As brownfield Open RAN deployments pick up and interoperability processes are refined, questions around fiber expense and massive MIMO still dog the ecosystem

Open RAN has come a long way since the days of the xRAN Forum and C-RAN Alliance. Standards have been developed and refined, equipment has gone from lab to live, and the story of radio disaggregation will eventually, probably, have a happy ending. At the same time, any conversation about Open RAN will likely involve use of the words “maturity” and “journey,” which means critical discussions often look into when exactly is this coming of age going to happen and where, if there is indeed a destination, does the journey end?

Understanding the ongoing evolution of RAN disaggregation is a priority of the Open RAN Global Forum, available on demand here, and, as such, the above questions were widely debated. And while there’s no single, definitive answer, there is ample evidence that Open RAN continues to mature as supported by real-world examples, and there’s gathering consensus as to what the primary impediments to bringing O-RAN mainstream are.

As to the benefits, Intel’s Christopher Moezzi, vice president and general manager of the Network and Edge Group, pointed to how the focus on Open RAN for greenfield has given way to implementations in brownfield networks, and called out operational benefits the new architecture has enabled.

Open RAN deployments have “demonstrated multiple dimensions of value”

Name-checking Rakuten and Dish on the greenfield side, and Verizon and Vodafone on the brownfield side, Moezzi focused on how “Rakuten has publicly demonstrated multiple dimensions of value.” Customer activation times going from three hours to three minutes, cell site deployments from months to day, and new feature deployments from months to weeks; all of that meaning “the overall opex costs have come down considerably,” he said.

He continued: “And at the same time the standardization of equipment that’s been done as an example in that particular case on COTS servers sort of allows for the operators to ride the commodity curve down and basically help reduce capex. Now at the same time, Intel is doing its part to help improve TCO and we recognize that vendor interoperability is still underway and it’s going to take some time for the ecosystem to get more mature and we are helping to contribute towards that. And in fact we’ve been deploying now three generations of equipment as well as offering blueprints that help improve g -to market for a number of these service providers. And in every generation of these deployments we have increased capacity by offering better compute, reduced power very considerably and increased the density on the Ethernet side.”

But, “There’s no lack of challenges”

Litepoint Director of Marketing Adam Smith gave a good reality check, noting that with Open RAN, “There’s no lack of challenges.” Chief among those challenges, he said, is metering expectations. The collective telecoms industry “tend[s] to be very, I’m going to say, overly optimistic or impatient when we’re launching new technology, and some of these things just take time. You get experience, you make changes and you make improvements.” He discussed how “subtle ambiguity” in relevant standards lead to variation in O-RU fronthaul implementations, for instance. “This is just a bit of a case of getting some more experience and solving these problems, but it’s going to be largely an interoperability challenge moving forward here.

Given that enabling multi-vendor RAN deployments is a key point of Open RAN both technologically and conceptually, interoperability testing is an imperative, and increasingly complex, step. And interoperability considerations extend from the lab to the field in that a software-centric approach to RAN upgrades requires a CI/CD pipeline coupled with a continuous testing regime.

Lauriston Hardin, NTIA chief technical advisor, said he’s observed “great[er] maturity” in the interoperability process which itself is going “much faster” now compared to just a year ago. “So from the standpoint of technology, we’re seeing great strides. There’s still a ways to go. Let’s be honest…a plug-and-play environment is probably an interesting term, but it’s probably not a reality term. It’s never been a reality term in RAN, but we’re getting much closer.”

“What’s really slowing us down is market dynamics”

Hardin continued to note that the primary impediment isn’t technology-related, but rather questions around scaled brownfield deployment—”how can I drop equipment into an existing legacy network, or when are the buying cycles such that they’re ready to buy new equipment to make this a larger market. So I think the answer really has much more to do with how do we approach the market, how do we present solutions to the market, whether it be Tier 1 operator, Tier 2, Tier 3 operators, or private network operators to move this ecosystem along to the point that it becomes mass market.”

This tricky balance around technical maturity and what larger buyers need “is a question grappling all the Open RAN vendors right now,” according to Ganesh Shenbagaraman, head of integrated products and ecosystems at Radisys. “The technology readiness and the technology innovation part that has been going at a very steady pace with the ecosystem expansion. And we have multiple new players entering, bringing in that innovation which was not thought about, but at the same time the market demands aspects…basically how does this all fit into a brownfield scenario? What happens to the total cost of ownership?”

Vendors need to ensure “the right mix of technology innovation and the performance”

That point is key given that the primary scaled example of Open RAN deployments come from greenfield environments with totally different economic realities than long-standing brownfield environments. “These are the challenges,” Shenbagaraman said. “The vendors have the responsibility of ensuring the right mix of technology innovation and the performance…at a cost which is comparable or at least which is tolerable for an operator or a private network to deal with in terms of long-term TCO.”

The TCO equation for Open RAN extends well beyond radio hardware and software. Operators have to consider how splitting functionality between central, distributed and radio units drives up the need for, and cost associated with, building out fiber, Jio SVP of Global Standards and Technology Development Satish Jamadagni said. “If you look at the fiber penetration of most of the operators around the world today, they are struggling to catch up…with respect to even LTE towers that are already installed. The [fiber] demand on just deploying 5G, even non-disaggregated RAN or even normal RAN, is extraordinarily high.”

“One of the big problems of disaggregated RAN is the cost of fiber”

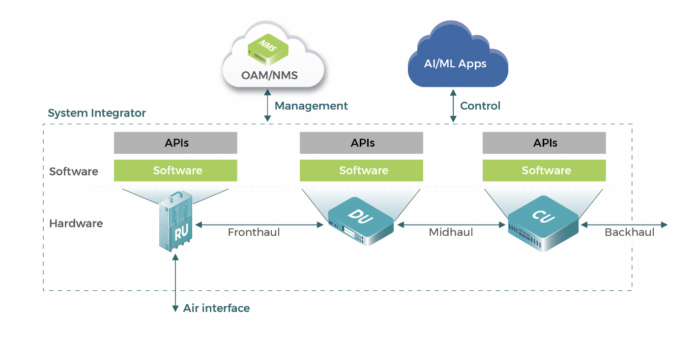

“There are a lot of fundamental design issues that have dogged Open RAN from the very initial days,” Jamadagni said. “It’s intuitive to think of aggregation of the RAN. You would think of RU, DU, CU all in a box and put up on the tower. The problem with disaggregated RAN…is the cost of fiber…If you’re trying to aggregate all of the DU baseband in a cloud, the amount of fiber requirements simply shoots up.”

From an operator’s perspective, the multi-vendor nature of Open RAN is “a tricky thing” because operators have to go through an added step of integration ahead of deployment. But, he said the promise of the RAN Intelligent Controller (RIC) is certainly interesting but, again, there are alternatives that potentially sidestep the RIC while still providing automated radio resource management and other capabilities.

“You might say I’m a naysayer for Open RAN, but there are issues. Once you know the issues, there are ways of tackling it, but then that’s another part of the story.” To the RIC point, “It was a bit too late…3GPP has a similar thing…along with some kind of platform which provides you all kinds of AI processing capabilities.”

The massive MIMO of it all

In terms of balancing coverage and capacity, and make most efficient use of 5G spectrum, massive MIMO radios seem to be the way forward. Unfortunately for Open RAN, this has led to a good deal of contentious debate as it relates to where various processing power resides and the other implications of moving processing from the radio to a distributed unit or vice versa.

Jamadagni, the lone operator on the panel, didn’t mince words. “Massive MIMO has to succeed if 5G has to succeed. This RU and DU diversity is bringing about some kind of a confusion as far as the efficiency of the massive MIMO itself is concerned. This is primordial. Most operators—really open/closed, it’s of course debated—then massive MIMO has to succeed…anything coming in the way of massive MIMO success is a no-go for operators. And operators will question it because at the end of the day, if you’re looking at per cell throughput efficiency, capacity…that’s what this massive MIMO will bring in. And that’a s a serious concern as far as operators [are] concerned. Diversity does not necessarily help…Sometimes diversity can be complex. That’s not always healthy.”

He reiterated: “This diversity is hitting on one fundamental issue. The success of 5G, closed or open, irrelevant. The success of 5G hinges on” massive MIMO. “There are a lot of things which can be discussed about this, but massive MIMO is the one which is supposed to bring the critical differentiation between LTE and 5G.”