In all the to-and-fro last week about how to size the private 4G/5G market, mostly following the quarterly results from Ericsson and Nokia, an email exchange with the Global mobile Suppliers Association (GSA), which seeks to keep score of it, threw certain perennial aspects of the tricky maths involved into sharp relief. As discussed in the Nokia review, the GSA stats seek to gauge progress, rather than the total size of the market. It does this by taking periodic contributions from member companies about their private 4G/5G sales to new customers in each territory.

On the face of it, this appears like a fair measure. After all, private 4G/5G remains a novel technology, to an extent, and its total addressable market (TAM), pegged at about 14 million enterprise venues (according to a definitive audit by Nokia a few years back), is vast and practically unknowable; certainly, despite its growing maturity, the vendor community has a long way to go fill its boots, and set cellular to work in the name of industrial revolution. As such, ‘new’ sales is a good indicator of how the market is spreading into the planet’s economic engine rooms.

But that newfound maturity, with sharper channels and better products, means total sales are increasingly different; the GSA stats, like vendors’ own quarterly results, say little in detail about how much money is being made, and how well enterprises are using and expanding the technology. This is the first point to remember, discussed below, when sizing the market and charting its progress. But there are others, too, generally known, but not always clear, which are explicit in the GSA exchange and worth memorialising here.

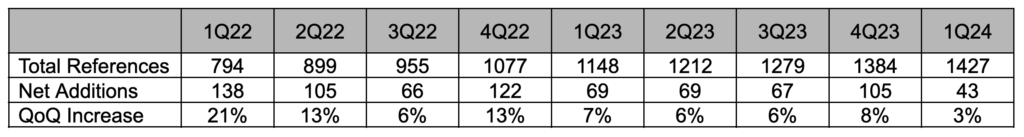

And also just because statistics tend to be used like drunk men use lamp-posts – for support, rather than illumination (to quote Andrew Lang, the Scottish novelist, anthropologist, and collector of folk tales). So let’s take a look at the gnarly sums involved – starting with the latest GSA count, as below, up to the end of March 2024. (Second-quarter GSA data will be available at the end of August). Note, all the quotes are from Luke Pearce, who represents GSA as part of his role as senior analyst for CCS Insight, the exclusive partner for the GSA stats.

1 | CUSTOMERS

This is the way GSA counts the market. But it is a measure that is fraught with clauses and provisos; ‘customer references’ refers to the number of different 4G/5G enterprise customers that a 4G/5G vendor has on its books – or that it signs up in a three-month period. But crucially, it is counted by country; so a deal with a single client in two different countries counts as two ‘logos’, to use the Nokia/Ericsson terminology. Equally, a new deal with an existing customer in 10 different countries – or indeed with an existing customer for 10 networks in a single country – counts for zero, zilch, nada.

Which is a confusing way, arguably, to assess progress in a market; it shows its breadth, perhaps, migrating customer-by-customer and industry-by-industry, but not its real depth, multiplying upwards and downwards with new networks, applications, workloads. Taken alone as a key performance indicator, it would suggest the private 4G/5G market is slowing. Just take a look at quarterly increases in the table above, from 21 percent at the end of the first quarter in 2022, to seven percent in the same period last year, to just three percent at the last count. That is a slump.

And 43 new references in the first three months of this year looks like a collapse – compared with 105 in the prior quarter, and 69 and 138 in the same quarters in 2023 and 2022. But that is not the perception of things, either. Private 5G has hardly set the market on fire, in the way the old TAM-forecasts might have predicted, but it still looks like progressive business. And digital change, leading to/from organisational change, was never going to be an easy sale; Industry 4.0 was never going to be an overnight sensation. So customer references should not be the only measure.

Plus, a further footnote; the GSA by-country count is not the only qualifying criteria for new private 4G/5G deployments to chart. Pearce explains: “GSA counts customer references as unique organisations or government entities deploying one or more 3GPP-based 4G/5G networks in a given country that are worth more than €100,000.” The point here is to jettison proofs and trials, and token efforts, from the mix. Which seems like a sensible move; except that, perhaps, it also precludes the market’s decisive downwards move into SME territory from the review.

For this reason, perhaps, GSA has changed its criteria to include references that are worth more than €50,000, as of June (2024). It will start to retrospectively adjust the figures to include these smaller-sized commercial deployments. “A further 52 references were added in the first quarter of 2024 worth between €50,000 and €100,000,” writes Pearce. Which, presumably, more-than-doubles the recorded first-quarter additions to 95 – which compares rather better to previous quarters (before the bar was lowered to €50,000), if we are judging the market on this measure.

There are some other points of interest, regarding customer references, before we look at other ways to cut the market. The GSA stats remain the most important benchmark in the private 4G/5G industry, probably, because they are the only broadly accepted measure of it. Seventy percent of its index references are not in the public domain, and not (identified and) counted elsewhere – except, contribution by contribution, company by company, by its members. This gives its review considerable weight; at the same time, it is hardly exhaustive.

Its confidentiality agreements with members mean it does not provide vendor-share data – which would have been useful, in ways, but is also a fair price for the bigger review. Its special interest group (SIG) has only nine members, of which only four (Nokia, Ericsson, Mavenir, Airspan) are actually network vendors; the others are a test company (Keysight), a network security company (OneLayer), and a random research and marketing outfit (PrivateLTEand5G.com), all of which have an eye on deployments too.

Huawei, which was a contributing member until the second quarter of last year, has quit. Without much explanation, it seems. “We do not have enough information to provide a comment,” responds Pearce. The Chinese vendor’s French exit might have explained a fall-off in numbers in the past 12 months; the fact there hasn’t been much of one implies Huawei either wasn’t doing much business, or else wasn’t reporting it anyway. But there are no contributions from HPE/Athonet, Celona, Samsung, Microsoft, or others – which would give a much healthier view of the state of things, about how private 4G/5G is spreading to new enterprises and industries.

After a considered review of the value of the GSA stats, and how, treated correctly, they provide illumination about the private 4G/5G market, what follows is a series of shorter and sharper observations about what key market stats tell us about the sector.

…

2 | NETWORKS

The latest first-quarter (2024) figures from GSA say there are a total of 1,427 customer references out there – of per-country enterprise marques with at least one private 4G/5G network, as provided by a select bunch of member companies. But, as per the above section, Pearce writes: “Although the number of new customer references is lower than reported in previous quarters, this does not consider increases in the number of sites or new revenue opportunities from existing customers.” Which is as an explanation of the quarterly count, and of the total as well.

Pearce’s full time role is at analyst firm CCS Insight, which has run the numbers on the private 4G/5G market as well and come up with a figure for the total private 4G/5G deployments. Which is the other key stat, probably, that we are after. CCS Insight says there were 5,564 network deployments across the globe at the end of March (2024), up from 4,437 a year ago – which represents annual growth of 25 percent, and shows a market in rude health, one might conclude. But actually, it shows exactly the same as the GSA reference count (24 percent annual growth).

As such, both sets of statistics will probably tell you what you want: that the market is cruising, or that it’s not going fast enough. Just how bright is the illumination? Importantly, CCS Insight uses an “expanded definition” of private 4G/5G to also include semi/hybrid private networks that piggyback in some fashion of public core network infrastructure – which captures the astonishing China story. Pearce writes of the expanded calculation: “The total market represents 37,154 [enterprise deployments], of which China is home to 31,409.”

He goes on: “The total is up from 31,983 in the fourth quarter of last year. [But] 85 percent of these (mostly in China) are ‘hybrid’ and ‘virtual’ networks leveraging public infrastructure.” It might be suggested, here, that the China model for hybrid private networking, which will be increasingly adopted in less-critical industries in other geographies, will inform how cellular is brought to bear on 14 million enterprise venues. And again, it shows how the private 4G/5G market must be deconstructed to be explained, and how statistics must be contextualised to give proper illumination.

3 | INDUSTRIES

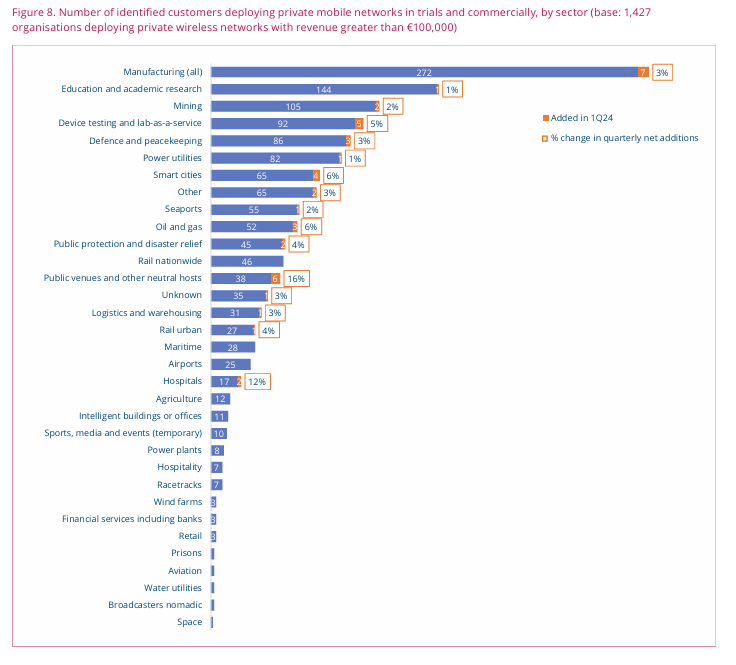

Very quickly – because the statistics show it, and because it is interesting – the last first-quarter review of the market by GSA suggests there is some movement in the destination of new sales. Pearce writes: “Public venues and other neutral hosts saw the highest growth of the top 15 sectors, quarter-on-quarter – up 16 percent. Hospitals also grew by over 10 percent. Manufacturing, education and academic research, and mining remain the top three sectors for customer references.” He provided a slide to support the findings (see below).

These figures might be taken with Nokia’s (second-quarter) results, which go into the GSA mix, and which say that it is adding most new-customers in the vast public sector and smart cities space (18 in the quarter, by Nokia alone), which ranges from quick-fire deployments with schools and universities, where deals are small and quick, to bureaucratic entanglements with national and local government operations, where they are slow, but also big. It also covers the defence, public safety, and healthcare sectors, where they are somewhere in-between.

Besides, Nokia signed 11 new logos in the period in the energy and utilities market, and 10 in the (process and discrete) manufacturing sector; by contrast, new-client sales to the transport and logistics industry, covering mainline and urban railways, plus also airports and shipping ports (and possibly warehousing), look like they fell off a cliff in the quarter (plus three) – although Nokia would likely say the ports industry was a forerunner in the private networks game, and that a handful of operators control the world’s ports, and that it is upselling and cross-selling all the while.

But also and again, these are just per-country new-customer stats. Pearce says: “This does not represent the actual size and scale of deployments, which vary by user type.”

4 | COUNTRIES

And finally, and predictably, the GSA figures, like every review of the private 4G/5G market, show that most new customers and new networks are in geographies that have moved to liberalise spectrum for enterprise usage. Pearce says: “There is typically a strong, positive correlation between the number of private mobile network references and countries with dedicated spectrum. Private mobile networks are mainly in the developed world so far, with the United States, Germany, the United Kingdom, China, and Japan having the most references.”

There are 78 countries around the world with at least one private mobile network, he says. Belgium and the Netherlands, with the newest spectrum legislation and the newest customer demand, are also the fastest growing for new customer references of the top 10 countries in its index – with growth of 14 percent and 11 percent respectively. Which are good stats, but would need also to be considered together with the exact date of spectrum releases in both countries to make a proper judgement about growth. Which we could do, but we won’t – because we are out of time, and need to get the story posted. But you get the idea.