Cinco de Mayo greetings from the East Coast and the Midwest. Lots of upcoming travel in the schedule as Jim will be attending the Broadband Communities Summit in Houston this week. If you are there and would like to trade notes, feel free to reach out to Jim through the email listed at the end of every Brief.

He also recently spent an hour on the 5G Guys podcast talking about first quarter telecom earnings (a video Brief that was anything but) – link here. Wonderful discussion with two great friends that provided the seeds for the next two Briefs.

This week our very full market commentary addresses Fab Five net debt levels, life in the fast lane, and two companies (finally) reuniting. We then attempt to answer the questions “Why Lumos? Why Now?” and examine company’s Jedi mind trick response to several questions (“May the Fourth” – the other holiday this weekend).

The fortnight that was

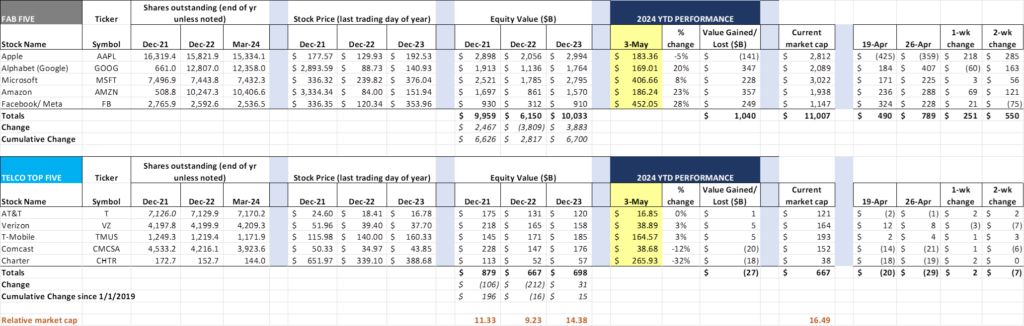

Since our last full Brief, each of the ten companies we track above have reported first quarter earnings. Over that fortnight, the Fab Five have gained $550 billion in market capitalization (note: this figure is net of any changes in share count due to stock buybacks in the quarter) while the Telco Top Five lost $7 billion.

The cumulative market capitalization of the Fab Five now exceeds $11 trillion with just over $1 trillion in growth so far in 2024 (a 9-10% increase after four months). Apple continues to be the lone year-to-date loser in the Fab Five for 2024, but recouped 60% of their losses last Friday with a $110 billion stock buyback announcement (see this Bloomberg article to see a comparison of this to previous stock buybacks).

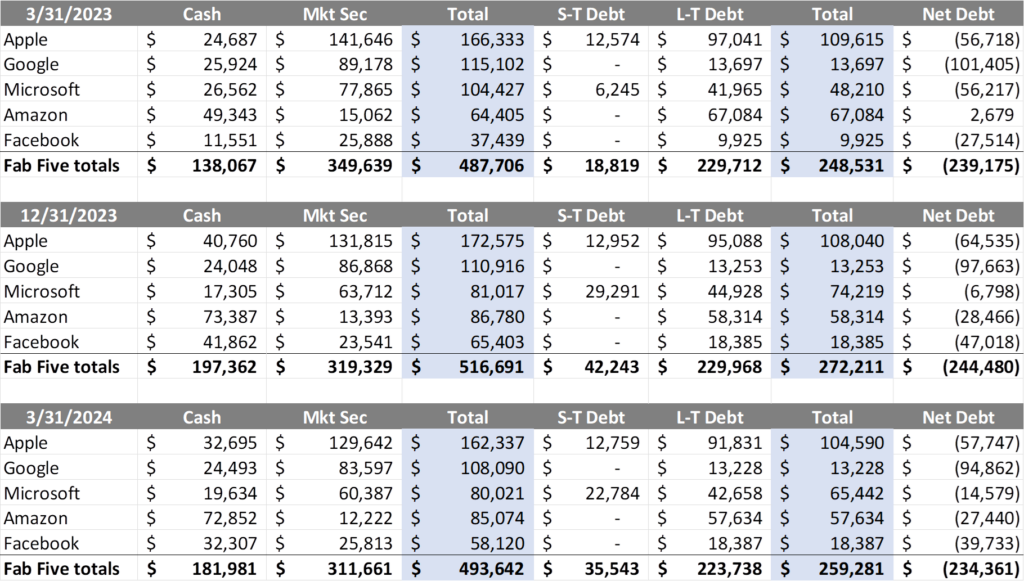

In case you were worried about Apple’s liquidity condition on the heels of this news, here is an updated net debt schedule for each of the Fab Five stocks through March 31, 2024 (Q1 2023 and Q4 2023 are shown for sequential and year-over-year comparisons):

For the Fab Five as a group, cash has grown $44 billion or 32% (likely driven by higher rates), marketable securities have fallen by $38 billion, and liquidity is up by $6 billion or 1.2% from Q1 2023. Debt is up ~ $11 billion, and the negative net debt balance has shrunk by ~ $5 billion or just over 2%.

Within the Fab Five, however, the differences are more striking. Microsoft’s cash balance was driven by Activision Blizzard funding requirements (liquidity down $24 billion from Q1 2023 – transaction approved and closed in October 2023). Amazon’s liquidity is much higher than early 2023 (+$21 billion or 32%), likely due to stronger operating cash flows and the abandonment of the iRobot acquisition last January. Facebook also continues to grow their cash balance (+$21 billion vs Q1 2023).

The bottom line is that Apple has $60 billion in negative net debt going into the $110 billion stock buyback. They generated just under $63 billion in operating cash flows over the last six months. Depending on the repurchase price, it’s quite possible they may end up paying for a majority of the buyback from current operations without issuing a lot of debt – a first class problem for sure. A random but interesting note: the highest interest rate on any of their current long-term debt is a mere 3.6% (on notes due in 2042).

As mentioned above, there is an hour of earnings-related discussions in the 5G Guys podcast (link above), and we will be dissecting earnings in the coming weeks. Telecom spending is definitely slowing down, but cloud spending continues unabated.

The Google Antitrust case that we have spoken about previously last September and October (here and here) had their closing arguments this week. Rather than rehash these well-written articles, we will simply link to this one on the options the judge faces and another one on the closing questions that the judge had for both sides (sometimes this provides an indication of where the ruling is headed). Both are from The New York Times. While we wouldn’t be surprised with any ruling, our hope is that the judge recognizes the validity of exclusive contracts and respects Google’s right to have a single browser.

There are many telecom newsworthy items from the last two weeks but we only have space for two. In what can only be described as an overt “pay for performance” plan, AT&T introduced Turbo (announcement here), a $7/ mo. add-on to existing data plans. AT&T describes it as a “first step in modernizing and preparing our mobile network for future innovative use cases.”

We applaud AT&T’s new product, which clearly states that “Eligible customers will be in control of whether to activate this service, which boosts all the high-speed and hot spot data on a user’s connection while it is active. Consistent with open internet principles, once turned on the boost applies to a customer’s data regardless of the internet content, applications, and services being used.” While a specific provider (e.g., Microsoft Teams) cannot pay to have their video packets prioritized over another (e.g., Google Meet or Zoom), they can market the Turbo service to their best customers (and include services like Turbo in premium subscriber packages). And, under no circumstances can Apple TV receive dedicated spectrum just to use for video streaming.

This is the nuanced world Internet Service Providers (ISPs) and application developers live in. From our experience over the last decade, the FCC needs to consider the quality of the application code in any complaint against the carriers when it comes to net neutrality. The assumption that applications are efficient is often made but rarely proven, and many/ most times, especially with video and gaming applications, there are layers of code inefficiency resident in the apps themselves. Giving the developer community a free pass does a disservice to the principles of Net Neutrality.

If the song to describe the last topic was The Eagles “Life in the Fast Lane,” we would need to slow it down to Peaches & Herb’s “Reunited” to describe our second telecom news item. Last Friday, another well-leaked rumor became official when Uniti and Windstream decided to get back together (announcement here). For those of you who missed the saga of the last decade, it was July 29, 2014 when Windstream announced the spinoff of the entity that eventually would become Uniti (full history of the company in this Wikipedia post). The spinoff was completed in April 2015.

Windstream was forced into bankruptcy in early 2019 after a judge ruled that they failed to get proper consent for broken bond covenants that arose from the Uniti spinoff (full chronicle from Bloomberg here). As a result of the bankruptcy, Windstream was able to reduce their debt by two-thirds (see the Standard & Poor’s analysis from September 2020 here). Per last week’s announcement “Net leverage at year-end 2023 for the combined company is 4.8x, which is a significant improvement over Uniti’s year-end net leverage of 6.0x, with growth and free cash flow generation expected to improve the combined company’s leverage trajectory over time. Both companies’ current debt silos are expected to initially remain in place following closing.”

The recombined company is more attractive to someone like Searchlight Capital, who recently took Consolidated Communications private in a transaction valued at $3.1 billion (including debt). It could also hasten the combination of Consolidated, Frontier, and Windstream with Brightspeed (owned by Apollo). The bottom line is that it’s a great long-term move for the company as it reunites the assets with customers. As for the lofty Uniti dividend (yielding close to 10% even with the 26% decrease in the equity value on Friday – see nearby picture), it’s safe to say that it’s going to be lowered, at least to a Verizon/ AT&T level (6-7%).

T-Mobile’s Jedi mind trick

One of the worst kept secrets heading into Q1 earnings was T-Mobile’s investment in Lumos. Investors knew that something was up per articles in major business periodicals (and this column), but few understood why a company who just sold their 30+ year-old nationwide fiber backbone wanted to pursue rural fiber.

Prior to their earnings release, T-Mobile announced additional details of the Lumos transaction. It underwhelmed the analyst community. On the earnings call that afternoon, an exasperated David Barden (Bank of America Securities) asked (video link here – question starts at about the 43rd minute):

“Mike, just to go back to this Lumos situation. You’re basically saying that today, you’re prepared to invest about $1.45 billion between now and 2028 to own 50% of basically 2.5% of the households in America. And if you got 50% of that, you would have slightly around under — between 1% and 1.5%. So what is the point? Like why is it worth the brain damage to spend the money, the years building the organization to get something that looks realistically so small in the grand scheme?”

Mike Sievert, T-Mobile’s CEO, responds to Barden as follows:

“Look, I’m really excited about this because I think we’re getting a lot and enabling this company to accelerate growth. And if you think about close to $1.5 billion spread over in time, 3.5 million passings being the goal for that funding, from what we — the capital we put out, that’s less than $500 per passing. And to the premise of the question, that’s not for sort of like half of it because the other way it works is that T-Mobile is the branded entity for all of those passings. And it’s up to us to make sure that it stays that way and we perform and so on. But our strategy is to be able to get augmentations to an already nationwide multi-million customer broadband strategy. And this is a smart way to do that. And I signaled we’re open to constructs like this around the margins. And so maybe in the end, it’ll add up to more than this, and certainly, 3.5 million isn’t where this probably ends. This is a growth engine that could continue into the future. We’re not obligated for it, too.”

There’s a lot of “said and unsaid” in Mike’s response. Given our recent experience in deploying rural fiber in the Midwest and South Central regions, this is a major win for T-Mobile because it marries the power of T-Mobile’s brand with the best available technology (fiber) to the residence. Let’s unpack the benefits of the transaction (and the high-level economic benefits) to T-Mobile:

- They inherit a customer base on a variety of technologies headed in the same direction (fiber to the home). With fresh capital, the impetus to convert the remainder from copper to fiber quickly is apparent – DSL is not palatable to their customers, and not good for the Magenta brand.

- We are not sure how this impacts the Segra (Cox) transaction (announced and closed in 2021) for the legacy Lumos territories (it is not addressed in the news release and was not asked on the call), but for new builds, it’s accretive to T-Mobile for Business. Worst case, it will draw Cox Business (wholesale)/ Segra and T-Mobile closer together, which isn’t a bad thing.

- T-Mobile gets a lot of cheap and fast cell site backhaul. This enables a new “coverage ring” around the fiber to the home (FTTH) deployments through fixed wireless at a slightly better price point. We are confident that there will be adequate mid-band (EBS/ BRS) spectrum in the covered regions.

- Once converted to fiber, T-Mobile now has an underpenetrated base of potential postpaid wireless customers. Assuming that T-Mobile has EBITDA of $50/ month per postpaid wireless account ($140 ARPA at a 36% margin) and an average life of 100 months (both conservative for postpaid accounts with superior wireless coverage), the company has an account lifetime value of ~$5,000.

- The JV will eventually pass 3.5 million homes. Let’s assume T-Mobile has a current wireless penetration of 25% of this base or 875,000 homes, and that they remain with their current provider for broadband (unlikely but an assumption). That leaves 2.625 million homes with no T-Mobile (fiber or wireless) presence today.

- Thanks to the powerful T-Mobile brand, the company acquires 40% share of the unpenetrated residential base, or 1.05 million homes. This results in a market share of ~60% assuming the base in #5 is included (on par with Charter’s RDOF penetration). The additional value of the postpaid wireless accounts alone (ascribing no value to the residential fiber Internet revenues) that T-Mobile acquires is ~$5.25 billion.

Said differently, either a) the value per newly acquired home/ account could decrease to $1,500 (highly unlikely) for the 40% they acquire or b) the 40% incremental penetration falls to 11% (also highly unlikely; 289,000 incremental homes at $5,000 CLV per home) to sour the investment.

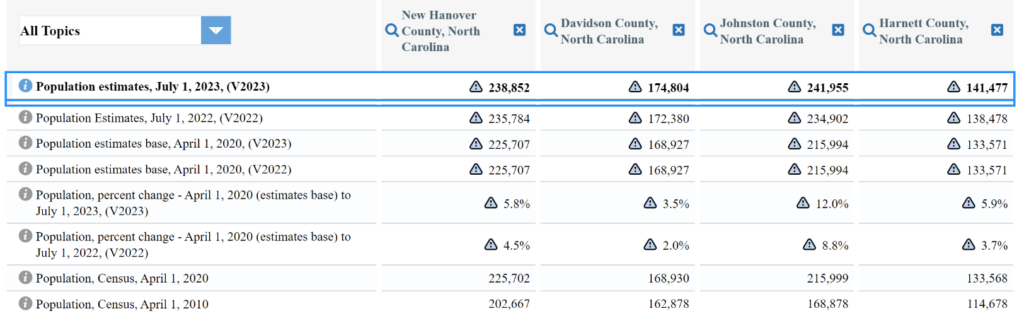

- While there is a lot of rural territory in the legacy Lumos region, the expansion markets are largely suburban. Below is the census data for four of the major North Carolina counties making up 345,000 of the incremental homes. Lexington is in Davidson County (+18% population growth since 2010), Wilmington in New Hanover County (+7%), while Johnston (+45%) and Harnett (+23%) Counties adjoin and form the southern ring of growth for the Raleigh-Durham MSA. Hardly poor, and not shrinking. In fact, many of my FTTH peers would gladly trade for these areas.

Bottom line: T-Mobile brings fresh equity to EQT. This can be levered 5x which delivers an incremental value of $7.5 billion to finish the expansion (which equates to roughly $2,800 per home passed prior to any BEAD matching funds). Even if the JV generates no value, T-Mobile comes out ahead provided they do what they do best, market and sell postpaid wireless (and broadband) services. Unless our math is incorrect, this investment represents a far better use of capital than incremental share buybacks or even an increased dividend.

There’s more to the value equation than T-Mobile’s “Hey, it’s just $1.5 billion over time” Jedi mind trick. A master stroke for both EQT and T-Mobile. It is completely understandable why T-Mobile might want to keep this under wraps. They have excess cash (fresh equity) that FTTH providers and their owners desperately need. This financial arrangement will make them more attractive to state broadband offices analyzing BEAD applications. And T-Mobile already knows the nuances of rural marketing.

That’s it for this week. Thanks again for all your support and referrals. In two weeks, we will continue our earnings analysis. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!