Mid-September greetings from Missouri, where fall is beginning to break out. The close of the Royals season is coming soon (opening pic), football is back (although the Chiefs’ opening game left much to be desired) as well as apple cider, pumpkins, and the new iPhone 15. Apple’s new flagship product started pre-orders on Friday and hits most store shelves next weekend. We will touch on how each carrier is marketing the new devices in next week’s Interim Brief and include our latest take on backlogs by model and memory (here’s our first take on Apple iPhone 14 availability from September 2022). We think demand will be stronger than expectations, particularly for the Pro and Pro Max. And we think cable plays a bigger role than ever in the iPhone 15 launch success.

But Apple’s device launch was not the only newsworthy item since Labor Day. We have stock buyback and dividend announcements, spectrum purchases, resolved programming disputes, FTC trial opening arguments, and much, much more. Now that the Briefer is part-time at Fastwyre, the news cycle explodes – how convenient!

This week, we explore two long-standing assumptions (cable’s perpetual broadband dominance and T-Mobile’s perpetual challenger status) and question whether either is correct.

As mentioned in the last Brief, we will continue with our every other week format (interim Brief format will continue to be posted online) except during earnings season when we will have weekly Briefs and daily posts on the Sunday Brief website.

The fortnight that was

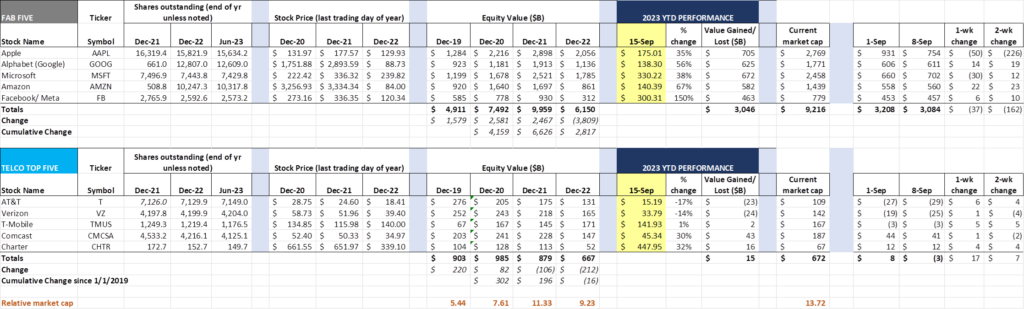

Over the last two weeks, the Fab Five have lost $162 billion in market capitalization while the Telco Top Five have gained $7 billion. The $162 billion loss consists of a $226 billion decrease in Apple’s market capitalization offset by small ($64 billion) gains by each of the other Fab Five holdings. The $7 billion is made up of modest gains from T-Mobile, AT&T and Charter offset by small losses in Verizon and Comcast.

Through the first 8.5 months of 2023, the Fab Five have gained $3.05 trillion, offsetting 80% of 2022’s $3.81 trillion loss. Long-term holders of any of these equities are still smiling, and the prospects for continued growth are high. As we discussed in a previous Brief, the net debt levels for each of the Fab Five companies are still very healthy (only Amazon has a positive net debt number and it’s a measly $3.2 billion – the other four have negative net debt levels). The only thing that can dent the long-term prospects of any of these companies is a coordinated global effort to restrict their success through increased regulation and legal scrutiny.

Google is the current target of US government attention. This week, the Department of Justice and 38 states began their trial against the Mountain View behemoth, alleging that their deals with phone manufacturers (mainly Apple and Samsung) and telecom carriers to gain prominent if not exclusive browser positioning on smartphones was illegal. There is a lot of great coverage of the trial here from The New York Times.

Judging from the first few days of the trial, this argument is going to be difficult to win, and even if they do, the remedy is even trickier. The government must prove that Google prevented Apple from featuring the Safari browser on iPhones (and Samsung from their home-grown browser on their phones). Keep in mind that during part of the timeline in question, then Google CEO Eric Schmidt sat on the Apple Board of Directors (August 2006-August 2009).

During a Financial Times interview in 2013 (captured here by CNET, an industry publication), Schmidt specifically stated that his resignation from the Apple Board was not due to browser competition (Safari vs. Chrome), but for mobile operating device competition (iOS vs. Android). Per the article – “Apple did not mind the Chrome vs Safari issues,” recalls Schmidt, “but they really did mind the iOS vs Android issues.”

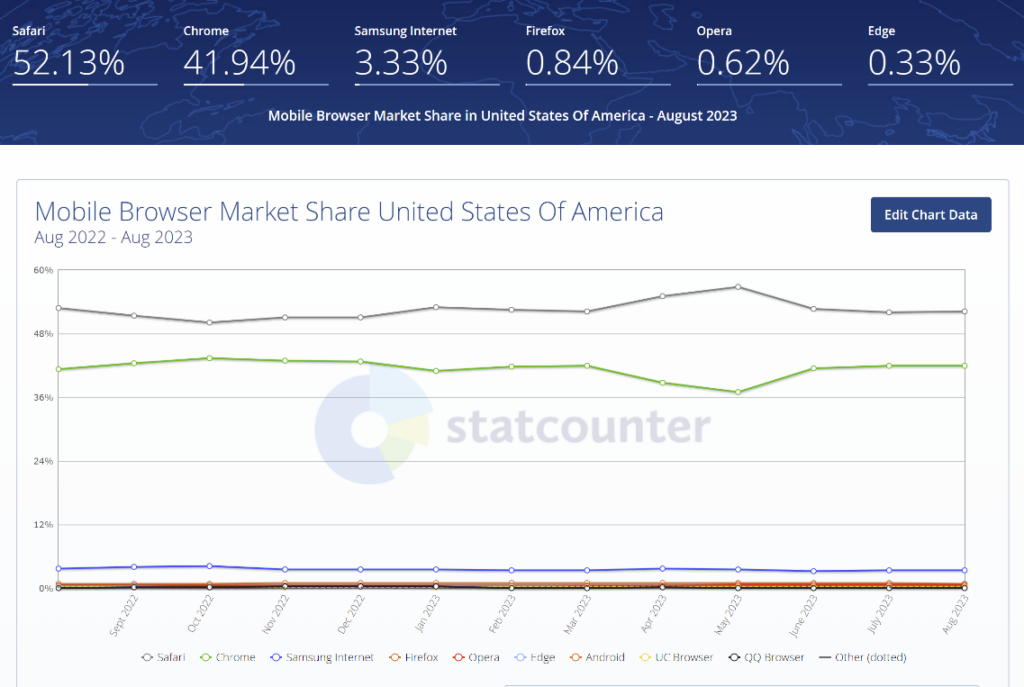

What’s most interesting to us is that, even with the assertions made by the DOJ in the trial, Google Chrome is not the dominant browser in the US Mobile market per Statcounter:

Chrome is currently #2 in mobile browser market share (although they are #1 by 20%+ points across all platforms). The argument that “buying their way” into the mobile market resulted in monopolistic mobile browser market share is not supported by current data (assuming Statcounter is correct). If anything, the data shows a duopoly that closely correlates to mobile operating system market share. Similarly, Apple’s iPad defaults to their Safari browser, and, as a result has a slightly higher market share than Chrome.

The government might have a stronger case in other areas such as advertising, but even there, Facebook/ Meta and Amazon are making great strides against their larger competitor (and traditional print and media advertising is still going strong) – advertising is more dynamic than it was a decade ago because of Google. Or they might make the argument that Google somehow prevented Blackberry, Palm, and Sybmian operating platforms from succeeding (which would be one of the greatest pieces of revisionist history ever concocted – Blackberry killed itself through it’s closed platform and needed no help from Silicon Valley). Bottom line: While there might be an intriguing story and some additional historical insights revealed over the remaining nine weeks of the trial, current mobile browser market share shows that Google is not the dominant player and that payments to Verizon, AT&T, T-Mobile, Apple, and Samsung did not catapult them into dominance.

Meanwhile, we will likely see the legal arguments from the FTC and DOJ pertaining to Amazon’s dominance over third-party sellers on its Marketplace platform. Per the Wall Street Journal (article here), “The lawsuit will target a number of Amazon’s business practices, such as its Fulfillment by Amazon logistics program and pricing on Amazon.com by third-party sellers, some of the people said. The lawsuit will suggest that Amazon makes “structural remedies” that could lead to a break up of the company.”

If the DOJ action against Google turns up the antitrust heat to 400 degrees, the FTC lawsuit against Amazon appears to be a full broil. We will withhold commentary on the prognosis of the suit until it is filed, but it appears that the remedy sought is much more severe than “lookback” fines and minor process changes of the past.

Same as it ever was (3Q earnings preview – Part 1)?

The thesis of third quarter earnings is “Same as it Ever Was.” For those of you not attuned to the alternative yet popular 1980s rock band The Talking Heads, they had a hit called “Once in a Lifetime” (link is to the official video – the phrase “Same as it Ever Was” permeates the song). As they fought conventional wisdom through their music, we are going to present a few unconventional views of industry dynamics, starting this week with cable and ending with T-Mobile.

Same as it Ever Was #1: Cable will continue to dominate the broadband landscape. Competition will be fleeting as Comcast, Cox, and Spectrum use promotional pricing to thwart fiber and fixed wireless.

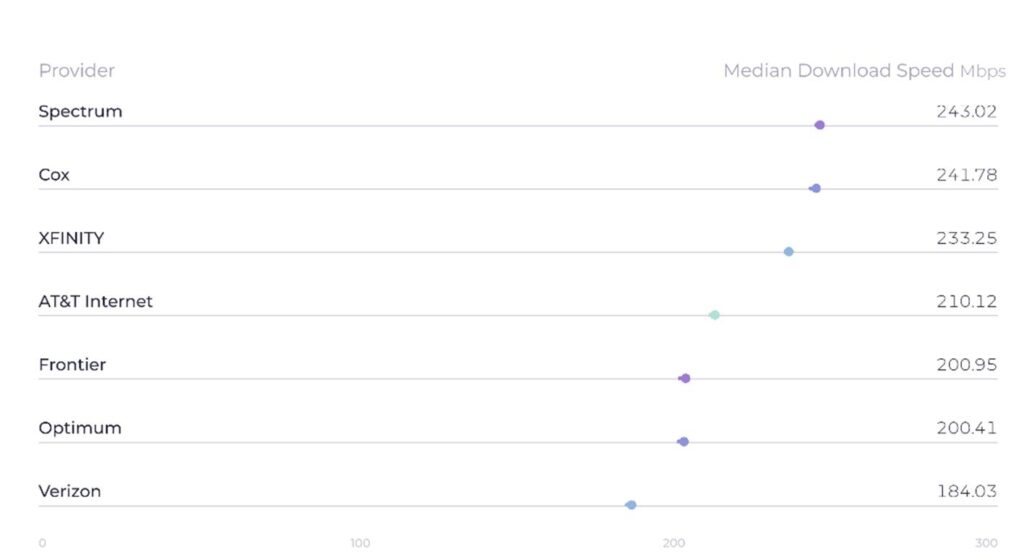

Cable is in a tough spot – they enjoy majority (sometimes dominant) broadband market share in their markets, delivering against the DOCSIS 3.1 standard, and, using Ookla data as a guide, largely winning the speed wars (see nearby chart for download speed rankings as of September 1).

But there are cracks in cable’s original formula concocted over two decades ago. At that time, their strategy was to eliminate any other wire into the house but the coax cable. Copper had to go, and, with video and broadband already traversing the current coax, the triple-play (including home phone) began.

It was the most successful market share capture in the history of telecom, resulting in 20-30% share of total homes passed in less than five years. The telcos did not know what hit them, and were forced to respond with satellite alliances (or worse, U-verse TV) and the corresponding reseller economics. Cable peaked at around 35% of customer homes on their triple play offer in 2016 (per Charter’s 2Q earnings release from that year here – note that single play was just above 38% of the base and triple play was at 35%. Interestingly, Comcast’s triple play figure was over 36% in 2Q 2016 with single play at 30% – details here).

Now the tables are turned. Phone is not only not desired, mobile service has taken its place. Video, especially for Charter, has become a cost albatross for the company. The recent settlement with Disney (announcement here) helps, especially as they prepare to launch Xumo in a month or so (see article from Light Reading on Xumo’s role with Charter video here), but jettisoning eight minor channels won’t materially help the gross margin of their product lineup. And with increased fragmentation, Charter will be able to introduce skinner bundles, but they still start with a $23/ mo. broadcast surcharge in many markets. Video is their legacy, but other options (including ones offered over Xumo) are crowding out the set top box.

With phone on life support and video transitioning to a new distribution business model (although still leveraging the HFC plant into the home), where does that leave the company with respect to “owning the home?” The company line is “Wi-Fi is the primary data and voice distribution inside the home for mobile, and our Wi-Fi rocks. We offer competitively priced mobile services that leverage Verizon’s network.”

Let’s compare the situation to Charter’s entry into Digital Phone. Competition for phone services was from a) the the incumbent telephone and DSL provider, and b) over-the-top providers like Vonage, MagicJack or Ooma. Wireless substitution increased in popularity as unlimited plans were introduced and coverage improved throughout the 2000s.

Compare that situation to the bevy of wireless opportunities that exist for $30 for 2 lines:

- Infinite Mobile from Boost – $25/ mo.

- Visible by Verizon – $25/ mo.

- Mint Mobile 20 GB plan (Mint will soon be acquired by T-Mobile) – $25/ mo.

- T-Mobile retail 55+ Essentials Plan – $27.50/ mo.

- Red Pocket 20 GB plan (or their 12-month in advance unlimited plan) – $30/ mo.

This list is admittedly small, and there are many more (including Simple Mobile and Metro by T-Mobile) that start with unlimited at $35/ month, but the bottom line is that cable does not “own” the $30 price point by any stretch. Given comments by T-Mobile and others at recent analyst conferences, it appears that many of cable’s gross additions are coming from the prepaid (read: willing to switch) world.

That leaves a lot on broadband’s shoulders. Here’s the economics of Spectrum’s plan with and without promotion compared to AT&T retail (fiber + mobile), Verizon retail (fiber + mobile), and T-Mobile retail (fixed wireless + mobile):

| Plan | Promotion | Post-promotion |

| Spectrum One | $49.99/mo | $114.99/mo |

| AT&T (with mobile discount) | $100/mo | $100/mo |

| Verizon (here and here) | $89.99/mo | $89.99/mo |

| T-Mobile US (here and here) | $115/mo | $115/mo |

Because the lowest tier available for the T-Mobile plan is Magenta Max, the $115 includes Apple TV+ and Netflix standard tier (480p, one TV) as well as a full year of AAA. We aren’t quite sure how to make that an apples-to-apples comparison so leaving the bundle package as charged.

Overall, the pricing is $1,980 over two years for Spectrum One. For Verizon (Fios + Unlimited Plus), that cost would be $2,160. For AT&T, that cost would be $2,400 and for T-Mobile (with above caveats) that would be $2,760. After the third year, AT&T and Verizon are nearly the same cost.

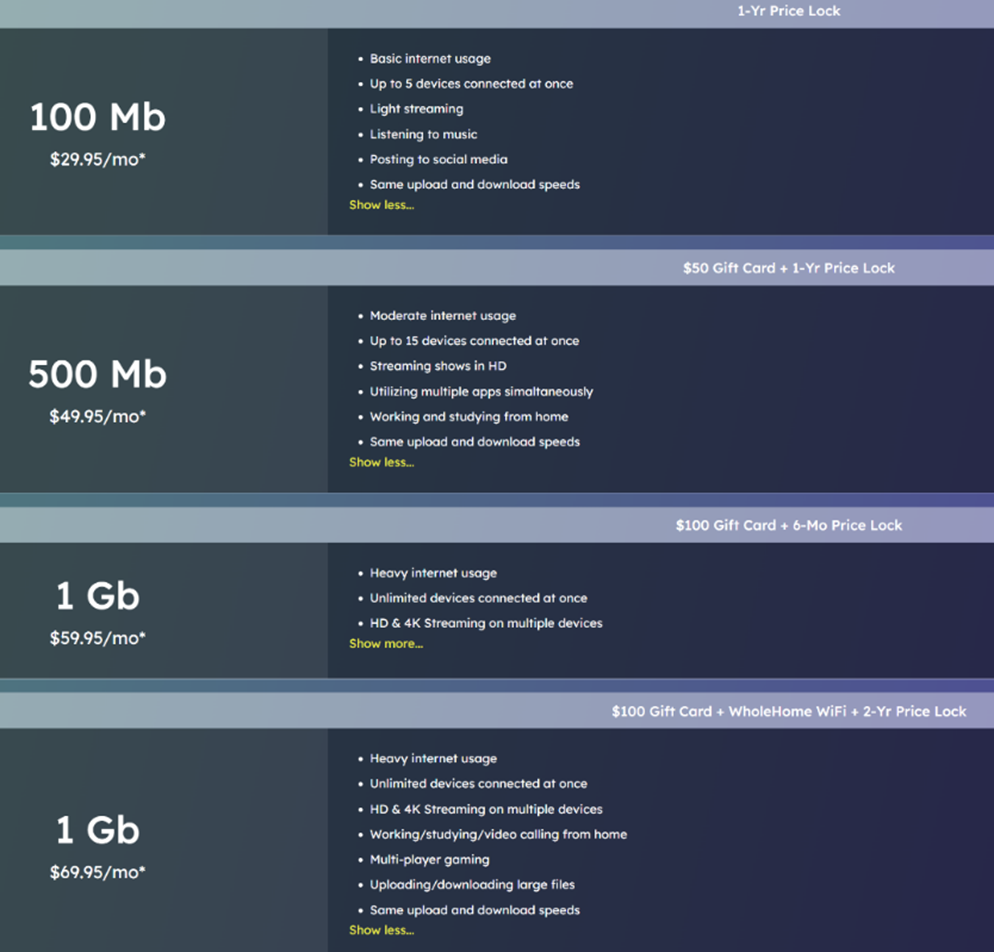

Add in MetroNet, a large fiber provider that competes with Charter in Ohio, who offers the rates in the nearby table. For a one-year price lock, a MetroNet customer could get more than 50% more more bandwidth (500 Mbps). MetroNet + Visible would be $75/ mo. for the first 12 months, and then $85/ mo. after that, slightly less than Spectrum at the 24-month comparable mark.

Bottom line: Charter (and Comcast) have a great and valuable mobile product, but it’s not the “no brainer” in a bundle that the Triple Play was 15-years ago. Fiber providers such as Greenlight (upstate NY), Allo (Nebraska), Frontier (New York, Florida, Texas), Fastwyre (Missouri) and AT&T (California, Texas, Florida) have newer plant and compelling stand-alone price points.

Same as it Ever Was #2: T-Mobile will continue to grow and dominate price leadership, extending their un-carrier behavior for the forseeable future. This will drive increased capital needs, reducing the availability of cash for shareholder-friendly stock buybacks and dividends.

We completely missed the magnitude and size of T-Mobile’s post-Labor Day annoucnement (here). It consisted of the following points:

- The current $14 billion share repurchase agreement has been completed;

- The T-Mobile Board approved a new $15.25 billion share repurchase agreement that should complete by the end of 2024;

- In addition, T-Mobile will pay a total of $3.75 billion in dividends to shareholders (50+% of this to Deutche Telekom, the majority shareholder of T-Mobile USA) starting with a $750 billion payment in 4Q 2023.

We were not surprised by the second share buyback and nearly hit the mark on the overall figure (our estimate was $17 billion in sharebuybacks and no dividend). We are surprised by T-Mobile’s perceived need to have a dividend (albeit less than a 2% yield), and do not think that they gain a larger share of growth + income buyers as a result.

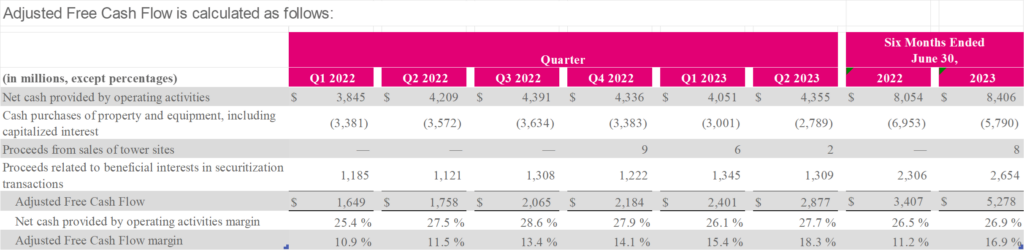

As most Sunday Brief readers are aware (Brief here from February), T-Mobile has a very bright cash flow future in front of it. Here is their free current cash flow trend (schedule available here):

Having seen AT&T and Verizon succumb to ever-increasing dividends, and understanding the overall tax inefficiencies of dividends versus share repurchases, we that this strategy is incorrect. Even with the terrific 600 MHz spectrum purchase from Comcast announced this week (a wise move by both companies – announcement/ blog post here from Tom Nagel at Comcast), as well as rumors in Bloomberg that T-Mobile is about to jump into the residential fiber game (another game-changing move we applaud if true), the commitment and expectations created by an ever-increasing dividend feels very much like an incumbent carrier move.

Bottom line: T-Mobile is doing a lot of great things. Establishing a dividend is not one of them.

In two weeks, we’ll conclude the “Same as is Ever Was” series with a look at Verizon and AT&T. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and Super Bowl champion Kansas City Chiefs!