China Tower said its net profit in the first half of the year climbed 14.6% year-on-year to $674 million

China Tower ended the first half of 2023 with a total of 2.06 million towers under management, after a net addition of 6,000 sites during the period, the company said in its earnings statement.

The company said that total tower tenants rose to 3.42 million at end-Q2, pushing the average number per tower to 1.67 from 1.65 at the end of 2022.

China Tower’s net profit in the first half of the year climbed 14.6% year-on-year to CNY4.84 billion ($674 million), while operating revenue grew 2.2% to CNY46.46 billion.

“Smart tower” revenue amounted to CNY3.38 billion in the first half of the year, climbing 31% year-on-year, while sales from the company’s energy unit increased 38.5% year-on-year to CNY1.97 billion.

Also, tower business revenue declined by 2.9% to CNY37.48 billion, while indoor distributed antenna system (DAS) sales increased by 24.4% to CNY3.42 billion.

The company added that it “proactively captured the increased demand for low-frequency network construction and for new construction arising from network optimization.”

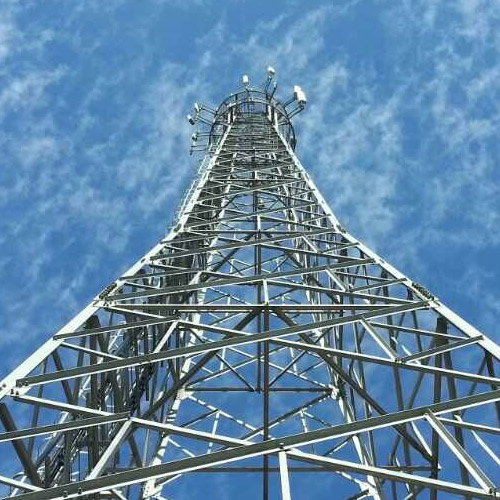

China Tower was formed in 2014, when the country’s mobile carrier China Mobile, China Unicom and China Telecom transferred their telecom towers to the new company. The three telcos decided to create the new entity in a move to reduce redundant construction of telecommunications infrastructure across the country. China Mobile, China Unicom and China Telecom currently own a 38%, 28.1% and 27.9% stake respectively. State-owned asset manager China Reform Holding owns the remaining 6%.

Chinese operators have outperformed the country’s own construction target for 5G base stations, deploying almost 3 million by the end of June, six months ahead of schedule, according to recent reports.

Chinese operators deployed nearly 600,000 5G base stations in the April-June period alone.

“As of the end of June, the number of 5G base stations in China had reached 2.937 million, covering all urban areas of prefecture-level and county-level cities and the coverage is continuously expanding in both breadth and depth,” said Zhao Zhiguo, chief engineer at the Ministry of Industry and Information Technology (MIIT).

China is forecasted to reach 1 billion 5G subscribers by 2025, while the number of 5G users by 2030 is expected to reach 1.6 billion, according to a recent report by the GSMA.

In 2022, mobile technologies and services generated 5.5% of China’s GDP – a contribution that amounted to $1.1 trillion of economic value added. According to the report, 5G technology will add $290 billion to the Chinese economy in 2030, with benefits spread across industries.

5G will overtake 4G in 2024 to become the dominant mobile technology in China, according to the report. “4G and 5G dominance in China means legacy networks are now being phased out. While most users have been migrated to 4G and 5G, legacy networks continue to support various IoT services. However, some estimates suggest that legacy networks could be almost entirely shut down in China by 2025,” the study reads.