July greetings from Cedar Rapids, Kansas City and Washington, DC. Kudos to my brother-in-law, Andrew Ashcroft, for earning his promotion to Captain in the U.S. Navy. It was an honor to join family and friends at the Pentagon earlier this month to celebrate his achievement.

It’s mid-July and the second quarter earnings season is upon us. Here is the current schedule of earnings announcements for the Fab Five and the Telco Top Five:

| Company | Day | Date | am/pm |

| Verizon | Monday | July 22 | am |

| Comcast | Tuesday | July 23 | am |

| Alphabet | Tuesday | July 23 | pm |

| AT&T | Wednesday | July 24 | am |

| Charter | Friday | July 26 | am |

| Meta | Wednesday | July 31 | pm |

| T-Mobile US | Wednesday | July 31 | am |

| Apple | Thursday | August 1 | pm |

| Microsoft | TBD | TBD | TBD |

| Amazon | TBD | TBD | TBD |

We will continue to update this chart through the spreadsheet distributed in our online-only interim Briefs. Our next full Brief will be on July 28th, which should split the results in half.

After a full market commentary, we will use the remainder of the Brief to highlight several items (including the expiration of the Affordable Connectivity Plan or ACP) that will influence earnings outlooks.

Two scheduling notes – Jim will be at the Fiber Connect 2024 conference in Nashville on July 29 and 30. If you would like to connect to discuss the industry in general and/or his new role as CEO of CellSite Solutions, please reach out to him through LinkedIn or through email. Secondly, if you will be in the Boston area the evening of July 31, Jim will be hosting a happy hour in Boston that evening. Please reach out to Jim if you are interested in attending. The location will be determined based on the number of attendees (currently 10).

The fortnight that was

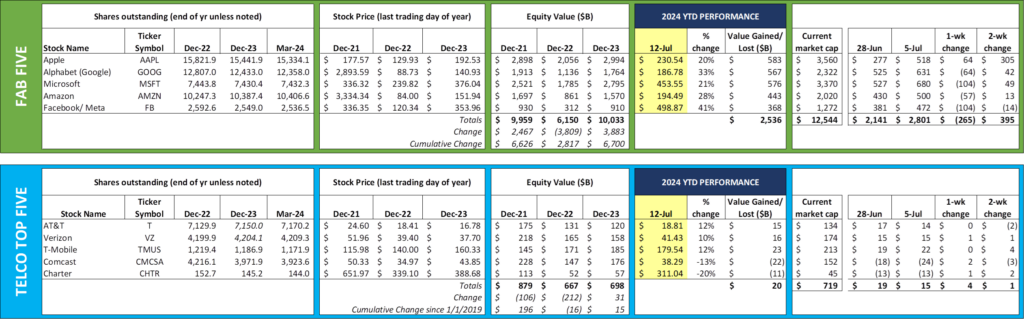

While the Fab Five had a down week in aggregate (-$265 billion), it managed to grow $395 billion over the fortnight. So far in 2024, the group has accumulated an additional $2.54 trillion in market capitalization. The Telco Top Five also managed to gain over the last two weeks (+$1 billion) and have increased $20 billion so far in 2024. It’s hard to believe that at the end of 2021 Comcast was the largest telecommunications company in the US while T-Mobile was fourth. Magenta’s ability to integrate Sprint with minimal losses, as well as excellent execution of a capacity-utilization driven fixed wireless strategy, drove them to the top spot with nearly $40 billion in market capitalization to spare.

Samsung’s Unpacked event (from the Louvre in Paris) was the big news story of the past week. New watch, new foldable smartphones (the Z Fold and Flip 6 – specs here and pictured nearby), and even a smart ring were debuted to improve health data colletion. Having used the Samsung Watch 6 Classic (now yesterday’s version) for a few weeks, it’s hard to think about the need for a ring with regular watch wear – the incremental health measurements are minimal. But that may be the point – there are certain instances when the simplicity of a ring can bridge any technology fears and a watch might not be the best solution.

Where Samsung (and Apple) has the opportunity to excel is when they incorporate relevant and personalized intelligence – from a physician, from a clinic, from a community, from family history, or even a large language model – into the daily patient data feed. Answering the question “What do I do now?” through this new ditigal array is definitely in an eary stage, but the implications are significant. While we recognize that Apple and Samsung want to dominate this space, it might be better suited for a health care records company like Oracle Health or Epic Systems to ingest the information given their existing relationships with hospitals and physicians.

The importance of network security was also reemphasized this week when AT&T relvealed that Call Detail Records (CDRs) from May to October 2022 had been downloaded through cloud carrier Snowflake for over 100 million customers (news release here). Since AT&T has not denied that government devices were a part of the breach (according to this New York Times article, AT&T serves the State Department, Department of Defense, Department of National Security, and other data-sensitive branches), attention should turn to the communications exchanges themselves. That information could be particularly harmful to national security even though the contents of each text message (or phone call) were not disclosed.

Fortunately, the CDRs contain no message content. In the future, however, Artificial Intelligence (AI) will generate conversation summaries and transcripts. How will that data be safeguarded? Will it be in a manner similar to sensitive profile billing/ financial data? What role will encryption play? Many questions remain unanswered, and the risks of early adoption without addressing each security issue create exposure.

Finally, it’s worth noting that Frontier and Stonepeak are talking about $500 million to $1 billion in additional funding for new fiber builds per this July 3 Bloomberg article. We presume this would be set up to bolster the Frontier’s success during BEAD funding negotiations (meaning that some of the remaining capital needed might come in the form of BEAD grants). How they would structure their agreement to satisfy Stonepeak’s investors remains to be seen, but Frontier has been able to issue revenue term notes with relative ease (see here for their June announcement).

The lowest quartile (2Q earnings preview)

There’s no doubt that one of the most important questions coming out of the quarter is “How did [your company name] handle the demise of the Affordable Connectivity Plan (ACP)?” Most of the responses will be nuanced, such as “none of our postpaid retail customers were impacted” or “even if there was a revenue impact, our EBITDAs were low so there should not be a lot of cash flow impact.”

The better question to ask, however, is “How did [your company name] gain from the turmoil created by the end of ACP?” The answers to that question will be answered differently by wireless vs. fiber/ wired companies. Spectrum is fungible, deployed fiber is not.

The problem with this answer, however, is that T-Mobile is only deploying fixed wireless where they have excess capacity. That condition may not overlap with post-ACP demand from potential T-Mobile fixed wireless customers. That leaves Verizon as he main technology alternative versus cable/ fiber/ telco (we assume AT&T is only deploying their Internet Air product for residential customers on a very limited basis).

If an affordable rate was determined (we think that $40-50/ month with no government subsidy is as high as cable can go to serve the lowest quartile of broadband customers – this number may be much lower in Multi-Dwelling Units or MDUs), then we think that Charter, Comcast, Cox and others probably saw many fewer net losses than analysts expect. However, with the $30/ month ACP subsidy gone, costs of monitoring payment/ suspending/ reconnecting likely grew in the quarter. The result is a large portion of customers paying $40-50/ home for broadband but hanging on by a thread. And the probability that future builds in lower demographic areas will proliferate with BEAD funding is diminished – if any carriers show up, the construction will likely be fully funded by BEAD if price controls are mandated.

The alternative to BEAD is to have increased usage through wireless devices (Hotspots, more cellular-only usage, especially for smaller households). Most plans have unlimited usage (no caps) but receive deprioritized data after 50-100 GB is consumed. Hotspot usage continued to be limited as well (15-60GB is the likely range, which would support a “[very] light streaming” consumption model at 480p but unlikely to be able to satisfy streaming/ remote learning/ other applications).

This is where products like Comcast’s NOW Mobile come in. At $25/ line (taxes and fees are included in that rate per the link), with 20 GB of data per line, Comcast can serve basic wireless and data needs for slightly more than the after-tax cost of working two hours at minimum wage. Not free, but low cost. We think that Comcast hit a home run with their NOW product line, but maintaining that base is not going to be cheap. The company has a long history of dealing with lower quartile cable bills, however, and they seem to be in a very good position to address concerns.

Fierce catalogued each carrier’s broadband plans in this April 16th article. The array of options is wide, and, as noted earlier, tends to favor traditional wired solutions. While most of the subscriber impacts will be at the prepaid or MVNO levels in wireless, the wired providers will be breaking out ACP losses for the first time and the EBITDA impact might be surprising, especially in the case of Charter. Our view, however, is that traditional wired providers are more focused on maintaining their higher-quality customer bases as Frontier, AT&T, and other FTTH providers like Metronet continue to expand and grow.

Where does this leave the lower quartile of broadband users? Waiting for BEAD implementation, and that could take some time. Meanwhile, carriers like Tracfone, Metro and Cricket will continue to slowly boost their premium data allocations, and cable MVNOs will continue to bundle mobile with discounted DOCSIS services.

Outside of the lowest quartile, here are some other specific questions that we would recommend get asked on the calls:

- For Verizon: Is the below OpenSignal chart true (link here)? Why is Verizon significantly lagging in 5G availability and what can the company do to improve overall coverage? What additional expenditures will Verizon need to make (capex, towers/ operating leases) to reach 70%? What is a reasonable figure to achieve by the end of 2025?

- For AT&T: We think that AT&T is surprised by the success of AT&T Internet Air (mainly for businesses today). What are your plans to expand AT&T Internet Air to more places, including Work from Home (WFH) and/or redundant access?

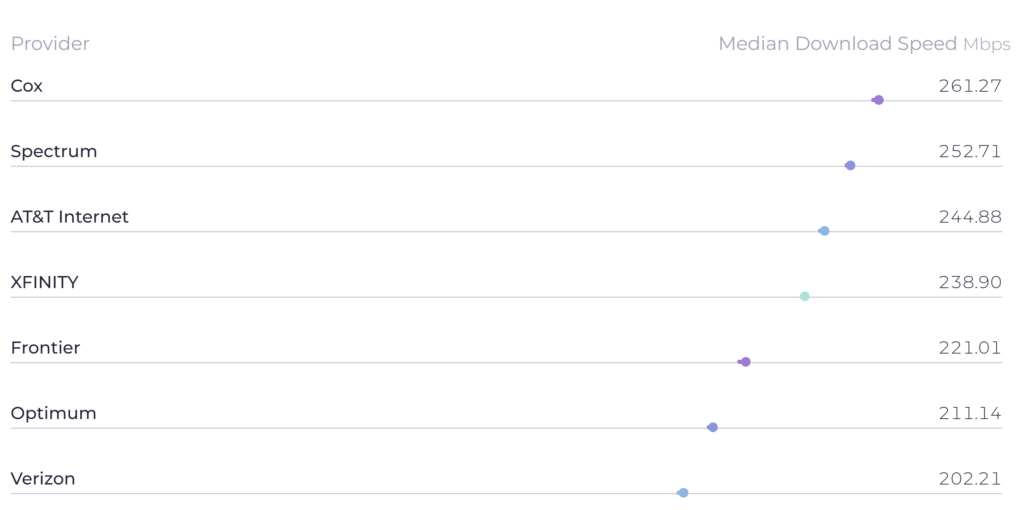

- For AT&T: This chart shows the most recent fixed broadband speeds from Ookla as of Q4 2023. Why is AT&T’s median download speed consistently lower than the advertised speed of the lowest tier plan (300 Mbps)? Given the upgrades reflected in reported ARPU, shouldn’t AT&T be the fastest? Note: AT&T recorded the fastest upload speed of all US fixed broadband providers.

- For AT&T: Here is the support article outlining rather dramatic changes in legacy pricing plans. How has this change impacted calls to care, churn, and ARPU/ downgrades? What are the EBITDA implications of this change?

- For AT&T: The US Census Bureau recently released their fastest growing markets (see our Sunday Brief coverage here). With so many of these markets served by AT&T, shouldn’t fiber subscribers be growing faster then currently shown? Isn’t AT&T a net beneficiary of the household migration from North to South (and West)?

- For T-Mobile: How will T-Mobile overcome government objections to their acquisition of US Cellular’s operations? Will T-Mobile have to make significant concessions? Is the company willing to take on a costly and protracted lawsuit with the [Biden 2nd term] DOJ?

- For T-Mobile: How is the 800 MHz auction progressing, and how will the companies use the proceeds from the auction? Has the company made any additional progress on network changes that would increase the capacity available for fixed wireless access?

- For cable: The second half of the year is going to be full of political advertising. With Wisconsin (mostly Charter), Pennsylvania (Comcast and others), Michigan (Comcast/ Charter), Arizona (Cox), Nevada (Cox), and North Carolina (Charter) likely key battleground states, and folks like Elon Musk, Ken Griffin, and Paul Singer likely contributing record amounts, how good could it get for advertising in the second half of 2024?

That’s it for this week. Many thanks for the comments and notes about the last Brief which focused on capital spending. Based on your requests, we will do our best to update that information twice per year. Earnings will be dominating the next two Briefs, and we will likely post interim updates online. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Team USA, and Kansas City Royals!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.