Note, this article is a continuation of a previous post, which can be found here.

Funny thing about telecoms, and telcos specifically, so often derided in the Industry 4.0 market for not ‘getting’ enterprise, is that they have listened and changed, arguably, and are selling new digital services based on new business ‘outcomes’ at last – which is more than can be said for their own suppliers, failing in general terms to articulate the value of their services. This is the gist of the initial conversation with Phil Skipper, head of strategy at Vodafone IoT, before catching up about its move to spin-off its IoT unit as a standalone affair with Microsoft.

It is interesting to RCR Wireless to hear the counter-narrative, after pointing the finger for so long in the general direction of the operator crowd when covering the role of cellular in this Industry 4.0 tale. “‘Buy my stuff and it will make you money’, they tell you. And you think, well, the only sure thing is that I am going to pay money for that– and that it’s down to me to do the heavy lifting to make it back,” says Skipper, reflecting on MWC 2024 in Barcelona in late February. It is anecdotal, he notes; just impressions from walking the floor.

But it takes remembering, sometimes, that telcos are another link in the chain, even for the supply of 5G into the enterprise market; the buck doesn’t just stop with them, the message goes. “When I looked at the show this year, it was like AI is not good enough. It has to be Telco AI – the same way cloud wasn’t good enough, and it has to be Telco Cloud. There is this weird perception that telco is somehow more demanding than other infrastructure-centric industries. I mean, you don’t find Utilities Cloud being sold to utilities companies. But they sell us Telco Cloud.”

He goes on: “We should have moved away from that. Because infrastructure is infrastructure, and cloud is the great normaliser, and you want standard solutions for a standardised technology. But we have this carrier-grade [pitch] going on. And meantime, AI is like an afterthought – on many of the stands. It gets talked about like it is going to empty the dishwasher for me; but it won’t do that because it can’t put my plates back on the shelves. Right? Very few companies at MWC could show the real outcome of AI.” There is a lot to unpick, here; and it is pertinent and funny.

The big point is about demonstrable value, relevant to the end-user, which applies to every technology in the stack, from the IoT sensor to the AI sense-maker, and every link in the telecoms chain, from the chip maker to the network maker to the network operator. As it is, and as per Skipper’s MWC walkabout, operators are just better at explaining the value of their services. “The enterprise sale has become more specific, more outcome-based. Whereas the way the telco industry is sold-to is woollier; it’s harder to understand. While we have made it easier for our customers.”

Indeed, the whole as-a-service shift has complicated things, suggests Skipper. “It’s about this move from shifting boxes to selling services. Telcos are the ultimate service providers – asset-rich companies, which have made a virtue of selling services on top. But they are now being sold these boxes as-a-service [upstream], and figuring out how to add value to them in order to sell their own services [downstream]. It is just more fragmented – where we used to put boxes together and differentiate in how they were aligned, and transmit their value as a service to buy.”

It’s the new tech discipline of service stacking (“as-a-service on as-a-service”) – and it gets harder “to conceptualise” as services are interleaved by service providers at every turn, he suggests. “If you are buying them as-a-service, then, sure, you transfer your capital expense, but you also need to put a service on top,” he says. The difference is that operator service-providers are good at this, by definition; whereas telco equipment makers of various sorts are relatively new to it, and struggling to talk the telco language. And it is a funny thing, because the story is rarely told.

Skipper says more: “There’s a kind of divergence between the supply to this industry and this industry’s supply to other industries. And you could see it, just from going about MWC. But the good thing from MWC, which maybe I saw because I was looking for it (ed: and because it was MWC), is that connectivity is back in play. Companies are promoting the benefits of connectivity, again. Which is interesting; a little more of a focus on the knitting. Because, of course, if you want to do AI, you need a connection to get the data from the sensor to the application.”

This focus on the knitting – or regard for it, and for specialists that do it – is what brought Vodafone’s conversation about cloud transformation with Microsoft last year so quickly around to its IoT business, and for it to be hived-off and hyper-scaled — with Microsoft expressing an interest to be part of the project. Which is what happened on April 1, when Vodafone IoT quit the mothership to stand alone, with Microsoft as a major-minority shareholder. “IoT is in two parts,” he says, in reference to these twin disciplines of data capture/carriage/delivery, and of data storage/processing/access.

The new IoT venture establishes a two-tier platform for its application and outcome, the message goes. “This combination of parts and the opportunity for like-minded and like-sized organisations to operate together is a very strong proposition… Many of our IoT providers are Azure specialists. So having Microsoft in the middle is just access to a particular development environment on which they already build their applications. And I hate to use the word ecosystem, but that’s what it sort of becomes – where all of these parts work together to deliver a single outcome.”

How does the new regime play with the old one? Vodafone IoT will continue to supply Vodafone Business, just as the UK operator’s enterprise division draws on its private networks, public networks, hybrid networks, and multi-access edge computing (MEC) services across its global operating companies. “That is the way you create this performance continuum. On top, you stand up the vertical applications [for] automotive, manufacturing healthcare, utilities, and so on. So you can still buy complete end-to-end multi-tower solutions from Vodafone Business, as you always could.”

Skipper adds: “The IoT business still provides the fuel for all of those services above it. The difference now [as a standalone business] is we have more freedom to hyper-scale as a managed IoT connectivity business, and sell through as many channels as possible.” As written, this includes selling global IoT airtime services via other operators, too – should they accept its autonomy, and see the need. What about IoT.nxt, Vodafone’s IoT developer business, which always comes up when talking with Vodafone about IoT?

Is that part of the potential arrangement with Microsoft, whose broader IoT ecosystem proposition surely dovetails with it. “Yes. Because the application sits on the top. So if you want to buy an end-to-end application service, you go to IoT.next, which will pull-through connectivity from us,” he says. And, just briefly, what of you – what of Skipper himself? “I only know how IoT works,” he laughs. “Scaling IoT is what I’m interested in.” And also, because we write about it all the time, how is private 5G – the high-power IoT market, if you will – going for Vodafone, and how does it fit with the straighter IoT piece?

“Yeah, so NPNs (non-public networks) are like the new thing – where the big guys [in industry] have done the proofs and kicked the tyres – and it is now moving into proper integration, and smaller organisations are engaging without having to get into the nuts and bolts of it. Which is exactly what we saw with IoT a couple of years ago. All of these technologies mature at different stages. So you’ve now got people asking about 5G RedCap and 6G, even. And the tyres will get kicked again, which will crystallise the solution, and make it part of common telco parlance, as it were.”

Integration? Do you mean with enterprise systems, or with wider-area telecoms infrastructure? With both, it turns out; but the angle is about the logistics of overlapping enterprise applications and telecoms services. Skipper responds: “More enterprises are operationalising their NPNs, but they are also being orchestrated together – so private networks are linked on public networks to other private networks. One of the things we didn’t realise was how many private networks there are from different vendors in different sites. The owners of those sites now want to join up.

“So they’re building these kinds of SCADA systems across all their sites. Which is great for us because it brings together public and private networks. I mean, it’s what we saw with IoT – where everyone wanted to see it was real, and now it’s an operational asset on which their business relies. It is maturing very fast.” And, sorry, I know we are out of time, but does Vodafone’s standalone (low-power) IoT unit plug back into Vodafone’s (high-power) private 5G/IoT service, as offered globally by Vodafone Business? Is there much crossover on the factory floor?

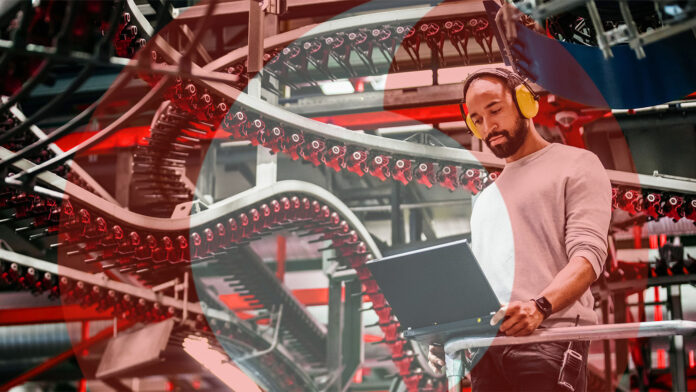

Or is Vodafone IoT mostly about bikes and elevators and watches, and meters of course? There’s crossover, no question, responds Skipper. “Industrial IoT is really interesting because it covers both private and public network IoT. The enterprise wants to know where the forklift is inside the factory, and the forklift maker wants to know where it is in the world. So there are two aspects, and they converge in the factory. So indoor IoT, as it were, is really important. The factory worker wants to deliver his schedule and manage his assets. Which is a powerful conversation.”

And hey, look; we are back at the start – talking about how operators get enterprises. Skipper explains: “It is a powerful conversation because it is in the language of the enterprise, of the factory manager, and not the telco. That’s the trick – to escalate yourself above the technology, to talk about manufacturing execution. Because it is a long way from Silicon Valley to the factory floor. You need to understand how the factory operates – in order to understand how to configure and deploy the technology, and then how to bring the ecosystem in-tow behind it.”