

On a related tangent, the driver for having all this connectivity is as much about connecting things as connecting people. Whereas the North American messaging about 5G seems mainly consumer-based – gaming, social media, livestreaming, etc. – my MWC Shanghai experience was more about B2B applications. Yes, there was lots to see about 5G for consumers – especially South Korea and Japan – but for China in particular, I saw more emphasis on IoT and Industry 4.0 scenarios.

This isn’t all that surprising, since so much manufacturing has migrated West to East. By its nature, our globalized economy is hyper-competitive, and manufacturers need these capabilities to drive efficiencies and reduce costs. The use of AI, robotics, and wireless networks to automate factories is pervasive here, and there was no shortage of really cool demos across all kinds of manufacturing scenarios. In this context, the concept of connectivity at MWC Shanghai seems more ambitious than what you might see at mobile events in the US or EU.

Theme 2 – Adoption is accelerating

This market is not without its challenges, notwithstanding messy East/West geopolitics. The pace of growth is certainly exciting, and it was noted that it took 12 years for 3G to reach 1 million users, but only five years for 5G to do the same. Where there’s utility, adoption will follow, and the connectivity numbers reflect that. To a large extent, however, this is a supply-driven market, where carriers bear the risk and cost to build out their networks, but the track record is short for monetizing new services.

Many carriers are still trying to monetize their 4G networks, so there are no guarantees of economic success for 5G. Not to mention the lag for smartphones, where upgrade cycles for 5G handsets will be costly. With today’s economic headwinds, carriers may have to provide incentives so subscribers can upgrade in order to make use of cool 5G-driven services.

These realities will raise red flags for some, but from what I saw at MWC Shanghai, both carriers and vendors are doubling down on 5G. On this front, Alex Sinclair noted that 230 mobile carriers across 90 countries are offering 5G services, and another 30 markets are expected to launch going into 2024. Clearly, 5G is a global phenomenon, and while China is leading the way, it’s a bigger story for how communications technology is evolving.

That said, aside from the point of pride from being the host country, China seems to have every intention of remaining the leader, evidenced by their announcement to allocate 6GHz spectrum for 5 and 6G development. Not only are they the first country off the mark for 6GHz, but they’re already planning for 6G.

This news is notable, as 6GHz is mid-band spectrum, which provides faster speeds than low-band – used more in the US – but with less coverage. For most of today’s B2B 5G use cases, however, mid-band provides enough coverage, such as warehouses, factories, campuses, etc. This is consistent with China’s emphasis on IoT and Industry 4.0 focus for 5G, and it’s another factor for accelerating 5G adoption.

Stepping back, all of this momentum speaks to something bigger with 5G. Mobile technology is important in its own right, but these 5G trends are unfolding in parallel with other meta-trends, namely cloud, AI and digital transformation. These are now main themes in my analyst work, and they all point to a digital world that is hyper-connected and driven by data. All businesses are adapting to digital transformation, cloud provides an economical way to store and share data, and AI is completely reshaping the relationship between man and machine.

5G is an essential part of this, as mobility untethers us from desks, the shop floor and physical spaces that require human interaction. With faster speeds, reliable connectivity, secure networks and reasonable pricing, 5G enables transformative change. This isn’t about incremental value – it’s about creating entirely new value propositions supported by standards-based ecosystems that can transform how businesses operate.

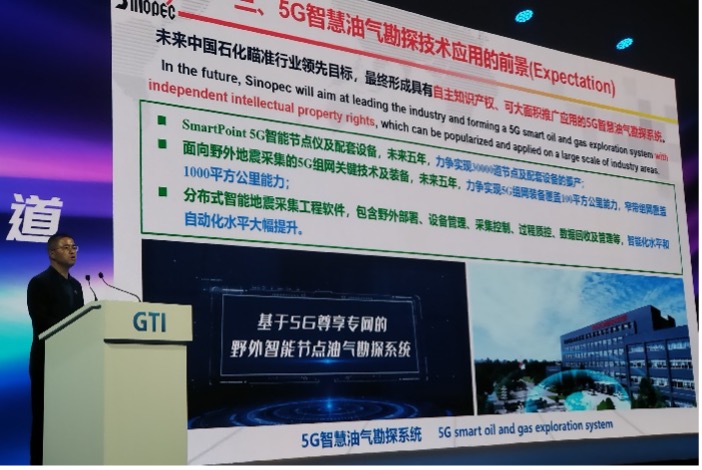

As noted earlier, there was no end of B2B scenarios where 5G was driving intelligent forms of automation that could only be possible by harnessing all of these meta-trends. Aside from manufacturing, there were many other vertical B2B demos, such as mining, oil and gas exploration, logistics, transportation, agriculture, smart grid, and smart cities.

Also noteworthy is that the accelerated pace of adoption doesn’t stop at 5G. While a bit early to be touting 6G, Huawei in particular is advocating for 5.5G, which seems closer to reality as a next step for mobile evolution.

This is very much aligned with the above meta-trends, as 5.5G is an order of magnitude faster than 5G, and provides the horsepower that’s needed for AI to really deliver on its promise. Aside from much faster connectivity – 1 Gig uplink and 10 Gig downlink – Huawei’s aspiration for 5.5G is to support 100 billion connections. That level of adoption is clearly for IoT use cases, where connectivity among things far exceeds connectivity among people.

Theme 3 – Innovation is everywhere

This theme is more subjective, but as with any large-scale industry event, everyone is competing for your attention, and nothing does that better than showcasing the latest and greatest. With 5G being further along here than in West, almost everything seemed new, and for me, MWC Shanghai was the shape of things to come for the West.

Mobile operators have done well offering 2/3/4G communications services that make the convenience of mobility a value driver, but that market is mature and saturated. Growth is getting hard to come by with so much competition and commodity-like offerings that drive pricing ever-lower. 5G can only save that business model if 5G handsets proliferate, and if carriers get more creative with new offerings.

On that front, handset innovation was on display at the show, especially for foldable phones, two examples being Honor’s V2 model, and Huawei’s Mate series. Yes, they’re expensive, but very cool, and will certainly play a role in consumer-side adoption of 5G.

Handsets aren’t the whole story around user experience, though, as other types of endpoints and peripherals will drive 5G growth among mobile-first consumers – which in China, seems to be everybody. Good examples would be smart glasses from ZTE, nubia Pad 3D tablet – also from ZTE, Naked 3D from Huawei (incredible 3D experiences without needing special glasses), and smartphone maker Meizu partnering with Polestar to build operating systems for smart cars for the China market.

Finally, it’s worth noting that the vendors that develop 5G technology, and the carriers that bring 5G to market, do drive some innovation, but not all of it. Arguably, the innovation that matters the most are the services and applications that subscribers are actually willing to pay money for. Fat, dumb pipes is the death spiral scenario for mobile operators, and this type of innovation has never been their forte.

For all these reasons, the API Economy mantra that rings loudly in the enterprise communications world is now gaining traction with mobile carriers. Earlier this year at MWC Barcelona, GSMA launched Open Gateway Initiative, with backing from 21 mobile operators. The API Economy needs open systems to thrive, and OGI is a big first step for mobile operators to finally open up their networks so developers can bring much-needed innovation to help drive 5G.

At MWC Shanghai, the news was that membership is now up to 29 MNOs, but perhaps more importantly, this includes all three major Chinese operators – China Mobile, China Unicom and China Telecom – another indicator of how China is doubling down on 5G.

Final Thoughts

There was a lot to digest from MWC Shanghai, and with limited time – along with brutal heat and humidity – it was not possible to take in all five exhibit halls. As an analyst, based on what I did see, these three themes reflect the essence of 5G’s state of play in Asia, and for those who haven’t seen this up close, I hope you’ll find my takeaways of interest.