Greetings from Iowa and Missouri. Pictured is our neighbor’s elaborate balloon arc for their daughter’s graduation bash (it’s even more impressive than the photo). This has been another full news week, including an announcement by Comcast at last week’s MoffetNathanson Technology, Media, and Telecom Conference that they would be offering a bundled content product with Peacock, Apple+ and Netflix.

After a full market commentary, we will look at the content landscape through the telecom provider lens. As expected, there are some similarities, but it would be an overstatement to claim that the telecom industry is moving in lock step when it comes to content bundling. We also offer a few prognostications concerning AT&T just to keep it interesting.

Before moving on, it’s worth noting the legacies of two recently departed giants of the finance and telecom worlds. We received word, through an “Out of Office” reply, that Cam Lanier had passed away on Saturday, May 4th. He was a telecom titan in the South and a close friend of this publication. For those of you who do not know Cam or his legacy, please read this summary from the Atlanta Business Journal (here) and also watch his TED Talk entitled “How to Make a Million Dollars raising Dogs on Paper” here.

The finance world also lost one of its smartest investors, Jim Simons, in the last fortnight. We posted an interim Brief last week which links to a lengthy interview he did at MIT in 2019 here. Jim amassed essentially all his $31 billion fortune after the age of 40 (he was 86 when he died), and gave much of that away while he was alive ($1.2 billion of that to Stony Brook University). If you are not familiar with his story, take some time over the Memorial Day weekend and look at the linked video. Finance nerds, capitalists and students of philanthropy will not be disappointed.

The fortnight that was

While the headline as we ended the week concerned the Dow 30 Index (which closed above 40,000 for the first time), there were many other data points influencing the market conversation. Inflation at the producer level was higher than expected for April (but lowered for March), and was relatively muted at the consumer level which was greeted with relief by the markets. Most pundits see one rate cut (in September) but others see any cuts pushed to 2025.

The bond markets are uncertain on interest rates. After an initial drop on Wednesday, the interest rate tide began to turn back higher, and, going into the weekend, the 10-year Treasury had given back just under two-thirds of the post-CPI announcement dip (now at 4.42%, down from 4.62% a month ago but up from 3.94% at the beginning of the year). Shorter Treasury durations are still yielding ~ 5.3% which is keeping a lot of cash on the sidelines.

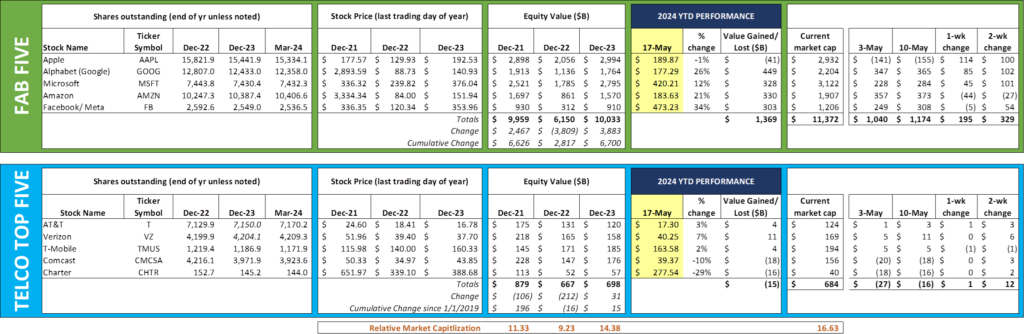

The Fab Five are less subject to interest rate fluctuations than other sectors of the economy because of their collectively large cash balances ($494 billion in cash and marketable securities as of 3/31/2024). They can self-fund if needed and have no refinancing risk. As we discussed in the May 5th Brief, Apple has begun to buy back shares, which has helped them get back to break-even for the year. Since their earnings announcement just over two weeks ago, the value of the Cupertino technology leader has increased by more than $310 billion. Despite their recent comeback, they meaningfully trail their Fab Five peers in 2024 value creation.

Meanwhile, the Telco Top Five continue to slowly accumulate value. Since April 26th, the group has halved their total 2024 equity loss to -$15 billion, with cable stocks down $34 billion and wireless/ telco stocks up $19 billion. There were no material value changes last week, but Verizon made up half of the market capitalization increase ($6 of $12 billion) over the last fortnight. T-Mobile continues to be the 2nd most valuable telecommunications company in the world after China Mobile (see rankings here), with four of the Telco Top Five making up #2- #5. The only catalyst, as we will discuss below, is increased broadband competition, which will likely have a net negative impact on overall valuations (great for consumers, not so much for investors).

Google held its annual I/O meeting last week, and Artificial Intelligence (AI) was on full display. In a blog post, the company summarized the top 100 show announcements (a few of which made their debut in the blog). The most impressive demo of the session was the Audio Overviews section of NotebookLM (it’s at minute 14 of this YouTube video featuring Google Labs VP Josh Woodward). If you have been skeptical of the benefits of AI, watch the NotebookLM section of the linked video, assume it comes to fruition as demonstrated and think about how it will change the learning process. If that demo becomes reality, learning, particularly in the math and science fields, will fundamentally change.

Speaking of AI, content aggregator and community forum Reddit announced a strategic partnership with Open AI, which will incorporate Reddit feeds into OpenAI’s Large Language Model (LLM). More details are here, but, this non-exclusive deal should bolster Reddit’s cash balance (we presume OpenAI is paying a premium price for this unique content) while improving OpenAI’s ChatGPT product. It also made OpenAI’s CEO, Sam Altman a lot richer (his 7.6% stake in Reddit is now worth more than $750 million – details here and here).

On the broadband over satellite front, AT&T and AST SpaceMobile signed a commercial agreement after six years of operating under a Memorandum of Understanding (announcement here). The relationship will enable AT&T smartphones to access AST satellites for voice, text, and broadband capabilities. Based on this Bloomberg article, it appears that this service will be available to a vast array of smartphones starting later in 2024. This development puts additional pressure on Verizon to operationalize their satellite plans for Amazon/ Kuiper (T-Mobile and SpaceX announced their relationship in 2022, launched their first satellites earlier this year, and should have commercial service available shortly).

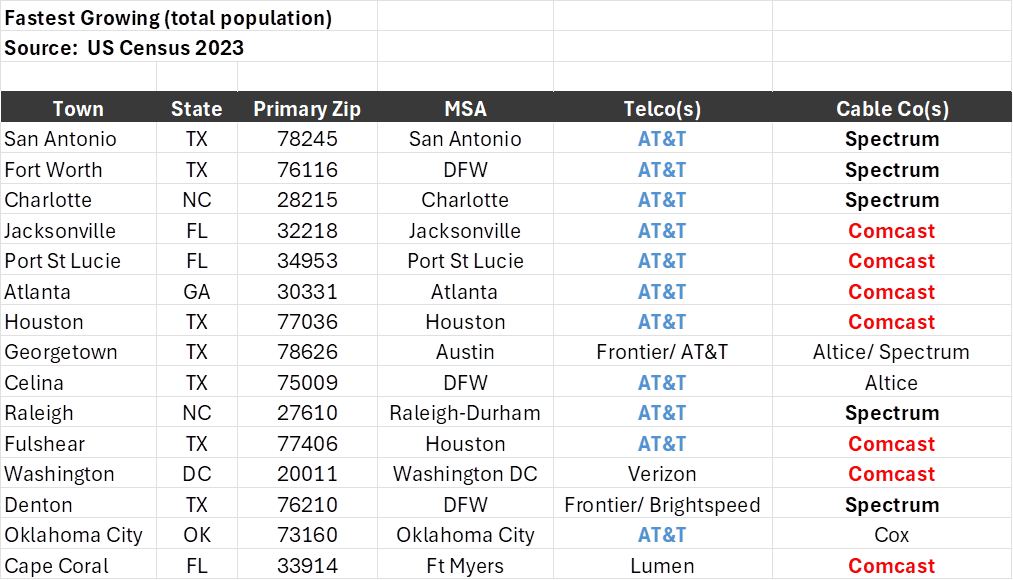

There us an entire Brief worth of material from this information, but our conclusion is a question: Is the analyst community giving AT&T a “hall pass” on HHP growth? If AT&T is in 11 of the fastest -growing markets (on an absolute basis), should they be posting more growth? Comcast and Spectrum are splitting their growth, so that story is more nuanced, although the town growth clearly shows that Suddenlink (now Altice) has some assets that are clearly poised to grow quickly (or be overbuilt).

The other big factor from this report is that the West is not as fast-growing as it used to be. This hurts Lumen, and to a lesser extent, Cox. Look for more data and details in next week’s interim Brief.

Post-earnings telecom landscape (you want some Netflix with that?)

First quarter telecom earnings are over, and the [in]digestion process has started. The first major post-earnings conference was held last week at MoffettNathanson. There were a lot of companies presenting, and this included four of the Telco Top Five.

Brian Roberts, CEO of Comcast, led off the conference with a spirited defense of their broadband strategy (transcript here), which included the following comment: “How do you accept that new competitive reality? Wait your time properly and then start growing again. And hopefully, that’s the kind of market we’re in now.”

After the volume vs. rate growth discussion ended (we think Comcast’s assumption that broadband ARPU growth will match inflation is optimistic), Brian mentioned two product matches – wireless, and a new product called Stream Saver:

“We’re very focused on adding value to broadband, and wireless is one way that we do that. Another way, and something that I’ll just kind of mention today but Dave [Watson, President & CEO of Comcast Cable] is going to talk about in the next few days, next week or so in more detail, is what other ways can we help a consumer if you take our broadband products. And we’re introducing something this month called Stream Saver and Stream Saver is going to be available to all customers, not just one segment or another. So, if you’re an Xfinity broadband customer, Xfinity TV customer, Stream Saver works for you. If you’re a NOW [prepaid product] customer, there will be a NOW Stream Saver. And Stream Saver is Peacock, Netflix and Apple TV. And those three products will come at a vastly reduced price to anything in the market today and be available to all our customers. And that’s an everyday pricing, not an introductory pricing. And we’ll reveal all that and will be available this month.”

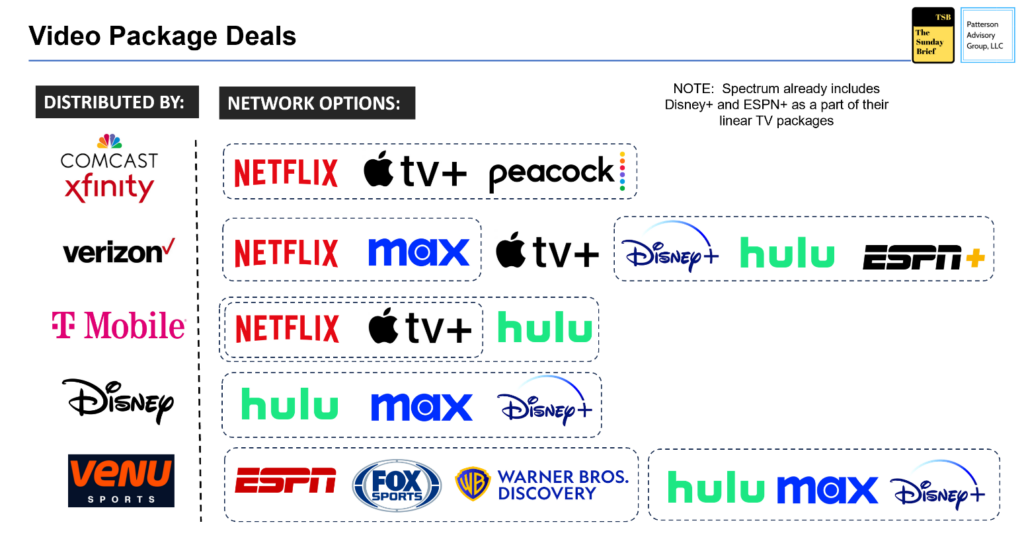

That’s a lot of news. Comcast has been silent on the topic of partnerships (outside of Xumo) and bundles until now. Here’s what they are up against (dashed shapes indicate the applications covered under specific bundles):

Note: For those of you who missed last week’s news, the “sports super channel” announced by ESPN, Fox and Warner Brothers/ Discovery is going to be called Venu Sports (ESPN.com announcement here).

The bundled content field is getting crowded. Verizon currently offers a bundle of Netflix and Max for $10/ mo. (both with ads). They also offer Apple TV+ as a part of another Apple-centric bundle. And they still include the Disney bundle in certain postpaid plans.

T-Mobile is the “OG” of telecom bundling. The “MLB.TV” and “Netflix on Us” 2016 and 2017 Un-carrier moves were groundbreaking, and they followed it up to include Apple TV+ in 2021 and Hulu (with ads) this year. Inclusion into the baseline offerings has strained margins, however, and the company cut back their offerings at the beginning of this year. T-Mobile is attempting to position the company as the premium network leader and, with their success to date, probably needs the bundle less than they did in 2017.

When AT&T owned WarnerMedia, they bundled HBO with certain wireless and broadband plans, first in 2017-2018, and then again with the launch of MBO Max in 2020 (which lasted until 2022). Currently, they do not offer any content bundles (plans here).

Not to be outdone by Verizon, Disney is aggressively promoting not only their bundle (Disney+, Hulu and ESPN+) but now will be incorporating Max into a new bundle (announcement here – product to launch this summer).

Then there’s Venu Sports. Expected to price in the $30-40/ month range, it will incorporate 14 networks of sports into one app. If it’s well organized and fairly priced (and launches around the start of the college football and NFL seasons), it’ll take a meaningful share of the streaming market. This “network” clearly diminishes the value of sports on Peacock, Paramount+ (CBS) and Amazon Prime.

Can Comcast win? They can with a little help from their friends. The new Comcast bundle needs to be trumpeted from Xumo partners Charter and Mediacom as well as Xfinity partners Altice and Cox Communications (the “vast discount” referenced by Brian in his quote needs to be extended to these partners as much as possible). Timing is everything, and with Olympics coverage beginning July 26th, Peacock is well positioned with expanded coverage. But the effort needs to be coordinated.

More details on Stream Saver will be greatly welcomed. Until then, yes, we will take more Netflix (and Max) in our bundles.

That’s it for this week. Thanks again for all your support and referrals. In two weeks, we will dive into capital budgets and likely have a special update on Jim’s new CEO gig. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!