Labor Day weekend greetings from Louisiana, Texas and Missouri. Pictured is the Venture Global LNG plant in Cameron, Louisiana. Over the last two years, we’ve passed by many times and continue to be amazed at the scale of their operation.

This week’s Labor Day edition includes a longer than normal market commentary and concludes with the question “What makes Comcast and T-Mobile great?” We will explore a couple of common factors as well as a few unique traits for each company.

As many of you saw on his Friday LinkedIn post, the Briefer will be stepping back from his day-to-day role as Chief Strategy Officer at Fastwyre Broadband starting this month and will leave the company by the end of the year. It’s been a full 27 months of “pedal to the metal” execution, and the hard work is really paying off with nine new market launches in 18 months. After a little time to recharge, the Patterson Advisory Group will kick back into higher gear in October. We’ll also be refreshing the “State of Telecom” presentation that many of you helped to create in 2019 and 2020. Stay tuned for more details.

We will continue with our every other week format (interim Brief format will continue to be posted online) except during earnings season when we will have weekly Briefs and daily posts on the Sunday Brief website.

The fortnight that was

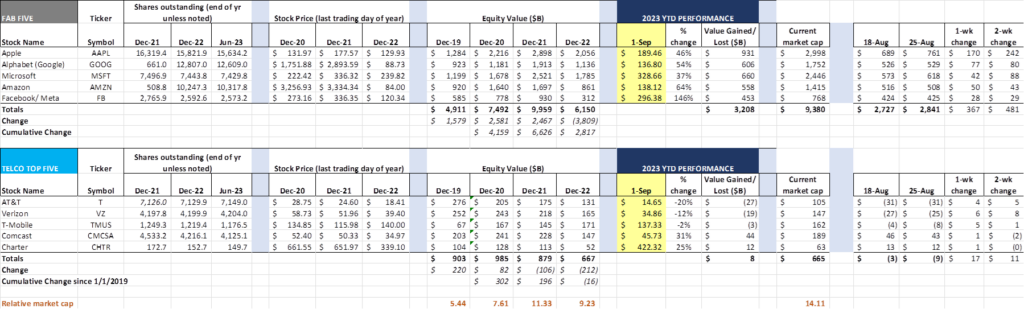

Since the last Brief, the Fab Five have gained more than $480 billion in market capitalization (roughly the value of T-Mobile + Comcast + AT&T – all in 2 weeks), and the Telco Top Five have gained $11 billion. AT&T’s market value is back above $100 billion, while Comcast and Charter (“big cable”) are the only two Telco Top Five companies that have gained value in 2023. Meanwhile, Meta/ Facebook continues to straddle the $300/ share price point. We live in crazy times where high valuations justify even higher multiples (and subsequently higher valuations).

Apple sent out its invitation for their September 12th event in Cupertino (see nearby picture). The theme for the event, Wonderlust (a derivative of the word wanderlust – definition here) indicates that there might be more discussion of location, roaming, travel, or even satellites (we find the parallel news item that Paul Jacobs was going to be joining Globalstar, Apple’s satellite partner, also interesting). Bloomberg’s Mark Gurman has a very good take on what will likely be announced here. Without a doubt, pricing is going to be challenged, and if any wireless carrier is going to advertise “iPhone 15 Pro on us” its going to cost more – potentially a lot more.

We think that higher phone costs are one increasingly contributing factor driving T-Mobile’s cost focus. Many of you messaged me in surprise over their 7% headcount reduction announcement (Aug 24 SEC 8K filing is here), and we addressed many of the reasons why it should not be a surprise in last week’s interim Brief.

One thing we did not consider in that analysis, however, was that the phone cost (particularly for the Pro model, which currently starts at $999 and could go up 10-15%) will go up, and that increase would need to be absorbed in T-Mobile’s cost per gross addition. Our guess is that T-Mobile is planning a very aggressive promotion, using what balance sheet/ liquidity advantages they have to wrest away disproportionate market share from AT&T and Verizon.

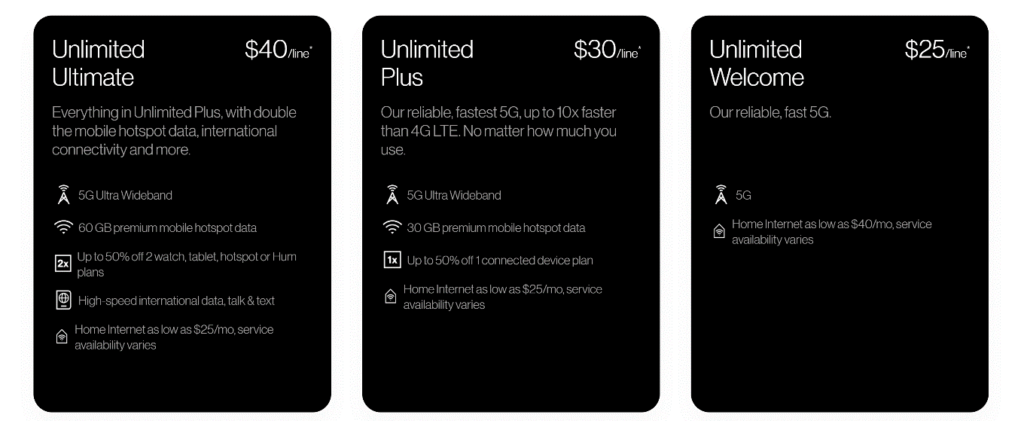

Speaking of Big Red, they introduced another premium network plan layer to their myPlan lineup. Here are the new network choices:

Verizon’s $10/ mo. addition caters to two unique segments not previously addressed in the Unlimited Plus plan – global travelers (to destinations outside of Canada and Mexico), and higher-usage hotspot customers. Also, if the individual has multiple connected devices (which could be correlated to hotspot usage), there’s an additional discount. To borrow a segment from the 2000s, this would be a “global prosumer.”

This plan type is needed for an additional reason, however. If/ when Verizon wants to offer a free device (iPhone, Samsung flip phone, etc.) without a trade-in credit, they are going to need more ARPU to support what amounts to a $30/ mo. subsidy. Given the low probability that the entire 60 GB hotspot allowance will be used each month (or that the customer will make frequent European trips), this new tier serves as the perfect place for premium phone offers.

We think that these extra layers create additional confusion for customers, require more training for store representatives and customer service associates, and provide ample opportunity for additional billing errors. We are still stuck on the explanation of Verizon’s two networks (Welcome versus Plus) given the longtime perception that each of Verizon’s networks is superior to their competitors. Having a “lesser but good enough” network choice on Verizon is like picking the Lexus IS model over the Lexus ES model (which, upon researching, is a real dilemma – see Motor Trend article here) – they both deliver a consistent 10 Mbps speed can be delivered for video viewing (more than ample for 720p, and just enough for 1080p screens).

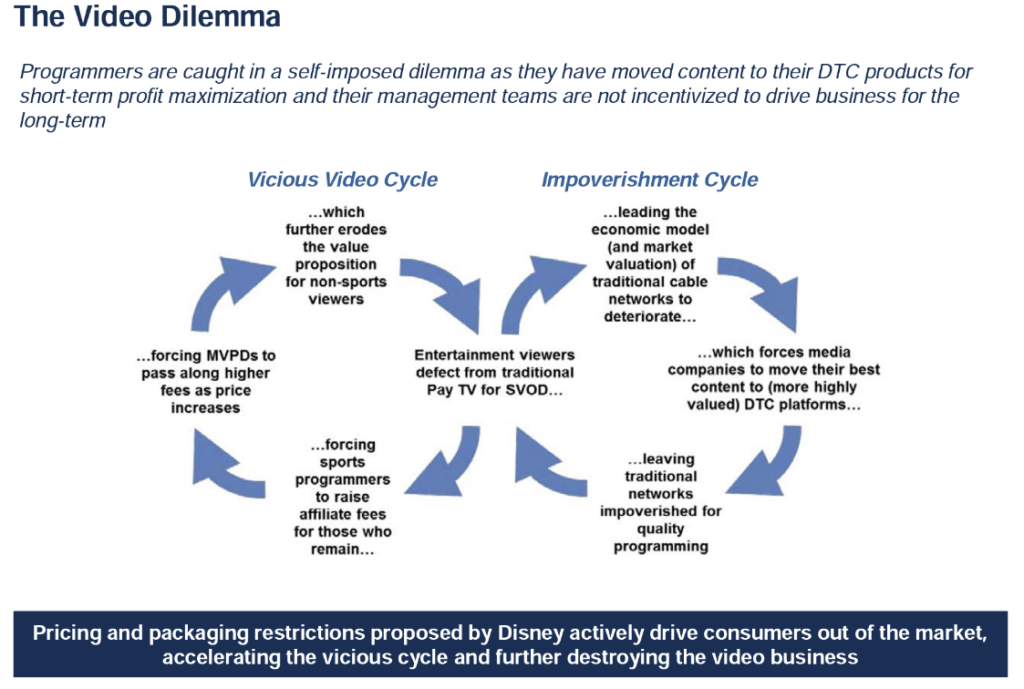

Finally, we have the Spectrum vs. Disney battle. On the opening weekend of college football, there will be no broadcasting of the LSU-Florida State game (ABC, 7:30 p.m. ET) over Spectrum’s cable systems in Dallas/ Ft Worth and New Orleans, and no ESPN coverage of the US Open in many parts of the New York metropolitan area. This is causing many current cable customers to quickly consider alternatives including YouTube TV ($72.99/ mo., first week free) and sports-oriented Fubo TV ($74.99. mo.).

Charter went on the offensive with an investor call on Friday (link to presentation materials here). They did a terrific job of summarizing the “transition to Direct To Consumer (DTC) model” in this slide:

Wireless dented the phone portion of cable’s high-ARPU Triple Play (and cable is assisting the acceleration of the transition from hardline home phone service to wireless only with their $29.99/ mo. everyday price), leaving video + broadband as the most likely double play bundle (only 54% of Charter’s residential base subscribes to two or more products, and most of these have video). Without ESPN and the remainder of the Disney channels, this $170-200/ mo. post-promotional ARPU stream is at risk.

Charter faces many fiber to the home (FTTH) challengers in their markets (including new-entrant Fastwyre in Warrensburg, Knob Noster, and Sedalia, Missouri). If customers devalue Spectrum/ Charter’s video product, either due to higher pricing (because they capitulated to Disney) or reduced channel lineups relative to D2C (because they didn’t), they will bundle other alternatives like YouTube TV and move their Spectrum/ Charter relationship to single play.

What many in the analyst community fail to realize is that if the matchup is Spectrum single-play broadband vs any other single-play competitor, the probability of competitive wins increases. The double-play moat becomes more of a pond. We hope that both parties get this resolved quickly. For more on the dispute and implications, we suggest this New York Times article.

What Makes Comcast and T-Mobile Great?

The long weekend here at the Brief allows us to take a more introspective look. Since the beginning of 2020, only two stocks in the Telco Top Five have held their value: T-Mobile (+$95 billion market cap increase, no dividend paid) and Comcast (-$14 billion market cap increase, +$15 billion paid dividends). The other three stocks in the Telco Top Five have lost a cumulative $318 billion in market cap over that period, offset by ~$61 billion in dividends. While T-Mobile and Comcast have not had the gains of their Fab Five peers, they are rewarding telecom investors with decent returns.

Each company has preserved or increased value in different ways, but we would like to highlight three similarities:

- Both companies have tightly controlled ownership. Comcast is still largely controlled by the Roberts family, thanks to Class B shares that control 33% of the voting power of the company. Comcast CEO Brian Roberts is the son of the founder, and there are no plans to cede control anytime soon. This certainty indicates a different return horizon, allowing the company to take on large investments such as Xfinity DVR (12 years of capital) and Flex (4 years). Earlier this year, Deutsche Telekom’s holdings in T-Mobile USA surpassed the 50% mark.

- Both companies are willing to build their success on other company’s assets. Saying “no” is a critical part of portfolio management because it allows higher priority projects to be sufficiently funded. One of the fundamental mistakes made by large telecom providers is that they require ownership of too many elements of the value chain: more company-owned stores, more out-of-region fiber ownership (5G Ultra Wideband), more data centers (later spun into Evoque), more commercial real estate, more undersea cables, more towers… the list goes on and on.

Even with Comcast’s massive size, they are sourcing most of their wireless capacity from Verizon to power Xfinity Mobile. While they have the capability to build (and know exactly where customer traffic would justify additional capital), they focus instead on deepening their fiber network, an investment that has business returns for both residential and business customers.

While less important, thanks to the prevalence of carrier hotels and other data centers in every major metropolitan area, Comcast never built a national fiber network, choosing instead to lease fiber from several well-known national fiber providers. It was an extremely wise move in hindsight and freed up capital to grow their DOCSIS network (and local fiber).

We have been critical of T-Mobile’s lack of a fiber-to-the-tower (FTTT) strategy and continue to be puzzled by their continued purchase of leased capacity even in dense markets. But their willingness to say “no” to FTTT enabled them to say “yes” to other scale-producing growth initiatives. It may have hurt Magenta with enterprise customers, but it helped with front line investment.

- Both companies used savvy deal-making coupled with exceptional merger execution to surpass synergy expectations. It’s too easy to contrast Comcast and T-Mobile’s deal-making strategy versus AT&T. In fact, one of Comcast’s savviest deals was buying AT&T’s cable asset (AT&T Broadband) in 2001 (original announcement here), and one of the near-term merger failures was AT&T’s inability to cross the finish line with T-Mobile in 2011 (New York Times article here).

Comcast’s success with AT&T Broadband was boosted in their acquisition of some of Adelphia Communications’ assets (along with Time Warner Cable) in 2005 (announcement here). In addition to those assets, the transaction allowed Comcast to re-cluster some assets (e.g., the Houston metro market, Washington DC, parts of Florida) to achieve greater local scale.

Then came the NBC Universal Joint Venture transaction with General Electric in 2009 (announcement here). This joint venture would be completely controlled by Comcast four years later. This transaction allowed Comcast to improve their cable system economics (owned content) and set the stage for the development of the Peacock streaming network. NBCU provided a diversified cash flow stream while providing the company with a “playing card” in their future negotiations with Disney (re: Comcast attempted a hostile takeover of Disney in 2004).

T-Mobile purchased a regional CDMA provider called Metro PCS in 2012 with limited room for error and not only executed the integration flawlessly, they kept the Metro brand. That set the stage for the largest M&A transaction in the telecom industry – Sprint. A $26 billion all-stock deal that met an unprecedented level of regulatory scrutiny. While all of the synergies have not been achieved as of this Brief, we think the Sprint acquisition will go down as one of the most value accretive transactions in recent memory, rivaling Verizon’s acquisition of Alltel Wireless in 2008.

Each of these transactions involved complex synergy achievements and operational discipline. They were also necessary to achieve economies of scale. Stable management teams, tightly-controlled ownership and favorable capital market conditions contributed to their history of success.

Bottom line: There are plenty of differences between T-Mobile and Comcast’s value creation strategies, but the three similarities mentioned above helped catapult them to the top of telecom.

In two weeks, we’ll begin our two-part series on third quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and Super Bowl champion Kansas City Chiefs!