Greetings from Denver, St. Louis, Kansas City, Charlotte/ Davidson and many points in between. Pictured is the full table of BBQ alternatives from Jim’s trip to LB Network’s annual BBQ and Dessert Competition. What an honor to be able to judge eight terrific entries (including a very tasty BBQ tofu dish). In the end, the burnt ends won. What a terrific time.

This has been an unexpectedly rich week of telecom news, so we are going to postpone the planned discussion of telecom capital expenses. Instead, we’ll look into Verizon’s YouTube Premium streaming and T-Mobile’s US Cellular acquisition announcements, along with why we think T-Mobile’s upcoming price increase is a yawner. We also have a very full market commentary.

The fortnight that was

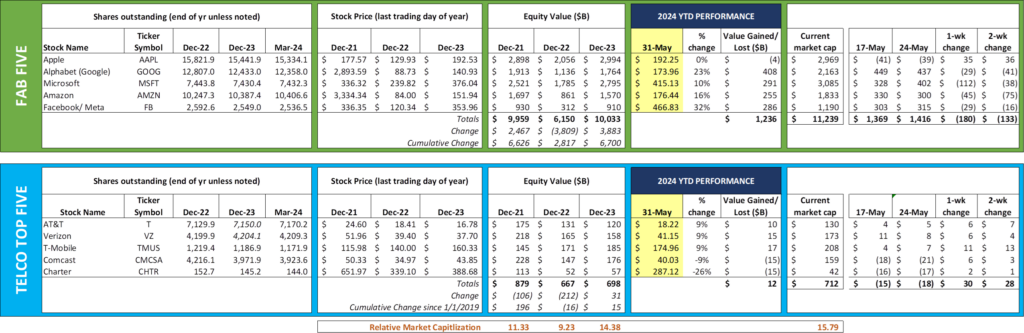

The last two weeks have been difficult for the Fab Five, with $180 billion (roughly one Verizon) in value lost over the period. Unlike most of the spring, Apple was the sole value generator this week, spurred by reports that China iPhone sales had turned around (Reuters article here). In addition, Bloomberg (Mark Gurman) reported that Apple’s Siri will be getting a host of upgrades throughout the next year with many of these features announced at June’s World Wide Developer Conference (WWDC).

As the article states, Siri will be performing more tasks through voice commands, such as deleting an email or cropping a photo and then emailing it to a friend. These make a lot of sense. Where it gets murkier, however, is when certain processing functions are performed in the cloud. Per the article (linked above):

“A major component of the new push is a system that [it] will use AI to automatically determine if a function should be handled on the device or via the cloud.

That has raised some privacy questions. While on-device tasks won’t share personal information, the cloud-based approach will require some user data to be transferred to remote servers. The information will be protected by the so-called Secure Enclave in the high-end Apple Mac chips powering the data centers, Bloomberg reported earlier this month.

Apple will attempt to further reassure customers that their data is private by creating an “intelligence report” that explains how the information is secured. The iPhone maker also won’t build profiles of customers — something it’s criticized Google and Meta Platforms Inc. for doing.”

We will be listening intently to see how Apple executives explain privacy within this AI-enabled world. Certainly not an easy task.

Google was another newsmaker this week with a blog post defining recent changes they had made to AI Overviews results (post here). The AI Overviews product is the text box that now appears prior to relevant links on a given searched topic. Liz Reid, Google’s VP and Head of Google Search, appears to tie a key source of current issues to “nonsensical queries and satirical content.” Said another way, AI Overviews are highly relevant for the most important, frequently asked questions and less so for obscure and nonsensical ones. The blog walks up to the “You are holding the phone wrong” line made famous by Steve Jobs without crossing it.

The actions that Google took to correct the AI Overview product were as follows (from the blog post linked above – the “we” below represents Google):

- We built better detection mechanisms for nonsensical queries that shouldn’t show an AI Overview and limited the inclusion of satire and humor content.

- We updated our systems to limit the use of user-generated content in responses that could offer misleading advice.

- We added triggering restrictions for queries where AI Overviews were not proving to be as helpful.

- For topics like news and health, we already have strong guardrails in place. For example, we aim to not show AI Overviews for hard news topics, where freshness and factuality are important. In the case of health, we launched additional triggering refinements to enhance our quality protections.

AI is going to continue to mature. The AI Overviews product is going to get better even for the “long tail” questions (sensical or not). But this is the second setback in less than a year for Google’s product (although this one appears to be minor), and Google’s reputation as a trusted source for results is clearly waning. For most users, the setback simply means that searchers will ignore AI-generated content prior to the link results for the near future. When they will reengage is anyone’s guess (update: WIRED published a very insightful article on AI Overview and how Google could improve their product yesterday. Have a look here).

Finally, in the last Brief, we commented on the AT&T/ AST SpaceMobile agreement, mentioning that it would place additional pressure on Verizon to select a partner. Last Wednesday, Verizon surprised many by also announcing a $100 million agreement with AST SpaceMobile (here) which consists of $65 million in prepaid charges and $35 million in convertible notes. As the nearby chart shows, this has been an exceptional month for AST SpaceMobile shareholders with the first price bump coming from AT&T’s announcement and the second from Verizon.

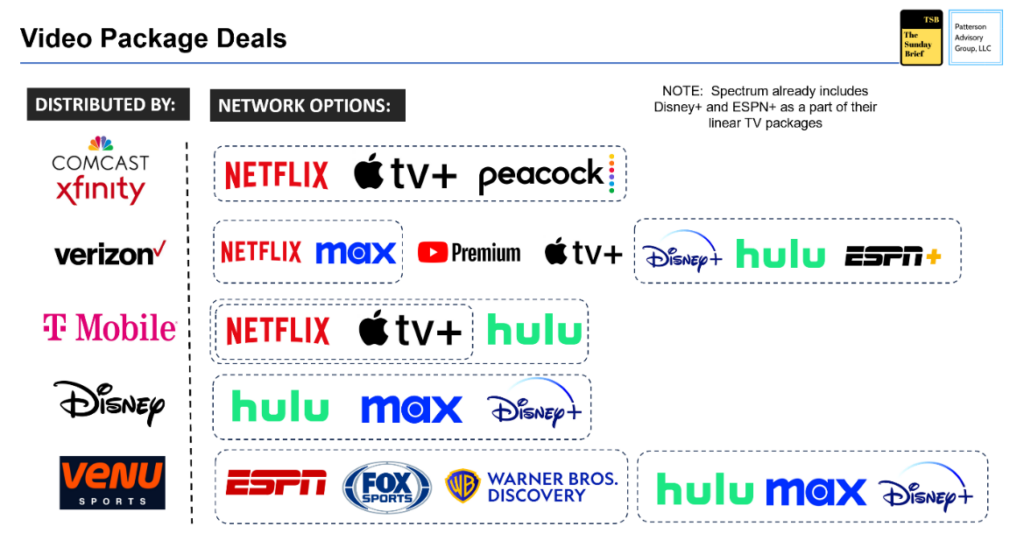

Verizon beefs up its streaming presence

Then, on May 28th, as a part of a larger announcement concerning phone upgrades for existing and new Verizon wireless subscribers (here), the company announced that they would be offering YouTube Premium for $10/ month as a myPlan perk (they also announced that they would be offering the Peacock streaming service on their Xumo competitor product called +play but it does not appear that any discounts will be offered).

This leaves Verizon as the only option with YouTube Premium (which includes YouTube Music, the second largest provider of streaming music in the US with more than 100 million paid and trial subscribers). Having been YouTube Premium and YouTube Music subscribers for a long time, we especially like Google’s product development focus on offnet downloads and content management. More than others, YouTube Music appears to have the customer’s end objective as a priority: view or listen to YouTube content wherever and whenever.

We do not think that there will be a lot of conversions from Spotify (or even Pandora) simply because of Verizon’s YouTube Premium offering, but do think that there will be some conversions from AT&T to Verizon due to the savings (for those of you recalling AT&T’s previous music streaming offering, it was Spotify and it lasted less than 24 months as an inclusion on their AT&T Unlimited & More Premium plans – original announcement here). Currently AT&T does not incorporate streaming music or video services into any bundled plan. Apple (disproportionately attached to iPhone users) or YouTube Premium (attached to both iPhone and Android devices) plans could alter the attractiveness of a non-bundled AT&T offer.

Some of you speculated after the last Brief that AT&T might try an end-around and get an exclusive on the Venu sports bundle. Given the growing anticipation surrounding a fall launch, we can confirm that there will not be an exclusive at launch. What we do know is that if Comcast gets the NBA (rumors are swirling – see here), the attribution to the Warner Brothers Discovery networks is going to diminish.

Bottom line: Verizon’s YouTube Premium move is great, and the inclusion of Peacock into the +play offerings is long overdue. Music libraries are difficult to recreate, which reduces the likelihood of switching but also increases the opportunity for one service provider to offer a “value menu” of streaming voice and entertainment options.

T-Mobile buys most of US Cellular—will anyone care?

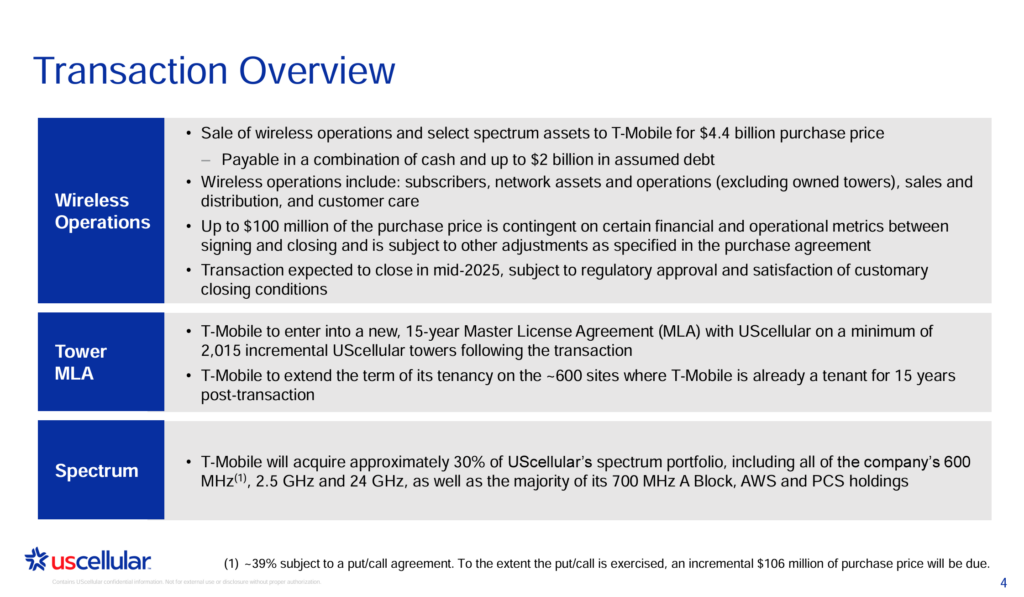

Also in the last Brief, we discussed the possibility of T-Mobile purchasing some or all of US Cellular (as a recap, there are some NY-based cooperative agreements that Verizon has the right to purchase, but the remainder of the assets seems up for grabs). On Tuesday, the rumor became news, and the transaction appears to be even better for T-Mobile than most analysts suspected. Here is the summary from the US Cellular investor call:

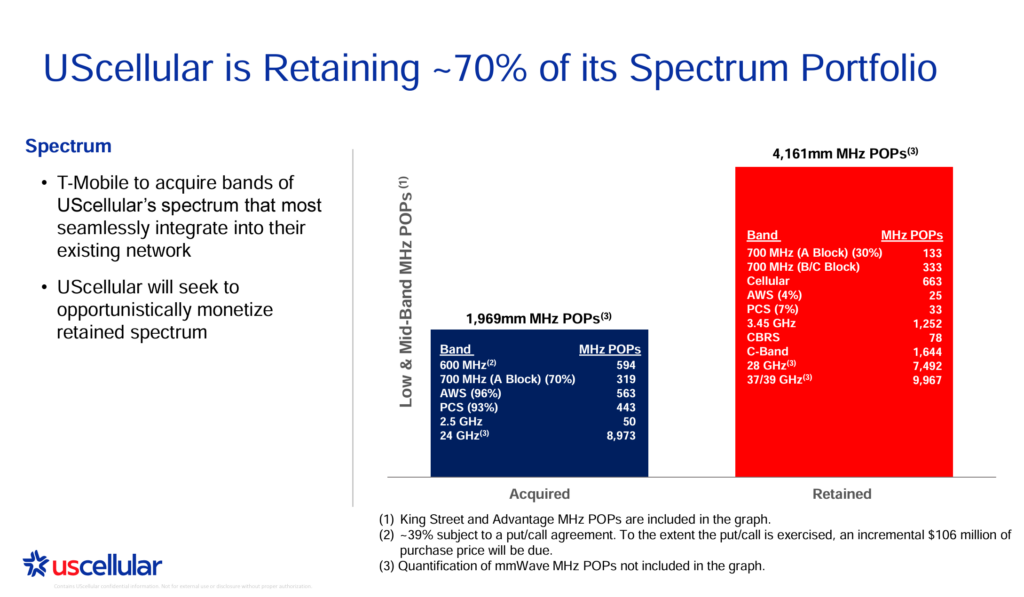

Rather than create a fight over spectrum caps, T-Mobile acquired all of the customers yet only 30% of the total spectrum holdings. While that might sound puzzling at first, it’s important to see how the numerator and denominator are calculated. Here is the spectrum split from the same US Cellular investor call:

T-Mobile elected to take the lower bands to improve coverage (and already on the T-Mobile network), leaving US Cellular with any spectrum that would create cap issues with US Cellular. And, to make the deal palatable to US Cellular, they also agreed to sign long-term deals on an additional 2000+ cell tower sites while extending the terms on the existing 600+ sites that they currently have under contract. Those tower deals are not included in the overall $4.4 billion announced purchase price.

As we discussed in the last Brief, this is a very easy deal to integrate, and adds a lot of low-band coverage to states like Iowa, Wisconsin, Nebraska, Missouri, Kansas and Oklahoma. In addition, however, it will materially augment wireless coverage in West Virginia, Virginia, and North Carolina, which happens to be where the vast majority of the Lumos fiber builds will be occurring.

To answer the question posed for this discussion, we think there are many people who are going to care.

Bottom line: T-Mobile has been very active with announcements in the last few months. They have Mint Mobile integration (relatively easy since they are keeping the brand and Mint was exclusively on T-Mobile’s network already). They have the Lumos integration (now with many new cell sites to connect to), and the US Cellular acquisition (which looks like a “Sprint Light” project to integration teams). When T-Mobile emerges from integrations and begins to realize cash flows ($1 billion in synergy savings from the US Cellular acquisition alone) is anyone’s guess, but the degree of difficulty is mid-level at best. In fact, the hardest part of the entire US Cellular transaction is convincing the FTC and the FCC that it’s in the public interest without giving up significant transaction value.

T-Mobile’s price hike—a yawner?

Shortly after the last Brief was published, T-Mobile began to send notices to some of their legacy plan customers that their bills would be increasing by $2/ mo. (connected devices) and $5/ mo. (traditional voice/ text/ data customers). These impacts, per this support page set up by the company, will go into effect on June 5th (this Wednesday).

T-Mobile CEO Mike Sievert addressed the changes at a recent investor conference:

“Well, anything that we might do in the space would be designed to make sure that T-Mobile is and remains the greatest value in this industry…. It’s been roughly a decade since we’ve addressed any core pricing, and costs rise over a period of time. I think even our customers understand that. So we’re going to be thoughtful and make sure that we jealously guard the fame that our brand has as the lowest prices, best value in this marketplace. And what that looks like changes a little bit over time, but we’re going to be very thoughtful about it.”

Costs have risen across the industry – labor, electricity, real estate leases, fuel costs – there are few if any offsets. And data consumption has grown considerably over the same period. T-Mobile could have gotten cute and reinstated taxes and fees on certain plans – they didn’t. They could have raised late fees or created a new transfer fee or done something completely different – but they didn’t. And, according to reports (here) they have increased staffing to handle any calls (which will likely lead to downgrades as opposed to outright churn).

We believe this will have a second quarter impact but will be largely offset by ACP-sunsetting gross additions. After the second quarter, it’s a yawner until electricity and other prices go up in 2025.

That’s it for this week. Thanks again for all your support and referrals. Because of the bevy of news over the last week, our capital discussion will need to wait until the mid-June edition. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!