Just to muddy the water, already stirred-up with competing analyst forecasts; the number of private LTE/5G networks worldwide will grow from over 4,000 in 2022 to over 60,000 in 2028, reckons research company Analysys Mason. Enterprise spending on private networks will increase from $1 billion in 2022 to $9.2 billion in 2028, it says. The figures, just in, suggest growth of 1,400 percent in total network deployments in the period, and of 800 percent in annual network spend.

Which is perhaps the biggest forecast from an analyst firm yet, putting the compound annual growth rate (CAGR) at 48 percent on the latter score. But Analysys Mason notes such a spend would be less than five percent of the equivalent spend on public networks in 2028, according to its own market predictions for the public cellular market. As such, it suggested the private networks game will have been something of a failure.

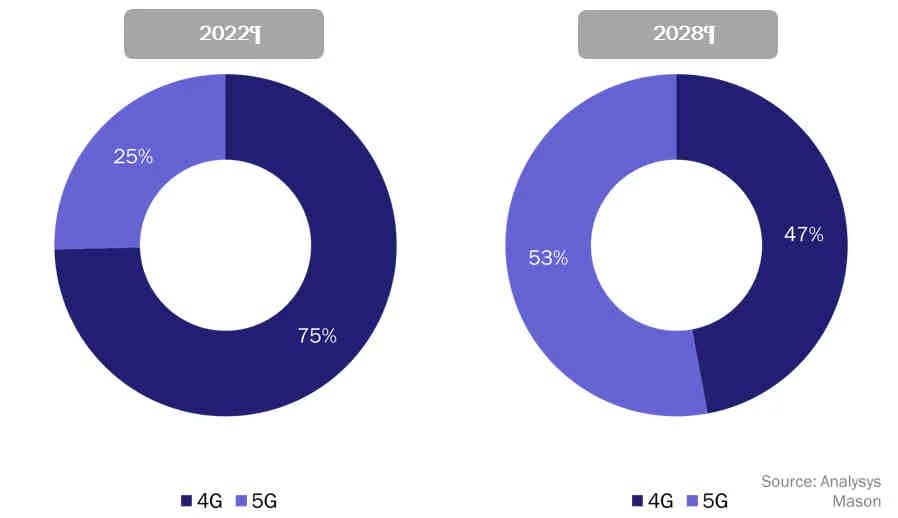

“The market will not have reached its potential,” it said in a press note, adding that interest “remains high despite the relatively modest long-term opportunity”. Almost half (47 percent) of all private networks will be based on 5G by 2028. The majority (53 percent) will be based on LTE through the end of the period; down from about three quarters (75 percent) at the end of 2022. “Interest in private 5G is high but… devices and costs have held back adoption,” it said.

Analysys Mason explained perceptions of the market opportunity from the point of view of mobile operators, and also for legacy and startup network vendors (Nokia and Ericsson, notably, versus Celona, Athonet/HPE, and even Siemens, for example). “Private networks will provide a small boost to operators’ enterprise revenue,” it said. Meanwhile, legacy vendors will consider the income as “useful incremental revenue” and newbies will consider “even a market of just a few billion US dollars is hugely attractive”.

The new research qualifies private LTE/5G networks “built specifically for an individual enterprise, where at least one of the network elements (packet core or radio-access network) is deployed on-site”. It does not count virtual private networks delivered over public infrastructure, it writes. It predicts network deployments and associated capital and operational expenditure (op-ex and cap-ex), split by region, sector, and technology.

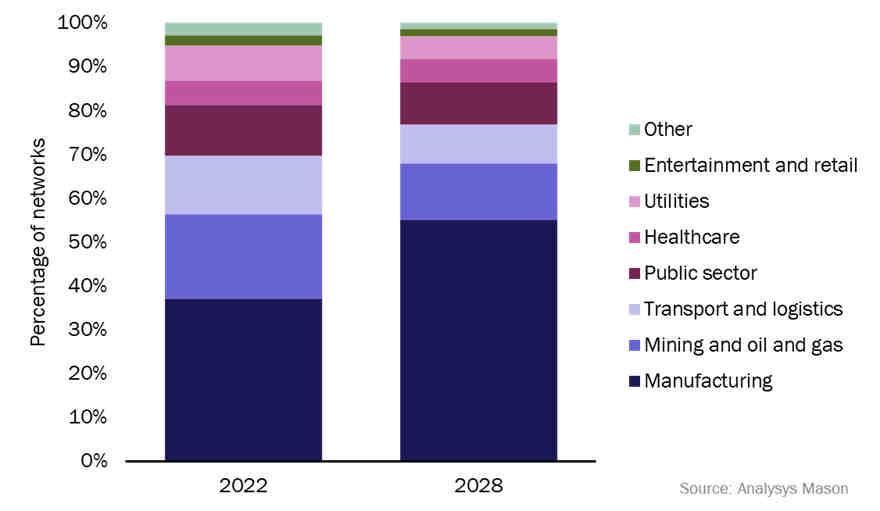

Industrial sectors – manufacturing, transport, mining – are leading the race, it says. “The manufacturing sector in particular is driving the market… [and] will account for over half of all private networks deployed by 2028,” it said. Key drivers for private networks are primarily operational efficiency (“automation and cost savings” and support enterprises’ digital transformation projects) and the replacement of “legacy/fixed networks” (to “enable applications such as automated guided vehicles” and make up for “limitations of Wi-Fi”), it said.

At the same time, and contrary to the cellular market’s one-time myth-making, it stated: “Private LTE/5G is rarely deployed to replace existing Wi-Fi networks completely.” It added: “The two technologies will co-exist and private cellular will support applications where Wi-Fi performance is limited. This includes outdoor coverage of large sites, where Wi-Fi may not be cost-effective, and indoor sites such as factories, where dedicated spectrum can perform better than Wi-Fi in ‘noisy’ signal environments.”

Analysys Mason listed barriers to adoption as cost (“can be expensive”) and complexity (“highly bespoke requirements”). “Complexity is difficult for private network players to tackle. Enterprises would ideally like private networks to be as simple to deploy and manage as Wi-Fi, but private cellular currently requires extensive network planning, systems integration and ongoing support,” it said. The other big barrier is a lack of 5G-IoT devices, described as “expensive and not widely available”.

Analysys Mason concluded: “The size of the opportunity in the long term depends on providers reducing costs and complexity. Private LTE/5G networks have mostly been deployed by large enterprises and organisations and we expect this trend to continue. The market will look considerably different when these opportunities slow down and providers target smaller firms. Suppliers will need to adapt their propositions so that they are cheap and simple enough to be adopted by SMEs. Private network providers are gradually taking steps to achieve this, with flexible pricing options and hybrid deployment models, but it will take a few years to spread across the market.”