Projects in Vermont and New York include factory refurbishment

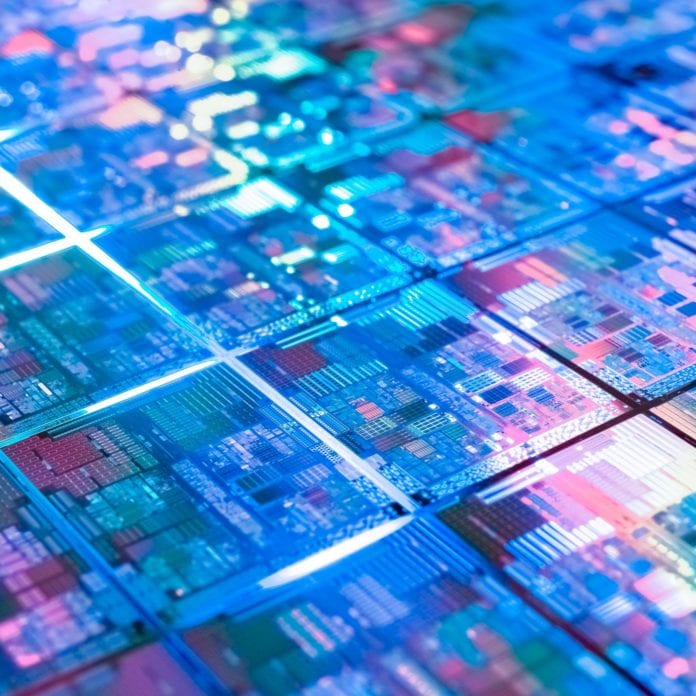

The Biden administration has announced $1.5 billion in potential funding to support multiple semiconductor manufacturing projects in New York and Vermont.

The Department of Commerce and GlobalFoundries have signed a non-binding agreement of terms for the funding under the CHIPS and Science Act. The projects are expected to include direct funding plus loans, and about $10 million in dedicated funding for workforce development, with total potential public and private investment for the projects estimated at about $12.5 billion, according to Commerce.

In a release, the Commerce Department said that GlobalFoundries’ chips “are fundamental to everyday applications that impact all Americans, from blind spot detection and collision warnings in cars, to smartphones and electric vehicles that last longer between charges, to secure and reliable Wi-Fi and cellular connections.” Shortages of these chips during the Covid-19 pandemic contributed to availability and price crunches for a broad range of goods, the agency added—particularly in the automotive sector. GF also provides chips to support defense applications.

The proposed funding would involve three projects:

-A new, large-scale 300-mm fabrication facility “expected to produce high value technologies not currently available in the U.S.” and leverage existing infrastructure at a GlobalFoundries site in Malta, New York, for faster realization of the facility.

-Expansion of the Malta fab, including a strategic agreement with General Motors for the automotive manufacturer to lock down a domestic supply of essential chips.

-A third project would modernize an existing fab in Burlington, Vermont to support 200 nm manufacturing, in what the Commerce Department described as the “first U.S. facility capable of high-volume manufacturing of next-generation Gallium Nitride on Silicon for use in electric vehicles, power grid, 5G and 6G smartphones, and other critical technologies.” The fab would also include an on-site solar system and a focus on leveraging other sustainable and “carbon-free neutral energy.”

The two Malta projects are expected to triple existing capacity and increase wafer production to 1 million per year, once all the phases are complete.

There are only four companies outside of China that currently provide “current and mature foundry capabilities” at the scale that GlobalFoundries does, the agency added, and GF is the only one of those which is based in the United States.

“These proposed investments, along with the investment tax credit (ITC) for semiconductor manufacturing, are central to the next chapter of the GlobalFoundries story and our industry. They would also play an important role in making the U.S. semiconductor ecosystem more globally competitive and resilient,” said Dr. Thomas Caulfield, president and CEO of GF. “With new onshore capacity and technology on the horizon, as an industry we now need to turn our attention to increasing the demand for U.S.-made chips, and to growing our talented U.S. semiconductor workforce.”

The Commerce Department said that the proposed projects would create about 1,500 manufacturing jobs and about 9,000 construction jobs over the next 10 years.

In related news, Intel is reportedly in conversations with the U.S. government to make its case for receiving upwards of $10 billion in CHIPS Act funding.