Nokia is preparing an ultra-compact version of its private cellular network solution to pitch to the small-and-medium sized enterprise (SME) market, particularly as it aligns with its focus on selling edge-based network-and-compute solutions to Industry 4.0 sectors. Speaking with RCR Wireless at Mobile World Congress (MWC) in Barcelona last month, the Finnish network vendor said it hoped to have the new product ready for the second half of 2024.

The ultra-compact version of its Digital Automation Cloud (DAC) product, as yet unnamed, will support a couple of radio cells, as required, and compete with Wi-Fi solutions in small enterprise venues. It will follow the firm’s DAC (Private Wireless) Compact service, launched in October and February in the US and Europe, which supports up to four radios in small-to-mid sized indoor venues of 5,000 to 20,000 square metres.

Its DAC product, which has fuelled most of its private 4G/5G sales, supports up to 100 cells for indoor campuses larger than 20,000 square metres. The three-tier DAC portfolio will also complement its macro-sized Modular Private Wireless (MPW) product, used for wide-area private 4G/5G projects, and its micro-sized Perimeter Network (NPN) solution, which fits in a bag, and is customised and resold by specialist channel partners.

The latter is used mostly for temporary LTE/5G connectivity in difficult scenarios, such as by the emergency services and armed forces. Along with network slicing, sold as a capability to network operators rolling out standalone 5G (SA) infrastructure, the new ultra-compact DAC solution rounds out Nokia’s cellular network proposition for enterprises, and, it reasons, gives it the most comprehensive portfolio in the market.

Speaking at MWC, Stephane Daeuble, responsible for enterprise solutions marketing in Nokia’s enterprise division, explained: “We’ve got more and more large companies asking us for smaller sites. We’ve done their large sites and we’ve done their medium sites, and they’re now asking us to cover 2,000 small distribution centres with the same solution and the same management centre. But they want something cheaper for small sites.”

The new product is the result of a partnership with Intel, flagged at MWC, to run virtual baseband capabilities on its DAC line. In other words, by using Intel’s so-called Enterprise Edge RAN in the DAC system, to run the baseband processing unit in the radio as an application on its Mission-Critical Industrial Edge (MXIE) server. “It means we are removing one more [server] box – which means we can go cheaper and even more compact,” said Daeuble.

Around the back of Nokia’s monster booth at MWC, he pointed the other way, and said: “You’ve seen the booth; seventy-two metres across, and the technical room is way over there. There must be 20 meeting rooms in between. It’s on private 4G; one indoor picocell – running at 100mW power, instead of 250mW. So I’ve got two and a half times less power, and four bars [signal] at a distance of 72 metres – through walls, meetings, demos and everything.”

Integration of Intel’s virtual open RAN (“capable”) baseband into the MXIE server – already running the core network in the DAC system, plus other industrial edge applications, potentially – opens up a new part of the enterprise market Indeed, it opens up the lion’s share of an addressable market that could stretch to as many as 14 million venues, potentially – according to a seminal Nokia-sponsored forecast from five years ago.

Daeuble said: “We said 14 million [industrial] sites – which is one million large sites, two or three million mid-sized ones, and everything else is small or very small. So we need to tap into those markets. Our customers say, ‘Okay, we’ve done the 40 big ports; I want to do the next 60 medium-sized ports, and then the next 200 small-sized ports’. Those markets were not very aware of private wireless before, or willing to do much with it. But now we can present them with a single radio and a single blade, and cover the entire [small-sized] port.”

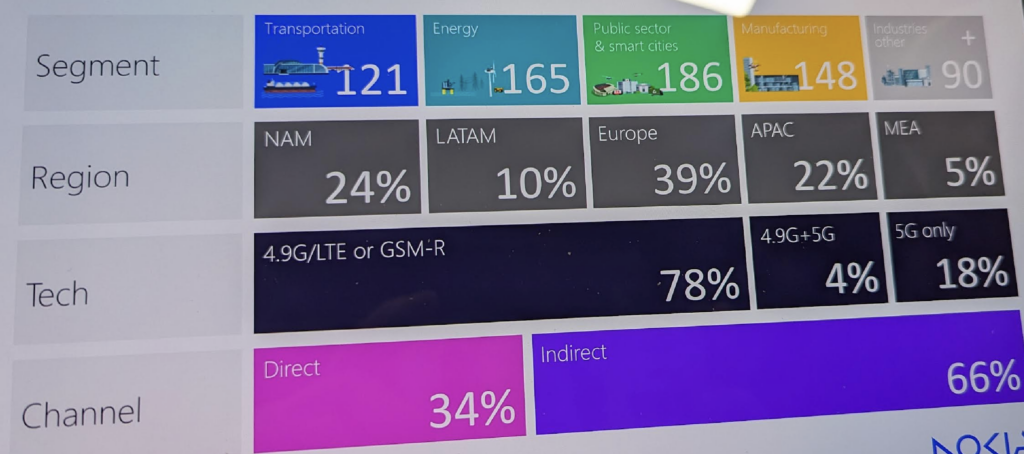

Nokia claims to have 710 customers for its private 4G/5G solutions, as of now (March 2024). These comprise 186 customers in the ‘public sector and smart cities’ space, 165 in energy and utilities, 148 in manufacturing, 121 in transportation, and 90 in ‘other industries’ (see image). “We have 10 new markets this year as well,” said Daeuble. “Which is good – it shows we are covering the ground.” In particular, process manufacturing has picked up, he said.

“We had ignored some markets, which have huge potential, to an extent. One was process manufacturing, which splits into about a dozen segments – petrochemicals, oil refineries, food production, pharmaceuticals; all of these – where our stuff makes a lot of sense, and brings lots of value. Because they’re less advanced in terms of automation, for example. So we’ve put a lot of focus on process manufacturing and we are getting a lot of big deals in it.”

High-profile clients like BASF, Chevron Phillips, and Dow are all in process manufacturing. The total 148-count in the manufacturing sector, as a whole, has grown out of nothing four years ago, he noted, when the DAC product was first introduced – whereas the energy industry and public sector has been taking wide-area private networks and public safety solutions from Nokia for decades. “We only started four or five years ago, and it has almost caught up.”

The transport sector is also growing fast for Nokia, he said – mostly on the back of private 4G/5G deployments in airports and seaports. Meanwhile Nokia’s regional split for private wireless customers shows Europe remains its stronghold (39 percent of customers), but North America gained a whole percentage point in terms of cumulative market share in 2023, alone, to finish the period with 24 percent, leading from Asia Pacific with 22 percent.

“We had a very, very good 2023 in North America,” commented Daeuble. Other statistics of interest, from the Nokia overview, include the 4G/5G split among its enterprise customers, which says 82 percent “basically use” 4G/LTE, compared with a 5G base of just 18 percent. “That hasn’t moved at all; 4G is still dominant,” he said. “What has changed a lot is the channel split,” he added, referring to how Nokia sells in the market.

Two third (66 percent) of its private LTE/5G sales are coming via indirect integrator, reseller, and operator channels, it said; the other third is via Nokia’s own enterprise sales team. “Two or three years ago this was the other way around. So the indirect channel is growing really fast. So that’s the market.” There was a question, in there, too, about the impact and meaning of Kyndryl’s decision to also sell rival gear from HPE, as announced at MWC.

Daeuble said: “None of our partners are exclusive. That’s the reality of it. So they are all fighting in the same market, and it is entirely likely that we will work with others, too.” Indeed, Nokia has just signed with Wipro. At MWC, Daeuble also highlighted the work of other integrators like DXC (“big deals, great traction, fantastic focus”) and smaller regional players like Smart Mobile Labs in Germany (““some of the best and most focused are smaller in size”).

US reseller Future Technologies also got a shout (“amazing; really active, really good – they’re running shows, going to customers, collaborating with us”). He also pointed to Nokia’s new deal with Dell, which will see the US computer/server maker sell DAC as its preferred private LTE/5G solution. “It will be a big channel for us; another reseller channel, basically. It is a new breed of partner to a degree,” he said.

Nokia puts Dell servers in its higher-end MXIE solutions; HPE servers go in the DAC Compact product. There was also talk about generative AI, but we have covered that.

Nokia claims a 51 percent share of GSA’s recorded private LTE/5G installations, as contributed by (various) members of the vendor community.