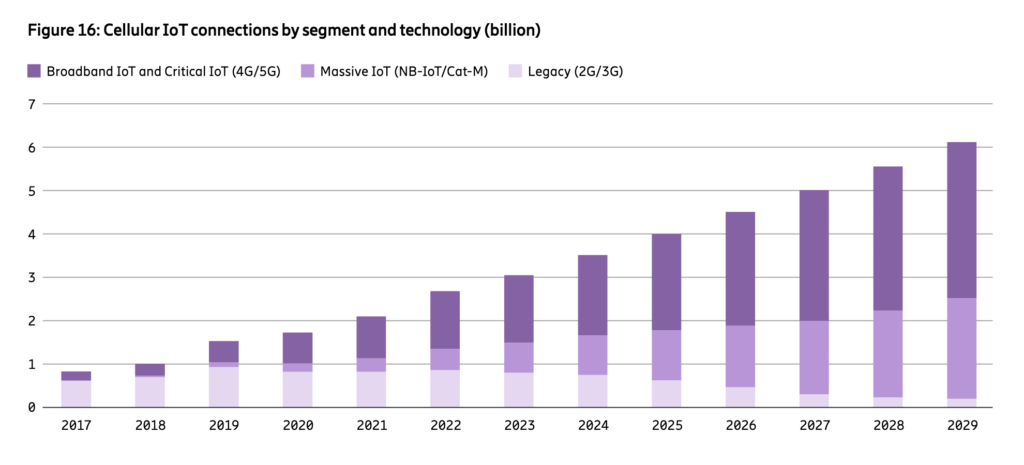

The total number of cellular IoT connections will reach around three billion at the end of 2023, reckons Ericsson, with most, and the increasing majority, connected on so-called ‘broadband’ cellular IoT technologies LTE (4G) and 5G. The arrival of reduced-capability (RedCap) 5G through 2024/5 will further boost this ‘broadband’ segment, said the Swedish vendor.

The twin narrow(er)-band IoT technologies NB-IoT and LTE-M (Cat-M) will continue to take share from legacy 2G and 3G, but will remain off the pace set by LTE and 5G – the mainstays also of the mobile industry’s private networking push. The latest instalment of Ericsson’s bi-annual Mobility Report, available here, says 1.6 billion (53 percent) of the total cellular-IoT forecast will be on LTE and 5G by the end of the year.

By contrast, a cursory view of a bar chart (see below) provided with the report suggests cellular IoT will account for closer to 600 million by the end of 2023. Ericsson quoted GSMA stats that 128 mobile operators have now deployed or commercially launched NB-IoT networks and 60 have launched LTE-M (Cat-M), while 45 are running both technologies in tandem.

Meanwhile, the same graph says around 800 million IoT devices will still be connected on either 2G or 3G by year-end, but Ericsson said the switch-off rate for these networks will see a negative annual growth rate of around 20 percent up to 2029. By 2029, practically nothing will be connected on 2G and 3G, while broadband IoT and ‘massive’ (narrowband) IoT will account for about 3.65 billion and 2.2 billion connections, respectively (again, written without the precise figures to hand).

Specifically, Ericsson stated: “By the end of 2029, almost 60 percent of cellular IoT connections are forecast to be broadband IoT, with 4G connecting the majority.” It said the lion’s share of cellular IoT activity is in the North East Asia region – which includes China, notably, and is expected to pass two billion (out of three billion; 66 percent of) cellular IoT connections in 2023.

Of interest, as well, the report says broadband IoT use cases are primarily served by 4G LTE device categories 1 and 4 (cat 1 and cat 4), but the use case possibilities are expanding with the introduction of RedCap-based 5G New Radio (NR) devices. Cellular IoT will grow at a compound annual rate (CAGR) of 12 percent through to 2029; the number of broadband IoT (cat 1 and cat 4) and critical IoT (full-fat 4G-LTE and 5G) will double in three-to-four years, said Ericsson.

Interestingly, the report does not yet incorporate a forecast for RedCap connections – which Ericsson compares to cat-4 performance with “improved latency, plus device energy and spectrum efficiencies”. As reference, it positions RedCap as a 5G-native alternative to mid-range category 1-through-4 LTE devices, offering peak downlink/uplink data rates from 50/35 Mbps to 240/175 Mbps in the simplest devices, and from 130/45 Mbps to 645/235 Mbps in more advanced devices.

RedCap modules and devices, also supporting 5G NR features such as enhanced positioning and network slicing, will be commercially available during 2024, it said. These will enable simpler and smaller 5G modules, which should open-up a bunch of new use cases, said Ericsson. It listed consumer wearables, IoT devices, and AR glasses, plus “low-cost routers, cameras, high-end meters, and fixed-wireless access (FWA) devices”.

In time, RedCap will also emerge as an industrial IoT technology, it said. The US, China, Australia, and some Asian markets will be “frontrunner markets” for RedCap, it said.

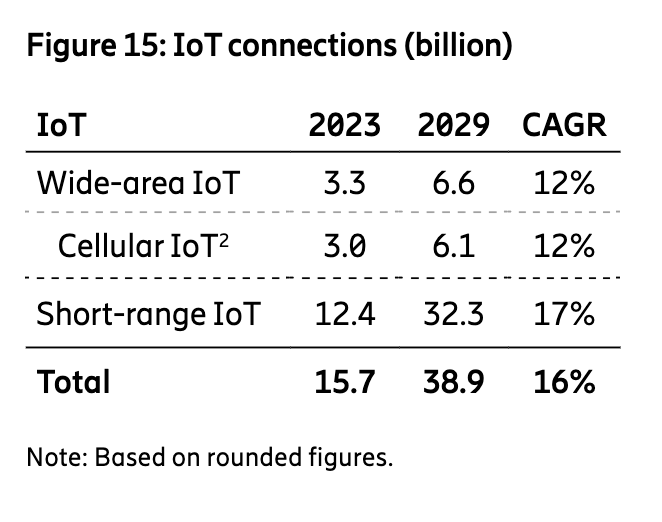

But the IoT findings make clear something else, as well: that cellular IoT represents, and will continue to represent, a fragment of the wider IoT market. The total number of wide-area IoT connections, which counts non-cellular IoT connections on technologies like LoRaWAN and Sigfox, will reach 3.3 billion by the end of 2023 and 6.6 billion by 2029, growing at a compound rate (CAGR) of 12 percent – which is the same in the period as for the cellular IoT sub-segment.

The non-cellular share of wide-area IoT will go from around nine percent (300 million connections) in 2023 to around 7.5 percent (500 million) in 2029. These other camps will take issue with the figures, clearly. But most significantly, the total IoT market is worth 15.7 billion connections already (2023-end), meaning cellular IoT is only responsible for a fraction of it (about 19 percent).

And the rest of the market – dominated by short- and mid-range technologies like Bluetooth, RFID, and Wi-Fi, notably, plus a number of proprietary 805.14 mesh technologies – will grow at 17 percent in the period to 2029, by comparison, upping its collective share from 79 percent in 2023 to 83 percent in 2029. Perhaps Ericsson’s next Mobility Report will include a RedCap forecast, to see if that makes a difference to the niche tale of massive IoT.