Editor’s Note: RCR Wireless News goes all in for “Throwback Thursdays,” tapping into our archives to resuscitate the top headlines from the past. Fire up the time machine, put on those sepia-tinted shades, set the date for #TBT and enjoy the memories!

Cellular’s market share drops as PCS rises

DENVER, United States-Personal Communications Services (PCS) carriers have made significant inroads into the U.S. wireless telecommunications industry, weakening the entrenched cellular carriers’ net additions and driving down airtime prices. The total number of PCS subscribers in the States reached 3.1 million during the first quarter of 1998. Major PCS operators blazed a trail throughout 1997, rapidly launching new markets across the United States. Service is available in virtually every major U.S. market, with most markets supporting more than one PCS operator. PCS carriers’ quick entry into the U.S. wireless market has begun to take its toll on the U.S. cellular industry, which turned 15 years old this year. PCS carriers’ success in both subscriber and revenue growth has surprised analysts. A report released earlier this year from New York analyst firm Salomon Smith Barney forecasts cellular net adds will decline 33 percent year-to-year going forward. The major cellular carriers experienced significant declines in net additions during the first quarter. AT&T Wireless Services Inc.’s net additions declined 22 percent compared with those in first-quarter 1997, while SBC Communications Inc. and GTE Wireless experienced the sharpest declines in subscriber growth at 79.3 percent and 77.7 percent, respectively, according to a Bear, Stearns & Co. Inc. report. Smith Barney said PCS carriers’ strong net gains reflect growing demand by new customers for digital service, no contracts and lower airtime rates, as well as ongoing migration of existing analog customers to digital networks. … Read more

The ‘calling party pays’ movement

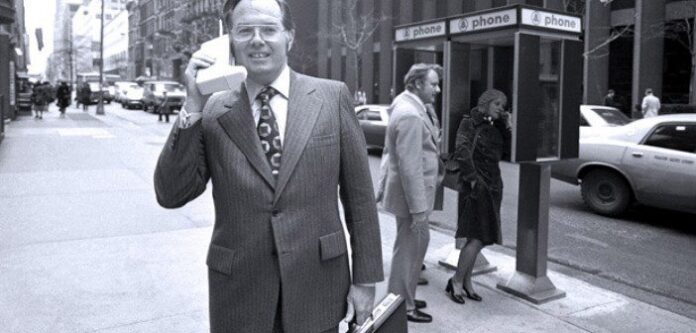

WASHINGTON-The American novelist Edith Wharton once noted the only thing that distinguishes vice from virtue is point of view. Some might say her comment is an apt description of the current debate about whether the U.S. wireless market should adopt Calling Party Pays (CPP) as a nationwide billing option. CPP so far has been implemented or trialed on a very limited basis in the United States. And according to a July 1997 white paper from the Cellular Telecommunications Industry Association (CTIA), “CPP appears to be available only as an intraLATA service, and not effective between different [local exchange carriers]. In other words, a CPP call can originate on a given LEC’s network, but cannot transmit to another LEC’s network and thus to a [wireless] subscriber.” Advocates argue that Calling Party Pays, which is the billing norm in most European and Latin American wireless markets, would stimulate the growth of wireless service in the United States. If Calling Party Pays were a nationwide option, they say, subscribers would give out their wireless phone numbers more readily and leave their phones on. Consequently, minutes of use would climb, and wireless service would get a lot closer to achieving its objective of delivering “anytime, anywhere” communications. Other people, while not necessarily opposing the concept of Calling Party Pays, question whether it can work in the U.S. market. Relative to Europe and Latin America, they say, the United States is a much more complex arena, with its dual layers of state and federal regulations and its huge mix of wireless and wireline carriers, technologies and marketing strategies. In addition, they point to the entrenched American perceptions of how wireless service operates. Ever since cellular first became available in the early 1980s, both wireless and wireline customers have been accustomed to the “mobile party pays” practice. … Read more

Motorola sees a positive future in China

BEIJING-Motorola Inc. Chairman Gary Tooker called China “our second home” as he inaugurated a new 18-story office building in Beijing 19 June. P.Y. Lai, president of Motorola (China) Electronics, added that the completion of the North Asia Center “unveils a new chapter for Motorola and serves as the strongest possible testimony of the company’s confidence in the future of China.” On 22 June Tooker had a meeting with Chinese president Jiang Zemin, who praised Motorola for its contributions to the healthy development of relations between China and the United States. … Read more

Mobile data tomorrow, but not quite today

OXFORD, United Kingdom-The imminent explosion of the mobile data market has been like a constant companion for the past 12 years. The technology driving this supposed market expansion may have changed over time, but the predicted boom has always been present, always just about to happen. It hasn’t happened yet. But the predictions are still in place, and suddenly there is a mood of renewed optimism. A consensus is emerging on the conditions necessary to trigger the long-awaited explosion in mobile data. Recent industry initiatives could satisfy those conditions. The fuse may well have been lit. The original mobile data technology was based on dedicated, packet-switched wireless data networks. Two main systems fought over the European market-Mobitex from L.M. Ericsson and DataTAC from Motorola Inc.-but with limited success. Not many countries adopted dedicated mobile data technology, and very few of the installed networks attracted a significant subscriber base (see table below). The technology was dealt a fatal blow two years ago when a major German network and both French networks suddenly shut down. Competition from data over cellular was one reason for the demise of the dedicated networks. But in its turn, the promise of data over analog cellular was never fulfilled. Cellular Digital Packet Data (CDPD), one of the most promising variants of data over cellular, has seen the investment of nearly US$300 million in infrastructure in the United States, according to the Strategis Group. But by the end of last year, there were only some 15,000 active subscribers across the whole country, with average subscriber revenues of just US$41 per month. … Read more

Mexico auctions spectrum in six-month process

WASHINGTON-Mexico will receive US$1.06 billion, plus value-added tax, for Personal Communications Services (PCS) and Wireless Local Loop (WLL) spectrum auctioned in a six-month process completed 8 May. The Sistemas Profesionales de Comunicacion (SPC) consortium, Qualcomm Inc. with consortium partner Grupo Pegaso, cellular operator Radio Movil Dipsa S.A. de C.V. (Telcel), cellular operator Grupo Iusacell, Midicell and Grupo Hermes were awarded 30 megahertz and 10 megahertz 20-year PCS licenses. SPC, Midicell, Telefonia Inalambrica del Norte S.A. de CV (Telinor) and Telefonos de Mexico (Telmex) won WLL licenses. The SPC consortium, headed by Ricardo Salinas Pliego, owner of TV Azteca and Elektra stores, won all nine A-band 30 megahertz licenses, in addition to the D- and H-band 25 megahertz WLL licenses. SPC has since signed a US$700 million contract with Lucent Technologies Inc. for system buildout, and rapid network deployment is expected. “Salinas Pliego has a very pragmatic experience with the telecom market and, more importantly, with the demographics [he wants] to serve with these licenses-the B to E tiers of the population. [He is] not interested in `cherry-picking’ customers,” said Ed Czarnecki, director of international consulting at U.S.-based BIA Consulting Inc. Qualcomm won 30 megahertz licenses in regions 1, 2, 4, 6 and 9, as well as 10 megahertz licenses in the four remaining regions. It intends to initiate service in early 1999 using CDMA (Code Division Multiple Access) technology. … Read more

Prepaid start-ups accused of bilking investors

DENVER-Investors in two start-up prepaid cellular phone businesses have filed a class-action lawsuit against the businesses’ promotors, claiming they bilked investors out of more than $58 million. The lawsuit, filed in Denver District Court, alleges that 12 individuals and 10 businesses conspired to cheat investors in a “boiler-room” scheme designed to look like a start-up cellular business that would target credit-challenged customers. The investors claim the defendants were able to raise within about two years in excess of $58 million from more than 5,500 investors throughout the nation. Today that money is almost gone, unaccounted for and many of the businesses are in bankruptcy. An ongoing audit by Deloitte & Touche has yet to be able to account for a large portion of the money, according to the lawsuit. About $3 million remains locked in an escrow account under orders from a federal judge. The suit names Lawson M. Kerster, Edward D. Duncan and Brian J. O’Shaughnessy as key conspirators in the scheme. The two businesses funded by the investors-One-Stop Wireless of America Inc. and Pre-Paid Cellular Inc.-have filed for Chapter 11 bankruptcy protection. The remaining businesses and individuals named in the lawsuit worked with One-Stop Wireless and Pre-Paid Cellular to sell partnership units to the investors. These defendants include David Chadwick and his company, C/Net Solutions Inc., which served as a consulting firm to the businesses. … Read more

Check out the RCR Wireless News Archives for more stories from the past.