Various forms of Artificial Intelligence (AI) are pivotal for an upcoming surge in mobile ecosystem development and revenue growth over the next couple of years. New applications, services and network efficiency enhancements will escalate demand for AI workload processing in cloud data centers, mobile-edge servers and on new devices containing Graphics Processing Units (GPUs) and Neural Processing Units (NPUs).

In the run-up to the first commercial launches of 5G in 2019, I predicted the new G would largely be a capacity booster until the mid-2020s. Indeed: so far, 5G has generally delivered little more than enhance 4G LTE’s Mobile Broadband (MBB) by making it eMBB. In doing so, 5G occasionally provides some amazing headline speeds, but these are generally much faster than can be noticed by smartphone users, other than with a “speed test” app. In another article here around New Year 2023 I observed that 5G had yet to deliver its own defining singularity— “a hypothesized future era or event when exponential improvements in computer intelligence and advances in technology will result in an acute change in human society and evolution.” However, developments since then will spur substantial mobile ecosystem growth in the next couple of years while we’re still waiting for something that profound.

The quest is on for new for new generative AI-based mobile applications that demand more than simply more speed and capacity in networks and devices. Tech Giants and some other Over-the-Top (OTT) players will, again, be major beneficiaries, but they will also require devices with new capabilities and service enhancements that will put technology vendors’ revenues back into significant growth while also providing opportunities for Mobile Network Operators (MNOs) to improve their revenues.

Next gen effects

As I noted in my 2019 article, as each new cellular technology generation growth wave has subsided, the industry has reinvented itself to satisfy new needs and with — until so far this time — significant market expansions.

For example, while the introduction of 4G from around 2010 provided some relief for 3G networks that were overwhelmed by browsing and email in population centers like New York City and San Francisco, it was the possibility of being able to stream video from various sources and to geolocate, together with new applications such as Instagram and Uber, that escalated 4G device and MBB services demand in the following years.

However, 5G has been rather disappointing to date for mobile technology providers and MNOs. 5G — including new spectrum in mid-band and mmWave deployments — has provided lots of additional network capacity since 2019. Nevertheless, capabilities have been insufficient to stem declining global smartphone sales volumes or boost MNO revenue growth above a lackluster 1% annually, despite relentless ongoing data traffic growth at a corresponding rate of around 50% over the last five years.

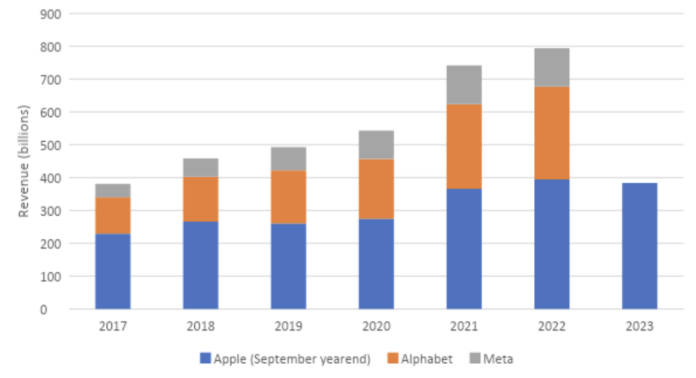

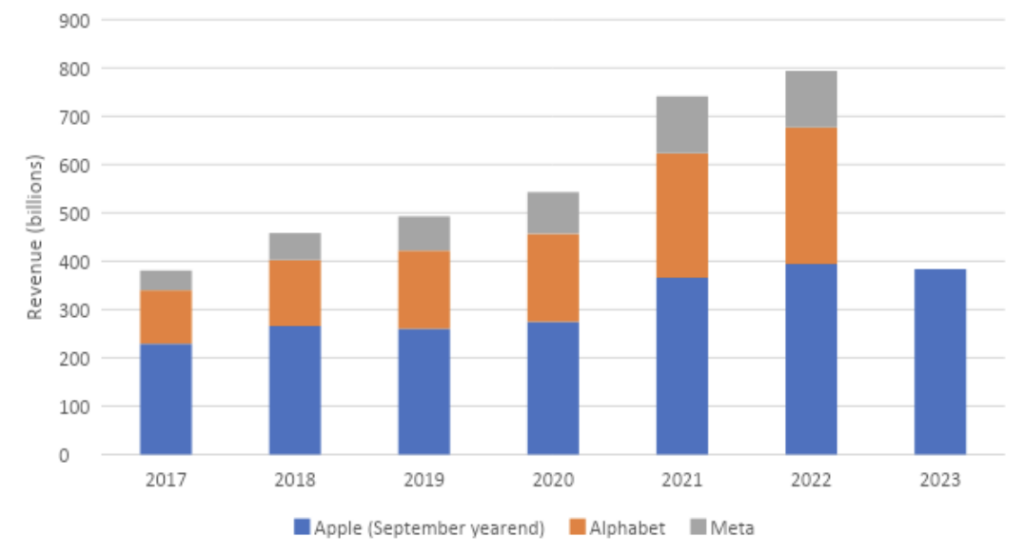

The Tech Giants have fared rather better — for example revenues for Apple, Alphabet (Including Google Play and YouTube) and Meta (including Facebook and Instagram) have doubled their combined revenues, largely due to smartphones.

Big Tech revenue growth in our mobile-first world*

* I’ve omitted Amazon and Microsoft because most of their revenues are not from mobile

Generative AI for the masses

Public awareness of, enthusiasm for and concerns about AI have all increased inordinately over the last year since the introduction of OpenAI’s Large Language Model (LLM) ChatGPT. Generative AI’s astounding capabilities — such as writing pass-grade essays — and some dystopian views of its existential threats to humanity have taken press and social media by storm.

Intelligent agents can find us information, draft us documents and organize our schedules. Generative AI can also compose works of art including music, pictures and motion video. It can even be used to help determine whether patented technologies are essential in the implementation of technology standards such as 5G.

Cloud data centers with huge computing and storage resources are ideal places to process these kinds of workloads. For example, latency is not a constraint when composition of an essay in seconds is lightning fast in comparison to the hours or even days the task would take a human. Mobile devices will be where many tasks might be initiated and outputted, but usually with training and inferencing workloads processed and corresponding value generated elsewhere deep in the cloud.

Consequently, AI is growing exponentially in the cloud. This is manifest in its seemingly insatiable demand for data center computing resources. For example, NVIDA’s sales revenues have tripled over the last year with stellar sales growth for its server GPUs. The firm’s market capitalization is now well over one trillion dollars.

ML for network geeks

Machine Learning (ML) —a subset of AI “that automatically enables a machine or system to learn and improve from experience” — is already enhancing MNO capabilities “under-the-hood.” Self-Organizing Network (SON) uses such techniques to automate network optimization without the need for laborious drive testing and manual adjustments. Development initiatives for 5G Advanced in upcoming 3GPP Release 18 include using ML techniques to optimize radio channel throughput, manage Multiple Input Multiple Output (MIMO) beams and improve positioning. Benefits from such developments include increased network performance and energy savings — for example, by turning off frequencies when there is little network use at night. On-device ML image processing techniques are used to enhance photos and video. This is exciting stuff for engineers and network planners, but seems to have had rather less impact on company stock prices than cloud-based generative AI and is rather ho hum for consumers who tend to take such things for granted.

Key capabilities and application characteristics on 5G devices

What would compelling generative AI applications and services running on mobile devices look like? While it is difficult even to envisage let alone demand forecast specific revolutionary new services — for example, I don’t recall anyone in the 2000s describing a “location-based” service that could severely disrupt the taxi industry — we can identify key technology ingredients and the benefits they might provide. The combination 5G with ever-improving positioning, together with AI, will enable improved latency, precision, reliability, privacy, safety and economy.

URLLC

While Ultra-Reliable and Low Latency Communications (URLLC) is one of 5G’s original thee apexes — depicted in a triangle with the other two corners being eMBB and massive Machine-Type Communications (mMTC) — URLLC embodies two distinct capabilities.

Low latency

When low latency is possible, network and device can interact in milliseconds. However, even processing in network-edge servers — let alone in cloud data centers — can introduce intolerable round-trip delays for some real-time processing, such as in Extended Reality (XR), where motion-to-photon (MTP) latency is critical and video captured is best processed on-device for rendering there. 5G latency is reducing with introduction of 5G standalone (SA) mode. But it’s still early days for that at most carriers. For example, Verizon Wireless is still working on establishing feature parity with 5G non-standalone (NSA) mode.

The need for low latency processing is also why techniques such as ML-based mMIMO beamforming need to be performed no further than a 30km fiber hop from a cell site to an O-RAN DU.

Precision, reliability and continuity

No matter how precise the positioning, or robust a mobile network might be, there is always the possibility that a device will stray outside of coverage or signals might bet blocked. When that happens and when the network goes down devices may need to continue running independently. Network-free operation is essential for safety in persistent applications such as autonomous driving.

Privacy

While many folk are currently willing to expose personal information including browsing and geolocation histories, some are not. It might only take one major incident to cause far more corporate executives and consumers to get cold feet about how much data is surrendered to certain cloud-based services. Companies are already regulating or forbidding use of chatbots as staff recklessly expose sensitive company information including source code.

Fighting fire with fire

A major anxiety with generative AI is with deep fakes including videos on social media and with phone callers conning the unsuspected to divulge personal information such as bank account details. The bad guys have hardly gotten started with all that. On-device generative AI trained on our genuine personal data could audit inputs — rather like malware protection software does — to save us from being duped.

Economy

Cloud computing including data centers and the data transport to them is costly. Centralizing processing and storage is attractive to and is encouraged by the Tech Giants because they own that infrastructure and because it gives then maximum control of personal and other data. However, on-device computing is cheap. As a sunk cost, once a device has been purchased, local AI workload processing costs nothing. This is no great revelation. Timesharing costly central mainframe computers was significantly displaced by use of departmental mini computers from the 1970s and by PCs from the 1980s.

Occasional AI enquiries make modest demands on cloud resources. In contrast, persistent demands for ML AI in image processing including XR rendering and mMIMO beamforming would overwhelm backhaul and cloud data center capacity. While the cloud has superlative computing power, edge and device computing gets better and better.

Autonomous vehicles will reputedly generate hundreds of gigabytes of data per hour. The bulk of this can only be viably processed in the vehicle.

Killer apps impending

AI will be engineered to run in all three domains: cloud, network edge and device. All the current buzz is about apps and services such as intelligent agents that are well suited to reside on the cloud. However, Qualcomm and others have demonstrated that at least inferencing for these kinds of AI apps can be achieved on devices, even if algorithms are trained elsewhere, in the cloud. For example, in early 2023, Qualcomm demoed use of Stable Diffusion’s text-to-image generative AI model to creating photorealistic images of characterized cats in various garbs (e.g. “Super cute fluffy cat warrior in armor”). That’s a great technical proof-point but for an implementation that has no apparent advantage running on a mobile devices versus in the cloud.

The generative AI application sweet spot for mobile devices including smartphones, PCs, XR headsets, gaming devices and vehicles will be as for other types of AI including ML on those devices — in applications processing massive amounts of data in real time.

Orthodoxy and hope for ecosystem growth from 5G

Conventional wisdom is that growth from 5G will be in the enterprise including industrial IoT. 5G’s ability obtain growth there in the short and medium term has been over-hyped. Unfortunately, things move slowly in that world. We will be in the 6G era and beyond before much of that promise will come to fruition. 5G urgently needs something to drive consumer device sales growth soon, in 2024 and 2025. The software and silicon platforms are there, all we’re missing is a killer app or two to employ those amazing capabilities.

Coming in early 2024, Apple’s Vision Pro XR headset and Meta’s Llama2 on its Quest 3 headset are mobile platforms that are well suited to host some compelling generative AI applications.

Generative AI is definitely fueling major revenue growth for NVIDA; it might also reverse declines in chip revenues and patent royalties for Qualcomm, and of smartphone sales for various brands. However, whether generative AI remains in the cloud, or migrates somewhat to the network edge and in devices, it remains unclear whether MNOs will do a better job at capturing revenue growth versus Big Tech than they’ve done in 4G and so far in 5G with global MNO revenues growing so little over many years.