Energy consumption is becoming a pressing issue for telcos, driven by the global energy crisis. High global energy prices, triggered by the Russia-Ukraine conflict, have pushed up Operational Expenditure (OPEX), draining cashflow and thereby constraining infrastructure investment. The GSMA has estimated that the telco industry consumes 2% to 3% of worldwide energy consumption — a remarkable number in its own right, but because data usage is currently growing at over 20% Year-over-Year (YoY), it has the leverage to drive up energy consumption. There are also challenges on the supply side. In many parts of the world, national power grids are struggling to keep up with the energy demands from multiple economic sectors, such as South Africa and Vietnam.

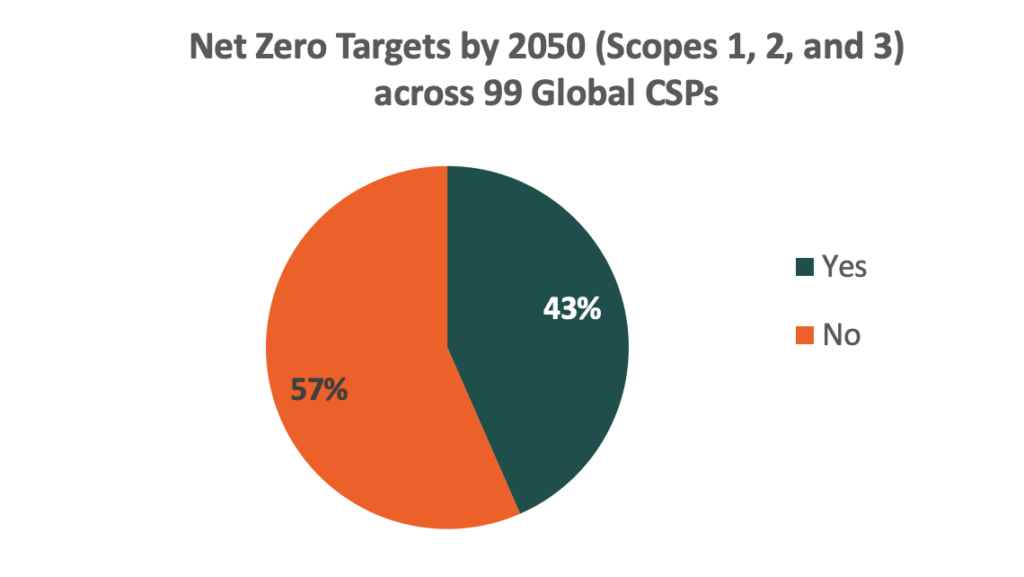

However, it is not all doom and gloom, as innovation has the potential to curtail energy consumption. The 3rd Generation Partnership Project (3GPP) has set a target of reducing 5G-related energy consumption by 90% — a noble goal indeed! Communications Service Providers (CSPs) have recognized the need to develop sustainable operations, with 43 out of 99 studied CSPs having committed to net zero targets (Scopes 1, 2 and 3[1]) by year 2050 (see Figure 1). If this is to be achieved, then energy savings need to be secured across the board.

Figure 1: Net Zero targets by 2050 (Scopes 1, 2 and 3) across 99 global CSPs

Tackling a major source of energy consumption — the cell site

From its own research, ABI Research has established that between 20% and 40% of a telco’s OPEX can be attributed to energy consumption, and of that amount, more than 50% relates to the Radio Access Network (RAN). Depending on the size of the country and its population, CSPs may need to deploy several tens of thousands (for a small European country) to even a million or more base stations (in China). Therefore, any savings in power consumption per base station sector will translate into tangible reduced OPEX and reduced Greenhouse Gas (GHG) emissions. Initiatives in the RAN domain that could contribute to those savings include the following:

- Wideband power amplifiers: In 3Q 2023, Huawei launched its GigaGreen next-generation Remote Radio Unit (RRU), which uses one wideband Power Amplifier (PA) for “three” separate spectrum bands. Previously, each spectrum band needed its own PA. The vendor has reported that one Ultra-Wideband (UWB) RRU can provide three single-band modules, resulting in an 30% energy consumption reduction. The upgraded RRUs were also able to demonstrate a 1.25X increase in network capacity.

- Default powered down status: Over the past two or so years, turning off some parts of the base station radio units during idle periods has become the common way among CSPs to secure power savings. However, it can be challenging to balance power saving and performance. This has brought down power consumption to around 100 Watts (W) from an initial 160-W range for an Active Antenna Unit (AAU). This is an improvement, but telcos need to do more if they are to achieve their goals. Notably, at Mobile World Congress 2023, Huawei announced its “0 Bit, 0 Watt” solution, which enables nearly all the energy-consuming electronic components to resort to a dormant, essentially “powered off” state, but can revert to full power depending on traffic volumes. In addition to electronic sub-systems being able to default to a dormant stasis, the telco can also take advantage of passive cooling solutions, such as reversible, hygroscopic materials, which can further push down power consumption. Dring an RRU/AAU power consumption trial at a Chinese mobile telco network, the mobile operator reported power consumption was reduced to 10 W, equivalent to a Light Emitting Diode (LED) bulb.

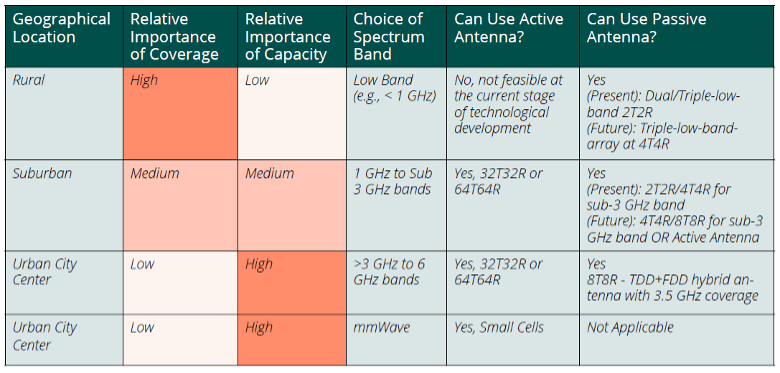

- Rolling out Sub-3 GHz 8T8R radio & antennas: CSPs have been upgrading the base station antennas to secure the benefits of Long-Term Evolution (LTE) Advanced and 5G by evolving their antennas from 2T2R to 4T4R in Sub-3 Gigahertz (GHz), but ABI Research believes CSPs should actively consider 8T8R configurations in addition to their Massive Multiple Input, Multiple Output (mMIMO) deployments of 32T32R and/or 64T64R. The latter mMIMO cell sites are typically deployed in urban and densely populated commercial business and residential districts. However, as traffic usage for all end users has soared, the passive cellular base stations in suburban areas have come under strain. Indeed, by deploying 8T8R macro base stations in urban areas, this strategy can guarantee coverage and deliver robust capacity for fast-moving vehicles and end users moving in and out of the mMIMO covered areas. Offloading end-user traffic with effective capacity ensures that the network is not operating at strained, inefficient energy consumption levels (see Table 1).

Table 1: Relative importance of coverage and capacity, and various antenna configurations (2T2R, 4T4R, 8T8R and mMIMO)

The following two mobile telco case examples can help bring into sharper focus the potential energy consumption and GHG emissions reductions:

- Reduce RAN-related 5G expenses in Indonesia: Telcos in Indonesia are very much aware of the benefits of 5G, but they still need to keep expenses on a tight budget. Telkomsel launched its commercial 5G service in May 2021. However, the company has been cautiously rolling out 5G, with only 284 5G cell sites, to date. The company has stated that it is only seeking to deploy 5G in areas where most users have a monthly Average Revenue per User (ARPU) of over IDR200,000 (US$13). Telkomsel has started to deploy 8T8R base stations to trim unnecessary cell site expenses. The operator was able to implement a “tower cost savings” and a “power savings” strategy. By reducing the number of RRUs at a cell site from 21 to 12, while still supporting the necessary spectrum bands, the operator was able to cut tower management fees incurred. The operator has been able to save US$1,600 per site per year. Furthermore, the switch from a 2T2R with 6 sectors to an 8T8R antenna configuration also resulted in an 18% reduction in energy consumption, which is equivalent to US$400 per cell site per year.

- China Mobile “intent” on power savings: China Mobile’s 5G services commenced in October 2019 and, by August 2023, had more than 730 million 5G subscribers. Those subscribers are served by 1.6 million base stations. China Mobile has been proactively seeking out potential operational cost savings in relation to its RAN. China Mobile conducted some initial tests with Huawei in Ningbo, China to investigate the technical capabilities of maximal power reduction. During off-peak hours, energy consumption could be dialed down to nearly 5 W, but then boost power levels when data traffic usage grows. The next step was for the engineering teams to roll out the solution in a wide area deployment where there may be different priorities and requirements for each cell site. An aggressive energy-saving profile may not suit “all” cell sites. An “intent-driven energy strategy” can mean that different variables such as scenario, service type and rate targets can be set. For example, a base station near a hospital or government building may need a greater level of connectivity “readiness.” The network-wide deployment was able to demonstrate an average energy saving of 38% (18 Kilowatt Hours (kWh) versus a previous daily average of 38 kWh).

Key takeaways

Telcos have some aggressive targets for energy consumption and Carbon Dioxide (CO2) reduction. The GSMA has promulgated some laudable objectives for the industry to deliver on those targets:

- Strive for reduced carbon generation for all operations YoY (Scopes 1, 2 and 3).

- A carbon emissions reduction target for Scope 1 and Scope 2 emissions in-line with the 1.5° Celsius (C) trajectory and for Scope 3 in-line with the “well below 2° C” trajectory following a science-based approach, using a baseline year of 2019.

- Achieve net zero emissions by 2050.

Meeting these essential and noble goals will not be easy for telcos. Each telco will need to steer its own course to achieving net zero emissions. Some may be constrained and will have to take a longer route due to budgetary requirements, but crucially, many of these green initiatives will not only reduce GHG emissions, but also generate immediate energy cost savings. Efficiency gains will need to be applied across the network, but the RAN does represent a very significant proportion of a network’s operational costs. This article could not delve into all the energy consumption solutions, but we wanted to demonstrate that there are tangible solutions entering the market and quantify some of the energy consumption metrics.

[1] Scope 1: Direct emissions from industry; Scope 2: indirect energy consumption; Scope 3: production of purchased materials.