We will use the interim Briefs to talk more about the telecom shelter remanufacturing business and how you can help. And, as we indicated while at Fastwyre Broadband, the opinions expressed in The Sunday Brief are the author’s alone and may not reflect those of CellSite Solutions.

News flow has not been short the last two weeks, but we will spend most of this Brief discussing capital plans for the wireless carriers and cable companies. We performed a similar analysis two years ago and think a refresher will help readers establish a realistic baseline for the remainder of 2024 and 2025.

The fortnight that was

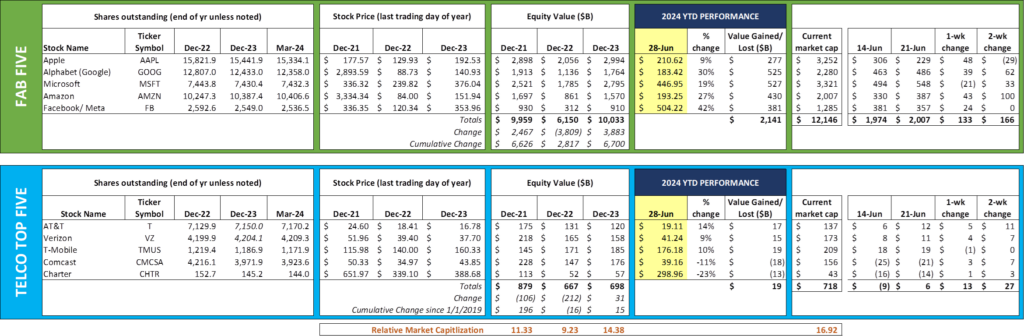

Since our mid-June Brief, the Fab Five have added $166 billion in value and the Telco Top Five have added $27 billion. The strongest gains have come from Amazon (who announced new plans to compete against Chinese online giant Temu – more here) and from Google. In the telco space, the gains have come from AT&T, Verizon and Comcast.

Notably, Amazon crossed the $2 trillion market value this week. Since the end of 2021 (what many call the “COVID peak”), Amazon has managed to grow their equity market capitalization by ~7.5% on an annualized basis. This is notable considering the profit tailwinds driven by “at home” activities, as well as the company’s investment approach (no buybacks, no dividend).

Many analysts mistakenly attribute Amazon’s market gains to the Artificial Intelligence (AI) trend. As the nearby chart shows, however, Amazon (green line) bears a striking resemblance to another retail heavyweight, Walmart (blue line), who does not have an AWS unit. Over the 5.5-year horizon shown, Amazon’s equity value has gained just over 40% more than Walmart, but both have been on a tear this year. Through the first six months of 2024, Walmart has slightly outpaced Amazon (+28.9% for WMT vs. +27.2% for AMZN, and that excludes another 0.6% return through Walmart’s dividend).

Whether this year’s change can be attributed to changing economic purchasing patterns at Walmart (see this Bloomberg article from late March which describes how higher income families are increasingly shopping there) or an indication that AWS’ market leadership is losing ground is anyone’s guess. What it does show is that “big cap” is winning, and Amazon’s AWS unit performance is not the main driver of the Seattle company’s terrific rebound.

Verizon’s new look

In telecom, two major news events occurred over the last fortnight. There were several price increases taken by telecommunications providers which were described in last Saturday’s interim Brief (here). How these will impact the earnings and competitive pictures throughout 2024 will be one of many topics in our July 14 second quarter earnings preview Brief.

The second big event, however, was Verizon’s rebranding (here). On top of the rebranding, the company also revamped their home broadband offering, now called Verizon myHome. With the exception of Apple Music Family and Apple One (to be debuted in the third quarter), the “adder” purchasing model that changed Verizon’s consumer wireless business has now been duplicated for home broadband. We view this as a very positive way for consumers to try new streaming channels/ bundles without having to sign up for a long-term contract. It is unclear, however, how myHome will intersect with the legacy +play platform (we assume it will replace it within a year, but the announcement was silent).

Verizon also expanded their trade-in program, and also took a page out of the T-Mobile playbook with a new Verizon Access program which rewards customers with “pre-sales, free giveaways, and highly sought after events.” The company has historically had a difficult time maintaining a loyalty program and it will be interesting to see how this one fares.

The big news, however, was the new logo. As the above picture shows, the checkmark logo (left) has been replaced with a glowing “V” (right). The introduction of a second color into the iconic logo was especially interesting, particularly the choice of yellow. In the extended commercial (here) debuting the new brand and messaging (all around the word “now”), Verizon shows an entirely yellow version of the logo (see screen shot nearby). We really like the use of an additional color but wonder if Sprint has been gone long enough to avoid resurrecting that association (and, for long-timers who remember Sprint’s “Be There Now” campaign in the 1990s, the tagline).

It’s a bold move, and Verizon is a brand investment champion. Time will tell if yellow was the right palette addition.

The Supreme Court overturns the Chevron Deference

Amongst many Supreme Court decisions handed down last week was the overturning of the Chevron Deference (ruling here). The New York Times summarizes this legal term as follows (article here):

“That decision held that when Congress passes a law that lacks specificity, courts must give wide leeway to decisions made by the federal agencies charged with implementing that law. The theory was that scientists, economists and other specialists at the agencies have more expertise than judges in determining regulations and that the executive branch is also more accountable to voters.”

The overturning of Chevron has wide implications for the health care, industrial/ environmental, and banking/ financial services sectors. Telecommunications is not immune either, as the authority to determine Title II classification by the FCC largely depends on how the agency defines a utility. The Verge has an excellent (but lengthy) article summarizing some of the possible changes that could occur with respect to Title II classification and recently enacted net neutrality rulings. Here’s a brief excerpt from the article:

“For example, even when the FCC previously chose to classify ISPs in a way that would lead to lighter-touch regulation, the Supreme Court ruled in National Cable & Telecommunications Association v. Brand X Internet Services that Chevron deference should be applied to the FCC’s interpretation of the Communications Act. “Brand X’s conclusion that the statute at issue is ambiguous made it highly likely that reviewing courts applying Chevron would uphold the net neutrality rules under review regardless of whether they were regulatory or deregulatory,” [University of Pennsylvania law professor Christopher] Yoo wrote.

Interestingly, several ISPs are currently challenging the FCC’s net neutrality authority (see this Broadband Breakfast article here). The result is that more second guessing of the FCC’s decisions will wind up in the courts. We will have more on the overturning of the Chevron deference in future Briefs.

Where are they spending money?

Every year, we update our capital spending tracker for each of the Telco Top Five. The high-level notes are published below (additional details available upon request).

Here’s the TLDR version:

- AT&T continues to spend a lot of money. $21 billion would be more than double T-Mobile spending and ~25% more than Verizon. This is driven by C-Band deployments as well as fiber to the home (FTTH) deployments.

- Verizon and T-Mobile are beginning to build reserves, providing some cushion prior to the next wireless spectrum auction (which could be 3-4 years away). T-Mobile is returning a lot of their free cash flow to shareholders, including their largest shareholder, Deutsche Telekom.

- Cable companies are beginning a new capital cycle focused on pushing their fiber network closer to the customer. This, plus new amplifiers and other network upgrades, will enable faster and symmetric speeds. Comcast appears to be 6-9 months ahead of Charter in this effort.

- All of the spending outlined below pales in comparison to the hyperscalers. Data center spending alone will exceed the entire telecom spend in 2024. Per Bloomberg, Amazon has announced plans to spend $150 billion in the next 15 years on data center infrastructure.

Here are the major excerpts from each company’s earnings calls and quarterly earnings reports that back up the statements:

Verizon (from their 10-Q):

“We continue to invest in our wireless networks, high-speed fiber and other advanced technologies to position ourselves at the center of growth trends for the future. During the three months ended March 31, 2024, these investments included $4.4 billion for capital expenditures. Capital expenditures for 2024 are expected to be in the range of $17.0 billion to $17.5 billion.

We are focusing our capital investment on building our next generation 5G network, while also adding capacity and density to our 4G LTE network. We are densifying our networks by utilizing macro and small cell technology, in-building solutions and distributed antenna systems. Network densification enables us to add capacity to address increasing mobile video consumption and the growing demand for IoT products and services on our 5G and 4G LTE networks. We obtained full access to our C-Band spectrum in August 2023, and will continue deploying this spectrum across the continental U.S.”

Key metrics for Verizon (cited by Joe Russo, President of Global Networks and Technology):

- 250 million POPs covered by C-Band by the end of 2024 (likely will be achieved in Q3 if they have not done so already).

- 50% of all Verizon cell sites are directly connected to Verizon-owned fiber.

- More than 50 million homes passed with fixed wireless access and 18 million with FTTH (Fios)

AT&T (from their 10-Q)

“The amount of capital expenditures is influenced by demand for services and products, capacity needs and network enhancements. Our capital expenditures and vendor financing payments were slightly elevated in 2023, reflecting strategic investments. In 2024, we expect that our capital investment, which includes capital expenditures and cash paid for vendor financing, will be in the $21,000 to $22,000 range.”

Areas of focus/ key metrics for AT&T (from various documents/ sources):

- Scale Open RAN deployment. (from the 10-K) “We plan for about 70% of our wireless network traffic to flow across open-capable platforms by late 2026, and to have fully integrated Open RAN sites operating starting in 2024. Beginning in 2025, we expect to scale this Open RAN environment throughout our wireless network in coordination with multiple suppliers.”

- 30 million homes and businesses passed with fiber by the end of 2025 (high probability of achieving by 2Q 2025)

- Mid-band spectrum coverage is currently “more than 220 million people” per their 5G website

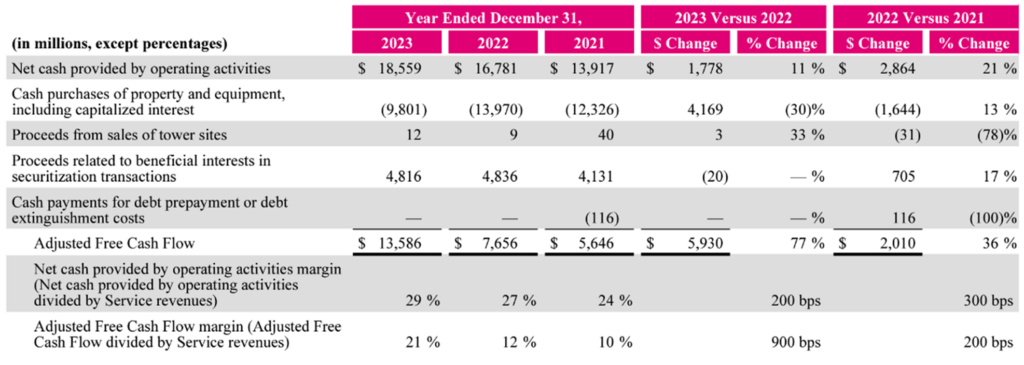

T-Mobile (from their 10-K, 10-Q and other management reports):

Capital spending trends:

- Per their latest Factbook, T-Mobile expects to spend $8.6-9.4 billion in capital in 2024, ~8% less than 2023.

- Over 300 million POPs covered with mid-band 5G. Currently densifying their network using proceeds from Auction 108 (which was released last March with a goal of densifying an additional 60 million POPs in 2024). Note: there remain an additional 20 million POPs to build out. These remaining sites involve new tower arrangements (likely new towers)

- T-Mobile also proposed a spectrum swap in May with SoniqWave Network that would transfer some 3.45 GHz licenses to SoniqWave in exchange for 42 2.5 GHz licenses and 16 lease assignments. More in this Fierce Network article.

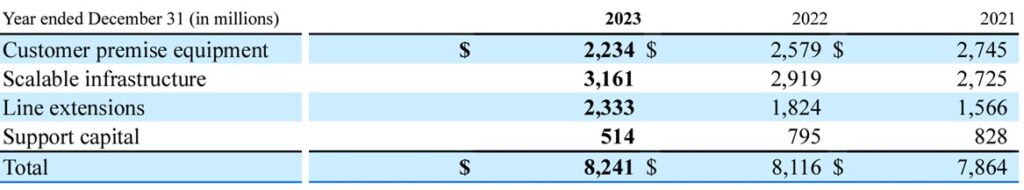

Comcast – per their 10-K, 10-Q reports and management presentations:

- Connectivity and Platforms: “Connectivity & Platforms’ capital expenditures decreased 3.8% to $1.9 billion, reflecting lower spending on customer premise equipment, scalable infrastructure and support capital, partially offset by higher investment in line extensions.”

- Three-year trend (note the changes in each capital category):

- 2024 spending: “We expect our capital expenditures in 2024 will continue to be focused on investments in line extensions for the expansion of both business services and residential passings in the Connectivity & Platforms business, in scalable infrastructure as we increase capacity and continue to execute our plans to upgrade our network to deliver multigigabit speeds, and in the continued deployment of wireless gateways.”

- 35% of customers receive download speeds in excess of 1 Gbps.

- Non-video Comcast customers consume more than 700 GB per month.

- DOCSIS 4.0 deployments underway (Seattle should launch soon); no published schedule although entire footprint will be covered with the new technology.

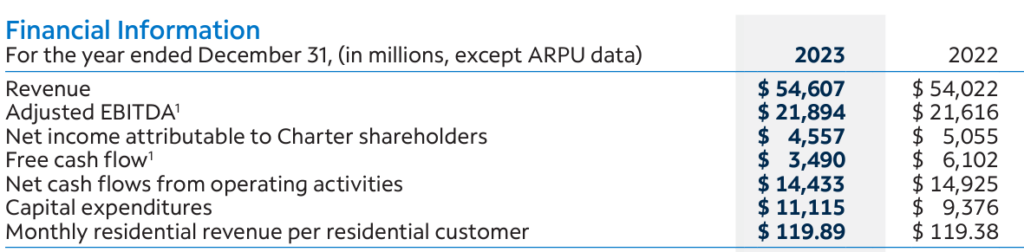

Charter:

- Currently in the middle of Rural Development Opportunity Fund (RDOF) buildouts. Note: Comcast did not participate in the RDOF program.

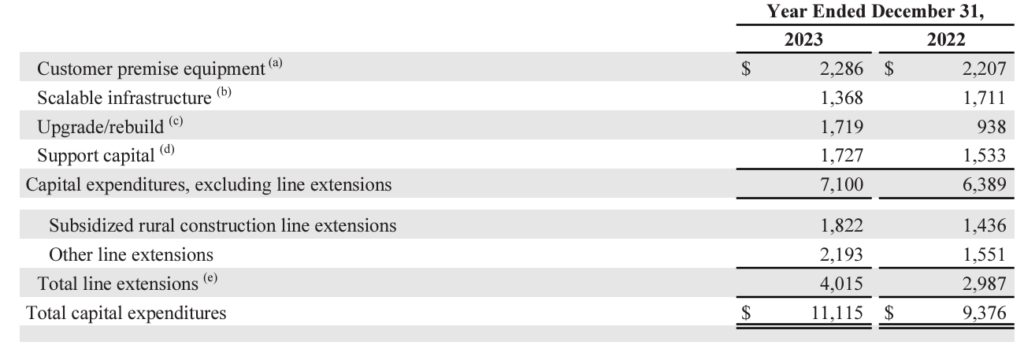

- 2023 vs. 2022 capital spending and other key statistics (from their 10-K):

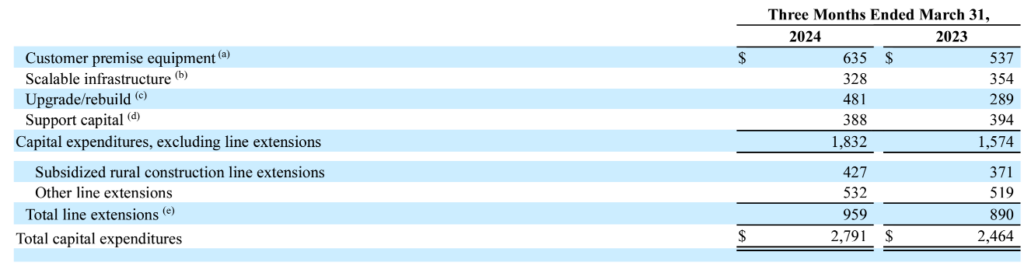

Detailed capital expenditures (current quarter in first table; 2023 vs. 2022 in second):

- Commercial services and the Rural broadband (RDOF subsidized) initiative represented $800 million (29%) of the $2.79 billion in Q1 spending.

- Charter has been paring back their rural build and has returned over 1,400 RDOF census blocks (with penalties) to the FCC in 2024.

- Charter will begin to spend more for DOCSIS 4.0 and high-split projects throughout 2024 and 2025.

That’s it for this week. Thanks again for all your support and referrals. The next Brief will focus on key metrics to look for in 2Q earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, a Happy Birthday to my dad, Dean Patterson, who turns 88 today. Also, go Sporting KC and Kansas City Royals!

Important disclosure: The opinions expressed in the Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.