Greetings from Atlanta and the Midwest. Pictured is a vintage t-shirt (from the Royals 2003 season) proclaiming what die hard fans are saying as team continues to be a contender throughout April for the first time in nearly a decade. Last night’s loss snapped their nine-game home winning streak, something not seen since their championship 2016 season. Whether the team will wilt in May is anyone’s guess, but at least they are making baseball watching a painless experience.

This week’s Brief will include an extended market commentary followed by a dozen KPIs we are hoping to see in next week’s telecommunications earnings. The full earnings picture is now finalized:

| Company | Date | Day | am/pm |

| Verizon | Monday | April 22 | am |

| AT&T | Wednesday | April 24 | am |

| Meta | Wednesday | April 24 | pm |

| Comcast | Thursday | April 25 | am |

| T-Mobile US | Thursday | April 25 | pm |

| Alphabet | Thursday | April 25 | pm |

| Microsoft | Thursday | April 25 | pm |

| Charter | Friday | April 26 | am |

| Amazon | Tuesday | April 30 | pm |

| Apple | Thursday | May 2 | pm |

If you are reading this Brief on Monday a.m., you might have already missed Verizon’s call.

On some “friends of the Brief” congratulatory notes, frequent Brief reader Craig Cowden has landed at Metronet as Chief Technology and Product Officer, while Jason Adkins is now the CEO of Bluebird Network and Justin Forte was recently named CEO of INDATEL. Mo Katibeh from AT&T (and most recently, RingCentral) is returning to telecom as Chief Marketing Officer for T-Mobile for Business (article here). And, in case you were wondering what he has been up to, Jim’s long-time friend Sunit Patel oversaw iBotta’s IPO last week. Congrats to each of you.

The fortnight that was

Market valuations are changing like weather in the Midwest – lots of volatility going into earnings. Last week, the Fab Five lost $589 billion in value. This represents 87% of the total value of the top five companies we track in the telecom sector. Fortunately, this loss occurred after $1 trillion of earlier market value gains, so most of the Fab Five are still producing comfortably above water in 2024 (Apple the notable exception – to be discussed later).

The Telco Top Five had broader gains of $12 billion last week, with Verizon, T-Mobile and Comcast each adding $3 billion in market capitalization. We anticipate a strong report from Verizon that will surprise to the upside (likely a smaller postpaid loss than analysts’ expectation) and, with strong wholesale earnings from multiple cable providers, will easily beat earnings expectations. We will touch base on a few Verizon metrics later in the Brief.

Service interruptions grabbed a lot of headlines this week, thanks to a multi-state Enhanced 911 outage in Lumen’s local exchange territory (New York Times coverage here) and a potentially intentional fiber cut of AT&T’s network outside the Sacramento airport (more from Fierce Telecom here). Both are indicative of the need for greater redundancy and network diversity. It was especially surprising that there was not a wireless backup in place for the Sacramento Airport. Perhaps the FCC could spend more time and monies on this topic versus considering lowering penalties for those choosing to default on their Rural Development Opportunity Fund obligations (article here).

Speaking of the FCC, they will hold a largely ceremonial vote on restoring Net Neutrality this coming Thursday. When future generations define the term “political football” they should have net neutrality as their Exhibit A. Regardless how one feels about whether companies could face Internet injustices like those contemplated a dozen years ago (few if anyone is complaining about blocking or even injustice caused by paid prioritization), it’s hard to see even smoke today, let alone a fire. And, if a digital Armageddon is just around the corner, then the legislative branch should have their “TikTok” moment to pass clear laws to make it right.

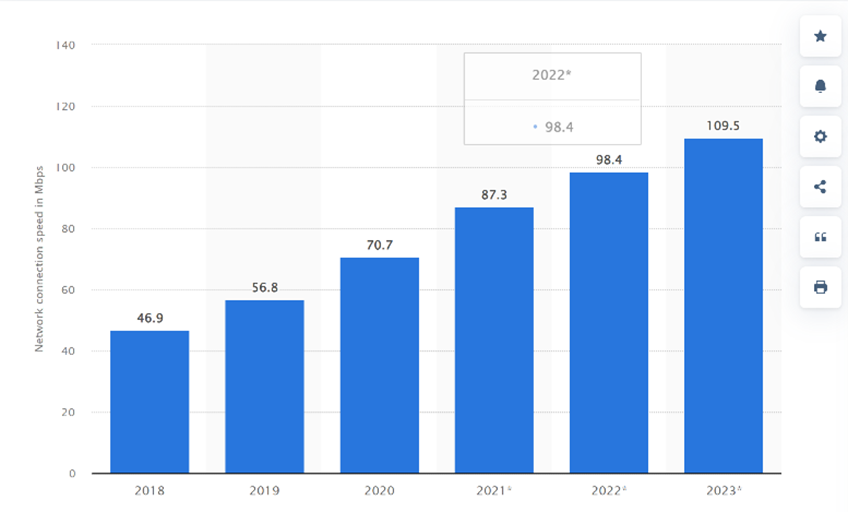

Nearby is the average North American Wi-Fi speed (which equates to Internet speed for many) from Statista (data here). Rather than focus on whether 110 Mbps is correct, or if we should segment into rural vs. suburban vs. urban (and remove Canada and Mexico speeds), let’s focus instead on the change in speed. From 2018 through last December, download speeds increased 18-19% per year on average.

In 2012, average Internet speeds were 10-20 Mbps. In five years, the average speed will be above 250 Mbps. Per our friends at Netflix (who care deeply about throughput to your TV set), that would cover 6 simultaneous 4K TV streams with 160 Mbps left over for schoolwork and work-from-home needs. Bottom line: Neutrality is not the issue in 2024, and if certain applications want to get a faster lane, telecom companies should receive net neutrality waivers if their 80th or 90th percentile of download speeds exceeds the national average. Companies who are fulfilling the vision of a consistently faster internet should be allowed to run their network in whatever way they see fit. Unfortunately, the FCC does not see it that way, and is focusing on a problem that is much smaller than it was a decade ago.

Speaking of discord with the FCC, we mentioned in last week’s Interim Brief Amazon CEO Andy Jassy’s comments about the iRobot decision. Rather than repeat that monologue, if you have not read or watched his interview with CNBC’s Andrew Ross Sorkin, we recommend you have a look. Jassy pulls no punches in his conclusion “I think that… some of these organizations are making decisions that are outside the bounds of the law.” That’s a bold statement for a Seattle-based company, whose executives give overwhelmingly to Blue candidates (OpenSecrets 2024 cycle contributions here and 2020 cycle here).

Finally, it’s worth a longer discussion of recent pricing activity from both cable companies and from T-Mobile. Here’s what occurred since the last Brief:

- April 9: Spectrum announces changes to their Unlimited Plus ($39.99/ mo.) plans to include unlimited device upgrades (see article here and footnote 3 at the bottom of the page). In the same announcement, Spectrum announces a $5/ mo. device production plan (a key profit source for the incumbent wireless carriers).

- April 11: T-Mobile announces changes to their Smartphone equality program, and now will accept 12 months of on-time payments as the only criteria to get prime credit deals on smartphones (details here).

- April 17: Comcast launches NOW, a month-to-month suite of prepaid broadband and wireless services. This announcement served as both a response to the sunsetting of Affordable Connectivity Plans (ACP) as well as a means to launch a basic/ baseline set of services to begin the Comcast experience.

These announcements show the subtle yet meaningful ways each cable company is creating some differentiation. Spectrum, who is the largest cable MVNO and who has the largest ACP exposure of any of the Telco Top Five, is tackling families and technology upgraders (upstream). Comcast is currently shoring up their low-end base. Meanwhile, T-Mobile is adding a different “prime” qualifier – mobile bill payment history.

There’s no doubt that others will join in with changes of their own, but anyone who accuses the industry of being stale should track headlines more closely.

The dirty (earnings) dozen

Here are the items we think will be worth tracking in Q1 2024.

- T-Mobile fixed wireless additions. We know that they slowed down from the 541K posted in 4Q 2023, but by how much? Any material drop will be viewed negatively.

- T-Mobile and Lumos. Rumor has it that there will be some sort of announcement coinciding with earnings. How long a leash will the German parent give T-Mobile USA? Can fiber achieve the priority it needs within Magenta to be successful?

- T-Mobile and Mint Mobile. Management stated on the call that Mint would likely close by March 2024. What is the revised date? Would Mike Sievert echo Andy Jassey’s comments referenced earlier?

- Verizon postpaid consumer wireless phone net losses. We are confident that this number is going to best expectations, but how much better will it be to Q1 2023 (-263K) and Q1 2022 (-292K)? If this number is strong enough to get the company to project net positive additions for Q2 2024, a lot of shareholder value will be added.

- Verizon’s free cash flow. There are a lot of rumors floating around that capital was extremely tight in the first quarter for all carriers, but especially Verizon. If the number comes in below $5 billion and there is no commentary about “making it up by the end of 2024” then that would be considered a positive for Big Red.

- Verizon’s prepaid churn. Verizon is churning more than half of its prepaid subscribers every year. That is a lot to manage. Our prediction is that churn will be higher than the 4.55% monthly rate posted in 4Q (and hope we are wrong).

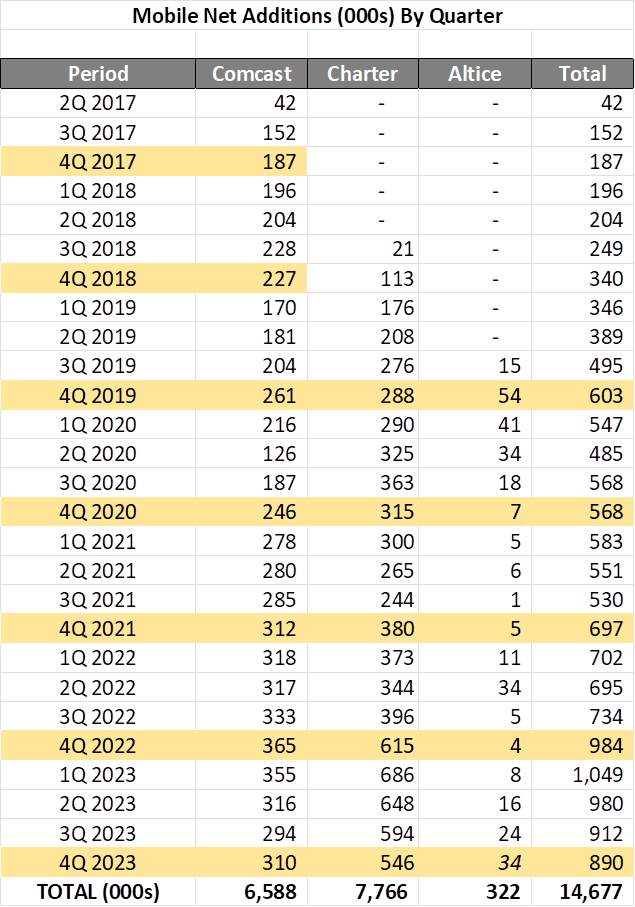

- Charter and Comcast’s mobile postpaid net additions. We think that larger numbers are beginning to catch up to Charter and Comcast, resulting in the bold pricing and product moves described earlier in the Brief. See the historical net additions nearby. We predict lower net additions for Comcast and similar to slightly lower levels for Charter to Q1 2023 (likely 900-920K combined).

- Comcast’s Business Services Connectivity growth. As we have discussed in previous Briefs, we don’t think Comcast has received enough credit for the Masergy acquisition. In 4Q, Comcast Business grew revenues at 6% with an overall EBITDA growth of 11%. For the year, the corresponding figures were 5% for both metrics. That’s extremely impressive performance in a highly competitive, low-growth market.

- AT&T Fiber Homes Added. Last quarter, that figure grew by about 400K, a reduction of about a third from the beginning of the year. Slower fiber passings = less cable broadband net losses (assuming fixed wireless did not scoop them up). Any number above 500K is good for AT&T and not as good for cable.

- AT&T Total Broadband Connections. This is the net of fiber additions less DSL losses. Traditionally, AT&T posts a negative number in the first quarter, but the second half of 2023 was very positive as some of their bundle price plans were introduced. A positive number will be very good for AT&T.

- AT&T Free Cash Flow and Debt Reduction. The company projected $17-18 billion in 2024 FCF. We think that’s going to come in at the $18-19 billion level with any excess going to debt reduction. Any material comments surrounding debt reduction and deleveraging will be viewed positively.

- Wild card comments. It could be Lumen. It could be Dish. It could be Frontier. There will be some piece of major news in the telecom “undercard.” Our guess is that time is running out faster than expected for Lumen.

We will have an expanded interim Brief next Saturday so please check it out on the website. Unless there is a major announcement (e.g., T-Mobile and Lumos), we will not have daily earnings posts on the website.

That’s it for this week. Thanks again for all your support. In two weeks, we will have plenty of earnings news to discuss. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!