China has successfully established itself as a global leader of 5G deployments. In the past two years, 5G user penetration in China has jumped from 18% to 36%. Similarly, China’s 5G subscriber base stands at 1.2 billion as of 1Q 2023, with the three major communication service providers (CSPs), China Telecom, China Unicom and China Mobile, continuing to gain millions of 5G users every month. As of June 2023, China Telecom added 4.24 million 5G users to their subscriber base, China Unicom added 2.82 million new 5G subscribers while China Mobile welcomed 14.85 million 5G users.

The commercialization of 5G applications has risen across the country to more than 50,000 and spans across 60 different industries as of March 2023. 5G has also bloomed in the B2B business service segment and contributed to Data, Information and Communications Technology (DICT) revenue. China Mobile saw their DICT revenue surpass RMB 36.5 billion (US$5.1 billion) dollars in 2022 and were involved in more than 18,000 5G enterprise projects across smart hospital, smart factories, smart city and more. Revenue for China Mobile’s 5G private networks also saw an increase of 107.4% Year-on-Year (Y-o-Y) growth, reaching RMB 2.55 billion (US$ 365.5 million) by December 2022. Meanwhile, China Unicom experienced a spike in 5G industry virtual private network customers from 491 to 5,816 between June 2022 and June 2023.

eMBB monetization opportunities ramp up

5G operators and service providers have been demonstrating new differentiated services for users that does not require network slicing and is based on the basic QoS network mechanisms. This approach nurtures the scope of 5G applications and promotes new business models for CSPs to target their subscribers.

CSPs that operate 5G networks have begun to offer personal broadcasting capabilities and gaming passes. Fueled by the low latency capabilities of 5G, China Unicom launched new 5G Live Broadcast Packages. This package includes higher uplink and downlink data rates than usual mobile plans to meet the needs of video bloggers to engage in live video broadcasts on platforms like Douyin, Kuaishou and Bilibili. Huawei provides the core network for this 5G service, guaranteeing a 3 Mbps uplink experience. Since the launch of this service in 4Q 2021, China Unicom has welcomed 200,000 users to its 5G Live Broadcast Package.

Additionally, Three Hong Kong released a similar package for personal broadcasting called 5G Live Connect. This package allows for unlimited data for streaming at US$ 10 per session and is compatible across major social media platforms such as YouTube, Facebook and Instagram. Huawei partnered with Three Hong Kong to provide their Huawei 5G CPE Pro 2 device to support Three Hong Kong users and their personal broadcasting needs. Latency reduction packages have also been targeted for gaming. Three Hong Kong offers a Gaming Service and Game Pack at a beginners and premium rate and serves as a value-added service on top of a mobile plan. The novelty and incentive of this package is that the monthly fee of US$ 6.28 to US$ 7.56 (HKD 49 to HKD 59) can be fully rebated to spend in the respective online gaming stores (MyCard, GASH, Razer Gold, App Store, Google Play Store).

Bringing down the barriers on the production & logistics floor

5G is gaining momentum as an enabler of digital transformation of the economy and society. On the manufacturing floor, the Communication Service Providers (CSPs) in China have demonstrated success with implementing 5G-enabled production lines that boost efficiency and productivity.

At the COOEC Tianjin Intelligent Manufacturing Base, COOEC Engineering built China’s first smart manufacturing production floor for offshore oil and gas production equipment. COOEC Engineering deployed a wireless 5G network to enable the use of industrial big data and artificial intelligence (AI), in addition to welding robots and autonomous guided vehicles (AGVs) on the smart factory floor. These aided the production of panels and process piping, automated warehouses and intelligent manufacturing, logistics and distribution management systems. As a result, it was reported that overall process pipeline efficiency has improved by 22%. Specifically, the final assembly duration has been reduced by 50% and human operations improved by 33%.

Meanwhile, China Mobile and Dpeda have partnered with Huawei to digitally transform China’s first 5G+ Smart Chemical Park of Dongying Port in Shandong. A total of 30 5G base stations were built in the production area to support the smart factory’s private 5G operations. The smart park solution comprised the integration of 5G, Multi-Access Edge Computing, Cloud, Internet-of-Things (IoT) and AI. Edge computing is especially valuable in Dongying Port as the data collection and analysis process from the millions of sensors throughout the park will be made more efficient and flexible. This will consequently benefit several work operations such as predictive maintenance and environment management. A special feature of this port includes the emergency control center, where real time, sensitive data in production safety and environmental management is monitored for efficient incidence identification and resolution.

5G RedCap is expected to grow its IoT market-share

China’s IoT ecosystem has also witnessed growing maturity of 5G RedCap as an IoT solution. 5G RedCap is ideal for large-scale Industrial IoT as it enables low latency and high reliability features of 5G but utilizes less power and is available at a lower cost. Huawei has been active in its engagements of RedCap, piloting a joint venture with China Unicom & China Southern Power Grid to test 5G/5.5G RedCap technology. The test was carried out in Shenzhen, Guangdong and the developed RedCap solution complies with 3GPP Release 17 performance specifications. Additionally, RedCap was successfully applied to digital power grid applications, namely power distribution automation, distributed power control and high-resolution video surveillance of up to 4K. The test also demonstrated a successful coexistence among regular 5G users with RedCap users on the same wireless network. Given the high scalability of 5G RedCap, the outlook for RedCap bodes well in the Massive IoT market. This should spur a wider device and chipset ecosystem for the RedCap in the coming future.

Private cellular & network slicing related 5G investments to grow

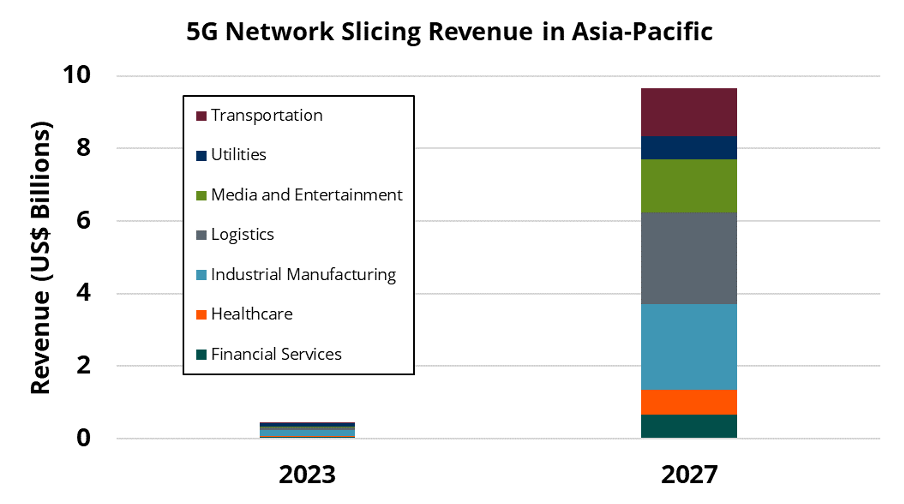

Source: ABI Research

Network slicing and private network solutions have become the preferred choice for enterprises when selecting their 5G-enabled systems. ABI Research forecasts 5G Network Slicing revenue in the Asia-Pacific region will experience an upward trajectory at a CAGR of 116% and reach US$ 10.1 billion by 2027, up from US$ 0.4 billion in 2023. The vertical that will experience the largest growth will be Logistics, followed by Industrial Manufacturing, expected to rake in US$ 2.59 billion and US$ 2.53 billion respectively by 2027.

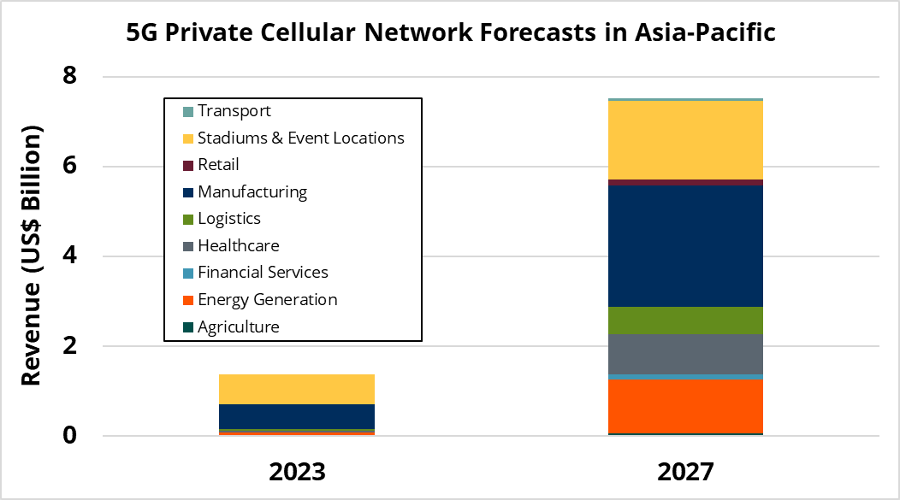

Source: ABI Research

Looking at the Asia-Pacific region’s forecasts for 5G Private Cellular Networks, on the other hand, ABI Research anticipates the market will grow at a CAGR of 53%, up to US$ 7.52 billion by 2027, from US$ 1.37 billion in 2023. Specifically, the Manufacturing industry is expected to draw the largest proportion of revenue, reaching US$ 2.71 billion by 2027. 5G private cellular networks that are adopted in Stadiums & Event Locations are likely to follow second, with a market value of US$ 1.74 billion over the same time.

Summary and conclusions

China has demonstrated remarkable success in its deployment of 5G network and likewise with their new revenue generating models in 5G consumer and enterprise applications. As a country, there is significant dedication towards unlocking the full potential of 5G and its applications amidst a still maturing ecosystem. In addition, with 5G RedCap ready for commercial adoption, the Industrial IoT market is set to reap the benefits of a highly scalable, low-cost solution on the market. As the world moves towards 5G-Advanced, China is a strong contender and example that 5G-Advanced can bring bright new value creation beyond communications.

Sources:

- 5G Network Slicing and Industry Verticals – 2Q 2022 (MD-SLIC-103)

- Private Cellular Network Forecasts – 1Q 2023 (MD-PCRN-22)