Greetings from Spain, Florida, and the Midwest. Pictured is Jim wearing a replica Roman emperor helmet while visiting filmmaking friends in Madrid. This has been an action-packed two weeks with Mobile World Congress and the C3 Transform conference. This week, we will have a full market commentary (which includes a mini-Brief on the FCC’s proposed “Bulk Ban”) and a very short summary of The Sunday Brief for new subscribers.

Many thanks for the many referrals since the beginning of the year. We have grown over 200 e-mail users and equal number of WordPress subscribers in just ten weeks. It’s humbling and gratifying to hear from dozens of you after every major Brief is published. And our website’s unique visitors (even without the Apple iPhone updates published every September-December) are higher now than ever. Thanks for your readership, input, and ideas.

Next week, on top of the normal condensed market commentary we usually include in interim Briefs, we will include our thoughts on Stephen Wolfram’s 2023 publication “What is ChatGPT Doing… and Why Does It Work?” It’s a short (102 page) but sweet assessment of how generative Artificial Intelligence (AI) works and was recommended to all participants at the C3 Transform conference. Amazon has the book in Kindle or paper forms here.

The fortnight that was

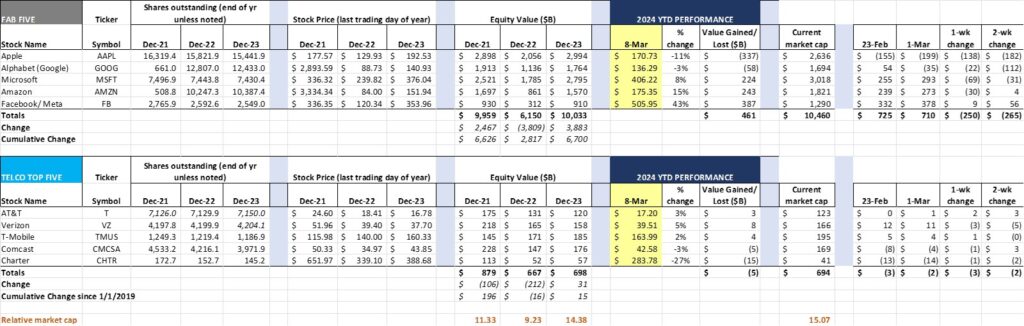

The market seems to have come to the conclusion that the Fab Five have peaked. This may change after first quarter earnings (and corresponding changes to guidance) are released, but the expectations underpinning high stock prices are shifting downwards.

One of the reasons why the Fab Five have gained trillions of dollars in value is because they have global addressable markets. We have contrasted Microsoft’s and Verizon’s market opportunities in many previous Briefs. Now, it appears that the higher weighting might be helping the Telco Top Five and many of their peers.

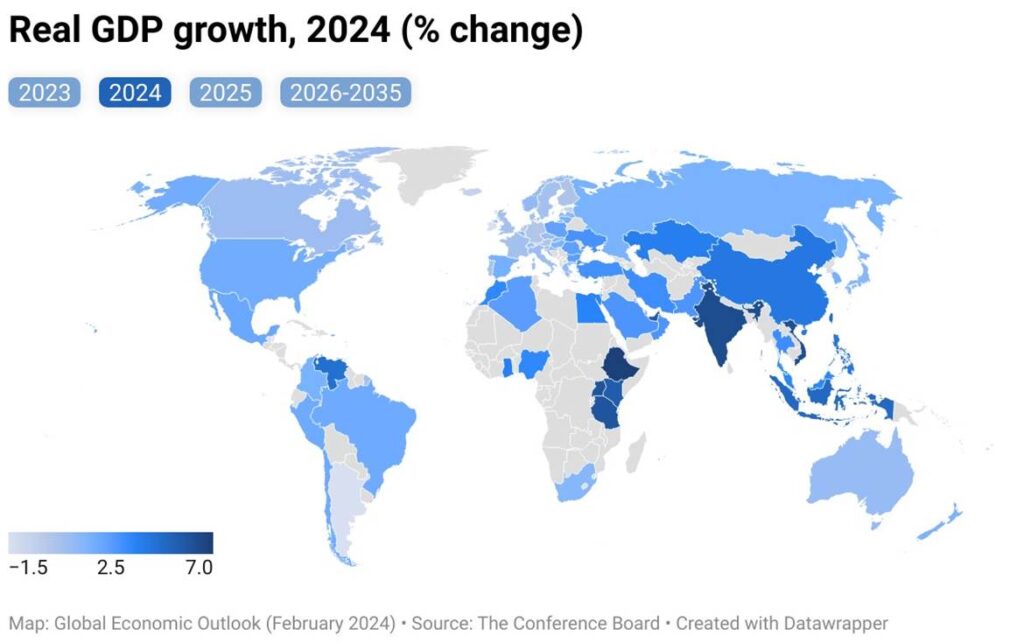

Nearby is a picture from The Conference Board of the anticipated growth for the US (1.9% Real GDP growth expected for 2024), the EU (0.9%), and various other world regions (China and India at 4.1% and 6.3% respectively). All of these are down from 2023. This is a sobering picture for those companies hoping to rapidly expand abroad. Forecasts look a little better, but multiple expansion is not in the cards until the second half of this year.

As a result, companies with more US exposure (and particularly those with access to government funds approved for infrastructure) look a lot more promising. This has helped companies like AT&T, Verizon, and T-Mobile (USA) who derive a large majority of their earnings in the US.

The FCC takes on bulk billing

On Tuesday, FCC Chairwoman Jessica Rosenworcel issued a press release indicating that she was circulating a draft Notice of Proposed Rule Making (NPRM) that would “seek to eliminate “bulk billing” arrangements imposed on tenants that impose a specific broadband service provider for their household.” The news release goes on to state:

“Specifically, the Notice of Proposed Rulemaking would propose banning bulk billing arrangements by which tenants are required to pay for broadband, cable, and satellite service provided by a specific communications provider, even if they do not wish to take the service or would prefer to use another provider. It proposes allowing tenants to opt out of bulk billing arrangements.”

The final NPRM has not been published as of the publication of this Brief, and we share the frustration that can occur when selling into long-standing, exclusive relationships. Here are a few of the questions/ observations from our Multi-Dwelling Unit experience:

- Would this ban apply to all Multi Dwelling Units? For example, providing service to a 75-room assisted living facility (see TV comment below given the high demographic correlation) would carry the same restrictions as a rural trailer park or a 1,400-unit suburban metroplex? It’s important to note that there are natural monopolies for smaller complexes and many of those exist in rural markets. We would strongly recommend that any rule consider the underlying cost economics for sub-100-unit complexes.

- If the landlord includes broadband in the rent (many providers do), how would a ban be implemented? Would the landlord be expected to lower rent (and does the FCC or any federal agency have jurisdiction to change what is charged for rent)? Or can the landlord say, “Have all of the fixed wireless you want, but your rent is not changing.”

- If the answer to #2 is no, what’s to prevent all of the exclusive relationships today from converting to an “in the rent” model as opposed to a separate surcharge? For example, if a Homeowners Association (HOA) has dues already in place, but separate out broadband as a separate payment, why not include broadband in the monthly or annual dues?

- Assuming the “in the rent” model takes off, will the FCC, in conjunction with state PUCs, also mandate competition for other utilities included in the rent (resulting in mandated multiple electric, gas, water, recycling, and trach pickup suppliers)? If it’s damaging to society for private companies to have exclusive arrangements, why not open up all utilities to this scrutiny?

- If the landlord receives a bulk data offer for $29/ unit/ month for 500 Mbps and charges a market-based rate (e.g., $70/ mo.), should the selling Internet Provider be subject to the ban if the landlord is reaping the majority of the profits? Said differently, won’t this action cause all prices to rise?

- What is the (unintended) effect of mandating broadband competition on TV rates (for those of you who are not aware, bulk purchases of TV packages generally take place at a meaningful discount to individually priced content)? If each tenant were forced back to “single family home” prices, regardless of the number of competitors, wouldn’t the TV rate rise for those customers who elect to take a broadband + TV bundle? Probably not intended, but the FCC will accelerate video “cord cutting” should this NPRM be enacted. And, as mentioned in #1, this would impose a massive price increase on those with fixed incomes.

- If the HOA voted last month to adopt a bulk billing scenario because it brought fiber services to the community, isn’t the FCC obviating the bylaws of hundreds of HOAs across the country because a small minority opposed the proposal? If another HOA were to vote to approve a single provider and kick out a copper-based solutions provider (e.g., Lumen or AT&T) in order to bring fiber to the community, would the FCC sue the HOA? On what basis?

Bottom line: Nice political headline, but the devil is in the details, and there is an “in the rent” loophole immediately available which will be used by building owners to circumvent the ruling. We struggle to see how this will survive legal and practical scrutiny, especially with low-income TV subscribers.

Clash of the titans at the Morgan Stanley Conference

Morgan Stanley had their Technology, Media, and Telecom conference this past week and each of the Telco Top Five presented. We could write an entire Brief on the discussions with the fixed wireless challengers (Verizon, T-Mobile) versus the cable incumbents, but will let these two quotes, one from Charter CEO Chris Winfrey and the other a lengthy quote from AT&T’s Jeff McElfresh do the talking for us:

Chris Winfrey (Charter): “If you took a look at the largest telcos, I won’t pick on anybody by name, but they have a mobile service that covers 100% of the country. And their ability to have a converged product offering might be in 20% max or 20% of their footprint. So they really can’t go — I’ve heard people say, well, we don’t believe in convergence. Well, the reason you don’t believe in convergence is because you can’t deliver it in 90% of your footprint.

“And so I get it. But we can deliver that convergence at seamless connectivity. It’s gigabit wireless everywhere we operate. And I think that’s a real advantage in the wireline overbuild and in the cellphone internet space.”

Jeff McElfresh (AT&T): “…if I could introduce you to a prototypical customer who is on our fiber network, they’re going to talk to you. They’re going to give you feedback on AT&T that’s going to include things in words like love. I mean the customer adoption of our fiber product is the fastest I have ever seen in my history with this company. We build it, and within 12 months, 1/3 of the people self-select. It’s not hard to sell it because of the engineering and the quality of the design.

“And we don’t have contracts. To your point, it’s everyday simple pricing. There is no entry-level pricing that resets a year later, and our churn, solid.

“Our investment thesis, every time we think about passing and investing in a home, unlike fixed wireless, yes, I’m going to invest fiber to connect your home up, Simon, but I’m connecting up your home with fiber. One day, you might not own your home. Somebody will own your home and they too will be an AT&T fiber customer, which is kind of different when you think about serving broadband connectivity with fixed wireless. It’s a bit more of a company to customer dynamic. For us, as we think about investing in fiber, we think about it long term.

“To do that, I need a sales organization to penetrate it. And we’re approaching — we’re a little over 39% pinned on our consumer network, which is just fantastic. It’s proof that all the incremental inventory we’re bringing on is at the same time getting penetrated very quickly. And every time that happens, that is an investment dollar turned into revenue quicker than our business case assumed. And as I mentioned earlier, with the convergence mindset, selling not only that and installing only the fiber service by bringing with it mobility, it’s just a real winning value equation. And those customers that are converged that have our wireless and our fiber have the lowest churn, the highest LTV, gives us the highest NPS and they use words like love it. So the success for us is we just need more of them. So investors should say, Jeff, bring me more of them because more of them results in more operating leverage and more free cash flow production, which gives us choice of what we do with our capital.”

This contrast is important as AT&T is deploying throughout several large Charter territories: Dallas/ Ft. Worth, Austin, and San Antonio, TX; Los Angeles and San Diego, CA; Charlotte and Raleigh/ Durham, NC and Columbus and Cleveland, OH. AT&T still has a lot of issues (over-levered and understaffed are two that come to mind), but Jeff’s comments convey a deep cultural commitment to challenge cable. The current AT&T model is not the previous overbuilder model. Bottom line: AT&T is the greatest threat to cable, especially as moving increases. And a reinvigorated Verizon Fios with next-generation optical network terminals (ONTs) might not be far behind.

Sunday Brief FAQ

As indicated above, we have many new subscribers to the Brief since the beginning of 2024. Here are the answers to four questions we receive monthly:

- Why is the Brief free? Many of you are astounded that we publish bi-weekly research for free (and nearly always include links to the underlying resources if/ as available). The simple answer to this question is “because we can.” We don’t sell mailing lists. We have no sponsors or banner ads. We don’t market the Brief outside of Jim’s LinkedIn and X posts. But we do get a lot of interactions from the Brief every week, and sometimes those interactions turn into Patterson Advisory Group clients.

We’ve toyed with the ideas of a) Sunday Brief merchandise, namely a t-shirt, and b) a semi-annual State of Telecom “for fee” presentation complete with charts, graphs and timelines we keep on each of the Fab Five and Telco Top Five. Still might do one or both of these, so stay tuned.

- How did the Brief get started? Jim was formerly the President of Wholesale for Sprint. As a part of that role, he had to describe what was going on in the worlds of cable (VoIP services), Machine-2-Machine (e.g., the Amazon Kindle), and IP transport. This was distributed to Sprint executives every other week. After Jim left Sprint in September of 2009, several executives asked if he would resume publication and the Sunday Brief was born (the joke, as long-time readers know, is that the Brief is rarely that. TLDR (Too Long Didn’t Read) was one of the problems with many early Briefs?).

- When did the Brief begin to include market capitalization charts each week? While we have tracked the “Four Horsemen” prior to Facebook’s IPO, we began to include this on a regular weekly basis with the March 1, 2020 edition (link here).

- What Brief has received the most views? This is a tough one as we get a lot of views through RCR Wireless News who has republished the Brief since 2009. It’s likely our “Dear Marcelo” Brief from August 2014 or “Dear John” post from 2012 (available upon request), along with our 2022 retrospective on John Legere here.

Thanks again for all of your support. In two weeks, we will begin our multi-part preview of first quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC and Davidson College basketball/ baseball!