The GSMA said it expects mobile traffic in the APAC region to quadruple between 2023 and 2030

The Global System for Mobile Communications Association (GSMA)’s most recent Asia Pacific (APAC) mobility report demonstrates how critical mobile technologies and services are for this region, which documented a combined 2023 GDP that amounted

to $880 billion of economic value. The report also highlighted several key developments and trends to keep an eye on — keep reading for the top five.

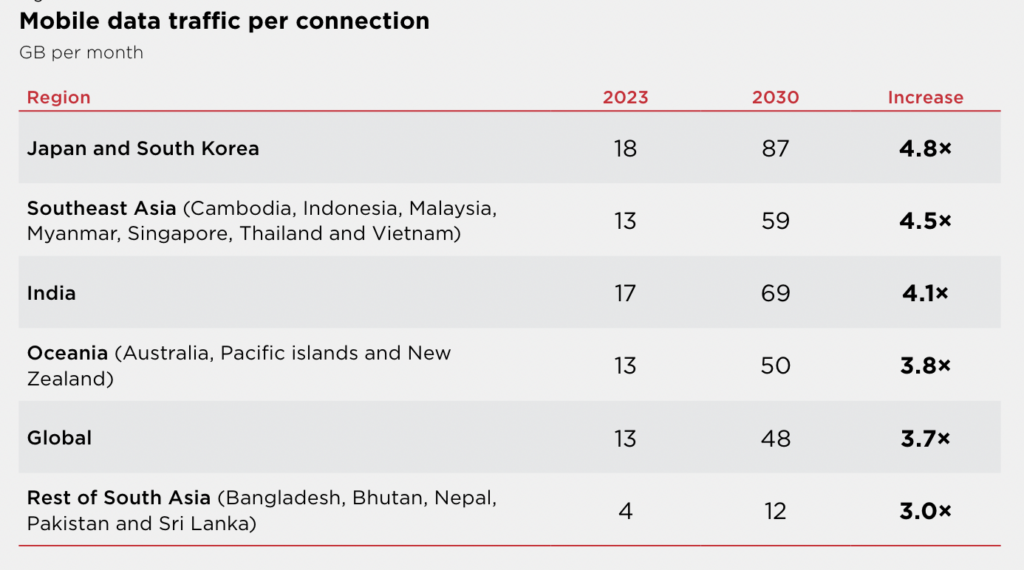

1. Mobile traffic in Asia Pacific to quadruple

Between 2023 and 2030, the GSMA expects mobile traffic in the APAC region to quadruple. “The growth in mobile data traffic per smartphone is primarily being driven by enhanced device capabilities, network improvements and an increase in data-intensive content,” stated the report, noting that the top smartphone markets in the region are India, Indonesia, Vietnam, Japan and Bangladesh.

The report continued: “Furthermore, as countries in the region progress with their digital nation agendas, new services could result in faster growth in mobile data traffic.”

2. Commercial 5G standalone (SA) is taking off

According to the GSMA, Australia, India, Japan, the Philippines, Singapore, South Korea and Thailand now have commercial 5G SA networks. In India, for instance, Reliance Jio has deployed more than 1 million 5G cell sites for its SA network, allowing it to introduce network slicing with dedicated slices for applications like for gaming, high-security services and FWA customers, among other applications.

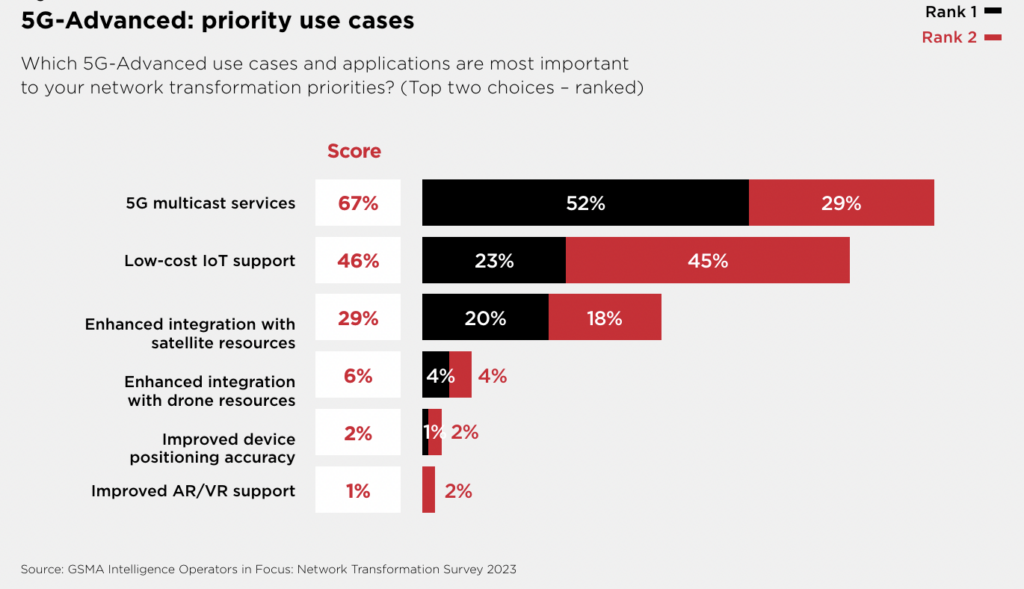

3. RedCap trials are underway

RedCap, introduced in 3GPP Release 17, is designed to enable energy- and cost-efficient 5G IoT connectivity. By many accounts, RedCap’s speeds, latency and spectrum use are largely on-par with advanced LTE capabilities.

In APAC, 5G RedCap trials are taking off, said the GSMA. For instance, in Korea, SK Telecom, Nokia and MediaTek are exploring the development of RedCap technology for commercial frequencies, and in August 2023, Optus conducted an over-the-air data call trail using precommercial Ericsson RedCap RAN software. Further, in Thailand, AIS, ZTE and MediaTek ran a validation test of 5G RedCap at 2.6 GHz at the AZ Innovation Centre in Bangkok.

4. Operators are looking to gen AI for revenue generation

In Asia Pacific — like other regions across the world — operators are hoping to use generative AI (gen AI) to drive digital transformation, improve network operations and tap into new revenue streams.

“Operators appear to be taking different approaches to developing genAI solutions,” the GSMA said in the report, explaining that some are turning to webscalers like Google, AWS and Microsoft Azure) to achieve their gen AI ambitions. Malaysia operator Maxis, for example, is leaning on Google Cloud to help it use GenAI for network coding by integrating this technology into its workflow and service offerings. Airtel and Telkomsel are also working with Google Cloud to enable personalized offerings and communications using gen AI. Japan’s KDDI, on the other hand, has partnered with AWS to develop its gen AI solutions.

The Global Telco Alliance, however, paints a different picture of gen AI development in Asia. The alliance, launched by SK Telecom, Singtel, SoftBank, Deutsche Telekom and e&, is dedicated to the co-development of their own telecoms-specific AI Large Language Models (LLMs), which they say will help telcos improve their customer interactions via digital assistants and chatbots.

5. Growing momentum around non-terrestrial networks

While non-terrestrial networks (NTN) are quickly becoming a hot topic for mobile operators around the world, the GSMA pointed out that in Asia Pacific, these networks will prove particularly critical in achieving universal connectivity due to the geographical make-up of several of the region’s countries. “From archipelagos and rainforests to deserts and mountain ranges, Asia Pacific is home to some of the most challenging terrains for terrestrial networks,” said the Association. “As a result, there has historically been significant interest in aerial solutions and the opportunity they offer to help extend connectivity to hard-to-reach locations.” It added that the emergence of low Earth orbit (LEO) and high-altitude platform station (HAPS) solutions have “heightened” this interest.

Asutralia’s Telstra, India’s Bharti Group and Japan’s NTT Docomo are just a few operators mentioned in the report that are actively exploring aerial connectivity.