Greetings from Missouri, where the Pattersons celebrated the Thanksgiving holiday with nearly 40 friends and family. It was a fun and festive time for us, and we hope that yours was equally as [ful]filling.

We have a very full Brief this week. After a shorter than normal market commentary, we will begin our two-part series on the Top Six events of 2023. While not in any particular order, they cross wireless, broadband, content, and regulatory boundaries. We welcome your input on the remaining three – send a message with our ideas to sundaybrief@gmail.com

As a reminder, we have four three remaining seats for our annual CES dinner at Gordon Ramsay’s pub. It will be at 7 p.m. on January 9th so everyone can hit one or two receptions beforehand. This is a good end of day event to gain others’ perspectives on the show and the industry. Please email us at sundaybrief@gmail.com if you are interested in attending.

The fortnight that was

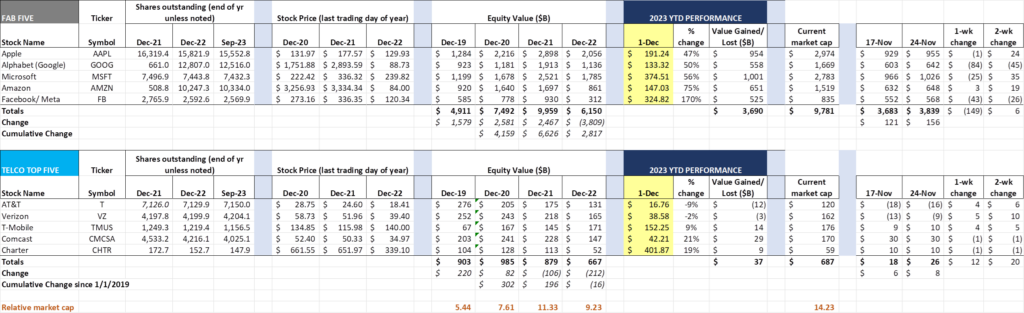

Since our November 18th interim Brief, the Fab Five have stayed remarkably stable: +$155 billion during Thanksgiving week, and -$149 billion the following week resulting in a net gain of $6 billion on a total capitalization of ~$9.8 trillion. As many of you who follow the market know, demand for large cap stocks excluding the Fab Five increased during the last month, with stocks such as Salesforce (+28% in November, market cap of $250 billion as of December 1st), Crowdstrike (+32%, $56 billion), Oracle (+11%, $321 billion), and Palantir(+36%, $44 billion) leading the way. Unlike telecom, most of the tech undercard is still positive in 2023.

The Telco Top Five managed to notch back-to-back gains and now has grown their cumulative market capitalization by $37 billion in 2023 (matching levels not seen since the end of March). Recent gains by Verizon (+$10 billion over the fortnight) and AT&T (+$6 billion) have grown the cumulative total despite continued sluggishness in Comcast and Charter. T-Mobile has regained the “most valuable US telecom carrier” crown and their German parent now holds slightly more than 56% of the common stock per recent SEC filings (they do not appear to have sold any of their stake – at least yet – as T-Mobile USA continues to buy back shares).

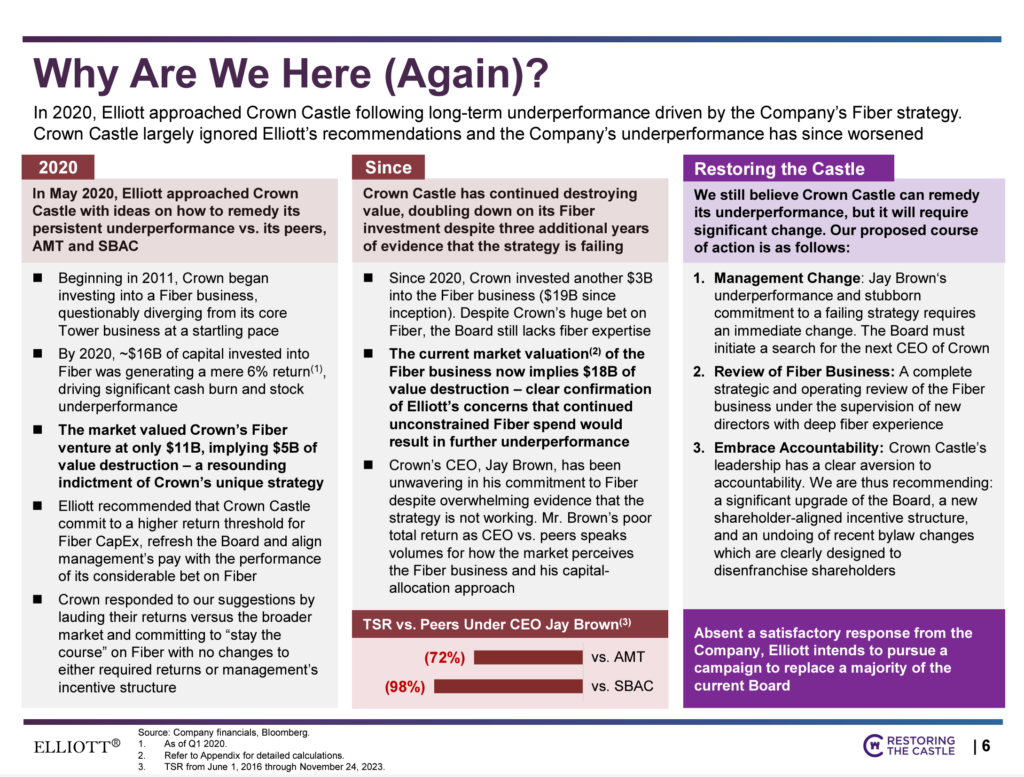

No sooner had the Thanksgiving table been cleared than Elliott Management showed up to Restore the [Crown] Castle (Elliott website here which has a full copy of the presentation we reference below). Why they are pursuing broad-based changes at the company is described in the following slide:

It would take an entire Brief to fully describe the many moving pieces behind the valuation of Crown Castle, and Elliott makes several good points in the presentation. Our view is that the fiber die has been cast and Crown likely overpaid for fiber assets that will be largely overbuilt (by current customers like AT&T in their local exchanges) as metro and suburban builds proliferate. Value can be unlocked, however (see page 42 and onward of the presentation linked above), and we think others might be able to achieve better fiber results (including, but not limited to, a strategic investor like T-Mobile). Bottom line: Elliott is not going to go away like they did in 2020 – more substantive changes will transpire in 2024.

Finally, John Stankey penned an article on The Messenger website called “We Need More Bandwidth for Innovation”, in which he stated that while the Biden administration’s spectrum plans (link to them here) were “a good start,” more needed to be done, faster. John concludes the brief article with the following paragraph:

“We need the government to move with urgency. Traffic on wireless networks is projected to grow by 500% in the next decade, and it can take years to create and navigate a spectrum pipeline. Failure to increase the supply of mobile bandwidth through affordable spectrum will increase costs as demand continues to rise. Sadly, we see government and industry resources now being consumed chasing the non-existent problems manufactured by the Net Neutrality faithful, instead of executing effectively to augment infrastructure in the most nascent and critical corner of the internet — mobile services.”

Getting urgency from any presidential administration in an election year that favors one part of one industry (or any cohort of companies in that industry) is difficult. John is correct, however, that without new licensed spectrum, wireless companies will be forced to focus on cell splitting and densification, an expensive and potentially lengthy process.

Six key events/ trends/ developments of 2023 (Part 1)

It’s hard to encapsulate in two Briefs what has been a very full year for telecom. We will do our best, however, to chronicle what we think are the six most impactful events of 2023. They are in no particular order. We will also include additional links in a special “deeper” section on the online site throughout next week.

# 1 Verizon introduces myPlan (May 15th). After a lackluster Q1 and the announcement of their longtime CFO’s retirement, Hans Vestberg shook things up in April with a “shift to the next office” strategy. Rather than bring in fresh faces, business unit leads moved to different departments. A full summary of the management changes which includes the announcement of Matt Ellis’ departure, is here.

The greatest shift was the movement of Sowmyanarayan Sampath from head of Verizon Business Group to Verizon Consumer. Within weeks of Sampath taking his new seat, myPlan was announced.

The purpose of myPlan, per the announcement linked above, was to increase customization options for current and future Verizon customers. We were critical of the plan at first because it reintroduced the concept of multiple Verizon networks:

- a basic, or essential network which provided no hotpot data and basic 5G and LTE network coverage, and;

- their brand new millimeter wave + 5G + LTE (for coverage) network.

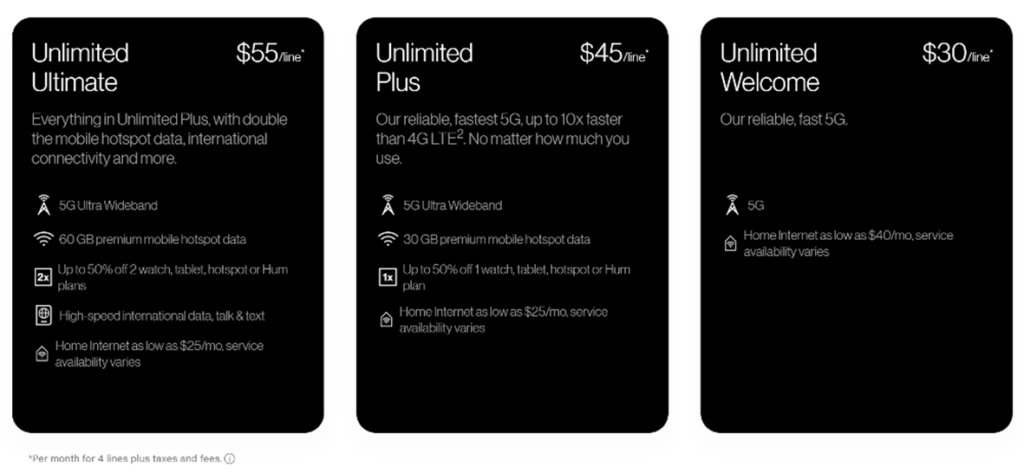

Since then (August 29th to be exact), Verizon has added a third option called Unlimited Ultimate (see nearby picture) with unlimited handset, more Hotspot (60 GB) and High-speed international data included. We saw this as more of a “working professional with global roaming” play when it was offered.

While we think three platforms in any retail context is crazy (and will likely lower ARPUs if the customer is not a Hotspot user), we believe that the ability to select content options is materially different for Big Red (especially compared to AT&T who has no streaming bundles even though they recently owned WarnerMedia, the parent of HBO).

Creating affordable optionality is a big move. Verizon turned some heads (particularly with their cloud partner, Amazon) by including Walmart+ as one of the options. They turned even more heads recently when the rumor leaked that they would be including a Netflix+Max (with ads) bundle for $10 (Wall Street Journal article here).

The results have not shown up yet for Big Red, but the myPlan potential is real. With their Bluejeans shutdown completed, we could see a Zoom (or Cisco or Teams) option, an Intuit (for working professionals) option, an Uber One, and even a Wall Street Journal option. While there are some difficulties explaining the various network options (and not tarnishing the Verizon “best network” brand), we are surprised that T-Mobile has not responded with a similar customization strategy.

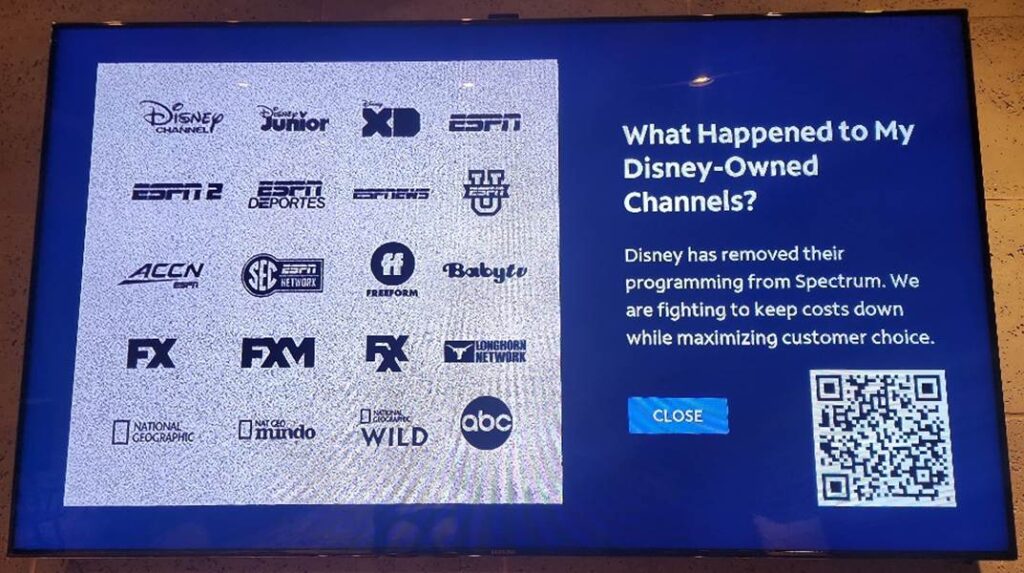

#2 Spectrum/ Charter carriage dispute (and subsequent resolution) with Disney (Aug – Sept)

On August 31st, after several months of negotiations, Disney and ESPN channels went dark on Spectrum’s cable networks (the view for Spectrum subscribers when attempting to tune in to one of these channels is shown nearby). They would stay dark until the debut of the 2023-2024 season of Monday Night Football on September 11th, which featured teams from two large Spectrum cable markets (Buffalo and New York City). Out of the dispute, Spectrum emerged with the following terms, according to Charter’s news release (here):

- Disney+ Basic ad-supported offering will be provided to customers who purchase the Spectrum TV Select package, as part of a wholesale arrangement;

- ESPN+ will be provided to Spectrum TV Select Plus subscribers;

- The ESPN flagship direct-to-consumer service will be made available to Spectrum TV Select subscribers upon launch;

- Charter will maintain flexibility to offer a range of video packages at varying price points based upon different customer’s viewing preferences;

- Charter will market Disney+, ESPN+ and Hulu to their broadband-only base (presumably through their Xumo product once that is extended to that base);

- Charter will no longer carry several less watched Disney channels: Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild, and Nat Geo Mundo (we are assuming that these will be put into a separate tier and not eliminated entirely);

- Charter will cooperate with Disney to crack down on illegal password sharing.

The structure of the settlement is important because it allows Charter to improve both its linear and streaming product options. Purchase Spectrum TV (which an increasing number of families are watching through a Roku or Amazon or Apple TV app), get Disney+ with ads. Upgrade to Spectrum TV Select Plus, get ESPN+. Each tier’s value increases, and Spectrum retains the right to have a basic bundle. Best of all, they get more advertising revenue opportunities which help defray the incremental cost of each content/ channel layer.

Can all of this save the video + broadband (+ mobile) bundle? We will know when each of the above innovations are released. Until then, the company is promoting their Spectrum One bundle which does not include Spectrum TV, and Xumo is off to a very unimpressive start, partially because the current offer (here) requires customers to subscribe to Spectrum TV Select.

Time will tell whether this was a “one off” retransmission agreement or sets a precedent for future ones. We think that Charter/ Spectrum will quickly learn from Disney and improve the model. In doing so, traditional linear video declines, but the product improves and is differentiated from You Tube TV and Fubo TV. The question is whether the vast majority of video users have moved to streaming and, as a result, moved away from cable’s video-based bundle.

#3 Anna Gomez is confirmed as the fifth member of the FCC (September 7th)

In the middle of the aforementioned Spectrum-Disney carriage dispute, Jim’s former Sprint-Nextel colleague Anna Gomez was confirmed as the fifth member of the Federal Communications Commission (see FCC Chair Jessica Rosenworcel’s announcement here – Anna’s picture is nearby).

For most of the Biden administration’s first term (900+ days), the FCC had been comprised of two Democrat and two Republican-appointed members. With Anna’s confirmation, the commission had its standard 3-2 majority favoring Biden appointees.

Chair Rosenworcel wasted no time, quickly proposing (and securing the approval of) the reinstatement of the 2015 Net Neutrality rules (announcement of approval here and analysis/ implications from the law firm Akin Gump are here).

We have been critical of the “on/ off” nature of the FCC’s net neutrality rulings. While their intentions may have been noble in 2010 when constraints were commonplace, today’s networks and wireless plans are different. 1 Gbps speeds are commonplace with the full deployment of DOCSIS 3.1 cable modem technology, and the QCI 9 data prioritization standard that enables the lowest-cost plans was not widely used a decade ago. We think that today’s neutrality standards could morph into tomorrow’s node or oversubscription regulations.

This thesis is manifested in the second FCC action announced during Thanksgiving week against “junk fees” (see Chair Rosenworcel’s news release on that proceeding here). Per the news release, this rule when implemented would:

- Propose to adopt customer service protections that prohibit cable operators and DBS service providers from imposing a fee for the early termination of a cable or DBS video service contract.

- Propose to adopt customer service protections to require cable and DBS service providers to grant subscribers a prorated credit or rebate for the remaining whole days in a monthly or periodic billing cycle after the cancellation of service.

While some will cheer (and no one likes the “don’t let the door hit you on your way out” fees), this rulemaking eliminates the use of promotional subscriptions as a marketing tool. No cable company will refuse a new customer who wants to pay the post-promotional rate during the first year. Competitors, if they offer video, are partnering with You Tube TV and others who do not have termination fees. This is placing additional pressure on cable and satellite companies to adopt Everyday Low Pricing (ELP).

The result will be less competition to win back cable cord-cutters and higher reconnect fees. A secondary effect might be to require higher up-front deposits for some customers who have lower credit scores. When the FCC gets involved with promotional commercial contract language and structure in the name of “consumer protection,” telecom companies understandably get very nervous.

Where the FCC goes from here will be the subject of a future Sunday Brief. With Anna Gomez on board, the majority can go farther, and that should concern the industry.

There are more impacting events to discuss, and we welcome your feedback on our omissions, but have reached our word limit for this week’s edition. On December 17, we will continue with three additional events based on your suggestions and our research. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Go Chiefs and Davidson College Basketball!