Note, this article forms the intro section to a new editorial report from RCR Wireless about ‘private 5G – hype versus reality’. The full report is available to download for free here. It might be taken, as well, with new numbers (just in; April 11) from Dell’Oro Group which say the market jumped 40 percent in 2023, and remains a “massive opportunity”.

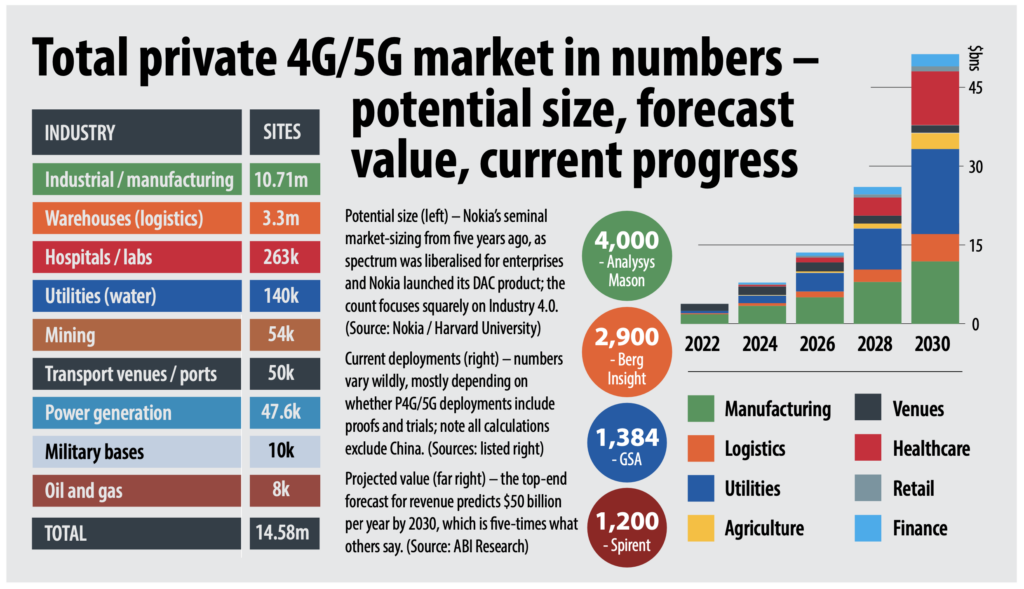

The private 5G market is spooked, apparently. Figures from Analysys Mason predict bountiful growth over the next five years (4,000 to 60,000 total deployments; $1 billion to $9 in annual spend), but also say that the market will have failed by the end of the period because it has “not reached its potential”. But is that potential, really? Or is it hype? Or is it just a narrow view of the market? Because every calculation and forecast out there – which disagree about the details but agree about the message (“growth”) – surely takes its cue from a market review commissioned by Nokia five years ago which said the addressable market for private 5G might stretch to 14 million industrial venues.

Let’s pause on that 14-million figure for a moment. It was mapped-out by Harvard University to count-out Nokia’s industrial targets – which have become the industry’s targets. Ten million factories, three million warehouses, 50,000 mines, or something-like; plus everywhere else in Industry 4.0 (see graphic below) – it captures the epic sweep of the industrial sector, and the grand promise of industrial revolution. It is a perfect explanation of why the market is so buzzed, and also so hyped. For context, there are only (!) seven million macro radio sites in the world, as deployed by mobile operators in public networks – and that double-sized 14 million figure counts just venues, not radios.

And so yeah: 4,000 out of 14 million is not very much (0.0003 percent; and not even), and abject failure by most measures. And it is the same no matter whose numbers you choose, nor how they are counted. Berg Insight says there were 2,900 private LTE/5G networks (including trials and proofs) at the end of 2023, and there will be 11,900 in 2028. The Global mobile Suppliers Association (GSA) counted 1,384 enterprises with at least one commercial-scale (€100,000-plus) private LTE/5G network at the start of 2024, based on shared vendor data. Test company Spirent, with its own market review, settles on about 1,200 commercial private LTE/5G installations globally, excluding China.

“There are thousands in China, but they are not necessarily clear-cut private,” comments Stephen Douglas, head of market strategy at Spirent. Revenue figures are equally hard to discern. What to believe? Who to believe? Again, Analysys Mason says annual spending on private LTE/5G will reach $9.2 billion in 2028, an 800 percent rise over five years. SNS Telecom & IT, based out of Dubai, says spending will hit $6.4 billion by 2026, an 18 percent compound yearly jump over the period. (Dell’Oro’s latest figures should be considered here, too.) ABI Research predicts a much bigger revenue opportunity: $50 billion (five times the Analysys Mason forecast) per year by 2030 – and that’s just for private 5G.

The total market, including private LTE (4G), will be worth significantly more – “roughly twice as much”, it says. “By 2030/31, we will reach a turning point, where private 5G takes over from 4G as the dominant cellular-based enterprise networking technology,” comments Leo Gergs, principal analyst at ABI Research. But even such top-end forecasts are drops-in-the-ocean compared to Nokia’s original 14-million count, and the revenues that would go against it. Analysys Mason notes an annual spend of $9.2 billion would be less than five percent (and $50 billion would be less than 25 percent) of its own forecast spend on public networks in the same timeframe.

As such, it is easy to see why the private networks game might be perceived as a failure, thus far. “The market will not have reached its potential,” writes Analysys Mason. But it says, as well, that interest “remains high despite the relatively modest long-term opportunity”, and it agrees broadly with ABI Research that the LTE/5G tipping point in the enterprise space will come at the end of the decade. Almost half (47 percent) of private networks will be based on 5G in 2028, it says; the rest will be LTE systems, reducing in proportion from about three quarters (75 percent) of total deployments in 2022. “Interest in private 5G is high but… devices and costs have held back adoption,” it says.

Ah, devices and costs; of course. We will come back to these. But Analysys Mason also explains-away the market’s progress from different points-of-view – for traditional mobile operators, but also for legacy and startup equipment vendors (Nokia and Ericsson, notably, versus Celona, Athonet/HPE, plus others). “Private networks will provide a small boost to operators’ enterprise revenue,” it says. Meanwhile, legacy vendors will consider the income as “useful incremental revenue” and newbies will consider “even a market of just a few billion dollars is hugely attractive”. This is an important perspective, and should be considered when assessing the various responses in this article.

HYPE TENSIONS

But the hype-fallout, as the promise outruns the reality, has appeared to create genuine panic in the supplier market – because the sales numbers do not reflect the impetus that vendors had expected, or else, maybe, just because it is too much like hard work. It is anecdotal, and rather colourful, but the off-record mood at Mobile World Congress in Barcelona in late February (2024) was a dark one, full of rumour and intrigue, and desperate looks – as if no one is quite sure of the road ahead, and some are heading for the skids (see the news that Casa Systems and Airspan Networks have hit the skids, lately; see also said sketches-of-Spain). Speaking ahead of MWC (and not at it), Celona said the wheels have locked for some firms, and the road has cleared for a few others.

Responding to a direct question about whether opportunist suppliers have started to flee the private 5G game as it slumps into a ‘trough of disillusionment’ (to use Gartner parlance), Rajeev Shah, co-founder and chief executive at Celona, says: “That’s fair; at the peak of the hype cycle, there were lots of players that thought they had a role to play, and which contributed to all the noise. Pretty much everyone was coming at it, saying, ‘this is my growth area’, and putting out press releases. But the enterprise market has spoken and… that long list has become a short list of players; and realistically, at this point, that list comprises Nokia, Ericsson, and ourselves.”

He adds: “So the amount of noise has reduced, because the number of people making it has reduced – because their systems don’t cut it.” So who has dropped out, then? Shah does not want to name names (and the news cycle has since revealed some of them). But then his list-of-three excludes some major ones – including big cloud providers like AWS and Microsoft that made a splash a couple of years back, a number of bit-part radio and core providers selling via big integrator brands, plus a swarm of noisy CBRS players offering related services, a hatful of niche specialists, and a handful of major IT/OT operatives. Shah plays a straight bat: “I just think a lot of companies have not got the traction that we have.”

What does he make of the likes of Cisco and HPE, coming at it from an IT angle? Surely the new HPE-plus-Athonet (plus-Juniper) looks like the kind of enterprise-friendly (Wi-Fi friendly) system that Celona likes to talk about? He responds: “I mean, the [Juniper] acquisition is still fresh. But, yes, I was expecting HPE and Cisco to be harbingers of the future; more than anyone else. And they may still be. I expect them to do something in this space, given their strong enterprise DNA. And we see them sporadically, but I suspect they are in a development cycle, building out their portfolio at this point.” But he’s not interested to say much more, and that’s the end of the conversation about vanishing rivals.

The idea of a three-horse race is preposterous, of course (as Dell’Oro’s figures make clear), even if the private 5G supplier market is starting to mutate in the post-hype era. The message about HPE/Athonet is probably a better explanation of how the sector is developing, still, and might be taken with equivalent logic about the likes of AWS and Siemens, say, where they are waiting for the technology to develop in opposite directions to address low- and high-end enterprise markets separately. Certainly, the line from Athonet at MWC is about rising sales. “We’ve gained more share, done more deployments,” responds Gianluca Verin, chief executive at the Italian firm, talking about his company’s acquisition by HPE a year ago.

He goes on: “We have maintained the promise to look after our customers. Which is not always the case after an acquisition.” So what is Verin’s view of the mood in the private 5G camp, more generally – because there is this nagging sense, even just at this show, that the hype is out of hand, and there’s a reckoning of sorts in the offing? He responds: “The market was overestimated, one or two years ago – so there is some down-sentiment. But as always with technology, it goes up and down, and the people that make it work, like ourselves, ensure that it goes slowly but relentlessly upwards – until the day that it’s all-up and it shows its power. We are close to that moment now.”

There is a reminder, as well, of HPE’s grand scheme to combine its Athonet and Aruba businesses to make 5G and Wi-Fi into a single network proposition. “Wi-Fi and 5G will be combined somehow in different roles. But 5G will not go away,” says Verin, before he reverts to the core sales narrative about why private 5G matters – and why the hype is real. “Because enterprises have needs that are not being addressed in any other way. We see completely new applications emerging… So the market is good, and there to be conquered. It has the attention of the top people in so many industries. The people that understand this technology understand how it can change things.”

This article is continued (across 32 pages) in a new editorial report from RCR Wireless on private 5G hype and reality, which is free to download; click here or below for the report.