Greetings from the Carolinas and the Midwest. Our Davidson dinner included local telecom/ tech leaders as well as many Davidson students. A great way to get caught up with several of you – thanks for making the evening so special.

We have a full market commentary and a relatively short earnings analysis section. Based on feedback from several dozens of you, the Brief must be kept short (2,000-2,500 words is hardly that) to remain relevant – we’ll try!

Speaking of earnings analysis, here is the latest calendar (Alphabet, Amazon, and Microsoft will announce their earnings schedules soon):

| Company | Day | Date | am/pm |

| Verizon | Monday | April 22 | am |

| AT&T | Wednesday | April 24 | am |

| Meta | Wednesday | April 24 | pm |

| Comcast | Thursday | April 25 | am |

| T-Mobile US | Thursday | April 25 | pm |

| Charter | Friday | April 26 | am |

| Apple | Thursday | May 2 | pm |

We will include the hyperlinks to each of the conference call details in next week’s interim Brief post.

The fortnight that was

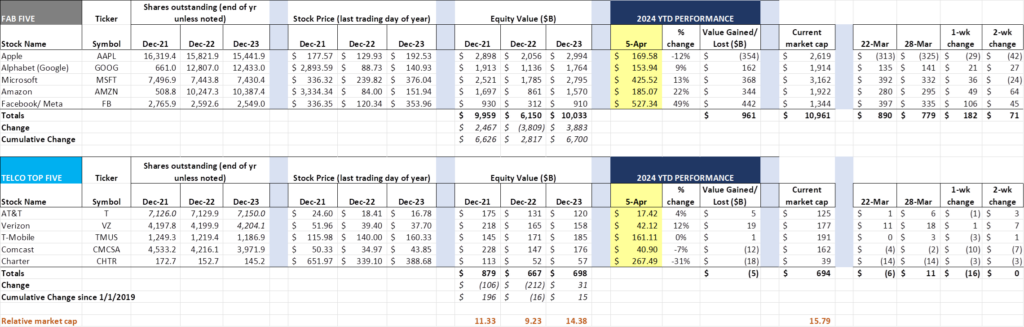

This was a decent week for the Fab Five (+$182 billion last week, +$961 billion year-to-date 2024) as the new quarter began and thoughts turned to earnings. It was not so great a week for the Telco Top Five (-$16 billion, -$5 billion) as both Comcast and Charter continued to drag. Comcast is now down 7% for the year while Charter is down 31%. Verizon is leading their telco peers year to date, driven by higher expectations for prepaid and fixed wireless. We analyze both below in our earnings preview.

Meanwhile, M&A rumors continue to accelerate. Per last Thursday’s report from Reuters (here), Google is giving serious consideration to purchasing marketing software company HubSpot for at least $33 billion. Both the article and our own net debt analysis (after quarterly earnings are announced) indicate Google could easily tap their $111 billion in cash and marketable securities to fund the acquisition. Alternatively, they might use this acquisition opportunity to float some additional debt, as their net debt level is a staggering negative $98 billion.

For those of you who are not familiar with HubSpot, they can be considered an alternative to Salesforce as a Customer Relationship Management (CRM) solution. There is likely an additional angle that Google has here (perhaps AI-driven) that would drive a meaningful premium. It’s a significantly larger dollar value than their next greatest acquisition (Motorola Mobility for $12.5 billion in 2011).

The news drove up HubSpot’s stock price to $670 on Friday. Many are wondering if this is the beginning of a new M&A wave that will peak around November’s election. More to come, but this would be a very bold software-focused move if Google proceeds with an offer.

Another rumor, which we addressed in last week’s interim Brief, surrounds T-Mobile and EQT-backed Lumos. This Morningstar report links to the original article from German newspaper Handlesblatt, which cites Deutsche Telekom executives. It appears to be a $1 billion investment with a focus on Virginia buildouts – chump change – barely a “toe dip” for Magenta. For an idea of the current Lumos footprint, check out this assessment from Broadbandnow.com.

We think that any announcement will coincide with earnings and serve as a funding mechanism to drive greater BEAD participation. As we have discussed previously, T-Mobile is smart to serve as the “letter of credit” not only for Lumos but other established rural local exchange providers participating in BEAD. It’s a relatively inexpensive way for the company to gain low-cost access for cell site backhaul while leveraging infrastructure funds to de-risk their investment. We await more details from the company but do not see any material regulatory hurdles.

Finally, we get to three very interesting new stories involving AT&T. First, there was a pretty severe data breach which went unnoticed and unacknowledged by the company for many months (The Verge alleges in this article that information about the accounts might have been out there since 2021). While the data included in the breach included social security numbers and dates of birth, no credit card or other financial information appears to have been compromised.

This is a big deal which will likely come up in the earnings conference call (which, as we outline below, will be strong). When 73 million customers are impacted, including 65+ million potential switchers (less than 8 million are current customers), it’s a highly sensitive issue. We have many questions on this event and will let the government get through their findings prior to drawing a final judgement. We also find it ironic that the company chose to advertise their cybersecurity prowess in this ad (nearby picture from that ad) while they likely knew that their own network had been breached. A head scratcher for sure and not a good encore to February’s widespread wireless network outage.

Second, AT&T introduced AT&T Air for Business on March 26th (press release here). This is a fixed wireless substitute for traditional copper and cable modem access (AT&T clearly states in the release that it is not a primary connectivity replacement for fiber) and will be launched in areas with adequate radio and backhaul capacities.

What intrigued us about this release is the two-tiered nature of their plans. The first is what we would expect – a “best efforts” plan that looks a lot like other fixed wireless solutions. The second, however, is a premium access plan described as follows:

AT&T Internet Air for Business Premium is $100 plus fees and includes a higher level of priority for the first 250GB of data used in each billing period – a benefit when the network is busy.

There is a longer footnote to further describe the service:

250GB at Higher Priority Level: Plan includes a network-based quality of service (QoS) feature that assigns a higher priority level (as compared to the Standard plan) for your first 250GB of data traffic originating on and traveling over the AT&T-owned domestic network in each billing period (excluding microcells, AT&T Wi-Fi service, and roaming partner networks). If you exceed 250GB of data usage in a bill cycle, then for all data usage for the remainder of the bill cycle, AT&T may temporarily slow data speeds if the network is busy. Feature does not (a) prioritize data traffic ahead of all other data traffic (which may receive a similar or higher QoS), (b) provide priority access to available network resources, or (c) provide preemption capabilities.

There’s a lot in that footnote. It was explained to me by a leading telecom analyst that this 250 GB would be traveling at a higher QCI level (think of QCI as the hierarchy of service levels). Just like we have lower QCIs for Visible data and some of the cable MVNOs (but not Charter) versus myPlan Unlimited Ultimate. Unlike Visible, however, this service from AT&T is marketed as a premium service.

The logic used to justify that this 67% premium is not a “pay to play” product is that the QCI protocol has existed for years, and AT&T is simply using the existing system to provide a higher-quality alternative to business customers. Meanwhile, letters are being written to the FCC asking for some spectrum slicing use cases to be ruled a violation of net neutrality because it would carry Broadband Internet Access Services or BIAS (versus private network data). Needless to say, we are very confused and hope that the Commission will define “pay to play” distinctly and promote more, not less, ways for wireless carriers to monetize their existing spectrum.

Finally, AT&T began to more broadly introduce a traditional telephone alternative to their hometown customer base. Per this article from Dallas Innovates, AT&T is beginning to roll out a wireless service to traditional telephone customers in their local territory that includes RJ-11 (traditional telephone jack) ports. This product uses AT&T’s wireless network as it’s primary and broadband as the secondary network (their business version of AT&T Phone – Advanced uses the wireless network as backup to the primary broadband network).

We are intrigued that a larger launch in Dallas is underway. The real value of this product, in our opinion, is in those 15-20 million households where AT&T is the current local (copper) phone provider today and is looking for regulatory relief. A lot of work has gone into creating a landline replacement product, and we look forward to seeing actual customer reaction to this Dallas/ Ft. Worth launch.

Finally, we would be remiss if we did not acknowledge the news this week that Crown Castle and Dish are in a major court battle right now over three feet of space. Per industry publication Wireless Estimator (article here):

“The legal battle centers around Dish Wireless’s use of additional space beyond what was agreed upon in the Master Lease Agreement (MLA) and subsequent Site Lease Acknowledgements (SLAs) with Crown Castle. The agreement specifies a monthly access fee, which escalates annually, based on the predetermined amount of space Dish would occupy at each site.

Crown Castle accuses Dish Wireless of occupying three extra feet of space at nearly 8,000 cell tower locations, contrary to the MLA’s stipulations that Dish pay extra for any additional space used beyond the contracted 5 feet by 7 feet of ground space per site. Despite Dish’s representation in thousands of SLAs that it would adhere to the agreed-upon space, Crown Castle asserts that Dish has consistently exceeded these limits, leading to the current legal dispute.”

It does not appear that either party has an appetite to settle the case. Judge Sarah Block Wallace is expected to rule on the case later in the month.

Q1 earnings preview—will Verizon be the most valuable telecommunications company after Q1 earnings?

As we stated in the last Brief (here), this is going to be a very interesting earnings cycle in the telecommunications industry. AT&T is hitting its fiber deployment stride. Charter and Comcast are beginning to hit their respective strides in the next wave of mobile growth. T-Mobile is buying back lots of shares and, as mentioned earlier, trying to figure out how to have a “capital light” fiber to the home strategy (seems like an oxymoron, at least on a large scale, but who knows? More on that in two weeks).

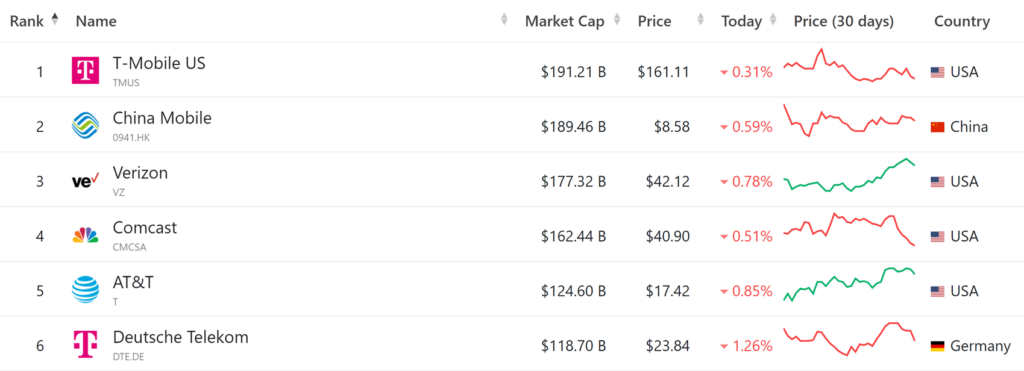

We are going to go on the record with the prediction that after Q1 earnings, Verizon will be the most valuable company in the telecommunications industry. Here are the current rankings as of Friday, April 5 (website here):

As the chart indicates, there is a difference of ~$14 billion between the leader (T-Mobile USA) and Verizon. We are going to assume that T-Mobile bought back 32 million shares of their equity (roughly $5 billion) in the quarter, and that there will not be a surprise dividend announcement (this assumes a similar buyback pattern as employed in 2023 – more here). We are also going to assume that Verizon surprises with lower capital spending than analysts expected in Q1, driving up Free Cash Flow (FCF) to ~$2-2.5 billion (versus $1 billion in Q1 2023).

The extent of Verizon’s FCF beat depends directly on the churn impact of $4/ mo. price increase on 32 million impacted subscribers. From recent executive comments, it sounds like the churn impact will be minimized. The combination of improved consumer earnings, driven by fixed wireless, wholesale, and better postpaid and prepaid execution, will drive Verizon’s stock price above $45/ share and into the $190-200 billion market capitalization level.

T-Mobile will have a great quarter as well (more on that in two weeks), but will not have the same “recovery/ growth” story as Big Red. The impact of C-Band deployments grows gross/net additions as well as ARPU (recent commentary was that Verizon was seeing 8% gross add growth, 10% better premium mix, and 4 basis points of churn improvement in the first 76 markets). And capital continues to ratchet down, driving up free cash flow and reducing net debt.

All of these metrics are great, and together, they will be well received. But behind the scenes there is a greater story unfolding, as described by Verizon’s Consumer unit CEO, Sowmyanarayan Sampath at the Deutsche Bank Media, Internet & Telecom Conference last month (link to transcript here):

“I think we’ve been mainly focused on just getting execution to a better place. So a couple of big blocks that we put in place. The first was myPlan… we had a price perception gap where people thought we were too expensive. We launched myPlan early in my tenure that fixed a lot of that. That, together with the perks, creates a really compelling value prop for customers, and we’ve seen the energy in the market come with that.

The second, in terms of execution, is we moved from a national sales structure to a regional sales model. So the country is now broken up into 6 markets. Each market has between 8 to 10 territories. So that’s around 50, 55 different territory directors. Each of them own their book of business. A lot of decision making happens in the field right now, so it’s work in play.

Third is local marketing. We moved from budgets from national marketing to local marketing, local activation. And it also helps us do a market-level strategy. The markets we want to hold share in terms of churns higher, we want to manage that. Some, we have an opportunity to gain share. So we have different tactics on the field to do that.”

This all seems like basic blocking and tackling. But large-scale change is hard, especially when you have postpaid, prepaid, and fixed wireless growth competing for scarce local and national engineering resources. For Sampath to mention this in his opening comments clearly indicates that it’s beginning to work and headed toward full stride in 2024.

Bringing decision making (with local marketing) back to the field is the best solution for Verizon. Many long-time employees remember how this model enabled meaningful market share gains for more than two decades. That part of the workforce will have an easier time embracing a hyper-local focus. Our view is that after several quarters of the new environment, Verizon is executing at a street-by-street level and that this is helping both the legacy FiOS business as well as wireless.

Can Big Red get scrappy again? We think it’s going to be a struggle and take time, but there are more indicators pointing towards “yes” than “no.” Two key earnings indicators will tell the story: 1) postpaid phone churn, and 2) prepaid to postpaid phone conversions (which reflects the early impact of hundreds of new Total by Verizon stores opened in 2023). We could be wrong but think there are enough data points to drive Verizon back to the top of the leaderboard.

That’s it for this week. Thanks again for all your support. In two weeks, we will focus solely on T-Mobile’s earnings outlook (hint: it’s more German flavored than ever). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!