mmWave infrastructure deployments are starting to gain traction as operators increasingly recognize the technology’s high-speed data throughput and low-latency capabilities. One standout application is 5G FWA mmWave, a promising alternative to traditional fixed line broadband. Although initial drawbacks have limited mmWave deployment, advancements in equipment and deployment practices have successfully addressed challenges such as signal attenuation and limited coverage. As a result, operators are increasingly considering 5G FWA mmWave services as a possible next generation revenue opportunity.

5G mmWave: Key regional developments

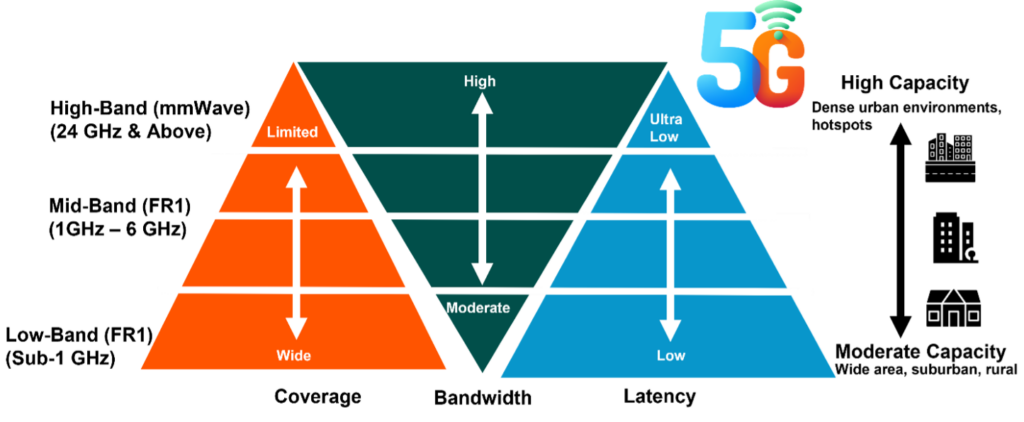

5G networks utilize various frequency bands, typically classified as low-band, mid-band and high-band (see below). Each band has distinct characteristics in terms of coverage, bandwidth and latency.

Figure 1: Key 5G frequency bands – Low, Mid and High

The high-band, also known as mmWave, operates at frequencies of 24 GHz and above, providing high-speed, low-latency connectivity with superior data processing and abundant bandwidth. This has led to increased operator deployments. Based on recent Global mobile Suppliers Association (GSA) reporting, in 2022, 140 operators in 24 countries possess mmWave licenses, with 28 actively deploying mmWave in 16 countries. Significantly, a large proportion of mmWave licensed operators have been allocated more than 400 MHz each, which provides the mobile operators with high capacity and therefore competitive service pricing options for end-user services. Additionally, 192 operators across 48 countries are investing in mmWave. FWA is the leading application in the mmWave domain, showing commercial potential through expanding operator deployments. The price of mmWave CPE equipment has also significantly decreased from US$ 350 in 2021 to around US$ 200+ in 2023. Besides FWA, Enhanced Mobile Broadband (eMBB), a 3GPP-defined service offering higher bandwidth and improved latency for applications like 4K media, AR and VR, etc. is also worth keeping an eye on. Notably, the outfield trials conducted by Huawei in Chengdu, China, have provided evidence for the commercial viability of eMBB with continuous mmWave coverage. Based on these trials using 400 MHz channels, the trial demonstrated peak data rates of 2 Gbps and maintained an average rate of 1.2 Gbps using mmWave-enabled smartphones.

FWA: One of the fastest growing 5G services

According to the Global mobile Suppliers Association (GSA), in June 2023, 149 operators worldwide have invested in 5G FWA. By combining the advantages of 5G and mmWave spectrum, 5G FWA mmWave presents a compelling alternative to wired connections. This technology enhances performance, introduces a wide range of in-home/SOHO applications and opens up lucrative business opportunities for operators.

- FWA can place high demands on capacity resources, rapidly loading a network. mmWave technology allows operators to leverage the expansive spectrum range starting from 24 GHz and above. This expanded spectrum allocation increases capacity and enhances network performance.

- ABI Research studies indicate that Sub-6 GHz networks are likely to experience congestion, leading to a projected surge in 5G mmWave deployments around 2025. For operators in countries like Chile, Italy and Germany with limited Sub-6 GHz spectrum available but are rapidly increasing the amount of mmWave spectrum (26 to 28 GHz bands) being made available. As a result, 5G FWA mmWave networks are becoming an attractive business case in both the short and long-term.

- With global mobile cellular service revenue largely plateauing, many operators have been struggling to find top-line revenue growth. 5G FWA mmWave broadband services have the potential to generate additional revenue for the operator.

Examples of 5G FWA deployments include nbn, in Australia, offering high-speed broadband to rural homes and SMEs using 5G FWA mmWave. In the U.S., US Cellular launched 5G FWA mmWave services in multiple US cities. T-Mobile is also considering FWA mmWave applications for its mmWave spectrum assets. In Asia, NTT Docomo (Japan), has debuted its 5G FWA service, home 5G, with mmWave in 2021. The operator has reported that the service had accumulated more than 290,000 subscribers (March 2022). Furthermore, Italy’s 5G mmWave FWA services have expanded their coverage to more than 400 towns.

Key technical challenges and bottlenecks

Despite the significant advantages of high-capacity and low-latency network performance in 5G FWA mmWave networks, it’s also important to acknowledge the associated challenges.

- Shorter Range/Coverage: As mmWave operates at higher frequencies of 24 GHz and above, its signals have a shorter wavelength, travel significantly lesser distance as compared to other 5G bands.

- Signal Attenuation/Blockage: mmWave operates in high-frequency bands with unique propagation characteristics. mmWave signals can experience degradation due to factors like rain and foliage attenuation, which must be planned and mitigated for.

Significant progress has been made in overcoming the limitations. Equipment manufacturers have improved their solutions with innovations such as ELAA (Extremely Large Antenna Arrays), beamforming antennas, EIRP (Effective Isotropic Radiated Power) enhancements, High-and-Low-Frequency coordination, etc. Among these technological advancements in equipment, active antenna units (AAUs) have emerged as an attractive choice for 5G mmWave coverage enhancement. These units combine the antenna unit (AU) and the radio unit (RU) into a single solution, effectively combining their functionalities. When evaluating the coverage capabilities of AAUs, the EIRP specifications are crucial. Specifically, a higher EIRP ensures a larger coverage radius, accommodates more users at a single site and improves the overall user experience. Huawei has been very proactive in enhancing the EIRP specifications of its antennas. Additionally, macro base stations, mmWave street sites and DIS (Digital Indoor System) solutions have also expanded the antenna toolkit at the disposal of the mobile operator.

Revenue and equipment outlook

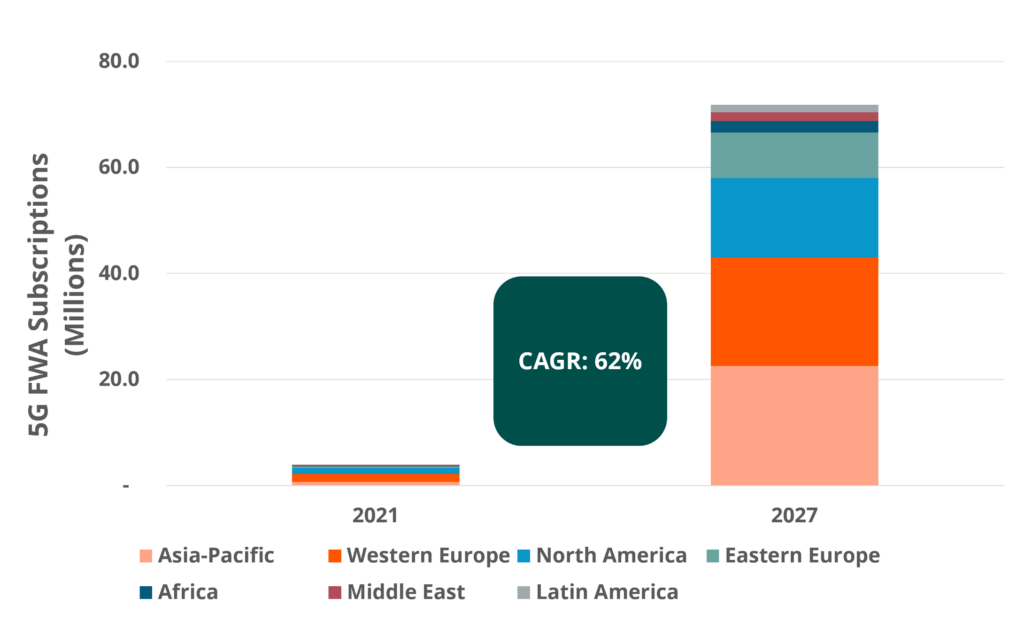

ABI Research forecasts a robust outlook for 5G FWA subscriptions, making it one of the fastest-growing broadband services for the cellular operator sector. Projections indicate a 62% Compound Annual Growth Rate (CAGR) from 2021 to 2027. While mid-band deployments have been dominant, future expansion is expected to focus on high band mmWave. ABI Research estimates a global base of around 72 million 5G FWA subscribers by 2027.

Figure 2: Forecast of Global 5G FWA Subscriptions

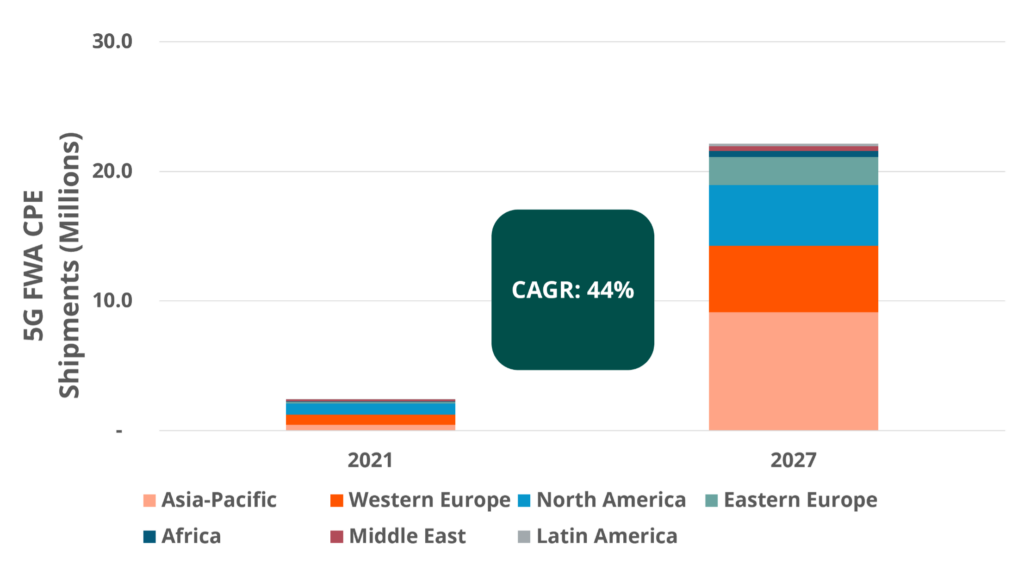

The increasing 5G FWA subscriptions will drive the rapid growth of CPEs (Customer Premise Equipment) sales. ABI Research forecasts that 5G FWA CPE shipments will surpass 22 million units annually by 2027, showing a 44% CAGR from 2021 to 2027. This underscores the market’s strong appetite for ongoing technological innovations in 5G FWA CPE devices. Furthermore, there will be a greater demand for CPEs with higher EIRP specifications to expand coverage and improve user experiences.

Figure 3: Forecast of Global 5G FWA CPE Shipments by ABI Research

Summary and conclusions

The business case for 5G FWA mmWave is increasingly being vindicated by deployments and subscriber growth on the ground. For operators with existing FWA services, mmWave could too be considered as a viable option to sustain the growth of their FWA offerings and to also prevent network overload.

Besides FWA, mmWave expands the commercial service opportunities for the mobile operator as it offers high capacity, low latency and high-accuracy positioning capabilities. These capabilities could unlock opportunities in applications such as connected vehicles, smart city, IoT and healthcare settings.

Though initial challenges like shorter range and signal attenuation/blockage have limited the deployment of mmWave networks, technological advancements and deployment practices have since mitigated those challenges. Thus, operators should incorporate 5G FWA mmWave services into their broadband access strategy. To enhance performance and extend coverage, it is recommended for operators to utilize CPEs equipped with advanced antenna technologies and higher EIRP specifications.