“Welcome to the fourth quarter” greetings from Florida, Georgia, Virginia, and Missouri (picture is of the Atlantic Ocean from Virginia Beach the morning after Tropical Storm Ophelia – the ocean was still churning). The Patterson Advisory Group “back in business” tour is in full force, and, after a brief respite this week, will be headed to the INCOMPAS show in Tampa October 8-10. It has been great seeing many of you and we look forward to more face-to-face discussions as we close out 2023.

We have a very full market commentary which will dominate most of this week’s Brief. However, at the end, we will touch on two “Same as it Ever Was” assumptions that should be considered with respect to Verizon and AT&T. As many of you commented with Part 1, if we are partially right, it’s going to be a very different telecom world in 5-10 years.

Last Sunday we restarted the Apple iPhone 15 availability posts (link here). This week’s edition will definitely be out prior to the Chiefs-Jets game, but probably not much sooner. Spoiler alert: it’s nice to have more predictable backlogs than those we saw from 2020-2022.

The fortnight that was

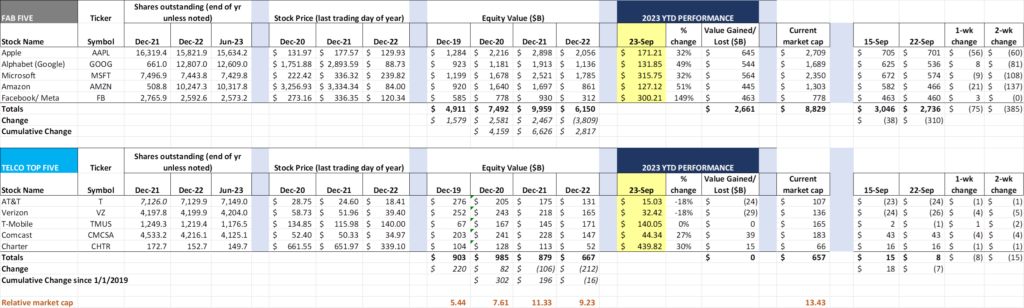

The last two weeks of the third quarter weren’t good for either the Fab Five or the Telco Top Five. Gains were non-existent, and Amazon and Microsoft both lost more than $100 billion over the fortnight. Each Fab Five stock now has a market capitalization less than their year-end 2021 COVID peak. Current year gains now make up a mere 70% of 2022’s losses.

Despite headlines of desperation, this is not the end of the world for the Fab Five. They boast a cumulative market capitalizaiton of $8.8 trillion and have lots of cash to invest (as of June 30th, 2023, the group had negative $256 billion in net debt, with $2 of cash and marketable secutiries for every dollar of debt on their balance sheets).

Many of you have asked how increasing interest rates impact these large, self-financing global corporate behemoths. Without a doubt, higher interest rates impact their customers’ discretionary spending levels (many studies like the latest PCE release here show that higher rates are impacting rich and poor alike). This certainly impacts larger durable goods purchases (e.g., house, car, appliances, etc.) but how does it impact each of the Fab Five?

Less household discretionary income may increase subscription charge scrutiny, and that impacts Apple and Amazon (and the Prime Video impact is secondary). Some home electronics expenditures might be delayed, like a Nest thermostat (Google), or a Surface (Microsoft) or Mac (Apple) laptop, but unit forecasts for these categories were already reduced thanks to the pull forward COVID-related demand.

The Fab Five impact is more pronounced with businesses, with deferral of advertising campaigns and equipment purchases impacting each of the Fab Five. Will these dent the growth of cloud computing revenues for Google, Amazon, or Microsoft? Growth could slow, but will still be very robust thanks to AI-driven cloud needs. Will Amazon Marketplace activity decrease? Not likely. Will this slow the development of applications that benefit Play and App Store revenues at Google and Apple? It’s probable that more intelligent iOS and Android applications will emerge that increase productivity over the next five years, not less. Hardware revenues will slow, but it’s hard to see services revenues stalling in 2024.

With relative immunity to activities related to higher interest rates, what could slow the Fab Five’s ascent? There are government actions such as the Google Trial (see The Verge daily coverage here, with a particularly interesting recap of Apple executive Eddy Cue’s public testimony here) and the Amazon lawsuit filed by the FTC this week (see FTC Commissioner Lena Khan’s interview on CNBC here and here). Will the remedy in the Google case be to force Apple to make changing browsers a three-step process as opposed to a five-step process (as if the government can somehow impose a better user experience than Apple – really)? Or will the Amazon trial result in marketplace sellers having more latitude to determine which delivery service customers will blame when their Holiday gifts arrive in five days versus two (spoiler alert – they will blame Amazon, the brand behind Prime, and hold them accountable)?

The FTC and DOJ can slow down innovation through the antitrust process, but it’s unlikely that they will stop the Fab Five’s ascent. The real Fab Five fear centers around geopolitically-driven prohibitions like those seen from China towards Apple in this recent Bloomberg article. From the article:

“China has not issued laws and regulations to ban the purchase of Apple or foreign brands’ phones,” Foreign Ministry spokeswoman Mao Ning told a regular press briefing in Beijing on Wednesday. It marked the government’s first comments on reports that authorities are reining in employees’ use of Apple products.

Mao also said that the government attaches “great importance” to security and that all companies operating in China need to abide by its laws and regulations. “We noticed that there have been many media reports about security incidents concerning Apple phones,” Mao said.

Clear as mud. Is China referring to Chinese media reports, or western media reports? And, if those are Chinese media reports – aren’t those messages heavily controlled by the Chinese government? With increased size, each Fab Five company has found increased scrutiny – from the FTC or DOJ or EU or China. Managing through that mudbog will determine how quickly Apple reaches $3 trillion (again) or Google tops $2 trillion.

But better to be worried about the next several hundred billion of growth than to be a Telco Top Five company. As shown in the opening chart, the Telcos are thankful that the industry has managed to retain any value in 2023. As we head into the fourth quarter, it’s clear that without a new iPhone to sell, there would be no material change from any other quarter. Thankfully, the threat of substitution is minimized (although competition is clearly accelerating).

On the bight side, Dish did receive confirmation from the FCC on Friday that they met the first phase of their 5G deployment commitments (see release here). Per the letter:

“the Wireless Telecommunications Bureau (Bureau) finds that DISH has met its band-specific 5G commitments and two of its three nationwide 5G commitments, and the Bureau accepts DISH’s proposed drive test methodology for verifying compliance with the remaining nationwide 5G commitment. The Bureau will evaluate compliance with the remaining commitment once DISH submits its drive test results consistent with this approved methodology… DISH has six months from the date of this letter to complete the testing and submit its results.”

This was welcome news for the Englewood, Colorado-based company. As a reminder, Dish’s hard work is ahead of it with a 2025 deadline to reach 75% of the US population with 35 Mbps download speeds. This will require at least 13,000 additional cell sites and likely $2-3 billion in additional investment. Many are already beginning to speculate that they will request (and likely receive) a short extension to the second commitment deadline. That the FCC responded in less than 90 days with both certification and approval of the drive test methodology is a positive for the company.

Finally, it appears that a Xumo announcement event is just around the corner. For those of you who are not following Xumo, it’s a joint venture of Comcast and Charter (with Walmart as the primary distributor) dedicated to making it “easy for consumers to find and enjoy their favorite streaming content through a world-class user interface and voice search.” If that sounds like a competitor to Roku, Amazon Fire Stick, Android TV, and Apple TV, it is.

Last Thursday, the company announced its first TV product (using the Pioneer brand) which will be distributed exclusively in Best Buy stores (see link to the various screen sizes and prices here). The 65” screen size shown in the nearby picture will retail for $499.99. For comparison, a similar (65”) TV made by TCL and equipped with Google TV (also sold at Best Buy) is currently on sale for $399.99 and an Amazon Fire TVs are selling for $399.99 and $549.99.

We have always thought that Comcast and Charter would market the actual TVs to their customers to assist with the migration to video. As of this writing, however, that does not appear to be the case. Our only question is, “If Xfinity Mobile is willing to finance a $1200 iPhone, why not finance a $500 TV?” They should be asked to explain their distribution and promotion reluctance on upcoming earnings conference calls – otherwise, it’ll just be another choice on the Best Buy TV wall.

Same as it ever was (3Q earnings preview—part 1)?

As we get ready for third quarter earnings (first one up is AT&T on October 19th), we thought it would be best to revisit some embedded assumptions (hence the hat tip to the lyric from the Talking Heads classic “Once in a Lifetime”). In the previous Brief (here), we tackled the following assumptions:

Same as it Ever Was #1: Cable will continue to dominate the broadband landscape. Competition will be fleeting as Comcast, Cox, and Spectrum use promotional pricing to thwart fiber and fixed wireless.

Same as it Ever Was #2: T-Mobile will continue to grow and dominate price leadership, extending their un-carrier behavior for the forseeable future. This will drive increased capital needs, reducing the availability of cash for shareholder-friendly stock buybacks and dividends.

Without rehashing each point, we see broadband degradation across cable, who is now sandwiched by 8% mortgage rates stymieing mover activities on one side, and competitive threats from fixed wireless and fiber providers on the other. We also think that the mobile bundling approach is not unique, and that AT&T and Verizon are now being more aggressive in their match.

Separately, we bemoaned the T-Mobile “big carrier” decision to pay a dividend and see the fingerprints of their 52+% shareowner, Deutsche Telekom, all over it. We think that proportional share buybacks would have been a far better decision for the Bellevue-based inovator.

This week, we tackle the following embedded thinking:

Same as it Ever Was #3: AT&T will merely substitute DSL for fiber and will not grow their broadband market share. Without meaningful BEAD grant wins, AT&T will never regain a market-leading position in the home.

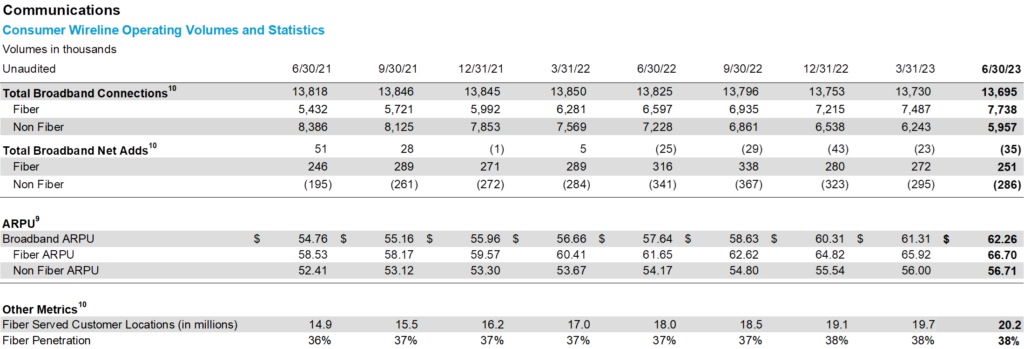

There is good reason for this thinking from AT&T’s 2Q earnings package (consumer unit shown):

As we have pointed out in virtually every Brief where AT&T earnings are discussed, the “Total Broadband Net Adds” line tells an interesting tale – fiber net additions are continually eclipsed by DSL (non-fiber) losses. We think that this course is going to change very soon as the full impact of AT&T’s bundle discounts is felt. We also think that non-fiber net losses will begin to decrease to the 200-250K level. This will result in higher net additions with increasing ARPUs.

Here’s the metamorphosis that is taking place:

- AT&T is filling in portions in major metros with fiber, creating broader metropolitan coverage (some of these maps resembled swiss cheese with the “holes” actually representing the deployed areas – most of the metro had not been retrofitted with fiber). This helps with marketing efficiency.

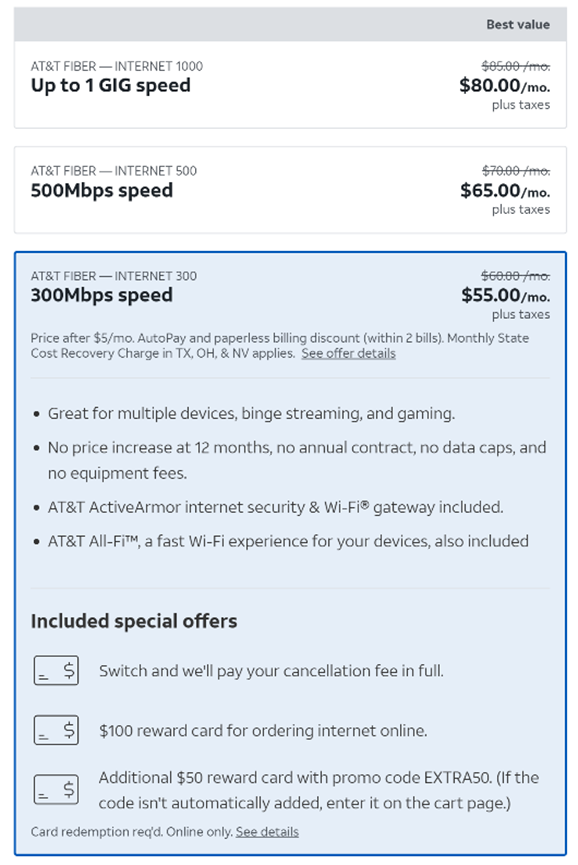

- Everyday low pricing (see pricing chart nearby for Westlake, Louisiana – note that mobile bundling will reduce the fiber rates shown by $20/ month), which includes premium Wi-Fi, is beginning to resonate with customers fatigued by cable’s exploding prices. Premium Wi-Fi inclusion reduces Tier II customer support expenses (time spent troubleshooting third-party customer routers) and possibly a few truck rolls.

- Bundling with mobile (and, we believe soon, Max) will resonate with their current mobile customer base. We think that their upcoming store revamp will also help broadband sales.

- Video bundling (currently using JV Partner DirecTV through an over-the-top application) is quickly becoming less critical to broadband adoption.

- Fiber churn is non-existent provided the installation was completed correctly. Network elements are easier to troubleshoot, and weather (specifically heat and rain) isn’t as impacting to fiber as it is to copper.

As AT&T continues to tout their new fiber network (contrasting it to 10- or 20-year old cable coax), they have the opportunity to materially change the maket share equation. They still have issues with penetrating small towns with long memories of their previous horrid DSL performance, but that memory will fade. And they still have more to do with multi-dwelling units, the long-standing domain of cable. A 300 Mbps product for $35/ mo. (with wireless bundle) is really compelling, however, and help with the 35 million homes they upgrade over the next 24 months.

Bottom line: Fiber to the home is a big deal for AT&T and it’s about to get a lot bigger. Wireless discounting is just the start. And BEAD helps but is not necessary to execute a winning strategy.

In two weeks, we’ll conclude the “Same as is Ever Was” series with a look at Verizon. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and Super Bowl champion Kansas City Chiefs!