Holiday greetings from the Midwest, where we recently finished up a very productive trip through St Louis and several other towns. Pictured are a few folks from the LB Networks team celebrating a terrific 2023 while Jim was in St Louis last Thursday.

This is another full Brief as there is no lack of industry news. We conclude our two-part series with three additional events that shaped the year (and will impact 2024). We publish an interim Brief next Saturday and conclude 2023 with our widely read CES preview.

Speaking of CES, we have a couple of seats left for our annual CES dinner at Gordon Ramsay’s pub. It will be at 7 p.m. on January 9th so everyone can hit one or two receptions beforehand. This is a good end of day event to gain others’ perspectives on the show and the industry. Please email us at sundaybrief@gmail.com if you are interested in attending.

The fortnight that was

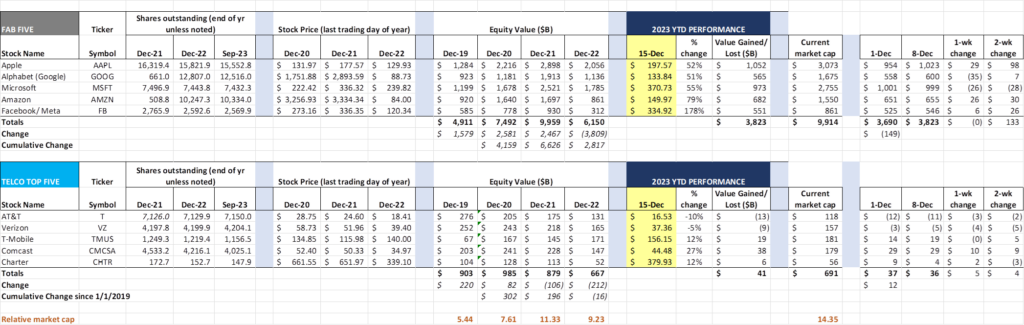

Despite the Fed-related stock market activity, both the Fab Five (< $1 billion loss) and Telco Top Five (+$5 billion) had quiet weeks. The big performers were Amazon (+$26 billion) and Comcast (+$10 billion). The movement in these stocks was muted relative to their peers (S&P 500 +2.5%, NASDAQ 100 +2.9% and Russell 2000 +5.6% last week).

The Fab Five continues to knock on the door of a $10 trillion cumulative market cap, and the worst performing stock (Google) is +51% YTD. Making the upside case is going to be more difficult given this year’s runup.

One test case that many are watching, however, is Microsoft 365’s Copilot which is a $30/ mo. addition to current 365 plans. An annual commitment is required. We are going to try it out at Patterson Advisory Group but probably won’t use it to write any future Briefs. We think that intra-company team productivity will improve significantly if folks are properly trained on the Copilot system.

The FCC was very active in November with two rulings of special note to Sunday Brief readers. The first was a widely expected refusal to reinstate the Rural Development Opportunity Fund (RDOF) awards for Starlink. There are many reasons for this, as outlined in the order on review (link to the document here). As the Commission states in their assessment, this was both a process and a “public interest” judgement call.

One of the original arguments was that SpaceX, the parent company of Starlink, did not have the financial resources necessary to complete the building. That assumption was largely muted in the response, for two good reasons. First, the company had raised a secondary round in July at a valuation of $150 billion (more than AT&T’s total enterprise value). In addition, CNBC reported this week that SpaceX is contemplating an IPO valuation of nearly $180 billion, which would make it more valuable than any US telecom company.

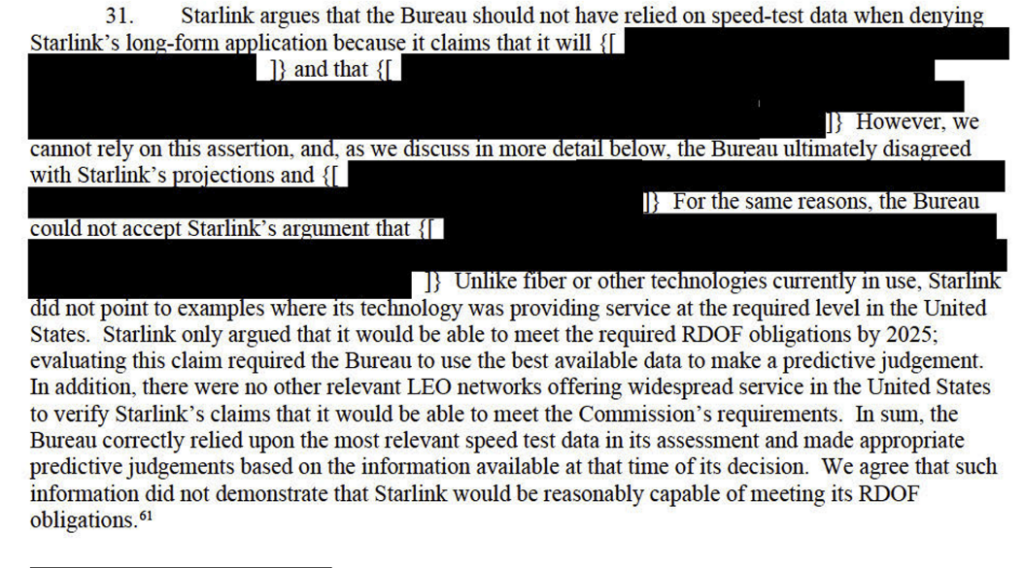

With Starlink having the financial wherewithal (and 1.2 million US customers according to this Light Reading article), attention turned to the efficacy of Low Earth Orbit (LEO) to meet the RDOF download speed and latency requirements. Rather than inserting a lengthy quote, we think it’s best to include a screenshot of the heavily redacted section directly from the order:

This is a judgement call, and, in our opinion, the FCC missed an opportunity to lean into what is likely a well-funded technological jump as opposed to other “leaps” that the industry has supported in the past. As we mentioned in the last Brief, Commissioner Gomez was an important supporter of the CBRS experiment which involved a lot of coordination. Here is the description of the sharing mechanism from the FCC’s website:

“Access and operations will be managed by an automated frequency coordinator, known as a Spectrum Access System (SAS). When managing spectrum access, SASs may incorporate information from an Environmental Sensing Capability (ESC), a sensor network that detects transmissions from Department of Defense radar systems and transmits that information to the SAS. Both SASs and ESCs must be approved by the Commission. SASs will coordinate operations between and among users in three tiers of authorization in the 3.5 GHz band: Incumbent Access, Priority Access, and General Authorized Access.”

We were very supportive of this regulatory “leap” to enable Priority Access Licenses and maintain that the addition of LEO capacity is a lower risk for the government than the CBRS three-tier authorization system.

Bottom line: The extent of the RDOF subsidy amounts to $1,377 per household passed. The replacement cost (now to be absorbed by the BEAD funding program) is going to be far larger – likely $5,000-$7,000 subsidy per home passed for a mix of fixed wireless and fiber. Starlink is not going to diminish their deployment because of the FCC decision. The Commission made the wrong call here and may have set a technological precedent that future Commissions will need to revise.

That was not the most perplexing FCC decision since the last Brief, however. On Thursday, the FCC trumpeted that they were eliminating “junk fees” on video and satellite providers (link to news release here). While we are supporters of broadband and video labels (and laud companies like Cox Communications for their clearly delineated schedule of fees in their ordering process), this ruling eliminates the use of promotional contracts for video services. And it does so prior to the introduction of broadband labels (scheduled for 2024).

Besides a quick “pat on the back” headline, the FCC’s action will result in the following:

- Fees will go up on other service components (e.g., installation, receiver and set-top box leases).

- Credit score-based deposits for video services will increase (where allowed by franchise).

- Pre-paid video service offerings will proliferate (at full prices).

- The use of customer service-based credits and “promise to pay” practices will diminish.

- Reconnect fees (charged after disconnection due to non-payment) will rise.

- Bundling of video with other services will increase (e.g., 300 Mbps Internet + “skinny” video + free mobile for $39.99 with a 12-month contract), allowing communications companies the opportunity to charge a fee if one part of the bundle is broken. Since the value cannot be directly attributed to video, it’s unlikely that the fee can be specifically attributed to video, and the FCC has not ruled on termination fees on bundled contracts.

We think that the exercise of “find and replace” (replacing all references to DBS and cable with broadband and Internet service in the news release provided in the aforementioned link) provides a possible indication of where the Commission is heading. For example, if a new FTTH provider in a college town wanted to offer an annual Internet plan for $399, and the student left after the school year ended, shouldn’t they be liable for the last 1-2 months? Why should the last couple of months be refunded?

Bottom line: The FCC should have stopped at broadband label enforcement. Reducing junk fees sounds good but will result in higher up-front costs for those who can least afford to pay them. We recommend that the FCC obviate content bundling agreements between providers and purchasers, freeing up the opportunity to create customized bundles for each household.

Finally, it’s worth acknowledging that Elliott Management’s campaign to “Restore the Castle” has resulted in the loss of its king. Jay Brown, who has worked for Crown for nearly 25 years, announced his retirement from the company on December 7 (effective 1/16/2024). Tony Melone, a long-time friend of the Brief and a seasoned former Verizon executive, will assume the interim CEO role. We continue to think that the Crown Fiber assets would be of high interest to T-Mobile or cable companies looking to augment current capacity or to increase redundancy (to the extent that they have not leased dark fiber from Crown already). We wish Jay and Tony the best in their new chapters.

Six key events/trends/developments of 2023 (part 2)

In the last Brief, we discussed three important events of 2023 (in no priority order):

#1: Verizon’s introduction of myPlan;

#2: Spectrum’s retransmission/ carriage dispute with Charter, and.

#3: Anna Gomez’s confirmation as the third Democrat-appointed FCC Commissioner

Your comments for the “next three” began to pour in shortly after we released the Brief. We received over 100 nominations, and, after some deliberation and consultation, have carefully selected the following three additional trends:

#4: AT&T’s recommitment to Open RAN

#5: BEAD state-by-state and Enhanced ACAM funding announcements

#6: The changing of the guard – industry retirements and fresh faces

What AT&T’s Open RAN announcement means

We were not surprised when we saw AT&T’s announcement the day after the last full Brief was published. After all, AT&T, Dell, and Intel have been three of the biggest sponsors of Airship, and Gordon Mansfield penned an insightful blog earlier last year (here) outlining challenges the company has faced with open Radio Access Network (RAN). We have always seen Giga Power as a means to achieve AT&T’s Open RAN objectives outside of their traditional local exchange footprint.

This is a massive project. Every cell tower using the Open RAN architecture will need to be reconfigured (we do not have time to go into each step, but this microsite from Mavenir does and is worth a careful read), and per the latest announcement, 70% of AT&T’s traffic (our estimate is that equates to 20-25% of the actual cell sites) will be completed by the end of 2026. Said differently, it’s not a forklift changeout but a transition. Sometimes, those are the hardest projects to execute.

Because Open RAN relies on local fiber from the tower to the first node (called a Distributed Unit – see nearby picture from Mavenir), AT&T now has a reason to extend their fiber footprint deeper. Scheduling (which is directly related to handoffs and voice quality) will improve dramatically. And, after the first deployments are complete, an Open RAN will be able to seamlessly integrate into Wi-Fi radios as well. This is one of the reasons why AT&T is including Wi-Fi in each AT&T Broadband offer (and not charging for it post-promotion as cable is doing). Bottom line: AT&T Open RAN network saves the company money, but, more importantly, it provides the initial platform to integrate with every AT&T asset.

We will have more commentary on this in coming Briefs, but here are today’s takeaways:

- Major project (lots of things could go wrong, but once they get going, they will move quickly)

- Fiber-dependent (which leaves us thinking, could some part of Crown Castle’s strategy have been correct, just early?)

- Knock-on benefits to home and business broadband (open platforms)

- Extremely attractive yet possibly threatening platform to partners like Google, Microsoft, and Apple

Why state-by-state BEAD and enhanced ACAM funding made our list

Many analysts have described the Broadband, Equity, Access and Deployment Program as a “once in a lifetime” (or simply “once”) event. However, as few others outside of this publication have noted, there is additional funding through the FCC’s Alternative Connect America Program (the latest version is referred to as Enhanced ACAM) that will add $18 billion in additional grants over the same construction period as BEAD. Think of this as the $41.6 billion (BEAD grants) + $18 billion (Enhanced ACAM grants) + $25 billion in private matches = $85 billion project that will change how and where we live and work.

To put this into context, we discussed the Rural Development Opportunity Fund (RDOF) earlier, which, at the time, was considered a sizeable project. Here were the original winners of government funds (from Light Reading):

Of the $9.2 billion awarded, Starry, SpaceX and LTD Broadband networks have had their funding rescinded or severely curtailed. Coupled with some smaller disqualifications, roughly 30% of the $9.2 billion has been voided. Excluding those amounts, the level of funding for BEAD + Enhanced ACAM is 10x that of RDOF.

And, as we have pointed out previously, those companies who are implementing RDOF are likely to have a higher cost profile than Enhanced ACAM and BEAD participants.

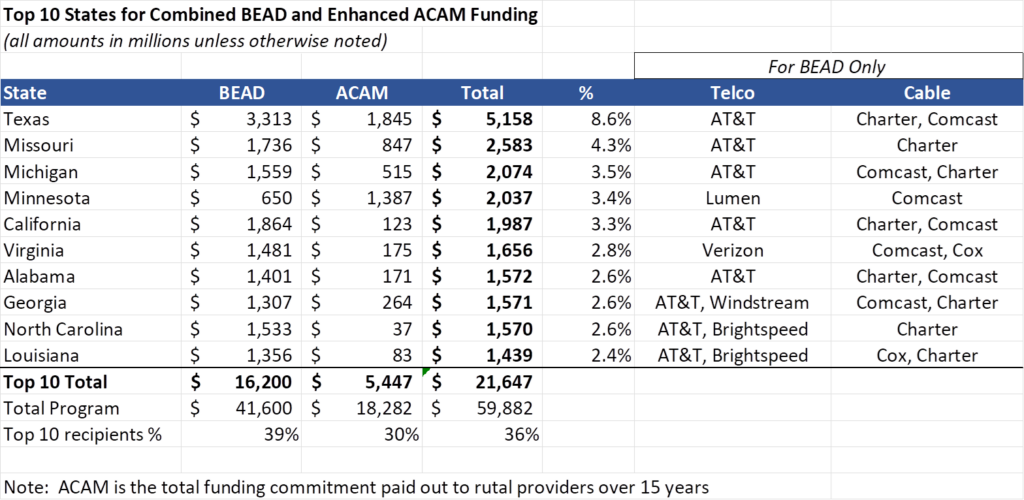

In late June, the National Telecommunications and Information Administration announced the mechanism for distributing the BEAD funding by state (shown in the table below). The Top 3 states receiving funding were Texas ($3.3 billion), California ($1.8 billion), and Missouri ($1.7 billion). Five of the top nine states are in the Southeast (Alabama, Georgia, Louisiana, North Carolina, and Virginia), and none of the top recipients are in the Northeast.

Enhanced ACAM only adds to these numbers. The below table shows the funding from BEAD and Enhanced ACAM by state for the top nine states:

These states get brand new, largely fiber networks in the next five years. AT&T is the largest incumbent telco provider in eight of them. Charter also has a meaningful presence in eight states. It comes as no surprise then that both of these providers have been talking a lot about BEAD funding given their existing broadband footprints.

Bottom line: Carriers who have deployed fiber today in these states will have the lowest costs to build out additional fiber. These largely Southern or Midwestern states will enjoy the economic benefits of five years of buildouts, followed by decades of benefits after homes and businesses have been connected at broadband speeds. This will spur additional economic growth in these states not seen since the construction of the Interstate Highway system in the 1950s and 1960s (a primer on that development is here).

Post-COVID retirements/changing of the guard

The rate of industry retirements accelerated in 2023 (likely attributed to post-COVID reflection and general demographic/ industry trends).

2023 started at Verizon without Tami Erwin, the CEO of Verizon Business and 35-year employee of the company. She had an excellent command of both wireless and wireline networks and understood how to invest in people and processes to gain market share. Losing Tami likely accelerated a lot of HR planning for Hans Vestberg.

Early on in 2023, T-Mobile announced the retirement of their President of Technology, Neville Ray. He immediately began to transition his role to the Chief Network Officer, Ulf Ewaldsson. Like Tami, Neville was one of the more frequent faces of the company, explaining with few industry acronyms how the network was evolving (see layer cake picture nearby – one of Neville’s favorite illustrations). Outside of then-CEO John Legere, Neville was the “voice of progress” for T-Mobile through both the Metro PCS (2013-2015) and Sprint (2020-2023) network integrations.

In addition to these individuals, folks like Craig Cowden at Charter Communications, Marcus East at T-Mobile, Peter Ewens at T-Mobile, Angela Santone at AT&T, Bill Stemper at Comcast Business, and Jeff Shell at NBC Universal left their positions (all for very different reasons).

Every year brings a lot of changes, but, with the exception of Marcus East, each of these individuals shaped long careers in the telecom industry, and, of this print, none have surfaced in new positions. That will likely change in 2024. In addition, the individuals taking their place are changing course when necessary. It seems like the pace of executive departures is accelerating, and, while that produces opportunities, it also creates uncertainty.

That’s it for this week. On December 31, we will publish one of our most read Briefs each year – our CES Preview. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Go Chiefs and Davidson College Basketball!