In an investor update, French satellite company Eutelsat said that its Low Earth Orbit (LEO) network via OneWeb is “progressing well” but more slowly than expected, and that it still won’t meet near-term financial expectations.

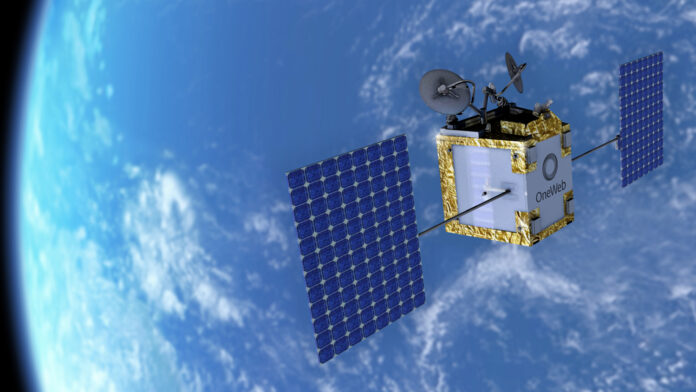

OneWeb has 100% of the expected satellites in place and an order backlog of $1.1 billion as of the end of the last quarter, Eutelsat said, but is still “running behind schedule relative to the original roadmap”. The company had originally expected that it would be able to provide global coverage by early 2024, but it is seeing delays in the availability of the accompanying ground network, which is impacting revenues and market access in some geographies.

Eutelsat expects the accompanying ground network to move towards a 90% completion rate in the second quarter of this year, and to achieve global coverage in the later part of this year. “We continue to see strong momentum in the take-up of pre-signed commitments with major customers, and we believe we are on track towards our longer-term targets,” the company added.

“We remain very confident in the commercial customer interest in the capacity,” said CEO Eva Berneke in a call with investors.

Eutelsat adjusted its expected revenues downward for the full-year of 2024 to compensate for the current dynamic in which OneWeb is operating, and it said that previously communicated objectives for 2025 were suspended. It plans to share another public update when it gives its full-year results in August 2024. The company will share first-half results on Feb. 16.

“Management remains confident in the prospects of OneWeb and the potential of Eutelsat Group’s unique combined GEO-LEO offer,” Eutelsat added.

Eutelsat also announced that it had completed the sale of OneWeb’s 50% stake in a joint venture with Airbus. Airbus bought out the stake in Airbus OneWeb Satellites, which is based in Florida and built the satellites for OneWeb’s first-generation satellite constellation. Eutelsat said that the move was part of optimization and monetizing its portfolio and reducing its debt.

The agreement reflects Eutelsat Group’s ongoing management of its assets with a view to optimizing and monetizing its portfolio as part of its debt reduction efforts.