Greetings from Missouri. This has been a couple of “at home” weeks prior to a travel-heavy February, which has allowed us to probe a little deeper into fourth quarter earnings. Since the last Brief, Jim’s interview with the 5G Guys podcast has been published (here and also part of the opening pic). Many thanks to Dan McVaugh and Wayne Smith for being such gracious hosts.

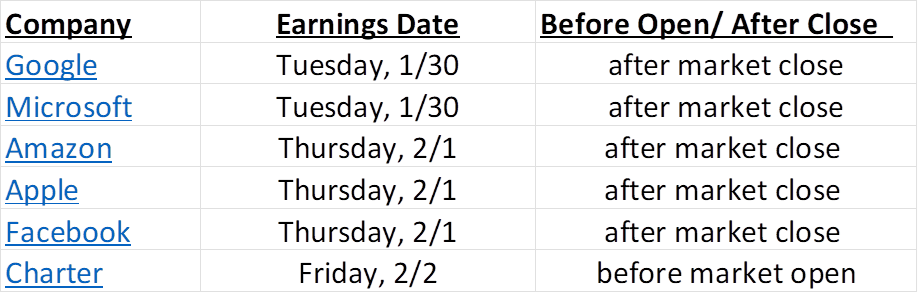

Because Charter has yet to publish earnings (currently scheduled for Friday, February 2, prior to the market open), our market comments will have more of a focus on AT&T, Verizon and T-Mobile. We will cover cable in the February 10th Brief. Speaking of cable, one correction to the previous Brief after speaking with the company: We stated “And, since Spectrum Mobile’s (LTE) data is deprioritized relative to many premium Verizon plans (but better than some offered by Xfinity Mobile – see Light reading article here), LTE can get very slow (< 1 Mbps download speeds common in many KC northland locations).” Turns out that Verizon’s LTE download data speeds in north Kansas city (and much of Missouri outside of the three largest metropolitan areas) is just slow and that the same bit prioritization applies to both Spectrum Mobile and Verizon’s premium plans (called qci8). Our apologies to Charter, and we will be happier Spectrum Mobile customers after Verizon completes their C-band upgrades throughout the City of Fountains.

The fortnight that was

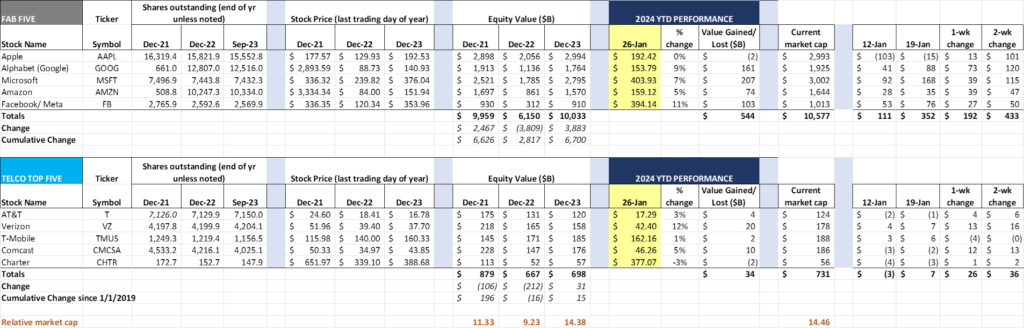

Another couple of weeks of “How good could it be?” anticipation of Fab Five earnings. As a result, the group was up $111 billion this week and $352 billion over the fortnight. We think that “constant currency” will be a well-used term on each conference call. In case you need the schedule, the remaining six conference calls of the ten stocks that we cover are listed below.

We will be carefully looking at the growth rates for each of the cloud providers (AWS/ Amazon, Microsoft, and Google). Also, Microsoft is not likely to give their Copilot early adoption statistics, but it won’t keep analysts from asking (and estimating). Our guess from discussions at CES and with several of you is that adoption is going to take a while and that $30/ seat/ mo. is a bit steep.

Four of the Telco Top Five reported last week, and each reporting company saw gains. T-Mobile announced that they now have 1.205 billion fully diluted shares as of the end of the year, which now includes the 48.752 million shares issued to Softbank as a result of achieving a trade-weighted stock price above $150 for 45 consecutive days. T-Mobile also had fewer stock buybacks in the quarter, which they attributed to the uncertain timing of the Softback share trigger. The year-end share price figured will be updated by the Feb 10 Brief, and the current T-Mobile market capitalization is ~ $194 billion as of Friday’s close.

Because of the earnings analysis below, we will keep this week’s market commentary short, leaving time for celebration of the Apple Macintosh’s 40th birthday. We read many tributes to Apple’s longest-running product line, and think that Mashable’s is the best (embedded in that article is another website called https://mac40th.com/ which has many of the old advertisements – definitely a trip down memory lane for Generation X and earlier age groups).

Fourth quarter earnings—who has the momentum?

In this analysis we look at Verizon, AT&T, and T-Mobile 4Q 2023 earnings. Until Charter reports, the simple answer to the question will be “likely T-Mobile” but Charter could surprise to the upside, particularly on wireless net additions.

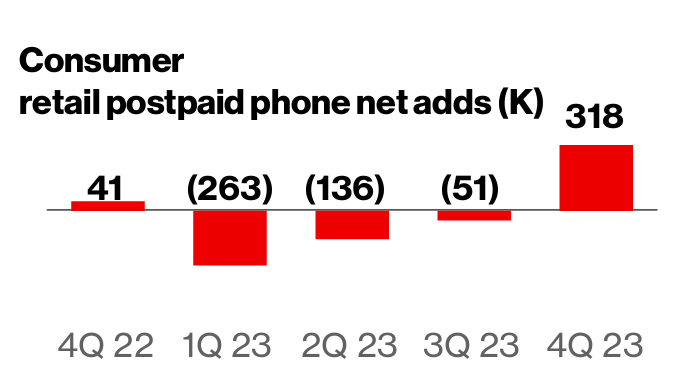

Verizon led off the earnings parade and created a lot of excitement over their wireless postpaid phone gross additions figure (up 16.9% from 4Q 2022 to 2.3 million from 1.8 million in 3Q 2023). As we discussed in the last Brief, Big Red pulled a lot of gross additions in to end 2022. So the 17% growth figure is even more remarkable. Nearby is the net additions chart from their earnings presentation.

A lot of that growth is due to the myPlan price restructuring (Verizon’s CFO, Tony Skiadas, indicated in the 3Q conference call that 70% of the myPlan additions were on their premium plan network tier). This should result in incremental (gross add) ARPU growth of about 5-9%, depending on which optional items were selected (see here for their current list, and also note that the Max + Netflix bundle was introduced in December). We credited Verizon’s introduction of myPlan as one of the six key events in telecom in 2023 (Brief here) and think that it will continue to be a key driver of incremental value for the company.

But we don’t think that’s the only reason why Verizon turned it around this quarter. In the third quarter conference call, Michael Rollins of Citi asked a question about prepaid to postpaid integration. Here is Hans Vestberg’s response (transcript here and emphasis and edit added):

“On the value segment in prepaid and TracFone. As we said in the prepared remarks, we were at the low point in the first half of ’23. And from here on, we should start sequentially improving. Secondly, this is really important for our strategy. We want to build the network [adds] and have as many connections as possible, and address the entire market on wireless. And of course, being strong and being the #1 in the value segment is important. Then from a market point of view, we all know that there has been some sort of a blend between the low end on postpaid and prepaid, which means that the volumes in prepaid is a little bit lower. And we have not been part of that transformation of taking customer for prepaid. So what we’re doing right now in our own operation, which is a lot, but one, we are building up Total by Verizon, which is a great seed we have on opening new doors. That’s going to help us to move up the postpaid for the customers that want to do that, but also have a high-end value proposition. Secondly, we work with the national retailers that we have to see that we are fortifying our offerings in our store. And finally, you’re seeing that DISH Visible continues with the pace it has. And then we’re working with a lot of other things. So it’s a lot of ongoing here that gives us confidence that we will sequentially continue to improve. But clearly, this is very important for our overall strategy.” (edited and emphasis added)

As Hans and the team headed into 4Q, prepaid to postpaid conversion was on the brain. Our guess (and it’s only that) is that they began to crack the code (if you compare the myPlan to Total Wireless plans here, it would make sense to make the jump to postpaid with the right credit score). They may have been doing it even earlier than the fourth quarter, as their 10-Q schedule (download here) shows on page 43. Or the offsets for both 3Q and the first three quarters of the year could be a coincidence. Clearly however, the opportunity to convert the highest quality prepaid customers to postpaid (particularly phone customers) was on Verizon’s 4Q list.

Verizon had 21.4 million prepaid subscribers at the end of 3Q. Could an incremental 300-400K (1-2% of the base) have qualified thanks to systems and process work done in the quarter? If that’s true (we wouldn’t rule it out), then there are many more conversions coming. We think there are as many as 4 million that they could bring into the postpaid fold as Visible and Total by Verizon continue to mature.

Merely moving customers from prepaid to postpaid, however, does not change the growth in consumer service revenues. As was noted on the call, service revenues need to grow. For 2023, Verizon grew total wireless (business and consumer) service revenues by $2.3 billion (3.2%), with 80%+ of that growth coming from the Consumer business unit.

Within the Consumer unit is the cable wholesale growth. Cable has grown just over 4 million net subscribers over the four quarters from 4Q 2022 through 3Q 2023. This equates to roughly 33-34 million new monthly RGUs for the year (this number could be understated as we aren’t quite sure how well Cox performed in 2023 but added in about 1 million incremental RGUs for them).

Per the operating statistics in the Financial and Operating Information earnings supplement, Consumer grew their service revenues by $1.85 billion in 2023. Of this amount we estimate that at least $550 million (30%) came from the cable MVNO. Additional growth came from price increases, fixed wireless growth, and myPlan success, but, since there was no discussion of the cable vector, we thought we would provide an estimate. (If we are materially incorrect with the 30% figure, we would call into question why Verizon would be leaving money on the table as this per unit rate reflects a ~50% gross margin for the MVNO service revenues).

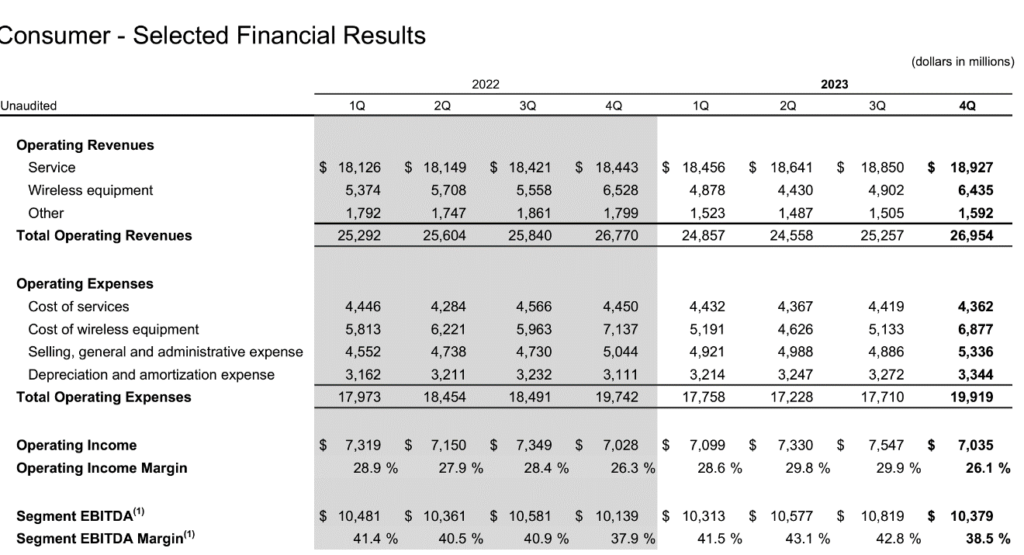

Being 30% of service revenue growth is one thing, but here is Verizon Consumer’s EBITDA picture (note that the service revenue line for the entire business unit includes both FiOS and wireless):

Segment EBITDA for Verizon’s Consumer unit grew a mere $526 million in 2023. Because of the high margins in the cable business, it’s highly likely that there would be very different EBITDA storylines without cable’s contribution (which we think is in the $450-475 million range for 2023).

Bottom line – Verizon: Verizon has myPlan momentum and is 1-2 further adders away from runaway success (we think a VPN addition like Norton would be highly appealing, as would a revamped Google One or the ability to purchase a status level with Shell or Marriott or National or Uber). But some of the revenue and most of the EBITDA momentum has to do with cable, and Verizon would be telling a very different story without that foundational cash flow.

AT&T also had a very good showing and made progress on many fronts. It’s hard, however, to ignore the massive debt load which places a growth albatross around the neck of the company. Currently, the company has just below a 3.0 net debt to adjusted EBITDA leverage ratio, and the company has pledged to bring that figure down to 2.5x in the next six quarters. This compares to a 2.6x net unsecured net debt leverage ratio for Verizon (3.1x when secured debt is considered) and a 2.5x ratio for T-Mobile.

Assuming we have an AT&T 2024 EBITDA growth rate that is more than 2023’s 4.7% figure (6% growth to $46 billion which is 2x what was targeted in their announcement), AT&T would need to lower their total debt to ~$115 billion to hit the 2.5 figure (~$14 billion in debt reduction). We think it’ll be on its way by the end of 2024 but will not attempt to overachieve this ratio until both the fiber and the C-Band programs are nearing completion. It’s likely that their ratio will be in ~2.7x range by the time we look at 4Q 2024 results. Needless to say there’s a deleveraging focus at the company that is not present at T-Mobile.

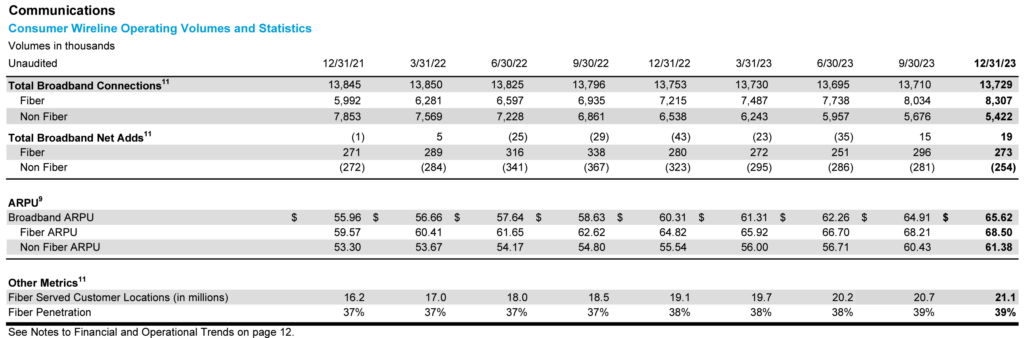

AT&T is moving very aggressively to finish (and perhaps expand) their fiber to the home program, and we saw in their results the fruits of 3+ years of accelerated builds. Here’s the chart from the financial and operating tables showing the puts and takes:

AT&T is in danger of missing their goal of building to 30 million locations by the end of 2025. The above figure shows 21.1 million homes passed with fiber and there are about 2.9-3.1 million businesses that also contribute to the goal. So they stand at 24.0–24.2 million locations passed with fiber and eight quarters to go. At their current pace, they would come up about 2 million homes short (500K consumer locations per quarter for the next 8 quarters). The company did not address their acceleration plan, but we expect additional color on this in upcoming investor conferences.

Fiber net additions growth is still positive (so better than Comcast and we assume Charter) but is not accelerating. This is especially interesting because the second half of 2023 was when AT&T began to introduce cross-bundle discounts with wireless ($20/ mo. discount from the fiber bill if the customer is also a wireless subscriber – more here). It seems like that should have been a needle mover on volume, but really only slowed down the growth of fiber ARPU growth (still strong at 5.7% but down from 3Q’s 8.9%).

In the next Brief we will touch on why we think AT&T’s cross-bundle discounting will grow after they reach the 30 million threshold (there is a very interesting quote from John Stankey in the earnings release which speaks about owners’ economics). We believe that this will put more pressure on cable to supplement Verizon’s network with additional CBRS builds in order to remain competitive with AT&T’s converged bundle price.

Many other analysts have pointed out AT&T’s double-digit service revenue declines in their business wireline segment (down 11% yr./ yr. and over 4% sequentially). Unlike Verizon (where costs of services are falling faster on a percentage basis than revenues), AT&T needs to accelerate their efforts to reduce access expenses outside of their operating territory (and also allocate resources in territory to replace copper with fiber wherever possible). Verizon seems well on their way to doing this and AT&T should copy those plays.

Bottom line – AT&T: Ma Bell has the largest executional risk in 2024 with homes passed acceleration and C-Band deployments required. We don’t see how, absent asset sales, they will reach their 2.5x leverage ratio target in 2025. AT&T’s 10-K will be a must read for all current investors, particularly with respect to deleveraging, OPEB (pension) obligations, and operating leases.

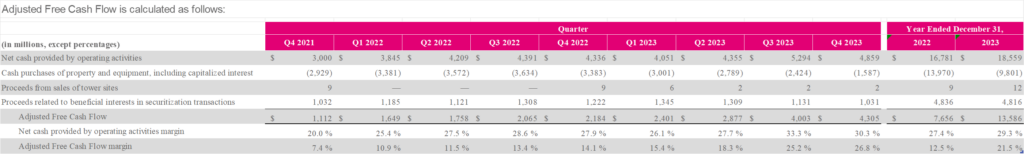

T-Mobile earnings (outside of the shares outstanding miss by most analysts) were very strong. We are not surprised by the company’s performance and applaud their “no excuses” mentality to financial performance. Interestingly, wholesale revenues are declining rapidly at T-Mobile (see their detailed operating income statement) but that did not keep them from posting stellar free cash flow as shown in the following table:

We are very surprised by the low capital spend for the quarter but were comforted by the forecast of $8.6-9.4 billion in capital spending for 2024. This should equate to low teens capital spending as a percentage of service revenues and allow T-Mobile plenty of room for rural expansion.

Speaking of rural initiatives (which are progressing nicely thanks to comments by Consumer Group President Jon Freier on the call), we would like to propose the following idea:

- T-Mobile announces up to $3 billion in rural funding (through a convertible bond) to all BEAD participants

- In exchange for providing this funding, T-Mobile would become the retail sales partner for each winner (they would use a “store within a store” concept)

- Each winner would provide fiber to T-Mobile for their use at cost (or a commercially reasonable rate)

- T-Mobile would receive a right of first refusal on the sale of any company

This will not work with certain types of participants (e.g., an electric cooperative or a municipality) but would work for many potential bidders. Like Google Fiber’s contest to determine the direction of their fiber footprint, we think Mighty Magenta could tip the scales while also enabling the 100 Mbps/ 20 Mbps minimum threshold using their vast amounts of licensed spectrum. With the convertible bond approach and perhaps some sales-driven warrants, this might be a clever way for T-Mobile to win in rural markets without meaningful dilution.

Bottom line – T-Mobile: Excellent “no excuses” quarter with strong cash flow growth. Interesting comment about US Cellular in response to a question about M&A at the end of the call that we do not have time to address in this Brief.

That’s it for this week. In two weeks, we will dive into cable earnings and round out our industry observations. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Happy New Year, and go Chiefs and Davidson College Basketball!