Across the globe, 5G deployments are ramping up rapidly. According to Global System for Mobile Communications Association (GSMA) intelligence, there were more than 220 5G networks deployed as of the end of 2022, with over 30 countries expected to launch 5G services in 2023. Accordingly, ABI Research forecasts that global 5G subscriptions will grow from 900 million to more than 3 billion between 2022 to 2027 (at a Compound Annual Growth Rate (CAGR) of 27%).

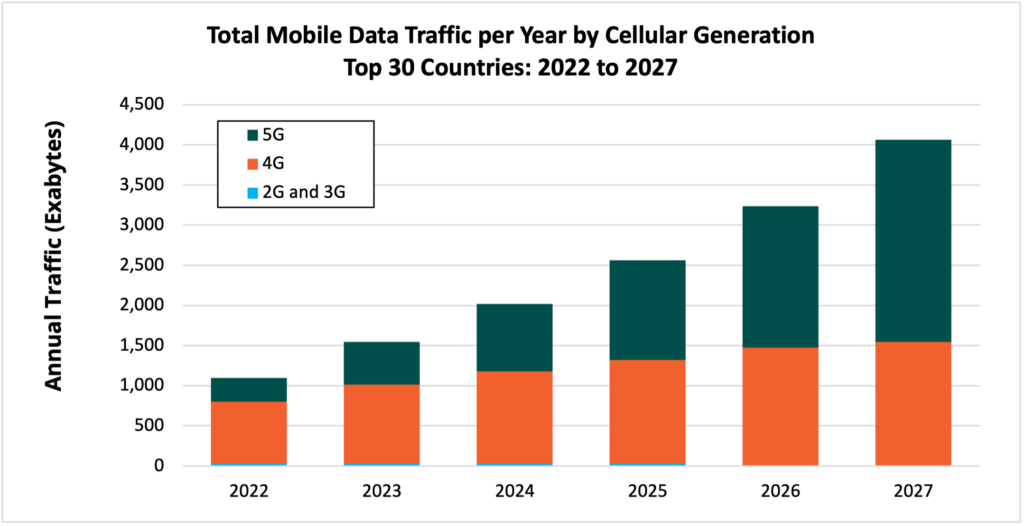

The high growth rates of 5G deployments are also expected to fuel increased demand for data. Annual data traffic from the top 30 countries monitored by ABI Research are forecast to grow from almost 1,100 exabytes in 2022 to over 4,000 exabytes in 2027 (at a CAGR of 30%), with 5G making up ~60% of total data traffic in 2027.

5G necessitates a revolution for backhaul dimensioning

With the higher data throughputs and lower latencies required by 5G networks, backhaul or transport solutions must also adapt to meet the increased requirements needed by 5G technology. According to the European Telecommunications Standards Institute (ETSI), 5G transport networks will need to meet capacity requirements of 3 Gigabytes per Second (Gbps) for rural, 5 Gbps for suburban, between 5 and 10 Gbps for urban, and more than 10 Gbps for dense urban environments. Additionally, latencies of below 5 milliseconds (ms) and 1 ms must also be met for Enhanced Mobile Broadband (eMBB) services and Ultra-Reliable Low Latency Communications (URLLC) mission-critical applications, respectively.

E-Band plays an important role in supporting 5G

Fiber networks are generally seen as a very attractive mode of transport for 5G backhaul. However, in areas where it is difficult, impractical, or cost inhibitive to deploy fiber cables (e.g., through water bodies to islands, in mountainous regions, in remote/rural areas, etc.), wireless backhaul links provide Communication Service Providers (CSPs) with a cost-effective and easy-to-deploy alternative.

Operating in the higher frequency ranges of between 71 Gigahertz (GHz) and 86 GHz, and coupled with wide channel sizes, E-band wireless links can support more than 10 Gbps capacities with low latency. These qualities of the E-band spectrum make it an ideal wireless alternative for 5G transport networks.

However, radio waves in the E-band frequency range are affected more by oxygen and rain attenuation compared to frequencies in the lower ranges. E-band links are also highly directional and require precise alignment between antennas. Factors like building or tower sway can affect the reliability of the connection. As a result, E-band link distances are usually limited to between 3 Kilometers (km) and 5 km, but some vendors are starting to push those upper limits.

High growth expected for E-Band usage

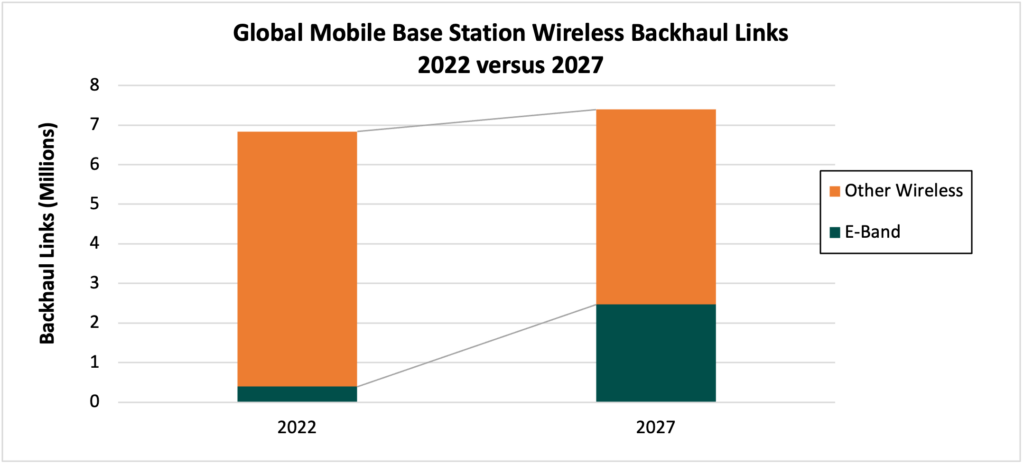

E-band deployments have seen successful adoption, particularly across European countries, such as Poland, Germany, and France, which have, in turn, facilitated the rollout of 5G networks. With several countries expected to launch 5G networks in 2023, ABI Research expects the number of global mobile base station E-band links to grow from close to 400,000 in 2022 to over 2.5 million in 2027, making up 33% of total wireless backhaul links.

Technical advancements to drive E-Band adoption

To push beyond the above-mentioned limitations of the E-band and make it a more viable solution for CSPs, various technological advancements have been developed to increase the capacity, range, and reliability of E-band links.

- Cross Polarization Interference Cancelling (XPIC) is done by propagating two signals horizontally and vertically over the same channel, increasing channel reusability and thereby overall link capacity. With the use of XPIC, E-band links can provide up to 20 Gbps capacities in urban environments.

- Band and Carrier Aggregation (BCA) bonds different frequency bands together, such as E-band with traditional microwave band links, to increase the range and reliability of higher-frequency Millimeter Wave (mmWave) bands. For example, by bonding a microwave band (e.g., the 18 GHz band) with the E-band, mobile operators can more than double the propagation range, with the link in the lower band being used to assure carrier-grade availability (i.e., 99.995%).

- More powerful E-band radios increase link range with higher transmit power. At the moment, the typical range of maximum transmit power in the industry for E-band radios is between 18 Decibel Milliwatts (dBm) and 20 dBm. However, advancements in Power Amplifier (PA) technologies are expected to increase maximum transmit power thresholds to 26 dBm and beyond, thereby increasing the range for the E-band.

- Beam tracking solutions make use ofintelligent algorithms to ensure beam alignment and stability, thereby significantly increasing the tolerance for E-band deployment on cell sites by overcoming issues with building and tower sway. This enables larger antennas (i.e., 0.6 Meter (m) and 0.9 m) to be deployed and increases the E-band signal transmit power for longer link distances—potentially up to 5 km to 7 km.

New backhaul dimensioning approach increases viability of E-Band usage

The traditional approach toward backhaul dimensioning was typically done by setting fixed and stringent targets (i.e., 99.995% or higher) for each link based on the highest peak traffic of the Radio Access Network (RAN) site. This same target was set in all scenarios, regardless of the level of actual RAN traffic demand experienced. As a result, E-band deployment has been restricted—due to its generally lower availability as compared to traditional microwave bands—and limited to shorter hops.

Recently, ETSI introduced a new perspective to measure microwave and mmWave Key Performance Indicators (KPIs). In its report, ETSI provided recommendations that will allow CSPs to reduce the Total Cost of Ownership (TCO) of deploying wireless backhaul solutions. These recommendations include the introduction of a new KPI, “Backhaul Traffic Availability” (BTA), that computes the probability that the microwave/mmWave backhaul link can deliver the RAN traffic demand without any impact on the end-user experience. This new KPI is intended to prevent unnecessary over-engineering by allowing CSPs to dimension backhaul requirements based on anticipated RAN traffic.

In this study, ETSI performed multiple simulations on the impact of BTA on end-user Quality of Experience (QoE) and concluded that even in high-traffic load scenarios, there was negligible impact on QoE as long as BTA remained in the ranges of between 99.7% to 99.9%. As a result, the use of BTA enables the telco to deploy longer E-band links with confidence—up to double the existing hop lengths — with greater assurance of negligible impact to end-user experiences.

Evolving spectrum pricing policies reflects increased importance of E-Band

The practicality of E-band deployments is also largely dependent on spectrum pricing policies in each country. While there are large E-band spectrum price disparities globally—where the highest spectrum prices in some markets can be up to 180X higher than the lowest priced markets—there have been positive developments observed in multiple countries.

In Saudi Arabia, for instance, the spectrum pricing methodology was recently updated in September 2022 to consider factors such as frequency band, frequency spectrum service, and frequency spectrum efficiency. In particular, pricing for E-band decreases with the use of higher frequency ranges, higher bandwidths, and solutions that make optimal use of frequency spectrum. Germany has also implemented a tiered pricing structure (i.e., lower factor) for E-band links, whereas Indonesia is also considering the introduction of such tiered pricing mechanisms.

Looking to the future for 5G and beyond

Investment in the next evolution of 5G is already very much underway. In March 2023, China Mobile Hangzhou and Huawei demonstrated a 5G-Advanced deployment, achieving peak rates of over 10 Gbps data rates. To support even higher, future capacity requirements leading up to 5G-Advanced and beyond, research on the use of even higher frequency ranges for wireless backhaul, such as W- and D-bands, has begun.

CSPs need to review their existing approach to backhaul dimensioning against the new KPIs proposed by ETSI and consider how the E-band can support their 5G rollouts and overall coverage strategies. Regulators, on the other hand, also need to recognize E-band backhaul as a critical component of national-level Information and Communication Technology (ICT) strategy and review spectrum pricing policies for E-band—and even W- and D-bands in the future—usage to ensure that national transport networks can be sustainably deployed to support 5G networks and beyond.