There are some clever companies in the IoT space. Of course there are; but there are, arguably, more in IoT than anywhere else in the tech game. They just don’t generally make the same kind of noise. Sure, some talk way too much, but many more exist in niches within niches. They are sinewy and smart, and go about their business with a laser-sharp strategic aim. Taiwan-based AMI specialist Ubiik, which has established a hybrid cellular/non-cellular IoT offer for smart meters and an expanding cellular/non-cellular LTE offer for smart grids, is one of these firms – and can present lessons on smart-grid IoT that are relevant for all of IoT.

Five years ago, Ubiik responded to a government tender to deploy advanced metering infrastructure (AMI) across the country by developing a solution based on the unfashionable low-power wide-area network (LPWAN) technology Weightless. It has since hoovered up just about every contract going, and helped to propel state-owned Taiwan Power (Taipower) to second in the league table for global smart-grid performance – only behind Electricite de France (EDF) in France; out of 94 companies in 39 countries, as ranked by Singapore Power Group (SP Group).

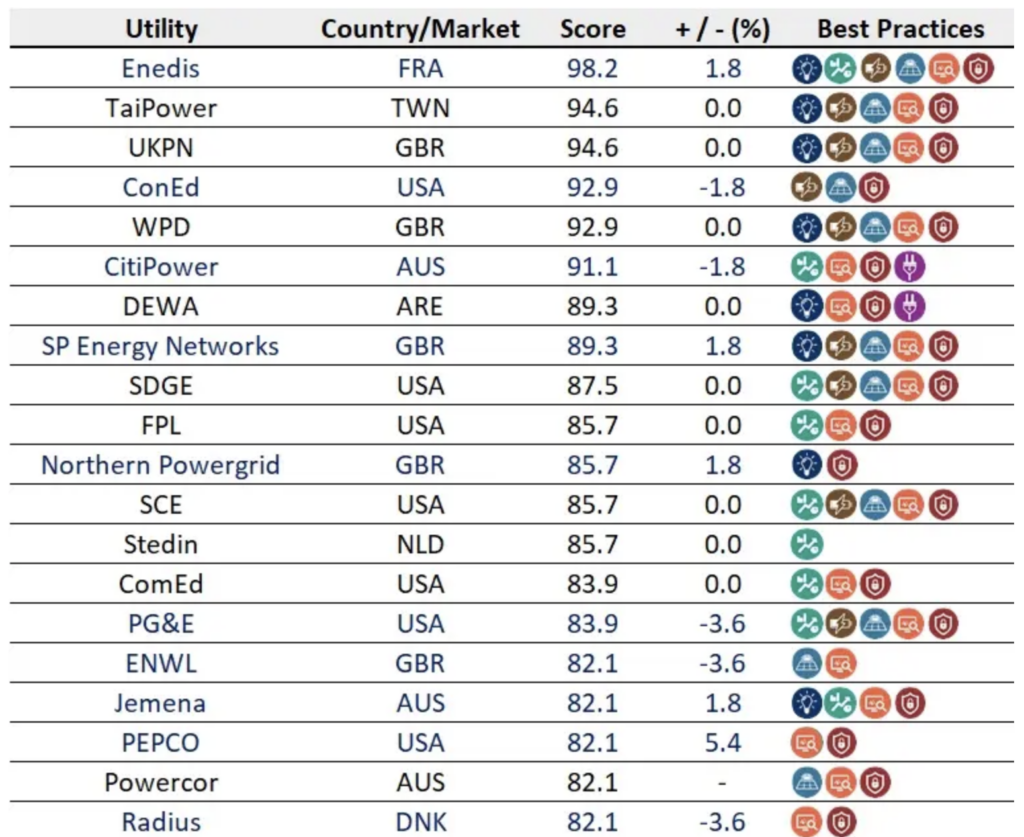

SG Group’s Smart Grid Index (SGI) – originally devised to inform its own smart grid development, but subsequently shared at various trade shows, and since turned into an annual review – considers seven factors for smart grid operations, as defined by the European Commission and the US Department of Energy. From the top, these are about grid monitoring (and control) and data analytics, enabled by meter hardware and networks, and enabling of the other elements – integration, management, security of distributed (and green) energy, plus customer engagement.

Taipower’s smart meter infrastructure, connected mostly by non-cellular Weightless, scores 94.6 percent in the review, tied in second with UK Power Networks (UKPN) in the UK, behind Enedis, running distribution in France for Électricité de France (EDF), on 98.2 percent, and ahead of Consolidated Edison (Con Edison) in New York and Westchester in the US on 92.9 percent. Some of the scores go way, way down; the average in Taipower’s backyard, in Asia Pacific, is 72.5 percent; the averages in the US and Europe are 78.9 and 75.8 percent, respectively.

Fabien Petitgrand, chief technology officer at Ubiik, says the difference is the Taiwanese government never stuck its oar into the tech soup. Its initial tender, back in 2018, did not seek to prescribe a connectivity solution, as in certain other markets, he says; only that its targets for in-time meter-reads should be met. He says: “There is no mandate for the technology. We qualified Weightless [as part of the tender], and we have to use it in 80 percent of deployments – which allows 20 percent of flexibility to meet the SLA, which asks for 95 percent of in-time meter reads.”

In-time means every 15 minutes in the Taipower meter network, to deliver data between the meter and the management platform in the head-end system (HES); Ubiik’s solution is currently delivering these updates in-time 96.5 percent of the time, says Petigrand. In terms of the delivery mechanism, 87 percent (one million, out of 1.2 million) is based on Weightless. The original 80/20 infrastructure rule has been easy, he says; the remainder (200,000) goes over cellular-based NB-IoT. “We use NB-IoT when the low, or when it’s remote or sparse. Which is the flexibility the model allows.”

He adds: “Taiwan was very pragmatic. It just said: ‘This is what I want; you propose the tech, and, if it works, you qualify.’ End of story. It didn’t try to harmonize the technology; just the interface with the meter. It’s not an approach you see very often. I mean, it is the opposite of France, say, where EDF spent years’ researching power-line communications (PLC), even participated in the standardization (of G3-PLC), and then said: ‘Okay, I need 20 million PLC units’. There was no other option. And it doesn’t work all that well, but that’s what they asked for.”

Ouch; and, maybe, EDF’s ranking at the top of SGI framework says otherwise. But PLC does get stick from the wireless crowd, noting as well that data in concentrator units (DCUs) in PLC networks is often backhauled over cellular. For its part, Ubiik has so far installed 750,000 smart meters (from a third-party vendor) on its LPWAN infrastructure in Taiwan, from contract wins in 2018, 2019, and 2020. Its managed base will (actually) rise to 1.23 million in 2024, following a further $17 million deal at the start of the year to host an additional 450,000 meters for Taipower.

The total value of its AMI contracts in Taiwan is $58 million. In total, the country has so far awarded AMI contracts for 4.5 million smart meters; Ubiik’s share stands at about 26 percent. Taiwan has around 12 million electricity meters, in all; the number designated as ‘smart’ will jump again after 2025 when a further 1.5 million are up for grabs. “We are the market leader, and we are winning tenders every time,” says Petitgrand. Where Ubiik wins, it has charge of the whole AMI system between the electric meter and the data platform; its latest contract is for six years.

Until now, the tender process in Taiwan has split into three parts: for the provision of the metering infrastructure, from the DLMS/COSEM field-area network (FAN) unit (meters, concentrators, gateways) to the radio infrastructure, as required, and the core network, to the head-end system (HES); for the installation and management thereof; and for the supply-side meter data management system (MDMS) for data processing, billing automation, and any kind of service delivery on top (“whatever they want to do with the data, which they are still figuring out”).

The process typically specifies six meter vendors, four-to-five infrastructure vendors (which makes Ubiik’s two-fifths share more impressive), and a single MDMS vendor; the meter management platform is always from Siemens (EnergyIP), typically serviced by a local system integrator. Ubiik’s installed base in Taiwan carries around 80 million meter messages per day, says Petitgrand, which are pushed back to Taipower’s MDMS, and retained in its own HES for 12 months as part of the contract. “It is running like a charm, I would say. It has been pretty smooth going.”

But the model may change from next year, says Petitgrand. “Volumes are going up, but margins are going down. It’s a finite game, right? Taiwan has 12 million meters, and is looking to transition to a service model – so they pay a subscription to an AMI provider each month, instead of putting it all into one big upfront tender. It means the service provider will need to have the financial means to cover the hardware – which means big conglomerates and financial institutions will take over those deals, and then maybe subcontract to different vendors.”

He adds: “India has a blueprint for that; all the regional tenders use that kind of a template. And Taiwan will start to do the same, just as trials, starting maybe later this year – with a service model for the whole AMI infrastructure.” But while Taiwan is copying the Indian AMI model for service provision, which could see Ubiik going instead via well-heeled middle-men conglomerates, India is copying the Taiwanese AMI model for service agreements, which levels the proverbial playing field for network technology and puts Ubiik’s Weightless portfolio in contention.

“India is going the same way, saying: ‘Okay, I want 96 or 98 percent of data on time’. Those are the kinds of SLAs; but there is flex with how that is achieved. Because none of this is magic; you have to take each technology on its merits. We use eight percent cellular. Taiwan Telecom, the second biggest vendor for Taipower, uses 80 percent LTE-M and 20 percent Weightless – and we deployed all of that. Because no matter how beautiful LTE-M is, it doesn’t go deep into basements. It struggles. It’s just a fact. And you have to meet those SLAs.”

Petitgrand goes on: “You have to be open about the technology. Because you can’t ask for both – you can’t ask for 100 percent on one SLA and 100 percent of one technology. If you want 100 percent cellular, then the performance you get is what you get. So you say: deliver me 98 percent on this SLA, and fire the provider that fails. Or you say: give me PLC or WiSUN. But you can’t ask for both. I am not saying Wi-SUN is a bad technology. But I would not guarantee an SLA with it. It’s not enough; I can’t commit to 98 percent with that.”

This article is continued here.

For more from Fabien Petitgrand and Ubiik, check out the recent webinar on smart meters, and check back for the attendant editorial report, out in the next couple of weeks.