Greetings from Louisiana, Texas, Nebraska and Missouri. Pictured are several of my colleagues and various city and civic officials cutting the ribbon in Nevada, Missouri. This represents the fifth new Fastwyre market launch in the Show-Me state in 2023 and the eighth overall. Kudos to the team for yet another successful launch — we look forward to serving Nevada and Vernon County.

This week, we have one more “he said, he/she said” earnings call comment to look at concerning the quality of cable gross additions. In the Labor Day Brief (likely released on Saturday), we will explore the sources of Comcast’s and T-Mobile’s increased market capitalization (Verizon and AT&T are now ranked #3 and #4, respectively).

While we mentioned this in the interim Brief, we thought a hat tip to Georges Karam (CEO of Sequans) is warranted. On August 7, Renasys announced that they will be acquiring the IoT chipmaker for $249 million. While Jim’s role on Sequans’ Board of Directors ended in 2017, we have been following Sequans’ activities diligently and congratulate Georges and the Board for their nearly two decades of leadership.

The fortnight that was

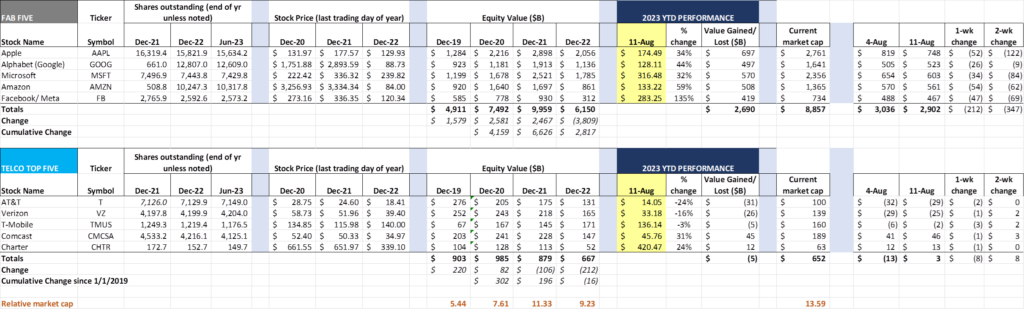

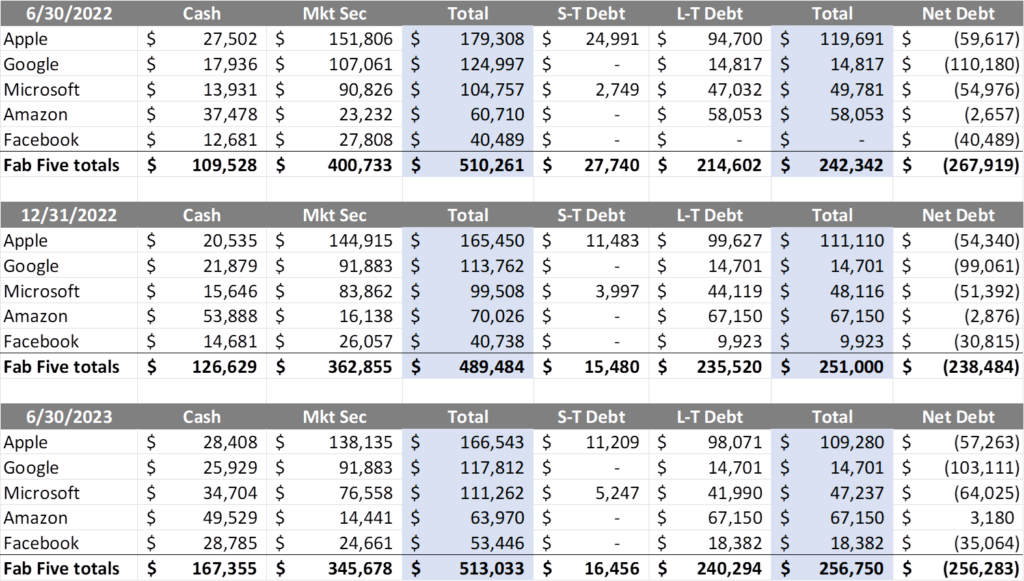

Fab Five stock prices have begun to melt with the August heat after rising throughout June and July. While few analysts believed the COVID-crazed prices at the end of 2021 were rational and justified, we would be remiss if we did not note that each Fab Five holding (including Apple) is now below their end of 2021 equity market capitalization.

While the buzz is around the impact Artificial Intelligence (AI) and Large Language Models (LLMs) on the Fab Five growth trajectory, we think stock growth should be based on a more fundamental question: “Does each company possess the ability and resources to attract the best developers and inventors who deliver ground-breaking innovation?” Whether that is AI or another productivity breakthrough (e.g., personalizing/ mass customizing childhood education), we run the risk of veering from one trend to another instead of asking whether Apple still inspires a culture of “being different.”

We think the Fab Five has plenty of resources to get the job done. Here are the net debt balance sheet totals for each company as of June 30th (showing 2Q 2022, end of year, and 2Q 2023 for comparative purposes — more details are available in the file that is distributed with each Interim Brief):

Each company is managing cash and net debt differently, especially compared to 2Q 2022. Apple, Google and Microsoft are reducing their debt levels, while Amazon and Facebook are growing theirs. Each company increased their cash balances (taking advantage of higher money market interest rates) and reduced their exposure to marketable securities. Amazon, who had been flirting with having a positive net debt balance for several quarters, now is firmly in the net debt category.

The state of each Fab Five balance sheet is stellar, especially when compared to AT&T or Verizon. The global options available for each Fab Five company are significantly greater than those available to any industry. A rising stock price attracts option-hungry talent, and there’s cash to pay for the best and brightest.

As interest rates remain stubbornly high, who is best positioned to weather the storm of debt refinancings? Which stocks have the strongest record of capital appreciation? Who has cash to buy back stock (or another company, FTC and DOJ permitting) when the timing is right? That’s what makes this group so special. It began with the debt aversion from the 1980s Silicon Valley and continues to the present day.

Contrast this with the current state of telecommunications. AT&T and Verizon alone carry 15% more debt than the entire Fab Five (and are significantly more dependent on the American economy). The Telco Top Five are consumed with monetization of existing assets (especially spectrum) while the Fab Five are kept awake by the invention required to win bigger bets (e.g., autonomous driving, low earth orbit satellites, improving logistical systems, AI, etc.). The Telco Top Five are highly dependent on others’ innovations (especially Apple and Samsung) to drive switching decisions, while their Fab Five counterparts are dependent on creation and invention.

We need all types of companies to create a balanced, productive economy, but when doubts are cast because the Fab Five has a bad week/month/quarter, we thought it would be good to elevate the conversation. They still attract the best and brightest, and, as long as that case remains, the Fab Five will continue to deliver shareholder value.

We have had plenty of news during the last two weeks. Verizon is shutting down the BlueJeans video service (great article on this ill-advised acquisition here), likely triggering a small 3Q write-down. AT&T lost their head of HR, Angela Santone, even as the company reduces their workforce by tens of thousands this year – Bloomberg article here. And Dish is merging into another Charlie Ergen-controlled company – Echostar — as they attempt to build a fourth wireless carrier (Wall Street Journal article here).

Speaking of Dish, we were not surprised to see their request to the FCC for an additional 10 months to come up with the money to buy T-Mobile’s 800 MHz spectrum holdings (Fierce Wireless article here). We expect the FCC to shorten the window to the end of the year. On their quarterly earnings call, T-Mobile CEO Mike Sievert indicated that the companies were discussing “additional win-win” alternatives to resolve the problem. How T-Mobile responded to the FCC concerning Dish’s request is anyone’s guess, but our bet is that the FCC likely adopted a “more time is best” policy.

Lastly, we would be remiss if we did not highlight the discussions that have and will continue to occur between Amazon and the Federal Trade Commission (more on these from The New York Times here). “Last rites” discussions rarely dissuade regulators from filing lawsuits, but they do allow them to fine tune their arguments. At the core is whether Amazon’s strategy is anti-competitive. The FTC will assert that Amazon’s focus on end-to-end logistical control creates a barrier to entry that stifles alternatives, and that the cost savings generated for tens of millions of households by their low-cost delivery platform is not enough to outweigh the harms their monopolistic activities have wrought on the global economy. We think that argument is going to be a difficult one to make, and especially to survive on appeal. More to come in September when the FTC files their lawsuit.

He said, he said (Part 2)

In the last Brief, we highlighted what appeared to be conflicting comments made on Verizon’s and Comcast’s earnings calls about the duration and durability of their MVNO agreement. This week’s sparring comments focus instead on the quality of cable’s gross additions. For the last two earnings calls, T-Mobile has been sharing their internal analysis on cable’s success. Mike Sievert, T-Mobile’s CEO, said this on their most recent call:

“… Our port ratios with cable have been improving for year-over-year for 9 quarters in a row. And what you see is that the big step forward they started to take in Q4, according to our analysis, about 80% of the year-over-year increment in their performance from the same period a year ago, Q4, Q1 and Q2 is from non-ports. So they’re actually not growing the porting side of their business at the same rate as the non-porting side of their business, instead kind of printing postpaid ads. They might be coming over from prepaid. They might be just simply net new. They might be kind of dropped in the bag. I don’t really know. There’s probably several different factors to it. And we just — we don’t know quite how to unpack it because we don’t have all the information. I mean, we double-click into things like Verizon’s wholesale revenue and note that it’s not growing. That’s sort of an interesting diagnostic for us that helps us understand what might be happening.”

Elsewhere on the call, Mike referred to cable’s additions as “low calorie.” We are surprised to see that T-Mobile still refers to the 80% figure – that may have been the case early on in Spectrum’s marketing efforts, but, as we see below, does not appear to be the case today.

We highlighted Verizon’s wholesale revenue growth in the last Brief as well in the context of how much Big Red’s postpaid retail consumer business is shrinking. Wholesale profitability and lower postpaid upgrades are their primary sources of annual EBITDA growth.

T-Mobile’s call was on Thursday, and on Friday’s Charter (Spectrum) earnings call, Chris Winfrey added additional color in his response to Craig Moffett’s question on the topic:

“I’ll start by saying that anytime you have your competitors that continue to talk about you on their earnings call, I take that as a compliment. The second thing, I would say is, clearly some of their data, they’re not really good at producing and that’s not accurate. The third thing I’d say is that in Jessica’s prepared remarks, she mentioned that the level of port activity is at or better than it was even prior to the Spectrum One launch. So we feel very good that these are… good and high-quality customers, the majority of which are broadband customers today. So — and so they resemble the marketplace and the product is very attractive, it’s selling in very well and it’s going to stick very well in and we look forward to seeing that develop over the next few quarters.”

What Charter CFO Jessica Fischer indicated earlier in the call was a) that the majority of new wireless gross additions are coming from Charter’s large embedded base of broadband customers; b) that that percentage was decreasing as Charter was being more successful with new customer acquisition (presumably through the Spectrum One offer); and c) that the overall percentage of port-ins (of total gross additions) has not changed, even though the volume has nearly doubled.

Could both T-Mobile and Charter be right? Could the disclosure that “we use Verizon’s network” disproportionately attract existing Verizon postpaid wireless customers? And could that be the factor that is pressuring churn and net addition at Big Red?

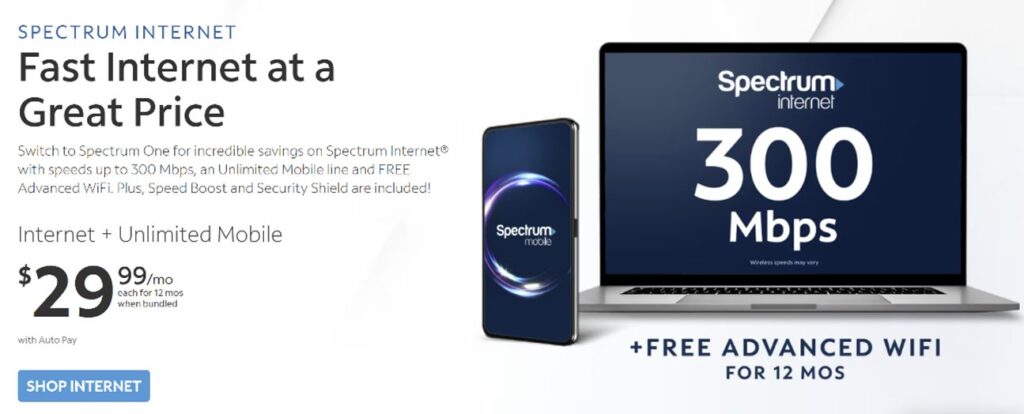

The simple answer is “yes.” T-Mobile can experience record low churn (0.77% per month) because of their network quality, value proposition, and customer experience. And Charter can attract customers who are cost-conscious and pinching every penny amid increasing prices. Their most recent promotion (see nearby picture) even implies a price hike for the Spectrum One to $59.98/ mo. (prior was $49.99). After that, the price increases to $114.99/ mo. with autopay and $119.99/ mo. without. That “month 13” pricing is at odds with AT&T fiber + mobile pricing for 300 Mbps asymmetric service that’s sub-$100 and bundled pricing (fiber + Mint Mobile, for example) that’s less than $90/mo.

Bottom line: We tend to believe Charter over T-Mobile on the port figures (our assumption is more like 65/35 ports to new which is still too high), but also believe that both are executing well to very different bases. The extent to which cable companies can use Equipment Installment Pricing contracts to extend the relationship beyond 12 months remains to be seen, but represents an opportunity to reduce “anniversary” churn.

In two weeks, we’ll focus on Comcast vs. T-Mobile and see who the strongest provider is headed into the end of 2023. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and Super Bowl champion Kansas City Chiefs!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.