Greetings from the Midwest as we get ready for the Big Game. This week, after a full market commentary, we will resume our earnings analysis as we look at the state of traditional cable providers Comcast and Charter.

As we mentioned in last week’s interim Brief, Jim will be the guest of Nagarro, a European-headquartered technology consulting firm, at this year’s Mobile World Congress. If you will be attending and would like to catch up, please reach out at sundaybrief@gmail.com. The schedule is filling up fast.

Jim will also be attending C3 Transform 2024 in Florida in March to learn about and contribute ideas on Artificial Intelligence and Machine Learning for the telecommunications industry. If you are attending and would like to get together, please send an email to the Sunday Brief email mentioned in the previous paragraph.

The fortnight that was

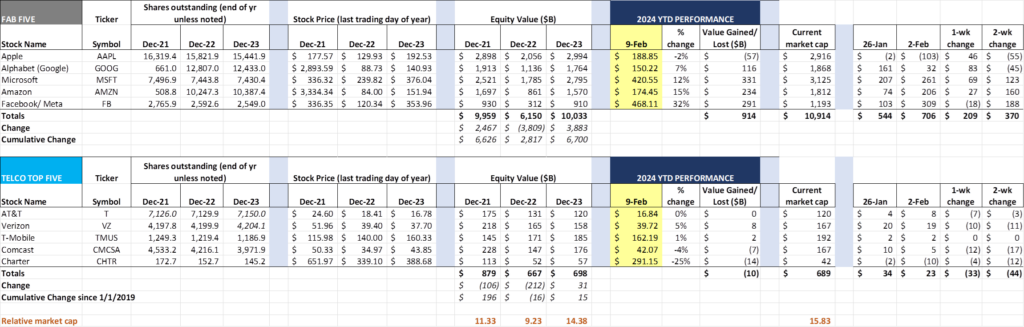

The Fab Five had another solid couple of weeks, adding $370 billion (or just over three AT&Ts) in market capitalization. Meta/ Facebook was the only stock that lost value this week, but that was on the heels of a terrific earnings-driven increase the previous week. We are barely through February and Meta has already added $291 billion in market capitalization (+32%).

Meanwhile, the market is having second thoughts on the traditional telecom industry. Since our last full Brief, the group has lost $44 billion in value. The only stock that hasn’t tanked is T-Mobile (thanks in large part to company buybacks). Charter (discussed below) has now lost 25% of their value. This on the heels of Verizon’s upbeat Analyst Event last Monday (link to a video replay is here).

There were several big news items, with the most important being the announcement of a mega sports streaming venture by ESPN/ Disney, Fox, and TNT/ TBS/ Warner. Per this New York Times article, it will feature fourteen channels that show sports: ABC, ESPN, ESPN2, ESPNU, SEC Network, ACC Network, ESPNews, Fox, Fox Sports 1, Fox Sports 2, Big Ten Network, TNT, TBS and truTV. ESPN+ will also be included in the package (see nearby table of sporting events covered through the partnership). While the final details are yet to be determined (and we are especially interested in seeing how the meta data for each broadcast is reconfigured), it’s probably best to think of this as the “sports tier” of streaming.

There is a lot of speculation about the impact to traditional cable TV. In the announcement of the service, Disney indicated that they will be offering Disney+ and Hulu to the sports package for an additional fee (Warner could also offer their Max service). Assuming that the baseline sports package is between $40-50/ month (likely the latter if Warner purchases CBS/Paramount), add-ons could take the price to YouTube TV’s current $73/ month rate (but without some local channels).

We had several thoughts when this was announced. First, Comcast (Peacock/ NBC) was not included. While our understanding is that they could eventually join, their omission is noticeable and places further pressure on Peacock to grow and scale faster. There was a lot of speculation if this venture was foreshadowing that Warner had retained their NBA rights, but most pundits (see this insightful CNBC Tom Rogers interview) seemed to think that the final decision had not been made.

Second, this should create a unique sports-focused advertising opportunity. Any slots created through the combined entity should be more valuable than what could be achieved for any single channel. This certainly helps the venture as well as the companies interested in reaching this viewing segment.

Finally, this development accelerates the demise of the traditional cable package, and, as a result, diminishes the value of cable television. As one of you said earlier in the week “The ice cube is going to melt faster now.” Where this leaves local broadcasters is unknown (particularly NBC affiliates). Stay tuned for more updates.

In a related disclosure, Google, in their official blog, via Neal Mohan, YouTube’s CEO, disclosed that YouTube TV had eclipsed 8 million customers and YouTube Music had surpassed 100 million subscriptions (including trials). This would put YouTube TV behind DirecTV (who formerly had exclusive rights to the NFL Sunday Ticket) but well ahead of Dish. We think it’s a matter of time (as broadband penetrates the countryside) until YouTube TV surpasses both of the satellite providers.

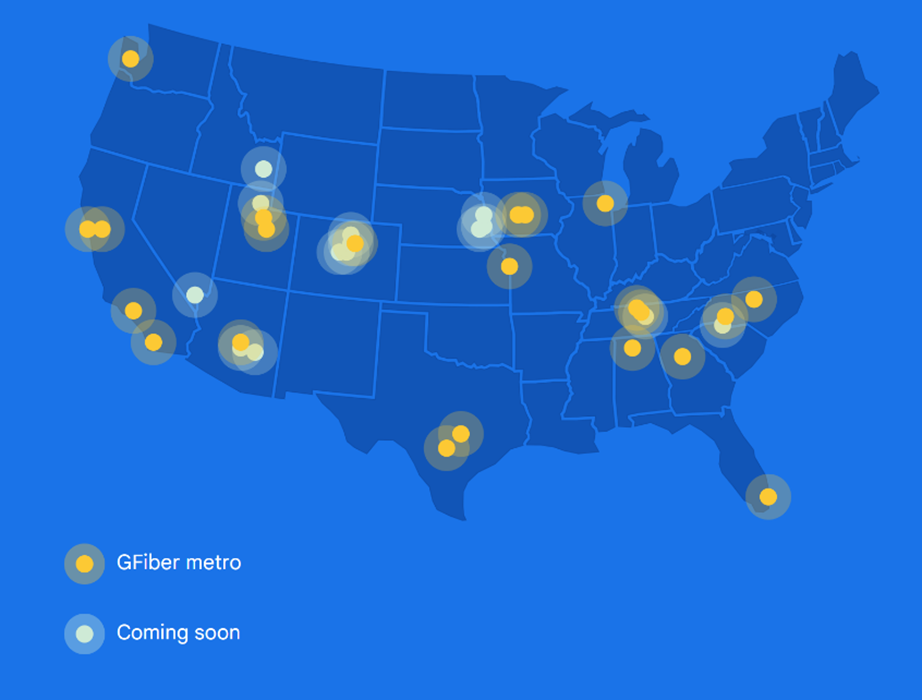

But achieving the 8-million milestone was not the biggest announcement of the week from Google. On Monday, Google announced through various news outlets (Reuters article here) that they were going to seek third-party investors with the eventual goal of fully separating GFiber (formerly Google Fiber) from Alphabet. The additional funds would be used to accelerate their fiber builds.

As we discussed in the interim Brief last week, Google has plenty of balance sheet flexibility to fund some GFiber expansion (they had $111 billion in cash/ marketable securities at the end of 2023 with only $13 billion in debt). Clearly, there are other ways the company would like to use those funds, however, and there would be high interest from many parties (private equity, AT&T/ Gigapower venture, T-Mobile, or maybe one or more of their Fab Five brethren), some of whom could contribute content or a wireless base to the entity).

We especially like the idea of T-Mobile investing in GFiber. With Google out of the video business, there’s little need for lots of equipment swaps common with retail stores. GFiber could easily form a “store within a store” presence within all Metro and Magenta doors. And there is some but not complete overlap between the GFiber and T-Mobile’s fixed wireless footprints which would immediately bolster T-Mobile’s broadband ambitions.

While T-Mobile might be the better strategic fit, we think that AT&T is the more likely suitor. As the nearby map shows (link to cities here), GFiber has Austin and San Antonio in Texas, but no presence in the Dallas/ Ft Worth or Houston areas. And GFiber has a modicum of the Sunshine State covered (roughly a third of Miami – that’s it). AT&T also contributes a lot of scale economies to the venture with their construction and engineering capabilities. And Ma Bell would receive all of the benefits described for T-Mobile with many months/ quarters of converged billing under their belt. As long as the stake is small, the FTC/ FCC/ DOJ would probably accept it as a means to increase competition. Bottom line: A separate GFiber is an extremely exciting development that accelerates someone’s fiber plans – we’re just not sure who wants it more.

Fourth quarter earnings—out of favor

In our previous earnings analysis, we looked at earnings from Verizon, AT&T and T-Mobile. Now that Charter Communications has reported, we have a pretty good idea of how the traditional cable providers did. As the nearby stock chart for Charter shows, the Street did not react favorably to their earnings (shares had fallen by nearly $100/ share or 24% between Thursday’s close and the following Wednesday), and Comcast (who is much more diversified than their Stamford-based peer) declined 8% in sympathy. Overall, both stocks have had a dismal two weeks and are now down more than $20 billion since the start of the year. Comcast is in danger of dropping to the third most valuable US telecom behind Verizon and T-Mobile.

Before diving into why cable is now out of favor, a quick recap of the key points from the previous Brief:

- Postpaid growth at Verizon was surprisingly strong, driven by the adoption of MyPlan accounts (which was disclosed to be about 30 million lines at their Analyst event last week). We continue to believe that a meaningful portion of their postpaid phone net additions came from prepaid upgrades, and that their growth estimates are reflective of wholesale service growth as well as a $4/ line price hike to Get More /Play More /Do More /Start 5G plans;

- AT&T, like Verizon, continues to struggle with Business Wireline as they lose share to Masergy/ Comcast, Charter, and Zayo. But they are diligently building out their fiber footprint, and as we will describe below, are holding share gains as they introduce bundle discounts. Debt reduction remains a top priority (AT&T has the largest deleveraging need in telecom);

- T-Mobile has a lot of business wireless momentum heading into 2024 and will generate a lot of free cash flow as they dramatically curtail merger charges and capital requirements. Besides disclosing that they

are lookinghad looked at possibly acquiring US Cellular (shocking no one), they also tempered expectations that fixed wireless net additions would accelerate, guiding to 400,000 net additions per quarter versus the 500,000+ run rate.

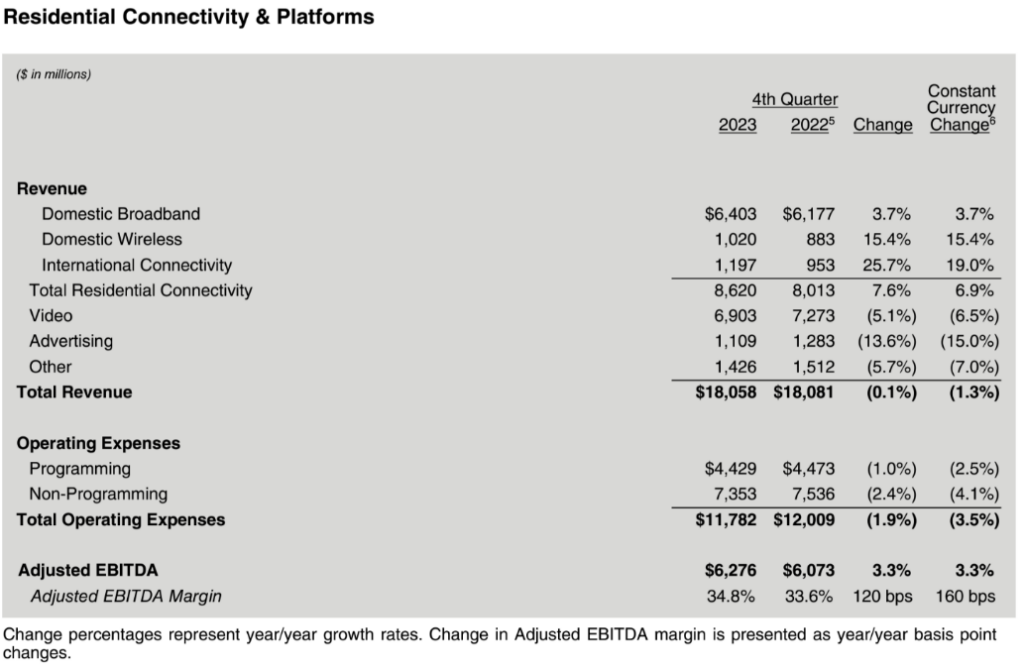

We ran out of room in the previous Brief to discuss Comcast’s earnings. Frankly, the cable side was not much better than Charter’s, but Comcast has a more diversified base of businesses, and some of them (studios +4.3% rev. growth yr/yr, theme parks +12% rev. growth) had exceptional quarters. The following table from Comcast’s earnings release describes the state of the domestic connectivity business:

Unit volumes fell across the board for domestic connectivity: 34K fewer broadband Revenue Generating Units or RGUS, 389K fewer video RGUs, and 295K fewer voice RGUs. The company responded by taking a host of price increases described in last week’s Brief (mostly in video, but also a small monthly service rate increase for broadband) to bolster average revenues for the remaining customer base. And, during the Q&A (transcript here), CFO Jason Armstrong made the following statement (emphasis added):

“Domestic broadband was once again driven by very strong ARPU growth of 3.9% for the quarter and for the year, landing at the high end of our historical 3% to 4% range, while our base of 32 million broadband subscribers remained stable over the past year, including the 34,000 subscriber loss this quarter. We remain focused on competing aggressively, but in a financially balanced way, as evidenced by this quarter and past year’s results. With the broadband marketplace remaining extremely competitive, we will continue to manage this balance and expect ARPU growth will remain strong within our historical range and continue to be the driver of our residential broadband revenue growth in 2024.

While we do not expect subscriber trends to improve in the coming quarters, we do expect them to improve over time. At the macro level, customers are consuming more, connecting more devices in their homes and are using them for applications that collectively require even faster speeds, lower latency and higher reliability over time. These secular trends are all moving in our favor, and we believe our marginal cost to add capacity to our network is unrivaled. This is why we are investing in our fiber-fed network to further increase capacity and offer multi-gig symmetrical speeds ubiquitously across our footprint and ensure that we stay way ahead of consumer demand with the best broadband offering and experience.”

This sentiment was echoed by Jessica Fischer, Charter’s CFO in answer to a question:

“Early on, we had some carryover from the Disney dispute and the August rate [increase] event that we talked about in last quarter’s call. We had expected November and December to recover to the levels that we had seen going into that event, and they didn’t. But as we exited the quarter, we saw December slightly negative, and January net adds are consistent with what we saw in December. So that environment does continue.”

The issue of pervasive net addition sluggishness, driven by lower than expected gross adds, continues for the two largest cable providers. This is attributable to two factors:

No promotional rate (e.g., Spectrum’s $39.99/ mo. 1 Gbps rate currently offered in Kansas City with a 24-month price lock – month 25 the rate jumps to $119.99/mo.) is going to woo back large quantities of customers who have switched to fiber. There may have been some movers who jumped on that offer (especially when stacked with a free wireless line for a year), but customers who left Spectrum are not returning. Newly built areas are outperforming expectations (and the faster those are completed, the better – definitely Charter’s strategy), but non-rural markets lost close to 100K customers. That’s due to the success of FTTH providers such as Frontier and AT&T (roughly 46% of Charter’s homes passed overlaps with these two providers per their 10-K filing), but also fixed wireless (which Charter described as a “moving target”).

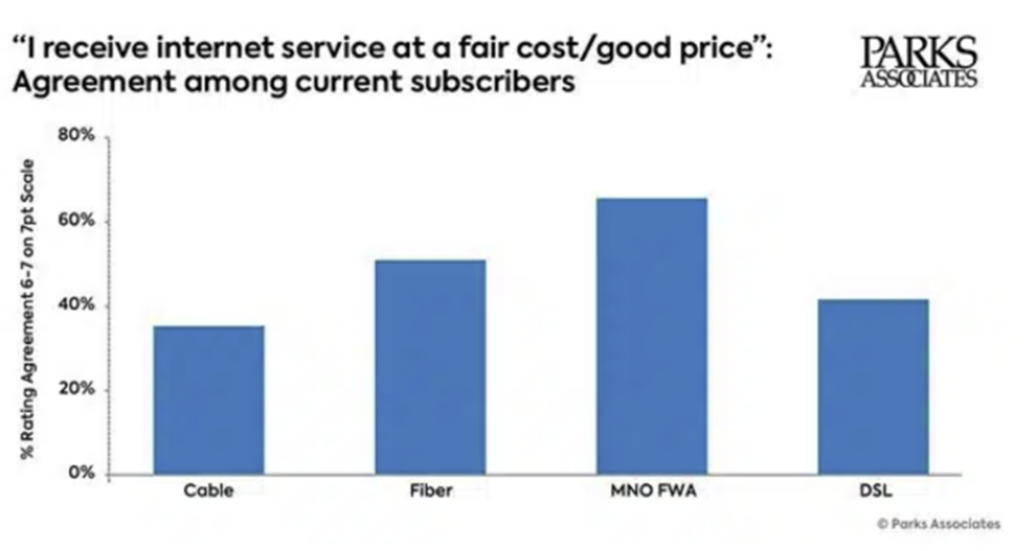

Nearby is a chart shared in a recent Parks Associates release indicating the price/ value customer satisfaction rates for various technologies. The news release summarizes their findings as follows:

“The firm found that 66% of subscribers that get 5G or LTE FWA from MNOs consider their prices to be fair or good. This compares to 51% of fiber subscribers and 35% of cable subscribers. In addition, 62% of FWA subscribers feel that it is easy to contact customer service or technical support personnel.”

The KPI each cable company should report is the recapture/ return rate. For every 100 customers that leave Comcast or Spectrum, how many return in 90 or 180 days. Cable companies should be relentless in their pursuit of that goal, which we think will involve changes in engineering, operations, and product.

- One of the best products to help cable recapture higher-value broadband customers is wireless. Net additions slowed down in 4Q 2023 as the Apple iPhone 15 was rolled out. If T-Mobile had their way, Apple would introduce new iPhones semi-annually – more changes drive increased consideration activity which is always good for Magenta. Why was the iPhone 15 launch a down quarter for Xfinity and Spectrum (we were very surprised no analysts asked that question on either Comcast’s or Charter’s call)?

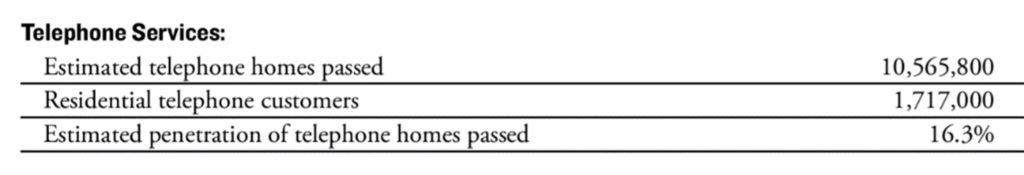

Mobile needs more attention. Nearby is a snippet from the 2010 Charter annual report summarizing their telephony-enabled homes passed, their actual digital phone customers, and derived penetration. Video, in comparison, had a homes passed penetration at the end of 2010 of 38.4%. If Charter, which was just emerging from bankruptcy at the time of this report, managed to penetrate over one sixth of their homes with digital phone (over 6 years), why is a homes passed penetration rate of ~ 6-7% for mobile acceptable today? Said differently, if mobile had a 16.3% (or 17.3% in the case of Comcast at the end of 2010) penetration of total homes passed (roughly a third of all broadband homes would have Spectrum or Xfinity Mobile), would we be wringing our hands about broadband RGU growth (we strongly agree that wireless+broadband will be a more difficult bundle to break than broadband alone)? No, we would be anxiously but excitedly determining the EBITDA impact of cable’s substantial metro overbuild.

Both companies should set a goal of penetration that paces with the digital phone gains. That can be achieved with several product enhancements. Comcast and Charter are correct – their product is better because of their overlay Wi-Fi presence. More reinforcement (proof points) are needed. And, as we have emphasized since 2019, use Peacock Premium (especially in an Olympic year) to drive additional RGU growth. Or, in an even bolder move, offer Peacock and Max (both premium) to all new wireless customers as a friendly dig to Verizon (and legacy dig to AT&T).

Bottom line: Cable’s only current growth engine (wireless) needs to grow even faster to prevent a long-term churn issue. It has a higher return than any share buyback or dividend increase. It also could help regain lost broadband customers in metro markets. While we think the market overreacted to slightly negative numbers, the underlying issues are clear – customers want either a) lower prices with greater reliability, which appears to be favoring fixed wireless, or b) higher quality 1 Gbps+ speeds which seem to be favoring new fiber entrants. We think that using overbuilder history as a predictor of future activity is useless because of the high gross and EBITDA margins each new connected home generates, as well as the breadth of build, especially with AT&T and Frontier.

That’s it for this week. In two weeks, we will continue this discussion and also provide a peek into what’s expected at Mobile World Congress. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, let’s go Chiefs and Davidson College Basketball!